The importance of this connection becomes clearer when we realize that cryptocurrencies are more sensitive than any other market to liquidity flows and investor expectations. Changes in interest rates may appear to be merely a technical decision on the surface, but behind the scenes they entail shifts in risk appetite, opportunity cost, capital inflows and outflows, and ultimately the formation of long term trends in the crypto market. This article from MondFx, by focusing on this less visible point, seeks to show how a single macroeconomic indicator can influence the future of one of the most innovative markets of our time.

What is an interest rate?

On the surface, the interest rate is just a simple number, but in reality it acts as the heartbeat of the economy. It determines the cost of holding cash, borrowing it, or investing in an asset. The higher the interest rate goes, the more expensive access to money becomes and the lower the appetite for high risk investments. And when it comes down, liquidity flows more freely and markets gain a new lease of life.

Despite all the conventional explanations given about interest rates, there is a more important point behind the scenes: the interest rate is a behavioral signal, not just a financial tool. Investors infer from changes in this rate whether the future of the economy is heading toward contraction or expansion; and it is these interpretations that ultimately change the course of markets.

What is the interest rate in the cryptocurrency market?

When we talk about the interest rate in the cryptocurrency market, we do not mean a rate set by a central bank, but rather the impact that changes in global interest rates have on the behavior of digital asset investors. In crypto, the notion of the interest rate is mostly reflected in the rate of return on capital, the opportunity cost of holding highly volatile assets, and the amount of liquidity flowing into blockchain projects.

In other words, the crypto market does not have its own dedicated interest rate, but it is fully influenced by official rates. This transmission sometimes happens directly for example, when a cut in interest rates leads to increased inflows into high risk assets and sometimes indirectly, such as when inflation expectations build and investors turn to Bitcoin to preserve the value of their assets. Therefore, in the world of crypto, interest rates amount to a behavioral translation of macroeconomic policy decisions.

The difference between the interest rate in crypto and the normal interest rate

On the surface, both concepts refer to the same economic variable, but their functioning and impact are completely different in the two markets. The normal interest rate is managed directly by central banks, and its effect is first seen in the banking system and then in the financial markets.

However, in crypto, everything happens more indirectly and more quickly. In the traditional market, a change in the interest rate affects the path of lending, deposits, the housing market and the stock market with a certain lag. But the cryptocurrency market, as a borderless market, reacts instantly; because sentiment plays a much more prominent role in this market and more investors make decisions based on expectations rather than official data.

On the other hand, in the traditional economy, the interest rate moves in tandem with complementary policies, whereas crypto has no safety net, no central bank, and no tools to control capital flows. Therefore, the same small change in the interest rate may create only a minor correction in the traditional market but appear in the crypto market as a large emotional wave. These differences lead professional analysts, when examining the effect of the interest rate on crypto, to focus more on the market’s psychological interpretation of the figure than on the number itself.

Examining the impact of interest rate changes on cryptocurrency returns

Research has shown that the crypto market’s reaction to interest rate fluctuations is not only variable, but also depends on the type of cryptocurrency and the overall market conditions. In particular, some coins such as Cardano, during bearish market phases, act as a tool for hedging inflation risk and exhibit different sensitivities to increases or decreases in interest rates.

In situations where the market is experiencing high volatility, this sensitivity is further amplified and the returns on digital assets show tangible reactions to changes in monetary policy. This reality is of vital importance for traders, because a precise understanding of this relationship can enable them to adjust their trading strategies in an intelligent way based on macroeconomic analysis and to avoid unwanted risks. Therefore, the sensitivity of cryptocurrency returns to interest rates is not only a research topic, but also a practical pillar in capital management and financial decision making in the world of crypto.

The impact of interest rates on cryptocurrencies

Cryptocurrencies, unlike traditional financial markets, continue their activity continuously 24 hours a day and without holidays, which is why market reactions and changes occur instantly and very rapidly. The interest rate, which is one of the main tools of central banks’ monetary policies, affects this market indirectly but very significantly.

For example, when the Federal Reserve raises interest rates, in addition to economic effects, it also creates greater psychological effects and expectations in the market, which can indicate increased concern about inflation or economic conditions.

Differences in the reaction of different cryptocurrencies to interest rates

Not all cryptocurrencies react to interest rate changes in the same way, and this depends on several key factors:

Structure and use case of the currency:

For example, Bitcoin is primarily known as a store of value and a digital asset with a limited supply. Therefore, it is affected by macroeconomic concerns such as the interest rate and is more sensitive to changes in monetary policy. Ethereum, which in addition to being a store of value has various applications in smart contracts and DeFi, may also be influenced by its own specific fundamental factors.

Inflation hedging properties:

Some coins such as Cardano, during periods of rising inflation and economic volatility, may act as a hedge against inflation and be less sensitive to increases in interest rates. This means that in uncertain conditions, investors seek refuge in these currencies.

Differences in the level of adoption and liquidity:

Cryptocurrencies with larger markets, higher liquidity, and greater adoption (such as Bitcoin and Ethereum) react more quickly and transparently to macro changes. Smaller altcoins may exhibit unexpected or non linear reactions.

