Call Margin is a term used in financial markets, especially in stocks and forex. It refers to a warning of a margin shortfall. When a trader uses a margin account for trading, they essentially provide part of the required capital themselves and borrow the rest from the brokerage.

A margin account allows you to make trades worth several times the amount of money you have. However, this comes with a high risk. If the price of the purchased assets decreases, the total value of your assets will also drop, which may lead to your account balance falling below the required level.

In such situations, the brokerage sends you a warning known as a call margin. This alert informs you that you need to deposit more money into your account or close some of your trades. If you ignore this warning and your account balance falls below a certain level, the brokerage may be forced to sell some of your assets without your permission to cover your losses.

Therefore, a call margin is a warning that gives you a chance to prevent further losses.

What is Leverage?

Leverage refers to an investor’s ability to make trades worth more than their initial capital. This is made possible through margin. In other words, leverage is the ratio of margin to the total value of the trade. For example, if the margin is 1%, the leverage is 100:1, meaning the investor can make a trade worth $100 with a $1 margin.

The Relationship Between Margin and Leverage

Margin and leverage are two sides of the same coin. Margin is the amount of money that an investor must have as collateral, while leverage refers to the investor’s ability to use margin to increase the value of their trades.

Advantages and Disadvantages of Leverage

Using leverage can offer many benefits to investors. With leverage, investors can earn higher profits with less capital. It also allows investors to invest in various markets and manage their risk.

However, using leverage can also carry high risks. If the price of the asset declines, the investor may face significant losses. Therefore, the use of leverage should be approached with caution and careful consideration.

Reasons for Margin Call in Forex Trading

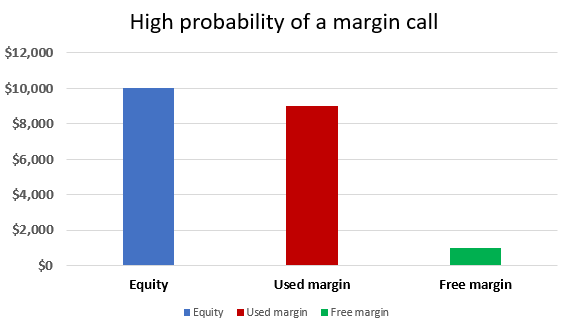

A margin call is an important term in the world of forex trading that many traders encounter. This phenomenon occurs when the value of your trading account falls below a certain level, forcing the broker to close part or all of your open positions.

To better understand this, it’s essential to be familiar with the concept of margin. Margin is essentially the collateral you must deposit with your broker to open a position in the forex market. This amount acts as a safeguard against potential losses.

When market prices move against your position, the value of your account decreases. If this decline reaches a point where the margin required to maintain your positions is not met, the broker will initiate a margin call. This means closing part or all of your positions at a loss.

Several factors can influence a margin call. One of the most significant factors is excessive use of financial leverage. Leverage allows you to open larger positions with a small amount of capital, but overusing leverage increases the risk of a margin call.

Additionally, poor risk management, failure to use stop-loss and take-profit orders, and severe market volatility are also contributing factors to margin calls.

To prevent a margin call, it is advisable to use leverage cautiously, set appropriate stop-loss and take-profit levels for your positions, and continuously monitor your trading account. Increasing your initial margin and dividing your capital among multiple trading accounts can also help reduce the risk of a margin call.

Ultimately, a margin call is a reality in the forex market, and there is no guarantee of completely avoiding it. However, by adhering to risk management principles and enhancing your knowledge and experience, you can reduce the likelihood of it occurring.

Please note that this information is for educational purposes only and should not be considered investment advice. Any investment decisions should be made based on individual circumstances and after consulting with professionals.

Methods to Prevent Margin Call

One of the most effective methods for preventing a margin call is proper risk management. Accurately determining the acceptable level of risk for each trade and avoiding over-investment in a single asset are key factors in reducing the likelihood of a margin call. Additionally, using risk management tools such as stop-loss and take-profit orders can help control losses and preserve profits.

Diversifying your investment portfolio also plays an important role in reducing the risk of margin calls. Distributing capital among different assets with low correlation decreases the likelihood of simultaneous declines in the value of all assets. This way, even if some assets experience negative volatility, others can help prevent significant losses.

