What is the Dow Jones Symbol in Forex?

The Dow Jones, also known as Dow 30, consists of 30 leading U.S. companies across various industries. Some of the most notable companies in this index include:Apple (AAPL)

Microsoft (MSFT)

Goldman Sachs (GS)

Boeing (BA)

McDonald's (MCD)

Coca-Cola (KO)

In the Forex and CFD markets, traders can trade the Dow Jones index using the following symbols:US30– The most common symbol for the Dow Jones index in Forex brokers.

DJI or DJIA– The standard symbol for Dow Jones in financial markets.

YM– The futures contract symbol for Dow Jones in the futures market.

Companies Listed in the Dow Jones Index

The Dow Jones Industrial Average (DJIA)is one of the most significant stock market indices in the United States, reflecting the performance of 30 top industrial and commercial companies in the stock market. These companies are selected from various economic sectors, and their price movements have a direct impact on the overall trend of the U.S. stock market.

This list is regularly reviewed by S&P Dow Jones Indices, and companies are added or removed based on their economic performance, market capitalization, and industry influence.List of Dow Jones Companies and Their Industry Sectors

| Company Name | Ticker Symbol | Industry Sector |

|---|---|---|

| 3M | MMM | Industrial Equipment and Manufacturing |

| American Express | AXP | Financial Services and Credit Cards |

| Amgen | AMGN | Biotechnology and Pharmaceuticals |

| Apple | AAPL | Technology and Electronics |

| Boeing | BA | Aerospace and Defense |

| Caterpillar | CAT | Heavy Equipment and Construction |

| Chevron | CVX | Oil and Energy |

| Cisco Systems | CSCO | Networking and IT Technology |

| The Coca-Cola Company | KO | Food and Beverage Industry |

| Dow Inc. | DOW | Chemicals and Petrochemicals |

| Goldman Sachs | GS | Financial Services and Investments |

| The Home Depot | HD | Home Improvement and Retail |

| Honeywell | HON | Engineering and Advanced Industries |

| IBM | IBM | Technology and IT Services |

| Intel | INTC | Semiconductors and Processors |

| Johnson & Johnson | JNJ | Pharmaceuticals and Medical Devices |

| JPMorgan Chase | JPM | Banking and Investment Services |

| McDonald's | MCD | Fast Food and Restaurant Industry |

| Merck & Co. | MRK | Biotechnology and Pharmaceuticals |

| Microsoft | MSFT | Software and Cloud Computing |

| Nike | NKE | Apparel and Sports Equipment |

| Procter & Gamble | PG | Consumer Goods and Personal Care |

| Salesforce | CRM | Customer Relationship Management (CRM) Software |

| The Travelers Companies | TRV | Insurance and Financial Services |

| UnitedHealth Group | UNH | Healthcare and Medical Services |

| Verizon Communications | VZ | Telecommunications and Communications |

| Visa | V | International Payment Processing |

| Walgreens Boots Alliance | WBA | Pharmacies and Healthcare Services |

| Walmart | WMT | Retail and Supermarket Chains |

| The Walt Disney Company | DIS | Entertainment and Media Industry |

Key Characteristics of Companies in the Dow Jones Index

Companies listed in the Dow Jones Industrial Average (DJIA)typically share the following characteristics:Largest and Most Influential U.S. Companies:All these companies have a high market capitalization and a significant impact on the U.S. economy.

Industrial Diversity:The Dow Jones index includes companies from various sectors, including technology, banking, healthcare, energy, retail, and manufacturing.

Lower Volatility Compared to Other Indices:Due to its composition of stable companies, the Dow Jones index tends to experience less volatility compared to indices like NASDAQ 100.

Company Replacements and Valuation Adjustments:If a company underperforms, it may be removed from the index and replaced with a stronger-performing company.

How Dow Jones Companies Influence the Market

Technology Companies like Apple and Microsoft:Growth in these companies has a major impact on the entire Dow Jones index.

Banking Institutions like JPMorgan Chase and Goldman Sachs:

Monetary policies and interest rates have a direct effect on the performance of these financial firms.

