Authors: Sabah Novinfar and Sajjad Sheikhi

US Government Shutdown and Vain Senate Efforts

The US government shutdown has entered its third week, with no agreement yet reached between Republicans and Democrats. Each party blames the other, and the core disagreement revolves around health subsidies:

Democrats demand the return of the health insurance plan to the budget. This policy largely benefits the middle class, and from their perspective, the fair distribution of resources is paramount.

Trump and the Right Wing, driven by a capitalist view, pursue tax cuts and support for economic growth, which has been damaged by tariffs. Eliminating health subsidies benefits the wealthy and large corporations, but it reduces government revenue.

In practice, the Senate has attempted to move forward with a vote and an agreement 11 times so far but has been unsuccessful. Nevertheless, markets are not taking the shutdown risk seriously in the short term, and traders believe the government will reopen sooner or later. The economic impact of this shutdown will be visible in the October employment data.

Hope for a Trade Deal with China

Heavy tariffs, especially those over 100%, which Trump uses as leverage, are detrimental to the economies of both countries.

Despite negative inflation and weak demand, the Chinese economy managed to register higher than expected growth in the third quarter of the year and hopes that its 2025 GDP will reach the set target.

On the other hand, the US economy, following the tariff crisis, has faced rising inflation expectations, a weak job market, and high interest rates. So far, the tariffs have caused more damage to the US, prompting Trump to pursue negotiations seriously. He has stated that the high tariffs will not be sustainable for China and that Americans prefer a trade deal to a trade war.

Upcoming meetings, including a potential meeting between Trump and Chinese President Xi Jinping, as well as negotiations between US Treasury Secretary Scott Bessent and Chinese officials, could increase risk appetite sentiment in the financial markets and benefit US stock indices.

Weak Job Market and Interest Rate Policies

Due to the government shutdown, critical economic data such as inflation, the unemployment rate, and retail sales have not been released over the past month. Around 900,000 federal employees remain furloughed, and Trump has threatened widespread layoffs if the shutdown continues.

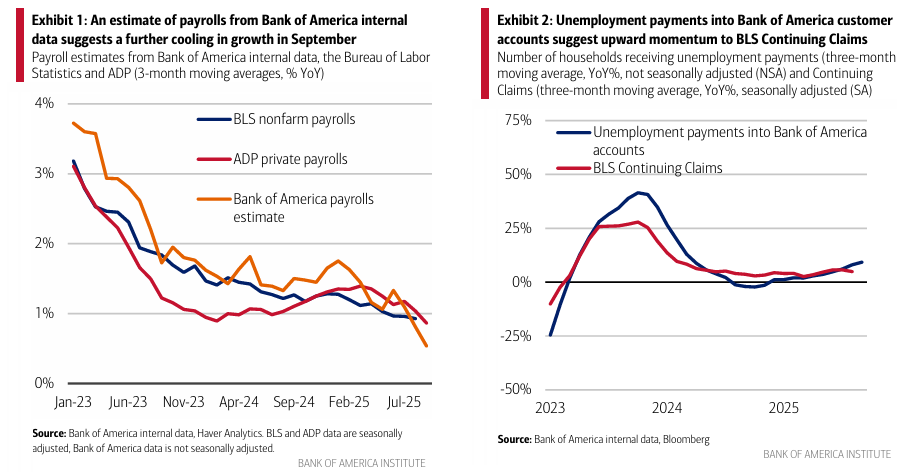

However, private sector data and internal analyses from the Bank of America indicate that the labor market is undergoing a significant weakening. The upcoming Federal Reserve meeting at the end of October will be challenging given the data scarcity. Members of the Federal Reserve Board, including Mr. Waller, have emphasized that an interest rate cut remains an option, even without the official government data.

The CPI data to be released this week is expected to confirm the inflationary pressures stemming from the tariffs. Still, these pressures are not significant enough to prevent an interest rate cut.

