Definition of a Limit Order in Forex

A limit order is a pending order that instructs the broker to execute a buy or sell order once the price reaches a specified level. Unlike Market Orders, which are executed immediately at the current market price, limit orders are only triggered when the price reaches the specified level.

Limit orders are commonly used for entering the market at better prices or exiting trades at a predetermined profit level. By using limit orders, traders can have greater control over their entry and exit prices.

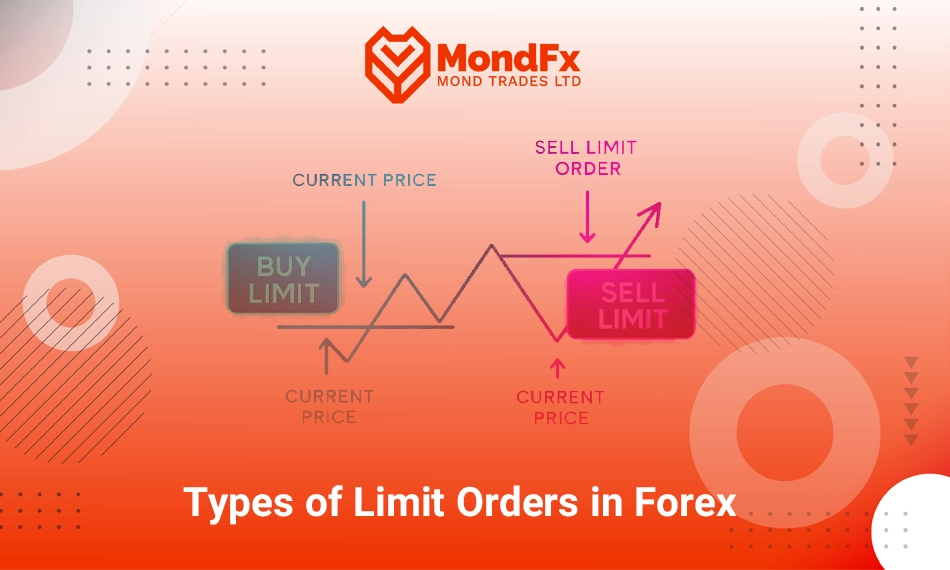

Types of Limit Orders in Forex

There are two main types of limit orders in Forex:Buy Limit Order

Sell Limit Order

| Feature | Buy Limit Order | Sell Limit Order |

|---|---|---|

| Definition | A buy order placed below the current market price | A sell order placed above the current market price |

| Objective | Enter a long position at a better price | Enter a short position at a better price |

| Activation Time | Activated when the price reaches the specified level or lower | Activated when the price reaches the specified level or higher |

| Best Use Case | When expecting the price to fall to a support level before rising | When expecting the price to rise to a resistance level before falling |

| Ideal Entry Point | Near support levels | Near resistance levels |

| Risk | The order may not activate if the price never reaches the specified level | The order may not activate if the price never reaches the specified level |

| Key Benefit | Buying at a lower price and benefiting from a price increase | Selling at a higher price and profiting from a price decrease |

| Potential Challenge | Missing the opportunity if the price doesn’t reach the set level | Missing the opportunity if the price doesn’t reach the set level |

1. Buy Limit Order

A Buy Limit Order is a pending order that allows a trader to buy an asset at a price lower than the current market price. This order is typically used when the trader expects the price to decline to a certain level before rising again.

A Buy Limit is beneficial when a trader anticipates that the price will reach a support level and then rebound. This technique allows traders to enter at a better price and take advantage of short-term market corrections.Example:Suppose the EUR/USD pair is trading at 1.1000. You predict that the price might fall to 1.0950 and then rise again. In this case, you can set a Buy Limit order at 1.0950. If the price drops to this level, your order will be activated, and a buy position will open. If the price rises afterward, you will have entered the trade at a favorable price.Important Note:A Buy Limit order will only activate when the price reaches or falls below the specified level. If the price never reaches this point, the order will remain inactive.2. Sell Limit Order

A Sell Limit Order is a pending order that allows a trader to sell an asset at a price higher than the current market price. This type of order is useful when the trader expects the price to rise to a certain level before declining.