Oil Companies like Chevron:The global oil price can influence the valuation of this company.

Retail Giants like Walmart and Home Depot:

Consumer demand levels play a crucial role in the profitability of these companies.

Factors Affecting the Dow Jones Index

To analyze and trade Dow Jones in Forex, it is necessary to pay attention to the factors that influence the movement of this index. Some of the most important factors include:Federal Reserve (Fed) Monetary Policies

The interest rate and monetary policies of the U.S. Federal Reserve have a direct impact on the stock value of companies listed in the Dow Jones Index. An increase in interest rates usually causes a decline in stock values and consequently leads to a drop in the Dow Jones Index.U.S. Economic Reports

Economic data such as:Unemployment Rate-Gross Domestic Product (GDP)-Consumer Price Index (CPI)-Purchasing Managers' Index (PMI)can affect the Dow Jones trend. Strong economic growth leads to an increase in the index, while economic weakness results in a decline.Performance of Companies in the Index

The quarterly earnings reports of companies listed in the Dow Jones Index, including profitability and growth outlook, have a direct impact on this index. Positive performance of major companies can lead to the index rising.Geopolitical Tensions and Economic Crises

Trade wars, sanctions, and global crises can cause instability in stock markets. In such conditions, investors usually move toward safe-haven assets such as gold and bonds, which can lead to a decline in the Dow Jones Index.Market Sentiment and the VIX Index

The VIX Index, known as the Volatility Index, can indicate the level of risk appetite among investors. An increase in VIX usually signifies higher market volatility and a drop in the Dow Jones Index.

Ways to Trade Dow Jones in Forex

Traders can trade the Dow Jones Index in the Forex market using CFDs, futures contracts, and ETFs. Below are the most common methods:1. Trading Dow Jones CFDs (US30)

Contracts for Difference (CFDs)allow traders to profit from price movements in Dow Jones without owning the underlying asset. Some key features of Dow Jones CFD trading include:

The ability to trade in both buy (Long)and sell (Short) directions

Leverage (Leverage)to amplify potential profits or losses

Suitable for short-term and intraday trading

2. Trading Dow Jones Futures (Dow Futures - YM)

Futures contracts for the Dow Jones Index, represented by the symbol YM, are a popular instrument among professional traders. Features of Dow Jones futures trading include:High liquidity and fast execution

Ideal for institutional traders and investment funds

Available for trading nearly 24 hours a day, except during market holidays

3. Investing in Dow Jones ETFs

For long-term investors,Exchange-Traded Funds (ETFs)like DIA can be a good option. These ETFs track the performance of the Dow Jones Index, allowing traders to invest in the index by purchasing ETF shares.

How the Dow Jones Index is Calculated

The Dow Jones Industrial Average (DJIA)is one of the oldest and most significant stock market indices in the United States, representing the performance of 30 major and influential industrial companies. Unlike many other indices, such as the S&P 500, which are calculated based on market capitalization (Market Cap), the Dow Jones Index is a price-weighted index.

In this method,companies with higher stock prices have a greater impact on the index, regardless of their total market value. Below, we will examine the exact calculation method for the Dow Jones Index.Formula for Calculating the Dow Jones Index

The formula for calculating the DJIA is as follows:DJIA = (P1 + P2 + ... + P30) / D Where:Pii= The stock price of each of the 30 companies in the Dow Jones Index

D= Dow Divisor

The Dow Divisor is a number used to adjust for the effects of stock splits, mergers, and other changes so that the index accurately reflects real price changes.Why Is the Dow Jones Divisor Important?

In the past, the Dow Jones Index simply reflected the average stock price of the 30 companies included in the index. However, over time, events such as stock splits, mergers, and other changes made the calculation of this index more complex.

