The Forex market, as one of the largest and most popular financial markets in the world, is a place for the exchange of various international currencies. Given the complexity and vastness of this market, many individuals seek ways to enter it. One of the key questions often raised by newcomers to this field is, “Is it possible to trade in Forex without a broker?” In this article, we will explore this question and discuss the importance of using brokers in the Forex market.

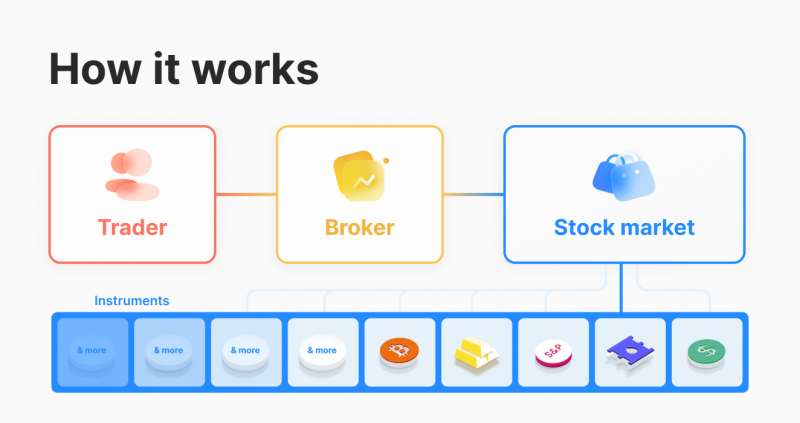

The Forex market, due to its international nature, requires access to interbank networks and large financial institutions. For ordinary individuals, gaining this access without intermediaries or brokers is extremely difficult. Brokers, as professional intermediaries, enable individual traders to participate in this market. Therefore, entering the Forex market without a broker is impossible.

Can I Trade in Forex Without a Broker?

Even if we assume that you have access to interbank networks, trading without a broker comes with numerous challenges. Brokers provide various tools and trading platforms that help traders conduct better analyses and make quicker decisions. Without these resources, conducting trades effectively and successfully would be very difficult.

Why Can’t You Trade in Forex Without a Broker?

Brokers play a crucial role in Forex trading. They not only act as intermediaries between traders and the market but also provide essential services and tools necessary for trading. Here are some key reasons why brokers are indispensable:

Access to the Market

One of the primary reasons for using brokers is that they provide access to the market. Brokers have extensive connections with banks and financial institutions, enabling them to quickly execute their clients’ trading orders. Without this access, conducting trades would be nearly impossible.

Provision of Trading Platforms

The trading platforms provided by brokers offer tools for technical and fundamental analysis, price charts, and features for quick order execution. These platforms often come with various features like chart analysis, technical indicators, and market news, without which trading would occur at a significantly lower quality.

Provision of Leverage

One of the key advantages of using brokers is access to leverage. Leverage allows traders to control larger positions in the market with a smaller amount of capital. Without leverage, you would need a substantial amount of capital to conduct high-volume trades.

Execution of Trades and Settlements

Brokers simplify the process of order execution and settlements. They ensure that trades are executed quickly and accurately, with profits and losses being calculated precisely and credited to traders’ accounts. Without these services, executing trades would be more manual and complicated.

Provision of Support Services

Brokers provide support services to their clients, which include answering questions, resolving technical issues, and offering necessary training for better use of trading platforms and tools. Without broker support, traders may encounter numerous problems that could hinder their ability to execute trades effectively.

Choosing the Right Broker

What Characteristics Make a Good Broker?

Selecting a suitable broker is one of the most important decisions for any trader in financial markets. Here are the characteristics of a good broker to help you trade with more confidence:

- Credibility and Regulation

Credibility and possessing the necessary licenses from regulatory authorities are the most critical features of a good broker. A broker that is overseen by reputable financial institutions has greater transparency and ensures the security of your capital. For example, brokers regulated by authorities like FCA, ASIC, and CySEC are generally considered more credible.

- User-Friendly Trading Platform

The trading platform is one of the main tools for traders. A good broker should provide a platform that is user-friendly, fast, and without delays. Additionally, the platform should offer a variety of features such as technical analysis, market news, and risk management tools. MetaTrader 4 and 5 are examples of popular platforms among traders.

- Competitive Spreads and Commissions

One important factor in choosing a broker is the level of spreads and commissions charged. Brokers with competitive spreads and commissions reduce your trading costs and help enhance profitability. Before selecting a broker, be sure to compare the different spreads and commissions.

- Diversity in Financial Instruments

A good broker should offer a wide variety of financial instruments. These instruments include Forex currency pairs, stocks, indices, commodities, and cryptocurrencies. Diversity in financial instruments allows you to maintain a more diversified portfolio and take advantage of various market opportunities.

- Excellent Customer Support

Customer support is one of the most important aspects of any broker. A good broker should have a professional and responsive support team that can assist you when needed. Ideally, customer support should be available in your language and accessible through various channels such as phone, email, and live chat.

- Education and Educational Resources

Brokers that prioritize the education and advancement of traders are typically better brokers. These brokers offer webinars, educational articles, and daily analyses that can help improve your trading skills. Additionally, some brokers provide demo accounts for practicing and testing trading strategies.

- Speed and Ease of Deposits and Withdrawals

One of the main concerns for traders is the speed and ease of depositing and withdrawing funds. A good broker should offer various quick methods for fund deposits and withdrawals, with processes that are transparent and uncomplicated. Furthermore, the broker should not charge additional fees for these services.

- Transparency in Terms and Conditions

A good broker should clearly and transparently outline its terms and conditions. This includes trading costs, withdrawal and deposit policies, terms for using bonuses, and how margin and leverage are calculated. Transparency in terms and conditions helps you avoid any ambiguity and potential issues.

- Appropriate Leverage

Leverage is a tool that can enhance profitability, but it also increases trading risks. A good broker should offer various leverage options, allowing you to choose the most suitable leverage based on your experience level and trading strategy.

- Diverse Trading Accounts

A good broker should provide a variety of trading accounts with different conditions. These accounts may include standard, ECN, micro, and VIP accounts. Diversity in trading accounts allows you to select the most appropriate account based on your needs and capital.

Choosing a suitable broker plays a crucial role in your success in financial markets. By examining the aforementioned features and comparing different brokers, you can select one that provides the best services and meets your needs effectively. Remember that researching and studying before choosing a broker can help prevent potential losses and contribute to your long-term success.

Conclusion

The Forex market, despite its complexities and numerous opportunities, requires the use of reputable and efficient brokers. Brokers play a crucial role in traders’ success by providing access to the market, offering trading platforms, financial leverage, and support services. Therefore, entering the Forex market without a broker is nearly impossible, and utilizing trustworthy and reliable brokers is essential.

Choosing the right broker can significantly impact your trading success and profitability. We hope this article has addressed your questions regarding the possibility of trading in Forex without a broker and clarified the importance of using brokers for your trading endeavors.