High-frequency trading (HFT) has revolutionized financial markets. This trading method utilizes advanced algorithms and powerful computer systems to execute trades in milliseconds. HFT has not only increased the speed and volume of transactions but also changed the competitive nature of financial markets. This article provides a comprehensive overview of HFT, explaining fundamental concepts as well as the technical, strategic, and regulatory challenges it faces. A deep understanding of HFT is essential for investors, market regulators, and financial professionals, as this technology increasingly influences the dynamics of global markets.

Definition of HFT

High-frequency trading (HFT) is a trading method that uses complex and powerful computer programs to execute a large number of orders in fractions of a second. This trading approach relies on sophisticated algorithms capable of analyzing multiple markets in real-time and making buy and sell decisions based on market conditions. The speed of order execution in HFT is so high that it can occur in less than a few milliseconds. This characteristic allows traders to take advantage of small price fluctuations in the market, generating quick and substantial profits.

In high-frequency trading, speed and accuracy are everything. Companies and financial institutions that employ HFT are continually improving their algorithms and infrastructures to react more swiftly to market changes and capitalize on arbitrage opportunities. This trading method requires advanced hardware and low-latency internet connections to send orders quickly to exchange servers.

History and Evolution of HFT in Financial Markets

The history of high-frequency trading dates back to the 1990s when stock exchanges began digitizing their systems. With advancements in information and communication technology, the ability to execute trades with greater speed and accuracy became feasible, gradually leading to the emergence of HFT. One of the earliest examples of HFT was observed in the early 2000s when major financial firms began utilizing complex algorithms for rapid trade execution.

During this period, major exchanges like the New York Stock Exchange (NYSE) and NASDAQ started offering colocation services, allowing HFT traders to place their servers near the exchange’s main servers. This reduced latency in sending and receiving orders and enabled HFT traders to respond more quickly to market changes.

Over the years, HFT has significantly evolved and become one of the primary trading methods in financial markets. This trading approach is utilized not only in stock markets but also in Forex, commodities, and even cryptocurrencies. As trading volumes and market complexities increased, HFT algorithms became more sophisticated and efficient.

A significant milestone in the history of HFT was the 2008 financial crisis, which heightened attention to market liquidity. Following this crisis, exchanges and regulatory bodies sought to enhance market liquidity through various incentives, with HFT emerging as a key tool for achieving this goal. For example, the New York Stock Exchange introduced a group called Supplemental Liquidity Providers (SLPs) aimed at increasing competition and liquidity in the market.

How High-Frequency Trading Works

Algorithms and Software Used

High-frequency trading (HFT) heavily relies on advanced algorithms and software. These algorithms are designed to analyze massive volumes of market data in real-time and make trading decisions based on that analysis. HFT algorithms typically incorporate advanced techniques such as machine learning, complex statistical analyses, and mathematical models that can identify arbitrage opportunities and price fluctuations.

These algorithms are implemented in sophisticated trading software capable of automatically sending buy and sell orders to the market. Such software must be highly efficient and have low latency to respond to market changes in fractions of a second. Some of the most popular programming languages used for developing these algorithms include Python, C++, and Java, which are favored for their speed and efficiency.

Hardware Requirements and Fast Communications

Successful implementation of high-frequency trading necessitates advanced hardware and communication infrastructures. One of the most critical factors in HFT is minimizing latency. Latency refers to the time gap between sending an order and receiving its confirmation. In HFT, even a delay of a few milliseconds can significantly impact profitability.

To reduce latency, HFT firms often utilize colocation services. These services allow them to place their servers close to the exchange’s servers. This physical proximity reduces the time delay in sending and receiving data.

Other hardware requirements include the use of high-performance computing processors, high-bandwidth communication networks, and low-latency memory. These components enable algorithms to process data rapidly and make trading decisions.

Examples of Notable HFT Firms

Notable Companies in HFT

Several large and well-known companies operate in the field of high-frequency trading (HFT) and have achieved significant success due to their use of advanced technologies and complex algorithms. Some of these companies include:

Tower Research Capital:

Tower Research Capital is a leading HFT firm established in 1998. The company employs complex algorithms and advanced technologies to execute trades in various markets. With a strong research and development team, Tower Research Capital has become a major player in the HFT arena.