For this reason, the Dow Jones Divisor was introduced to adjust these changes and prevent distortions in the index. The value of the Dow Jones Divisor changes over time and is determined by S&P Dow Jones Indices. Currently, its value is approximately 0.1517, but this amount varies over time.Example of Dow Jones Index Calculation

Suppose the stock prices of five companies in the index are as follows (for simplicity, we only consider five companies):

| Company | Stock Price ($) |

|---|---|

| Apple | 150 |

| Microsoft | 320 |

| Boeing | 230 |

| McDonald's | 250 |

| Visa | 210 |

Total Stock Price Calculation:

150+320+230+250+210=1160

If the Dow Divisor is 0.1517, the Dow Jones Index is calculated as follows:DJIA = 1160 / 0.1517 = 7647.99

Result:The number 7647.99 is the estimated value of the Dow Jones Index based on the prices of these five companies. In real calculations, this value is determined for all 30 companies.How Does a Company's Stock Price Affect the Dow Jones Index?

Since the Dow Jones Index is a price-weighted index, companies with higher stock prices have a greater influence on the index.

For example:

If Microsoft (MSFT), which has a high stock price, increases by 10%, its impact on the index will be greater than a 10% increase in Coca-Cola (KO), because Microsoft's stock price is significantly higher than Coca-Cola's.

If one of the companies in the Dow Jones Index

splits its stock(e.g.,2-for-1 split), its price will be halved, but the overall effect of this change will be adjusted through the Dow Divisor.Comparison of Dow Jones Calculation with Other Indices

| Index | Calculation Method | Key Feature |

|---|---|---|

| Dow Jones (DJIA) | Price-weighted average |

Companies with higher stock prices have more influence

| on the index | |

|---|---|

| S&P 500 | Market capitalization-weighted |

Companies with higher market value have

| greater impact | ||

|---|---|---|

| NASDAQ 100 | Market capitalization-weighted | Focuses primarily on technology companies |

✔The Dow Jones Index depends on stock prices, not total market value. This has led some analysts to consider it less comprehensive than indices like S&P 500, as companies with higher stock prices have a disproportionately larger impact on the index.

Best Trading Strategies for Dow Jones

Traders can use various strategies to trade the Dow Jones Index. Some of the most important strategies include:1. Dow Jones Scalping Strategy

Trading Session:The best time for scalping is during the New York trading session.

Tools:Using short-term moving averages, RSI, and Bollinger Bands.

Method:Trading in small price fluctuations with predefined take profit and stop-loss levels.

2. Dow Jones Day Trading Strategy

Trading Session:

London and New York sessions for higher liquidity.

Tools:

Support and resistance, price action, and 15-minute chart analysis.

Method:Entering trades based on price breakouts and volume analysis.

3. Dow Jones Swing Trading Strategy

Trading Session:

Daily and weekly timeframes.

Tools:

Fibonacci retracement, trend lines, and candlestick patterns.

Method:Entering trades based on divergence and key reversal points.

The Dow Jones (DJIA)is one of the most important financial indices globally, and it can be traded in Forex through CFDs, futures contracts, and ETFs. Various factors, such as Federal Reserve policies, economic data, and the performance of listed companies, influence its movement.

By utilizing trading strategies, technical and fundamental analysis, and proper risk management, traders can profit from the index's fluctuations in the Forex market. Professional traders always consider the Dow Jones Index as a benchmark for analyzing the overall U.S. stock market.

What is the Dow Jones Symbol in MetaTrader 4?

In MetaTrader 4 (MT4), the Dow Jones Index is usually displayed under one of the following symbols:US30– The most common symbol for the Dow Jones in MetaTrader 4.

DJI– Some brokers use this symbol to represent the Dow Jones.

DJIA– The standard symbol for the Dow Jones in financial markets.

Wall Street 30– Some brokers list this index under this name.

Different brokers may use different symbols to display the Dow Jones Index in MetaTrader 4. To find this symbol, simply go to the Market Watch window in MetaTrader 4, click on "Symbols," and search for US30 or DJI.Factors Affecting the Dow Jones Index in MetaTrader 4

Traders investing in Dow Jones in MetaTrader 4 should consider the key factors that influence this index's movement. Some of the most important factors include:Federal Reserve (Fed) Monetary Policies

Decisions by the Federal Reserve regarding interest rates, quantitative easing, and tightening policies significantly impact the Dow Jones Index.Higher interest rates usually cause the Dow Jones to decline.

