The Return of Tensions with Trump’s Tariff Threat

Last week, Donald Trump once again took a hardline stance against China, announcing that starting in early November, import tariffs on Chinese goods would be increased by 100%.

According to Bloomberg’s estimates, this decision will raise China’s effective tariff rate to around 140% a level that could effectively halt trade between the two countries. The news alone was enough to trigger a strong risk off sentiment across the markets. But is this threat real, or merely a negotiation tactic to exert pressure?

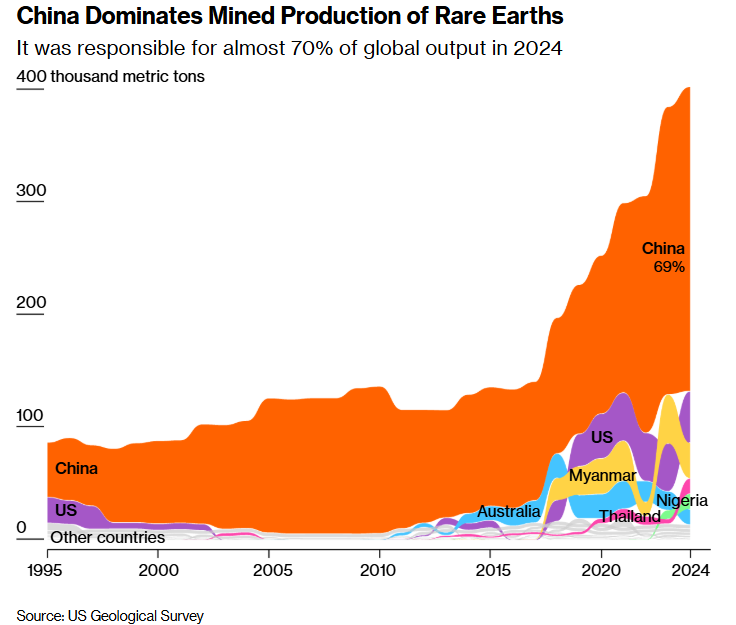

The Reason Behind the New Tensions: Rare Earth Elements

The source of the latest conflict lies in China’s new export restrictions on rare earth elements critical materials for the electronics, clean energy, automotive, and defense industries.

Under the new regulations, any country that uses these elements in manufacturing its products and intends to export them must obtain an official license from China.

As the world’s largest producer of these elements, China is using this move as a strategic leverage tool against the West. Although China’s Ministry of Commerce has emphasized that the impact of these restrictions on the global supply chain will be “limited,” the policy is clearly unwelcome in Washington and has prompted a strong reaction from Trump.

Beijing’s Response and Washington’s Verbal Retreat

In response, China’s Ministry of Commerce stated that export controls are a legitimate measure aimed at maintaining global stability and regional peace. Beijing warned that if the United States continues its hostile course, it will take decisive countermeasures.

However, on Sunday night, Trump softened his tone on Truth Social, writing:

“Don’t worry about China, everything will be fine! President Xi just had a bad moment. We don’t want to hurt China; we want to help.”

This message helped calm the markets slightly and allowed them to recover part of their losses.

Why Is China in a Position of Strength?

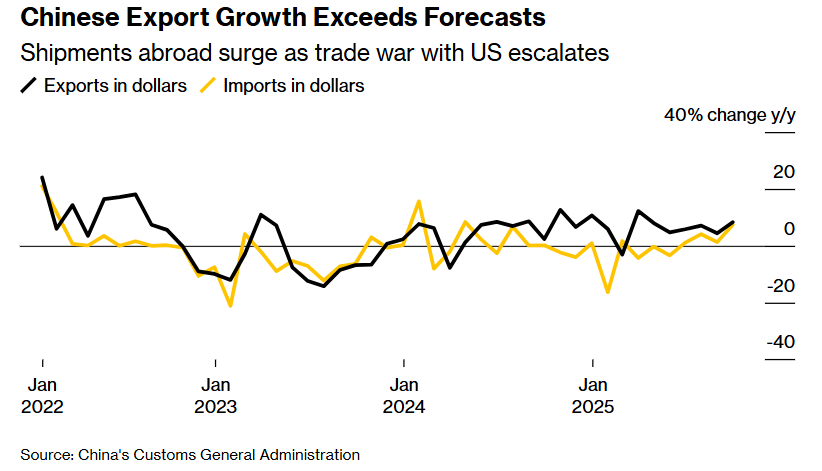

The latest data on China’s trade balance shows that the country has largely neutralized the impact of U.S. tariffs.

While exports to the United States have fallen by 27%, exports to other regions have grown significantly:

Africa: 56% growth

Europe: 14% growth

Latin America: 15.2% growth

Overall, China’s exports to non-U.S. markets have increased by about 15%.

This means Beijing has been able to find alternative markets for its products and minimize the pressure from U.S. tariffs.

The U.S. Economy Under Tariff Pressure

The U.S. economy, however, is in a more fragile condition. Prior to the government shutdown, economic data already indicated a weakening labor market and persistent inflationary pressures.

The NFP report showed a sharp decline in employment and a rise in the unemployment rate. Analysts suggest that high tariffs have hurt the U.S. economy more than China’s, as companies have been forced to lay off workers in an attempt to control costs.

As a result, further tariff increases could halt the disinflation process and even trigger a mild recession.

The Scenario Ahead: Threat or Reality?

Given Trump’s recent softer stance and the U.S. economy’s less than ideal condition, the threat of a 100% tariff hike appears to be more of a negotiation tool than a concrete policy decision.

Goldman Sachs analysts also believe that the most likely scenario is a mutual de-escalation and either an extension or removal of tariffs.

For now, markets remain in a wait and see mode: any positive news about improving relations could boost risk assets (stocks and crypto), while escalating tensions would drive capital flows toward safe haven assets like gold and the yen.

Conclusion

By leveraging its rare earth exports, China has once again placed Washington in a difficult position. Trump’s tariff threat triggered a wave of risk aversion in the markets, but the evidence suggests that this move is more tactical than practical.

The U.S. economy is currently unable to absorb another tariff shock, while China, by expanding its export markets, is unlikely to suffer significant damage from this trade war.

In such an environment, traders must be prepared for sudden volatility and politically driven decisions because in a trade war, economic logic is not always the winner.