A Sell Limit is ideal when a trader predicts that the price will reach a resistance level and then reverse. This strategy enables traders to sell at better prices before a potential downward move.Example:Suppose the GBP/USD pair is trading at 1.3000. You anticipate that if the price rises to 1.3050, it will likely start to decline. In this scenario, you can place a Sell Limit order at 1.3050. If the price reaches this level, your order will be activated, and a sell position will open.Important Note:A Sell Limit order will only activate when the price reaches or exceeds the specified level. If the price never reaches this point, the order will remain inactive.

Types of Orders in Forex

Traders in the Forex market utilize various types of orders to manage their trades effectively. Knowing these orders can help you make informed decisions and refine your trading strategies. Below are the key order types in Forex:1. Market Order

A Market Order is an order to buy or sell immediately at the current market price. Traders use this order when they want to enter the market quickly without specifying a precise entry price.

While market orders ensure immediate execution, they may be subject to slippage during volatile market conditions, where the order is filled at a slightly different price than expected.2. Limit Order

A Limit Order allows traders to set a specific price at which they wish to buy or sell. Limit orders include:Buy Limit:To buy below the current market price.

Sell Limit:To sell above the current market price.

Limit orders help traders enter the market at optimal prices without constant monitoring.3. Stop Order

A Stop Order is a pending order that becomes active only when the market price reaches a specified stop price. Stop orders are commonly used to catch breakouts or avoid further losses. Types of stop orders include:Buy Stop:Placed above the current price when expecting further upward movement.

Sell Stop:Placed below the current price when expecting further downward movement.

4. Stop-Limit Order

A Stop-Limit Order combines features of both Stop Orders and Limit Orders. In this type of order, the trader specifies:Stop Price:The price at which the order becomes active.

Limit Price:The maximum or minimum price at which the order should be executed.

This type of order ensures better price control but may not execute if the price moves beyond the limit price.5. Stop Loss Order

A Stop Loss Order is a protective order that automatically closes a trade if the price moves against the trader by a specified amount. Stop losses are essential for limiting potential losses.6. Trailing Stop Order

A Trailing Stop Order is a dynamic stop loss that automatically adjusts as the market moves favorably. If the price moves in the desired direction, the trailing stop will move accordingly to lock in profits. If the price reverses, the position closes at the last trailing stop level.7. OCO (One Cancels the Other) Order

An OCO Order is a combination of two orders placed simultaneously. If one order is activated, the other is automatically canceled. This method is ideal when traders are uncertain about the market’s direction.8. GTC (Good Till Canceled) Order

A GTC Order remains active until the trader cancels it. This order is useful for traders who want to maintain their orders until their price targets are reached.9. IOC (Immediate or Cancel) Order

An IOC Order is an instruction to execute all or part of an order immediately. Any unexecuted portion of the order is automatically canceled.10. FOK (Fill or Kill) Order

A FOK Order requires the order to be executed immediately in its entirety. If the entire order cannot be filled immediately, it is canceled.

Understanding the various types of orders in Forex is essential for developing effective trading strategies and managing risk efficiently. By incorporating tools like Limit Orders,Stop Orders, and Trailing Stops, traders can improve their entry and exit points, maximize profits, and minimize losses. Selecting the appropriate order type based on market conditions and trading objectives can significantly enhance your success in Forex trading.