Lower interest rates typically lead to an increase in the index.

U.S. Economic Reports

Key economic indicators such as:Unemployment Rate

Inflation (CPI - Consumer Price Index)

Gross Domestic Product (GDP)

Purchasing Managers' Index (PMI)

can lead to sudden fluctuations in the Dow Jones Index.Performance of Companies in the Dow Jones Index

The quarterly earnings reports of major companies in DJIA, such as Apple, Microsoft, Boeing, and McDonald's, play a significant role in the index's direction.Global Events and Geopolitical Tensions

Economic crises, trade wars, sanctions, and political shifts can cause significant volatility in the Dow Jones Index.Market Sentiment and the VIX (Volatility Index)

An increase in the VIX index indicates higher market uncertainty, which often leads to a decline in the Dow Jones Index.How to Trade Dow Jones in MetaTrader 4

Traders can trade the Dow Jones Index (US30)in MetaTrader 4 through CFDs (Contract for Difference). The methods for trading this index include:1. Trading Dow Jones CFDs in MetaTrader 4

CFD trading allows traders to profit from price movements in the Dow Jones Index without actually purchasing shares.

Key features of CFD trading on Dow Jones:

The ability to trade in both long (buy) and short (sell) positions.

Leverage availability to maximize profits (with controlled risk).

Stop-loss and take-profit orders to manage risk effectively.

2. Using Technical Analysis to Trade Dow Jones in MetaTrader 4

For successful Dow Jones (US30) trading in MetaTrader 4, traders use the following technical indicators:Moving Average (MA):Identifies trends.

Relative Strength Index (RSI):Determines overbought and oversold zones.

MACD Indicator:Confirms trends and potential entry/exit points.

Support and Resistance Levels:Helps define key buy and sell zones.

Trading Strategies for Dow Jones in MetaTrader 4

Traders can use various effective strategies for Dow Jones trading in MT4:Scalping Strategy for Dow Jones

Timeframe:1 to 5-minute charts for short-term trading.

Indicators Used:

Moving averages and oscillators.

Best Trading Session:

New York trading session for high volatility.

Day Trading Strategy for Dow Jones

Entry and exit within the same day.

Key tools:Support and resistance levels,breakout trading.

Best trading session:

London and New York session overlap.

Swing Trading Strategy for Dow Jones

Medium to long-term trading on daily and weekly timeframes.

Key tools:Fibonacci retracement, trendlines, and candlestick patterns.

Goal:Identifying major reversal points for optimal entries.

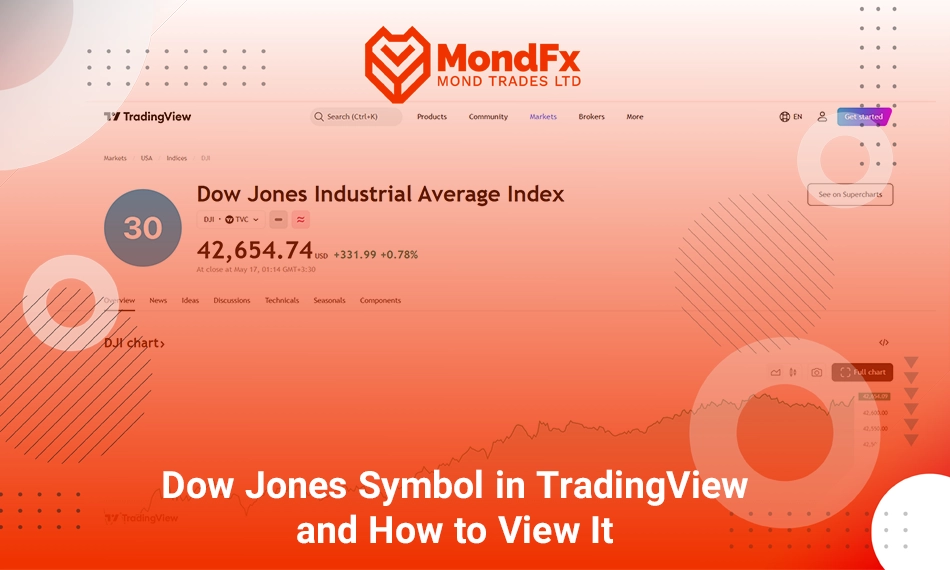

Dow Jones Symbol in TradingView and How to View It

The Dow Jones Industrial Average (DJIA)is one of the most widely used financial indices globally, representing the performance of 30 major industrial companies listed on the New York Stock Exchange (NYSE) and NASDAQ. Traders and investors can view and analyze the Dow Jones chart on the TradingView platform.What is the Dow Jones Symbol in TradingView?

