Author: Sajad Sheikhi

Long term holders are exiting

Traders, based on the familiar theories of Bitcoin’s four-year cycles and similar price behavior, predict that the price has already seen its peak and is now entering a downward cycle. The halving event occurs once every four years and cuts miners’ rewards in half. Historically, Bitcoin’s cycle has been such that one year after the halving, a new ATH is recorded, and then the market experiences a deep decline.

In the current cycle, the halving occurred in April 2024 and the price reached its peak in October, which so far aligns with historical patterns. However, with institutional investors entering the market, it is unclear whether the old scenarios will repeat.

Sentiment in the retail segment of the cryptocurrency market (the sentiment of small scale traders) is so weak that continued selling pressure and a downward trend are possible. Despite lower expectations for interest rate cuts, retail traders predict that Bitcoin’s bull phase in this four-year cycle may have ended and fear being trapped in a long term downtrend; as a result, they are rushing to exit the market.

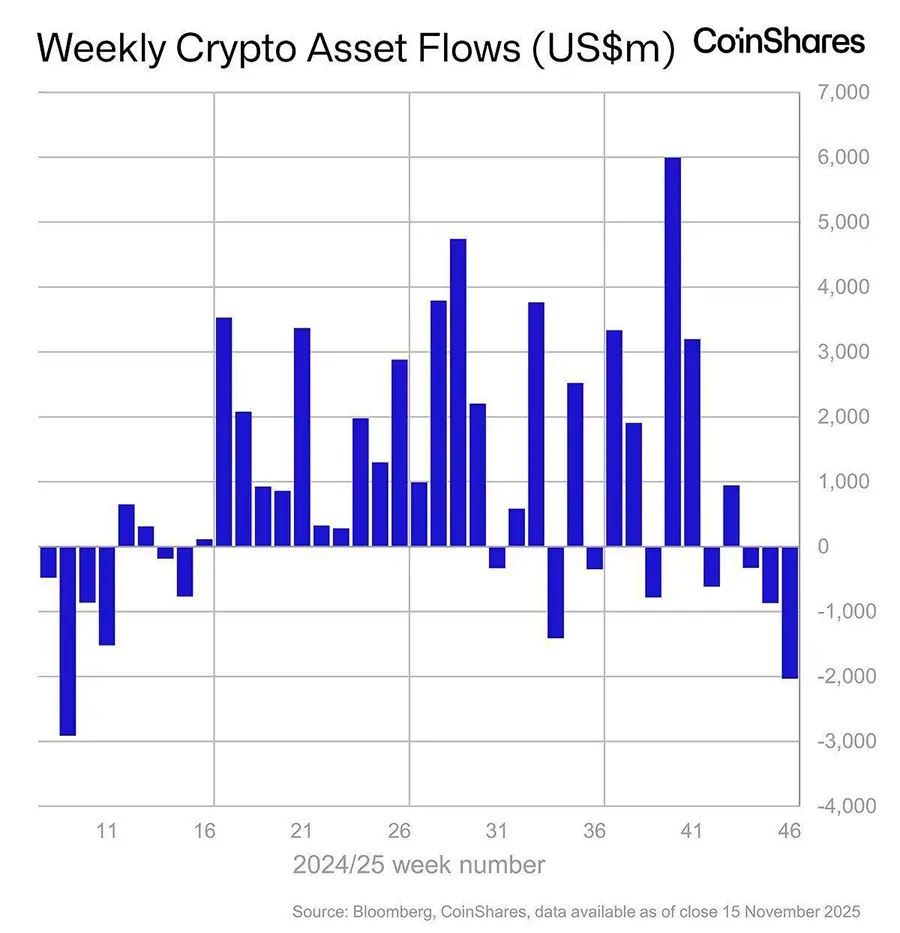

In addition to retail investors, capital outflows have also occurred among institutional investors. The chart above shows a heavy $2 billion outflow by institutional investors, which is the largest amount since February.

At the same time, the decline in the appeal of technology stocks has also influenced sentiment in the crypto market. Investors are paying attention to Wall Street’s warnings that companies in the technology and artificial intelligence sectors are overvalued. Bitcoin, historically, has been correlated with this group of stocks.

The Federal Reserve disappointed the market

After the risk aversion triggered by the escalation of the trade war in early October, the most important factor that drove the market’s decline was expectations of interest rate cuts. Prior to the October FOMC meeting, the market had very optimistically priced in a total of six rate cuts for 2025 and 2026 a pace of easing that would bring the interest rate by the end of 2026 down to the neutral rate estimated by the Federal Reserve in September.

However, the government shutdown and the resulting halt in data releases, along with persistent inflationary pressures and strong U.S. economic growth, led Powell to adopt a cautious approach. At the beginning of his speech, the Fed Chair stated that a December cut is not guaranteed and that alone was enough to trigger a market sell off. In effect, markets were disappointed about the absence of a December rate cut.