Citadel LLC:

Citadel LLC is one of the largest investment and HFT firms in the world. Founded in 1990 by Kenneth Griffin, Citadel quickly became a leader in HFT. The firm utilizes advanced algorithms and powerful hardware infrastructure to conduct trades across various markets, gaining a reputation for high efficiency and speed in executing trades.

Virtu Financial:

Virtu Financial is another significant player in HFT, established in 2008. The company employs complex algorithms and advanced technologies to conduct high-frequency trades in various markets. Virtu Financial is considered one of the most successful HFT firms globally due to its high efficiency and ability to execute trades at very high speeds.

These companies have achieved significant success in HFT by leveraging advanced technologies and specialized teams, playing an essential role in enhancing liquidity and efficiency in financial markets. They continuously improve their algorithms and infrastructure to react more swiftly to market changes and capitalize on arbitrage opportunities.

Key Features of High-Frequency Trading

High Speed in Order Execution and Cancellation:

One of the most prominent features of high-frequency trading (HFT) is the exceptionally high speed of order execution and cancellation. In HFT, trades are executed in fractions of a second, where even milliseconds can determine the difference between profit and loss. This extraordinary speed enables HFT traders to exploit small price fluctuations in the market and realize immediate profits.

Advantages of High-Frequency Trading

Improved Market Liquidity

One of the main advantages of high-frequency trading (HFT) is the improvement of market liquidity. Liquidity refers to the ability to quickly buy and sell assets without significantly impacting their prices. HFT firms contribute to increasing trading volume in the market by executing a large number of trades in short timeframes. This increase in trading volume allows assets to be bought and sold more quickly and at more stable prices.

With the active presence of HFT firms in the market, more buy and sell orders are available, enabling other market participants to execute their trades faster and at lower costs. As a result, market liquidity increases, making markets more dynamic and efficient.

Reduced Bid-Ask Spreads

Another advantage of HFT is the reduction of bid-ask spreads in the market. The bid-ask spread is the difference between the highest price buyers are willing to pay and the lowest price sellers are willing to accept for an asset. Smaller spreads are indicative of higher liquidity and greater market efficiency.

HFT firms help reduce bid-ask spreads by executing a large number of trades and placing multiple orders at various prices. This reduction in spreads benefits all market participants, as they incur lower trading costs and can execute trades at prices closer to the actual market prices.

Additionally, the reduction of spreads increases competition in the market, as HFT firms compete to offer the best prices. This competition leads to prices that more accurately reflect real supply and demand, pushing the market toward greater efficiency.

Increased Market Efficiency

High-frequency trading (HFT) contributes to enhanced market efficiency. Market efficiency means that asset prices accurately and quickly reflect the available information in the market. HFT firms utilize complex algorithms and rapid data processing to swiftly incorporate new information into market prices.

This quick reflection of information ensures that prices more accurately represent the true value of assets, reducing arbitrage opportunities and profits arising from misinformation. In other words, HFT aids in greater transparency and diminishes unnecessary market volatility.

Furthermore, HFT firms help distribute risk in the market by executing a large number of trades. This risk distribution reduces the likelihood of severe price fluctuations and increases market stability. As a result, markets become not only more efficient but also more stable.

Disadvantages and Criticisms of High-Frequency Trading

Elimination of Human Decision-Making and Interactions

One of the main criticisms of high-frequency trading (HFT) is the removal of human decision-making and interactions from the trading process. In HFT, complex algorithms and software make decisions and execute trades instead of humans. This can lead to decision-making that lacks human considerations and ethical judgments.

The absence of human decision-making can pose risks, as algorithms operate based on historical data and mathematical models, potentially failing to respond adequately to unexpected and unstable market conditions. Additionally, this type of trading can lead to reduced human interactions in markets, which in turn may negatively affect trust and transparency.

Creation of Severe Market Volatility

Another disadvantage of high-frequency trading (HFT) is the potential to create severe volatility in the market. HFT algorithms execute trades rapidly and in large volumes, which can lead to increased price fluctuations. When numerous algorithms respond simultaneously and similarly to market events, it may result in sudden and extreme price movements.

These abrupt fluctuations can diminish investor confidence in the market and cause significant losses for market participants. For instance, during the “Flash Crash” of 2010, the Dow Jones Industrial Average suddenly dropped several percentage points within minutes, an event many analysts attribute to HFT activities.