In TradingView, the Dow Jones Index is displayed under different symbols depending on the type of data provided:DJI– The Dow Jones Industrial Index, which reflects the actual price of this index.

DJIA– The standard Dow Jones symbol used on some platforms.

US30– A common symbol for Dow Jones, used in CFD accounts and by many brokers for trading.

DJI.F– Futures contracts for the Dow Jones Index.

How to Find Dow Jones in TradingView?

To view the live chart of the Dow Jones Index on TradingView, follow these steps:Go to the TradingView platform at TradingView.

Enter "DJI" or "US30" in the search bar.

Select the desired symbol from the list displayed.

The Dow Jones chart will appear, allowing for technical analysis.

Analyzing Dow Jones in TradingView

With TradingView's analytical tools, traders can analyze the DJI chart and make better trading decisions. Some of the most important technical indicators available for Dow Jones analysis in TradingView include:Moving Average (MA):Helps identify overall market trends.

RSI (Relative Strength Index):Detects overbought and oversold conditions.

MACD (Moving Average Convergence Divergence):Confirms trends and price momentum.

Fibonacci Retracement:Identifies support and resistance levels.

Candlestick Patterns:Helps spot reversal patterns such as Doji, Hammer, and Engulfing formations for entry or exit points.

Advantages of Using TradingView for Dow Jones Trading

Live charts and real-time updates for the Dow Jones Index.

Access to technical and fundamental analysis tools in a user-friendly interface.

Historical data availability to study past trends.

Ability to set price alerts for Dow Jones fluctuations.

Comparison tools to analyze Dow Jones alongside other indices and assets.

What is the Dow Jones Symbol in LiteFinance?

In the LiteFinance broker, the Dow Jones Index is listed under the YM symbol. This symbol represents Dow Jones CFD trading, allowing traders to profit from price changes without actually owning the stocks.Features of the Dow Jones Symbol (YM) in LiteFinance:

Asset Type:Dow Jones CFD (Contract for Difference)

Trading Platforms:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

Minimum Trade Volume:

0.1 lot

Maximum Trade Volume:

50 lots

Leverage:

Up to 1:100

Trading Hours:

Monday to Friday, aligning with U.S. market hours

Spread:

Varies depending on the account type

Swap Fees:

Overnight positions incur swap charges

How to Access the Dow Jones Symbol in LiteFinance

To view and trade the Dow Jones (YM) symbol in LiteFinance, follow these steps in MetaTrader 4 or 5:1. Finding Dow Jones in MetaTrader 4 (MT4)

Open MetaTrader 4.

Go to the "View" menu and select "Symbols."

Navigate to the "Indices" section and search for "YM" or "Dow Jones."

Click on the symbol and select "Show" to add it to the asset list.

Open the chart and start technical analysis.

2. Finding Dow Jones in MetaTrader 5 (MT5)

Launch MetaTrader 5.

In the left toolbar, click on "Market Watch."

Type "YM" in the search bar.

Right-click on the symbol and select "Show Symbol."

You can now start trading this symbol.

Important Considerations When Trading Dow Jones in LiteFinance

Pay attention to trading hours:The Dow Jones Index experiences the most volatility during the New York session.

Use risk management:Setting stop-loss and take-profit levels is essential to minimize large losses.

Monitor economic news:

Employment reports (NFP), Federal Reserve interest rate decisions, and key economic indicators can significantly impact Dow Jones price movements.

Combine technical and fundamental analysis:Using both approaches helps traders make more informed trading decisions.