Market psychology:

Some cryptocurrencies, due to news or technical or development related events, may in the short term move independently of the interest rate trend, but in the long term the interest rate shows its effect.

Implications of interest rate increases for cryptocurrencies for traders and investors

Interest rate changes are one of the most important macro factors that cryptocurrency investors must take seriously. Here are a few key points for managing these conditions:

Risk management:

When interest rates rise, higher risk markets such as cryptocurrencies usually face selling pressure. Traders should reduce position sizes, set stop loss levels (Stop Loss) precisely, and use less leverage.

Adjusting the trading strategy:

In periods of declining interest rates, when more liquidity flows into the market, buying opportunities and the potential for cryptocurrency price appreciation increase. Traders can enter trades during these periods with more reasonable risk.

Diversifying the investment portfolio:

The composition of assets in the investment portfolio should be adjusted based on the interest rate trend. When interest rates are rising, it may be better to shift part of the capital into lower risk assets or bonds, and during periods of falling interest rates, place greater emphasis on cryptocurrencies.

Paying attention to news and expectations:

Rather than reacting solely to changes in interest rates, it is better to analyze what messages the central bank or monetary authorities are sending, what the market’s expectations are, and what policies may be implemented in the future.

Using macro analysis tools:

Combining fundamental analysis of interest rates with technical analysis can help to better identify entry and exit points.

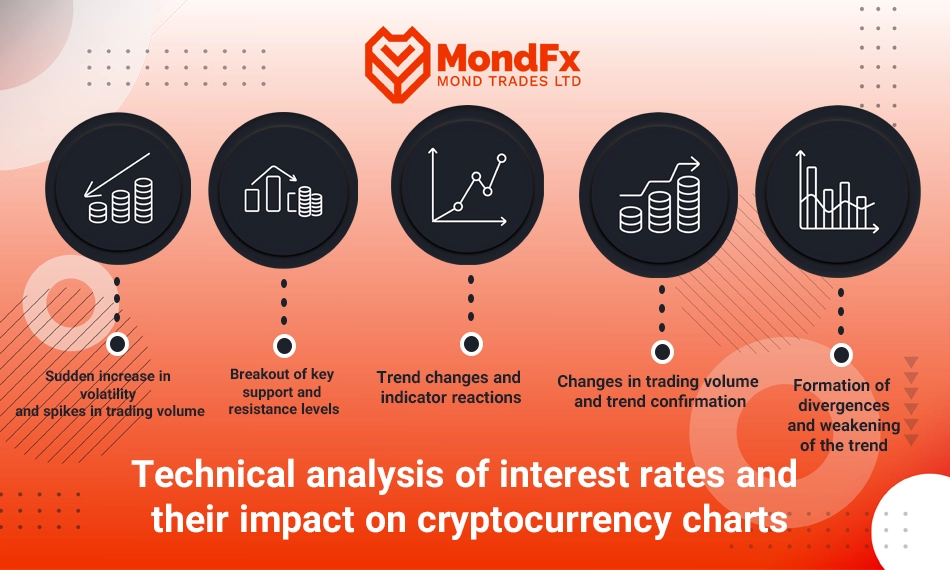

Technical analysis of interest rates on cryptocurrency charts

Interest rate changes are quickly reflected in the highly volatile cryptocurrency markets and exert their impact on the price charts of these cryptocurrencies. These changes include:

Sudden increase in volatility (Volatility):

The announcement of interest rate changes usually leads to an increase in trading volume and sharp fluctuations. At such moments, cryptocurrency prices may quickly move up or down, which creates trading opportunities and at the same time significant risks for short term traders.

Breakout of support and resistance levels:

When interest rates rise, selling pressure increases and key support levels (such as previous lows) are usually broken. This causes the downtrend to continue. Conversely, a decrease in interest rates may lead to the breakout of resistance levels and the beginning of an uptrend.

Trend reversal (Trend Reversal):

Technical indicators such as MACD or RSI point to changes in trend at the time of interest rate changes. For example, if the RSI enters the oversold zone, it indicates the possibility of a price rebound; however, if the interest rate trend has caused strong selling pressure, the downtrend may continue for some time.

Trading volume:

An increase in interest rates is usually accompanied by higher selling volume. This high volume can be a sign confirming the downtrend. Conversely, a decrease in interest rates can coincide with an increase in buying volume.

Divergence in indicators:

Sometimes changes in interest rates lead to divergence between price and indicators (for example, the price is declining while the indicator is rising). This is a sign of a weakening of the current trend and a possible reversal.

Technical analysis of interest rates and their impact on cryptocurrency charts

Changes in interest rates are among the factors that are reflected very quickly and noticeably in the price charts of the crypto market. Due to its highly volatile and reactive nature, this market experiences any correction or economic policy decision with greater intensity. When central banks announce changes in interest rates, traders’ behavior, trading volume, and the strength of trends in the cryptocurrency market also undergo changes. Below, we examine the most important effects of this variable from a technical perspective.