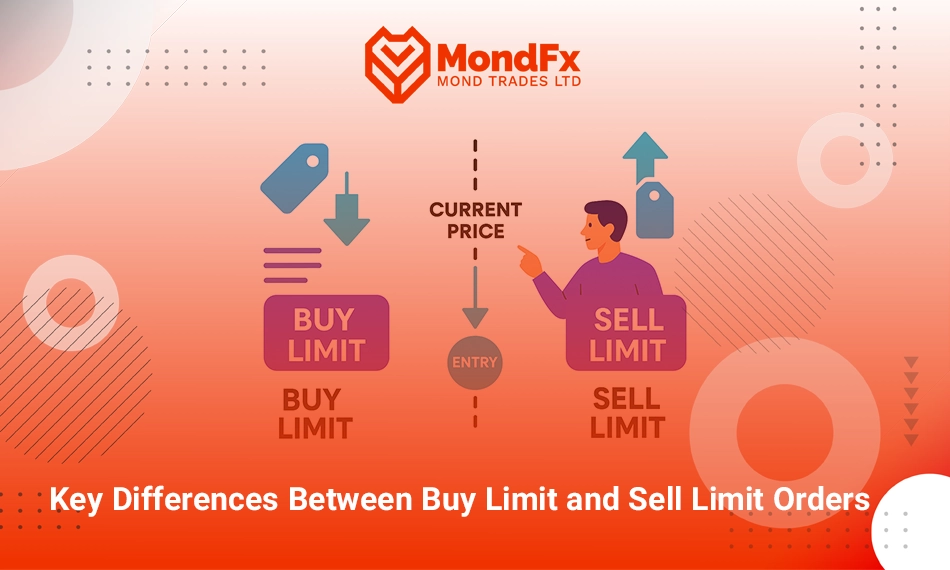

Key Differences Between Buy Limit and Sell Limit Orders

In a Buy Limit order, you aim to enter a buy position at a price lower than the current market price, whereas in a Sell Limit order, your goal is to enter a sell position at a price higher than the current market price.

Market conditions play a significant role in choosing the appropriate order type. A Buy Limit order is commonly used when a trader expects the price to decline to a support level before reversing upward. Conversely, a Sell Limit order is useful when it’s anticipated that the price will rise to a resistance level before reversing downward.

Regarding order activation, a Buy Limit order is activated when the market price reaches the specified level or lower. In contrast, a Sell Limit order is activated only when the market price reaches the specified level or higher.

Advantages of Limit Orders in Forex

Limit orders offer several significant advantages, making them one of the most popular tools among traders. One of the key benefits of this type of order is precise control over entry and exit prices. With limit orders, traders can enter or exit the market at predefined price levels without constant monitoring.

Another major advantage is that limit orders help reduce emotional trading decisions. By setting entry and exit points in advance, traders can avoid impulsive and emotionally driven decisions, allowing them to stick to their trading strategies.

Additionally, limit orders enable traders to execute trades at more favorable prices. In volatile market conditions, limit orders allow traders to enter or exit at optimal points, improving their chances of capturing profitable opportunities.

Disadvantages of Limit Orders in Forex

Despite their benefits, limit orders also have some drawbacks that traders should be aware of. One of the most significant disadvantages is the lack of guaranteed activation. If the market price never reaches the specified limit level, the order will remain inactive, and the trader may miss out on profitable opportunities.

Another potential drawback is the possibility of partial activation. In low-liquidity markets or during major economic news releases, a limit order may only be partially filled, preventing the trader from fully entering or exiting a position.

Lastly, limit orders often require longer waiting periods. Unlike market orders, which execute immediately, limit orders may remain pending for extended periods until the price reaches the specified level. This delay could result in missed quick market movements in certain situations.

How to Set Limit Orders in Trading Platforms

In popular trading platforms like MetaTrader 4 (MT4)and MetaTrader 5 (MT5), setting limit orders is a straightforward process. Follow these steps to place a limit order:Log in to your trading platform and open the chart for your desired currency pair.

Click on the"New Order"button.

In the"Type"section, select"Pending Order".

From the dropdown menu, choose either"Buy Limit"or"Sell Limit"depending on your desired order type.

Enter your preferred price level in the"Price"field.

If needed, set your Stop Loss and Take Profit levels for risk management.

Click"Place"to submit the order.

Important Tips for Using Limit Orders in Forex

To enhance your success with limit orders, consider the following key points:

Conduct thorough technical and fundamental analysis before setting limit orders to identify optimal entry and exit points.

In volatile markets, setting an appropriate buffer for limit orders can help prevent the premature activation of your order.

Always combine limit orders with risk management tools such as Stop Loss and Take Profit levels to minimize unexpected losses in unfavorable conditions.

By implementing these strategies, you can maximize the effectiveness of limit orders and improve your overall trading performance.Why Use a Limit Order in Trading?