Outlook for the US Dollar Index

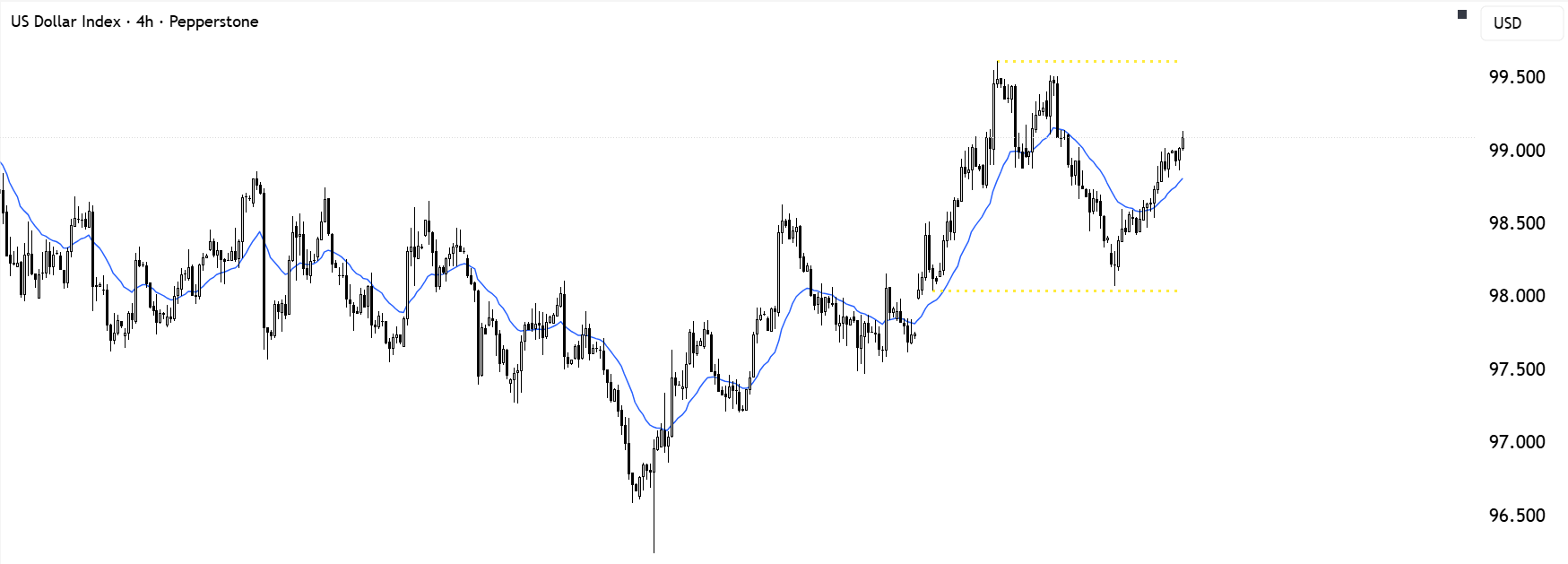

Following several days of powerful growth, the Dollar Index has entered a phase where continued ascent is difficult without strong inflation data:

If Friday's inflation statistics are higher than expected, the probability of lowered interest rate expectations decreases, which will boost support for the dollar.

Otherwise, a correction or consolidation of the dollar is likely.

Fresh tensions between the US and China and the possibility of canceling the Trump-Xi meeting could exert downward pressure on the dollar and intensify risk off sentiment in global markets.

From a Technical Analysis Perspective:

Conclusion and Recommendation for Forex Traders

The Dollar Index is being bolstered by optimism regarding trade talks with China and expectations for an end to the government shutdown, and it is likely to continue its short term upward trend.

In the medium term, a gradual weakening of the dollar is anticipated due to the expected interest rate cuts and the weakness in the US labor market.

Forex and US stock market traders should exercise caution in their decisions and consider rushing to sell the dollar as high risk.

For users of MondFx broker, closely following the Dollar Index and economic developments in the US and China will provide significant trading opportunities and can be instrumental in making strategic Forex and US stock market decisions.