What is cTrader?

The creators of cTrader define it as an advanced trading platform designed for Forex and CFD traders. With a wide range of tools and charts, cTrader enables users to place various orders and execute trades with exceptional speed and precision. This platform offers a professional and seamless experience for its users.

cTrader’s user friendly interface is available natively for desktop, web, and mobile devices, enabling traders to engage in the financial markets with high speed and accuracy.

How to Register on cTrader

To access all the features of cTrader, you need to first register on the platform. Follow these steps to complete your registration:Download cTrader Platform

Visit the official MondFx website and download the cTrader platform version you prefer (Desktop, Web, or Mobile) through the following link:

Direct download link for cTrader: https://mondfx.com/en/platforms

Create an Account

After installing or logging into the web or mobile version, click on the "Sign Up" option.

Enter Personal Information

Provide the necessary details, such as your name, email, phone number, and country. Ensure that you choose a strong password for your account.

Email Verification

A confirmation email will be sent to the address you provided. Open the email and click on the verification link.

Complete Account Information

Enter additional required details, such as your address and identification documents (for identity verification).

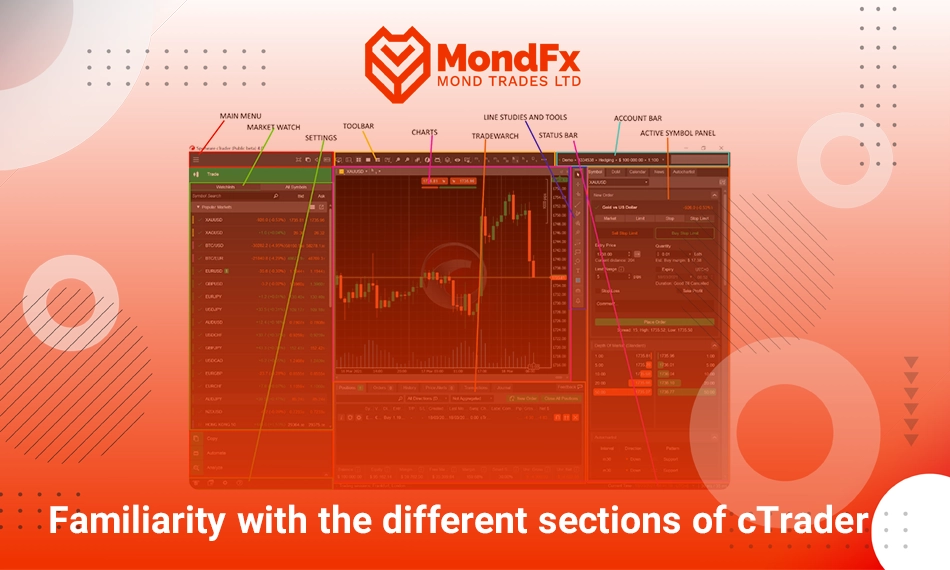

Familiarity with the Different Sections of cTrader

The cTrader user interface is designed for ease of use and smooth trade execution. The main screen provides comprehensive access to various options, sections, and tools available on the platform. These sections include:

Main Menu

This section provides access to trading software, copy trading, automated trading, analysis tools, as well as deposit, withdrawal, and platform settings for cTrader.

Toolbar

The toolbar is designed for configuring and accessing various tools within the platform.

Account Bar

Here, you can easily switch between your active cTID trading accounts.

Market Watch

In this section, you can select your trading symbols, enter trades, and manage your watchlists.

Charts

This section is for viewing the charts of your selected symbols. You can add multiple charts and place orders or manage positions directly from them.

Trade Watch

In this section, you can manage your orders and positions, check your account balance, and review your trading history.

Instruments Toolbar

In this section, you can change chart modes, adjust market research tools, configure drawing tools, and activate price alerts.

Status Bar

Here, you can view the current trading session, server status, real time updates, and proxy delays.

Active Symbol Panel (ASP)

In this section, you can place your trading orders, access the Depth of Market (DoM), and review market details and transaction statistics.

Settings

This section provides access to settings, deposits, withdrawals, and support for the platform.

How to Place an Order on cTrader

The main goal of traders using cTrader is to place their trading orders through the platform. To do so, follow these steps:

Select the "Trade" Option to Create an Order

To begin, go to the "New Order" menu and click on the "Trade" option. This will direct you to a page where you can enter all the details of your order and quickly enter the market.

Choose the Trade Direction (Buy or Sell)

Next, select the direction of your trade. Use the "Buy" or "Sell" buttons to specify whether you want to buy or sell. This choice will help you implement your strategy in the correct direction based on your market analysis.

Setting the Trade Volume

In this step, you need to determine the volume of your trade. From the dropdown menu, you can select the number of lots you wish to trade or manually enter the exact volume. Choosing the appropriate volume helps you manage both your risk and potential profits more effectively.

Setting the Market Range

In this section, you need to specify the range within which you want your order to be executed. Using the "Market Range" option, you can set your desired price range. If you uncheck this option or set its value to zero, you are effectively creating a Limit Order, meaning your order will only be executed at the specified price.

Configuring Stop Loss and Take Profit

To manage your risk and profits, you can set Stop Loss (SL) and Take Profit (TP) for your order. By checking the relevant boxes and entering your preferred values, you can define the price levels at which your position will be closed. These settings help you maintain better control over your trades under varying market conditions.

Adding a Comment to Your Order

If you want to add a note or explanation for yourself about the order, you can use the comment section. This feature allows you to write additional details about your strategy or specific conditions for the order, which you can refer to in the future.

Finalizing Your Order with "Place Order"

After completing all settings, click on the "Place Order" button to submit your order to the market. This action will register your order, and if it matches the conditions, it will be executed automatically.

Setting a Price Alert

If you want to be notified of price changes, you can activate the "Price Alert" option. This way, when the price reaches your specified level, the system will alert you, allowing you to make more timely decisions.

Managing Orders with Collapse/Expand Options

For better order management, you can use the Collapse/Expand options located on the right side of the chart. These options allow you to close orders or view and manage their details.

Viewing Trading Symbol Details

If you wish to see more detailed information about your trading symbol, simply click on the "Symbol" icon. This section will display additional data regarding the status and features of your trading symbol.

This guide has explained the step by step process of placing trading orders in the Forex market using the cTrader platform, from selecting the trade direction (Buy or Sell) to setting the volume, Stop Loss, Take Profit, and even setting price alerts. All the necessary tools and settings for executing trades accurately and efficiently have been covered.

With this guide and the cTrader platform, you can easily place your orders in the Forex market and make the most of the cTrader platform's features.