Temporary and Unreliable Liquidity

Although HFT (High-Frequency Trading) can increase market liquidity, this liquidity may be temporary and unreliable. HFT firms typically seek short-term profit opportunities and may reduce or halt their activities during critical times or periods of severe market volatility. This can lead to a sharp decrease in liquidity at times when the market needs it the most.

Temporary and unreliable liquidity can increase market risks and reduce its stability. Investors seeking stable and reliable liquidity may face difficulties in such situations and find it hard to buy and sell their assets easily.

High-Frequency Trading in the Forex Market

How HFT Operates in the Forex Market

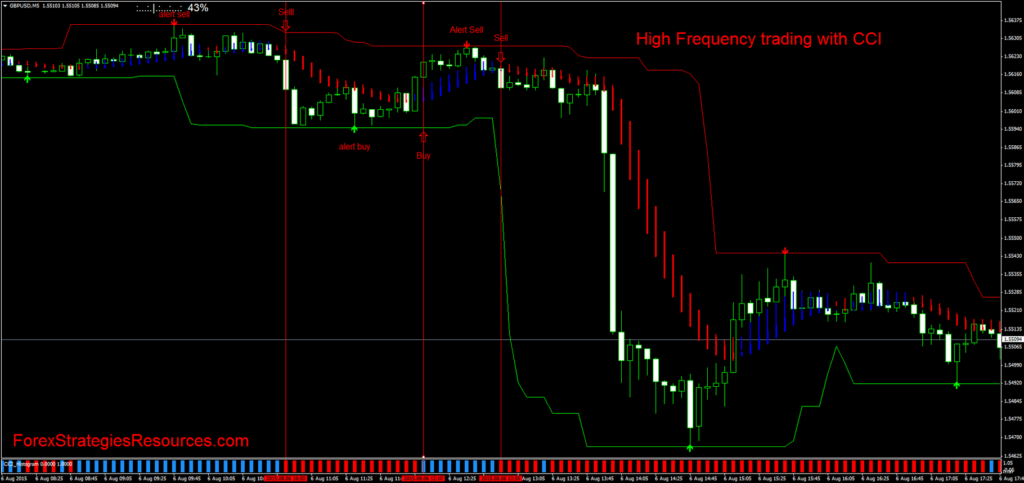

High-frequency trading in the Forex market (foreign exchange market) operates similarly to other financial markets. In Forex HFT, advanced algorithms and software are used to analyze market data and execute trades. These algorithms quickly analyze currency price changes and make trading decisions based on that.

In the Forex market, HFT primarily uses arbitrage, scalping, and news-based trading strategies. Arbitrage in Forex involves exploiting price differences in various markets, while scalping refers to making profits from small price fluctuations over short time frames, news-based trading involves quickly analyzing economic and political news and reacting to price changes resulting from them.

Specific Features of the Forex Market for HFT

The Forex market has specific characteristics that make it attractive for high-frequency trading:

High Trading Volume:

The Forex market is one of the largest and most liquid financial markets in the world. The high trading volume in this market provides abundant liquidity, which is very suitable for HFT strategies.

24-Hour Operation:

The Forex market operates 24 hours a day, seven days a week. This feature allows HFT to engage in continuous trading without interruption, taking advantage of trading opportunities at all hours of the day.

Variety of Currencies and Currency Pairs:

The Forex market includes a wide variety of currencies and currency pairs. This diversity enables HFT to exploit arbitrage opportunities and price fluctuations across different currency pairs.

Access to Real-Time Data:

Access to real-time data and economic news is crucial in the Forex market. HFT firms use this data to quickly respond to market changes and optimize their trading strategies.

History of High-Frequency Trading

Early Strategies and Systems

The history of high-frequency trading (HFT) dates back to the late 1980s and early 1990s. During this period, advancements in technology and increases in computing power led to the development of the first HFT strategies and systems. Initially, these trades were executed simply, using basic algorithms. Arbitrage and scalping were among the first strategies employed by HFT firms.

At this time, companies utilized electronic trading systems and fast communication networks to execute trades. These systems enabled rapid and automated transaction execution, reducing trading costs and increasing market efficiency.

Expansion and Complexity of Algorithms

Over time, and with further advancements in technology and data science, HFT algorithms became significantly more complex and sophisticated. In the 2000s, the use of more complex algorithms and advanced mathematical models for market data analysis and price prediction became common.