Sudden increase in volatility and spikes in trading volume

The announcement of interest rate changes is usually accompanied by an immediate increase in volatility. In such moments, trading volume grows and prices may rise or fall sharply within a short period of time. These conditions create attractive opportunities for short term traders, although at the same time the risk of losing positions also increases. During these periods, the chart takes on emotional behavior and oscillatory patterns are formed repeatedly.

Breakout of key support and resistance levels

With an increase in interest rates, selling pressure in the market usually intensifies, and this pressure can lead to the breakdown of key support levels. The breaking of previous lows paves the way for the continuation of the downtrend and prevents conservative traders from re-entering. Conversely, a decrease in interest rates strengthens buyers and increases the likelihood of prices breaking through resistance levels and the start of an upward wave.

Trend changes and indicator reactions

Technical indicators such as MACD and RSI, during periods when interest rates are fluctuating, often provide clear signs of a trend change. For example, when the RSI enters the oversold zone, it can signal the possibility of a price reversal. However, if an uptrend or downtrend has been strengthened by interest rate changes, the indicators may remain in the same area for an extended period and confirm the prevailing trend.

Changes in trading volume and trend confirmation

An increase in interest rates is generally accompanied by a rise in selling volume, and this can be regarded as a confirming signal for the continuation of the downtrend. On the other hand, when interest rates decrease, buying volume usually increases and the market moves toward a recovery. Examining trading volume in critical zones is one of the key tools for determining the validity of breakouts and reversals during periods of interest rate changes.

Formation of divergences and weakening of the trend

Sometimes changes in interest rates cause the price and indicators to move in different directions. For example, the price may still be declining while the indicator shows an upward trend. This situation, known as divergence, is a sign of a weakening prevailing trend and the potential for a price reversal. In such conditions, experienced traders monitor price action more closely in order to identify the appropriate point for entry or exit.

Conclusion

Examining the relationship between interest rates and the cryptocurrency market shows that, contrary to common belief, the two are tightly intertwined. Although the interest rate is a traditional economic tool, within the crypto ecosystem it turns into a driver that changes the direction of capital flows, investor behavior, and even the depth of technical volatility. Every central bank decision, whether an interest rate hike or cut, is quickly translated into the crypto market a translation that is shaped not on the basis of formal rules, but around expectations, collective psychology, and the level of risk appetite among market participants.

On the other hand, cryptocurrencies do not react to interest rates in the same way. Bitcoin, which plays the role of a store of value, is directly exposed to macroeconomic changes, while projects such as Ethereum and Cardano, depending on their use cases, liquidity, and position within their ecosystems, display different reactions. It is precisely these differences that make understanding interest rates essential for professional traders, because correctly understanding this linkage can determine when the market is ready for a breakout and when it is merely reacting emotionally to monetary policies.

Technical analysis also clearly displays this impact from sudden spikes in volatility to the breaking of support and resistance levels, indicator divergences, and increases in trading volume. In practice, the interest rate has become one of the few macro factors that can change the structure of a trend in the crypto market.

Ultimately, what matters is understanding that the interest rate is not just a number announced by the central bank, but a comprehensive signal about the future of the global economy. Traders or investors who interpret this signal correctly will have a greater chance of managing risk, choosing the right timing for entry and exit, and building sustainable strategies.

Frequently Asked Questions (FAQ)

How do interest rates indirectly affect the technical charts of cryptocurrencies?

Interest rates do not directly change the price of cryptocurrencies, but they change investors’ behavior toward risk. An increase in interest rates increases the preference for safe assets, and this in turn strengthens selling pressure on the technical charts. As a result, patterns such as support breaks or downtrends become more powerful.

Why does the price volatility of cryptocurrencies increase when interest rates are announced?

Because at the moment the data are released, traders adjust their expectations. This sudden adjustment leads to an increase in trading volume and sharp volatility. For this reason, indicators behave more sensitively during these periods and generate reverse or rapid signals.

Can market reactions to interest rates be predicted using indicators?

Indicators cannot predict the interest rate figure itself, but they can show its effect on market behavior. For example, rising volume, divergences, or the RSI entering overbought or oversold zones are usually the first signs of the market’s reaction to central bank decisions.

When interest rates are rising, which technical zones gain greater importance?

In periods of rising interest rates, support zones are the most important points on the chart, because the market often tends to decline and the breaking of these supports can deepen the downtrend. Traders usually also look for confirmations such as high selling volume or a candle closing below support.

Does a decrease in interest rates always lead to an uptrend in cryptocurrencies?

No. A reduction in interest rates usually leads to greater risk appetite and a flow of capital toward riskier assets, but the market’s reaction also depends on other factors such as macroeconomic conditions, liquidity, and prevailing sentiment. Therefore, an uptrend only forms when the technical data confirm it as well.

How can trading risk be managed when interest rates are announced?

The best approach is to use reasonable stop loss levels, reduce position size, and avoid entering trades without technical confirmation, because price movements in these periods may change direction very quickly, and many indicators may behave noisily for several minutes or even several hours.