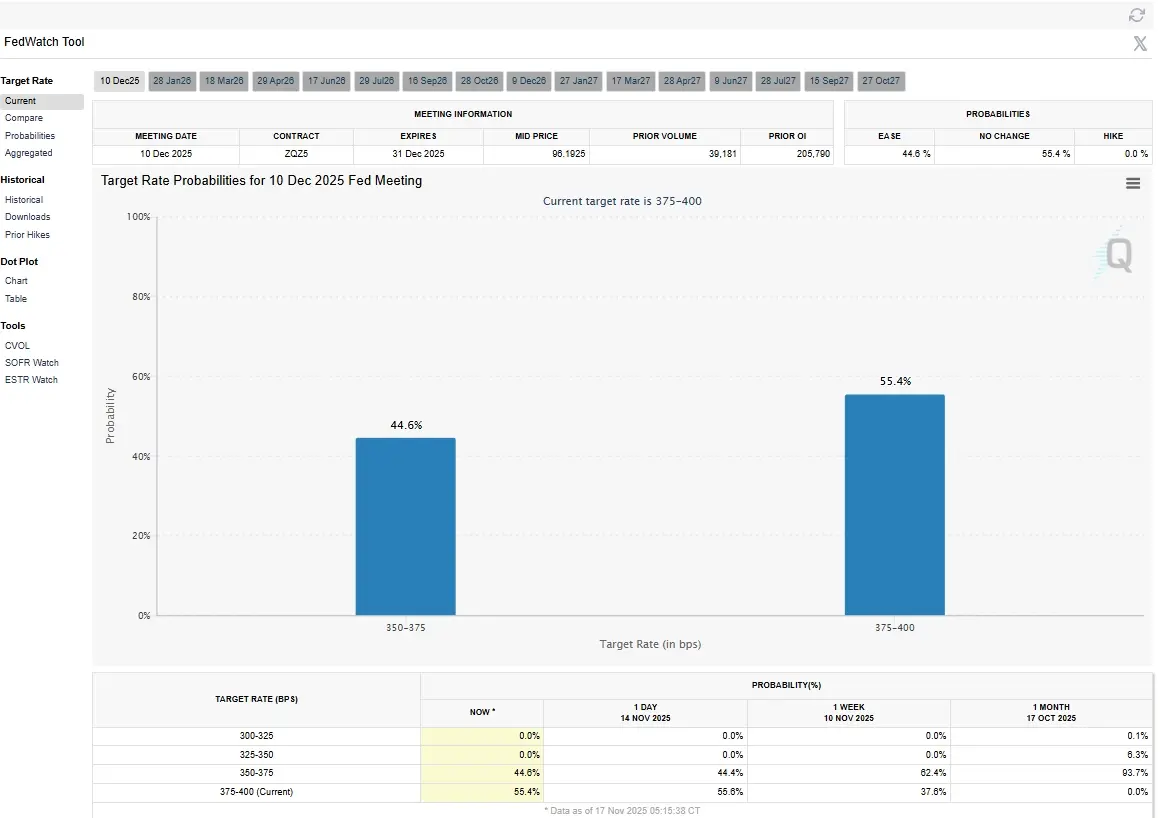

But the Federal Reserve’s emphasis did not end there. After the October meeting, Fed officials repeatedly spoke about uncertainty and the possibility that interest rates may remain unchanged in December. As a result, market expectations for a rate cut have fallen from 70 percent to 43 percent

The chart above shows expectations for an interest rate cut at the December meeting, based on data from the Chicago Mercantile Exchange. At this point, market expectations for the magnitude of rate cuts seem reasonable, as the resilience of the economy indicates that current monetary policy is not particularly restrictive and that we are already close to the neutral interest rate.

The Federal Reserve estimated the neutral rate at 3 percent in its September meeting. It is possible that in the December meeting when new forecasts are released the median estimate for the neutral rate may be higher.

The interest rate outlook for December is truly uncertain. Over the past two months, the market has lacked official government data, leaving the state of the labor market and inflation unclear. The September employment report, which will be released on Thursday, will partly clarify the market outlook, though this report is considered highly backward looking. If the employment data turns out weak, expectations for rate cuts will rise and will likely support the cryptocurrency market. All eyes are now on the employment report scheduled for Thursday at 17:00 Tehran time.

Conclusion

Bitcoin, after recording a new all-time high in October, has faced a sharp decline and has given back all of this year’s gains. This decline began with the risk aversion triggered by the escalation of the trade war and continued with the reduction in expectations for Federal Reserve rate cuts in late October. In addition to economic factors, market internal dynamics show that investors fear a post ATH crash similar to previous halving cycles and are rushing to sell.

Currently, expectations for rate cuts depend on the September employment data, which will be released on Thursday. If this data indicates labor market weakness, rising expectations for rate cuts will support the crypto market.