This era witnessed the emergence of algorithms based on machine learning and artificial intelligence. New algorithms were capable of quickly analyzing vast amounts of data and making trading decisions with high accuracy and speed. Additionally, the use of neural networks and genetic algorithms for optimizing trading strategies became prevalent.

Role of Pioneers in HFT

Regulations and Laws Related to HFT

Regulations and laws associated with HFT have multiple impacts on the efficiency of this type of trading. On one hand, regulations can enhance transparency and reduce the risks associated with HFT. This can help increase investor confidence and stabilize markets.

On the other hand, overly stringent regulations may lead to a decrease in innovation and efficiency in HFT. Excessive restrictions can raise operational costs and reduce liquidity and market efficiency. Therefore, regulatory authorities must strike a balance between the need for regulation and the maintenance of market efficiency.

Famous Strategies in High-Frequency Trading

Market Making

Market making is one of the common strategies in high-frequency trading (HFT) that plays a crucial role in increasing liquidity and reducing bid-ask spreads in the market. In this strategy, HFT firms continuously quote buy (bid) and sell (ask) prices, providing liquidity by buying from sellers and selling to buyers.

Market makers profit from the difference between the buy and sell prices. Although this profit is small per transaction, it can become significant due to the high volume of trades. Market making requires access to real-time data and rapid execution of trades to quickly respond to market changes.

Arbitrage

Arbitrage is another well-known strategy in high-frequency trading (HFT) that involves exploiting price differences across different markets or similar assets. In classic arbitrage, HFT traders buy an asset in a market where its price is lower and sell it in a market where its price is higher.

This strategy requires high speed and access to data from multiple markets to capitalize on arbitrage opportunities in a timely manner. Since these opportunities are typically very short-lived, HFT algorithms must execute trades quickly to be profitable.

Statistical Arbitrage

Statistical arbitrage is a more complex form of arbitrage that involves using mathematical and statistical models to identify profitable opportunities in the markets. In this strategy, HFT algorithms analyze historical data and identify price patterns that indicate temporary divergences from long-term equilibrium relationships.

These algorithms typically employ advanced techniques such as regression analysis, neural networks, and machine learning to identify statistical arbitrage opportunities. Once these opportunities are identified, the algorithms quickly execute trades to take advantage of price discrepancies.

Momentum Ignition

The momentum ignition strategy involves creating price fluctuations in the market to attract the attention of other traders and capitalize on their resulting reactions. In this strategy, HFT algorithms intentionally execute large trades to temporarily drive prices up or down.

Then, as other traders react to these price changes and trade in the same direction, the HFT algorithms reverse their trades and profit from the price movements caused by others’ reactions. This strategy requires a deep understanding of market behavior and the ability to predict traders’ reactions.

Spoofing and Layering

Spoofing and layering are two illegal strategies in HFT that involve creating fake demand or supply in the market to mislead other traders. In the spoofing strategy, HFT algorithms place large buy or sell orders in the market to provoke a reaction from other traders. Then, before these orders are executed, they cancel them and trade in the opposite direction to capitalize on the resulting price changes.

Layering also involves placing multiple buy or sell orders at different price levels to create fake demand or supply. The goal of this strategy is similarly to deceive other traders and exploit their reactions to price changes. Although these strategies can be profitable, they are illegal in many jurisdictions due to their negative effects on market transparency and fairness.

High-frequency trading strategies encompass various methods for exploiting profitable opportunities in the markets. From market making and arbitrage to more complex strategies like statistical arbitrage and momentum ignition, each of these methods requires access to advanced technologies and sophisticated algorithms. However, some of these strategies, such as spoofing and layering, are deemed illegal due to their detrimental effects on the markets. To successfully capitalize on HFT, it is essential to adhere to regulations and use fair and transparent strategies.

Conclusion:

High-frequency trading (HFT) is an advanced and complex method in financial markets that seeks to profit from small price fluctuations over very short time frames using sophisticated algorithms and advanced technologies. This trading method offers benefits such as increased liquidity and reduced spreads, but it also faces challenges like creating severe market volatility and regulatory issues. Given the significant impact of HFT on financial markets, it is essential to establish appropriate laws and regulations to regulate these activities, ensuring that the advantages are harnessed while preventing potential negative effects on market stability and transparency.