Using a Limit Order in Forex trading and other financial markets is recommended for several reasons. This type of order helps traders execute their strategies with greater precision and reduced risk by providing better control over entry and exit prices. Below are the key reasons why traders prefer limit orders:1. Entering at More Favorable Prices:

A limit order allows you to purchase an asset only if the price drops to your desired level or sell it at a higher price when the market reaches your target level. This feature prevents traders from entering or exiting at undesirable prices and ensures trades are executed under optimal conditions.2. Effective Risk Management:

With a limit order, you can specify the exact entry or exit price. This feature ensures that your order will only be executed under favorable conditions, reducing the risks associated with impulsive or emotional trading decisions.3. Time and Energy Efficiency:

Limit orders allow traders to set their orders in advance without constantly monitoring the market. By placing a limit order, your trade will automatically execute when the market price reaches your desired level. This is particularly useful for traders who cannot consistently observe the market due to time constraints.4. Reducing Slippage Risk:

In volatile markets, executing Market Orders may result in trades being filled at a price different from the expected level due to slippage. However, with limit orders, trades are executed only at the specified price or better, minimizing the risk of unwanted price fluctuations.5. Enhancing Trading Strategies:

Limit orders enable professional traders to design advanced strategies. For instance, placing multiple limit orders at various price levels can improve entry and exit timing, allowing traders to maximize profitable opportunities.6. Ideal for Cautious Traders:

Traders who prefer to enter trades at precise price points identified through technical or fundamental analysis can use limit orders to avoid entering at undesirable prices.

What Are Limit Orders and Stop-Limit Orders?

In Forex trading and other financial markets, advanced tools like Limit Orders and Stop-Limit Orders help traders exercise greater control over their entry and exit points. These two order types have distinct features, and choosing the right one based on market conditions and trading strategies can significantly impact risk management and profitability.What Is a Limit Order?

A Limit Order is a pending order in which the trader specifies that an asset should only be bought or sold at a predetermined price or better. There are two types of limit orders:Buy Limit:A buy order placed below the current market price.

Sell Limit:A sell order placed above the current market price.

Limit orders are useful when a trader anticipates that the market price will reach a predetermined level before reversing. This method allows traders to enter at optimal prices without overpaying or entering at an unfavorable point.Example of a Buy Limit Order:Suppose the EUR/USD pair is trading at 1.1000 and you expect the price to drop to 1.0950 before starting an upward trend. In this case, you can place a Buy Limit order at 1.0950. If the price reaches this level, your order will be activated.Example of a Sell Limit Order:Suppose the GBP/USD pair is trading at 1.3000 and you expect the price to rise to 1.3050 before reversing downward. By placing a Sell Limit order at 1.3050, your order will be triggered if the price reaches this level, opening a sell position.What Is a Stop-Limit Order?

A Stop-Limit Order combines the features of both a Stop Order and a Limit Order. In this type of order, the trader sets two price points:Stop Price:The level at which the order becomes active.

Limit Price:The maximum or minimum price at which the order will be executed.

Once the stop price is reached, the order converts into a Limit Order and will only be executed if the price remains within the defined limit range.Example of a Stop-Limit Order:Suppose the EUR/USD pair is trading at 1.1000, and you expect the price to rise if it reaches 1.1050, but you don’t want to enter the market if the price exceeds 1.1060. In this scenario, you can set a Stop-Limit Order with the following details:Stop Price:1.1050

Limit Price:1.1060

If the market reaches 1.1050, your order will be activated. However, the trade will only be executed if the price remains between 1.1050 and 1.1060. If the price moves above this range, your order will not be executed.Key Differences Between Limit Orders and Stop-Limit Orders

Execution Process:A Limit Order is executed only at the specified price or better, while a Stop-Limit Order activates when the stop price is reached and is executed within a specified price range.

Price Control:A Limit Order offers precise control over the entry/exit price, while a Stop-Limit Order allows for controlled execution within a specified range.

Slippage Risk:A Limit Order may not be executed if the price doesn’t reach the specified level. In a Stop-Limit Order, the trade may also fail to execute if the price exceeds the defined limit range.

Best Use Cases:

Limit Orders are ideal for buying near support levels and selling near resistance levels, while Stop-Limit Orders are better suited for managing risk in volatile market conditions.

Which Order Is Best for You?

Use a Limit Order if you want to enter at a precise price and are willing to wait until the market reaches your desired level.

Use a Stop-Limit Order if you prefer to enter a trade only after the price reaches a certain level, but want to avoid entering at undesirable prices.

Both Limit Orders and Stop-Limit Orders are powerful tools that allow traders to manage risk and execute trades with precision. By understanding their differences and applying them based on your trading strategy, you can improve your ability to capture profitable opportunities while maintaining control over your trades.