Furthermore, increasing your initial margin can serve as an effective preventive measure. By raising the margin, the trader creates more room for price fluctuations, thus reducing the risk of hitting the margin call level. However, increasing the margin also means reducing purchasing power, which may limit trading opportunities.

Finally, being fully aware of market conditions and conducting thorough trend analysis is one of the most crucial factors in preventing a margin call. Continuously monitoring economic news and performing technical and fundamental analysis helps traders stay informed about sudden market changes and make trading decisions based on accurate information.

By adhering to risk management principles, diversifying your investment portfolio, increasing margin, and conducting detailed market analysis, the likelihood of a margin call can be minimized, ensuring capital preservation and sustainable profit generation.

How to Prevent Margin Call in Forex?

A margin call is one of the nightmares for any forex trader. This situation occurs when a trader’s account balance falls below the required margin level, forcing the broker to close the trader’s positions. This usually results in significant losses for the trader. In this article, we will explore the factors that contribute to margin calls and strategies to prevent them.

Understanding the concepts of margin and leverage is essential for avoiding margin calls. Margin is the amount of money needed to execute a trade using leverage. Leverage allows traders to participate in larger trades with a smaller amount of capital. However, it’s important to remember that leverage can increase both profits and losses.

One of the most important factors in preventing a margin call is risk management. Setting stop-loss levels for each trade, using an appropriate risk-to-reward ratio, and diversifying capital among different trades are effective risk management strategies. Additionally, paying attention to significant economic news and events that could cause severe market fluctuations is crucial.

Using risk management tools like stop-loss and take-profit orders can also be effective in preventing margin calls. A stop-loss allows you to automatically close a trade if the price drops to a specified level, helping to prevent further losses. Take-profit is used to set a desired profit level and automatically close the trade when the price reaches that level.

Ultimately, education and experience play significant roles in preventing margin calls. Familiarity with forex market concepts, technical and fundamental analysis, capital management, and market psychology helps traders make better decisions and avoid potential risks.

Remember that forex is a high-risk market, and there are no guarantees of profit. Therefore, before starting to trade, ensure you are fully acquainted with its concepts and risks, and employ strong risk management practices.

By following the tips mentioned, you can reduce the likelihood of a margin call and manage the risks of your trades.

How to Prevent Margin Call in Forex?

A margin call is one of the biggest concerns for forex traders. This event occurs when the value of your trading account falls below a certain level, forcing the broker to automatically close some of your positions. To prevent this unpleasant situation, there are several key points to consider.

Use Appropriate Leverage

One of the most important factors in preventing a margin call is using appropriate leverage. High leverage allows you to open larger positions with less capital, but it also increases the risk. It’s best to choose a leverage level that aligns with your risk tolerance. Lower leverage helps you maintain better control over your account and minimizes the impact of market fluctuations.

Complete Product Knowledge

Before entering any trade, having a comprehensive understanding of the currency pair or asset in question is essential. Technical and fundamental analysis can help you better predict market trends and make more informed trading decisions. With a deep understanding of the product, you can identify better entry and exit points and reduce the risks of your trades.

Attention to Liquidity and Event Risks

Liquidity refers to the ability to quickly convert an asset into cash. Currency pairs with high liquidity typically experience lower volatility and carry less risk. Additionally, significant economic and political events can impact financial markets. Keep an eye on these events and manage your positions as necessary.

The Importance of Stop Loss

A stop loss is a very important risk management tool that allows you to limit your losses to a specified level. By setting a stop loss, even if the market moves against your prediction, your losses will be minimized, and you can prevent the forced closure of all your positions by the broker.

Continuous Monitoring of Your Account

Continuously monitoring your trading account helps you stay aware of any sudden changes in the market and take timely action. By using technical analysis tools and trading software, you can easily keep an eye on the market and take advantage of new opportunities.

Consequences of Margin Call in Forex

A margin call is a situation in which an individual’s trading account value falls below a specified level. In this case, the broker is compelled to automatically close part or all of the trading positions to prevent further losses. This event can have serious consequences for the trader.

One of the most significant consequences of a margin call is substantial financial loss. The forced closure of positions often occurs under unfavorable market conditions, leading to heavy losses. Additionally, a margin call can undermine a trader’s confidence and impact their trading strategies.

Moreover, a margin call can damage the trader’s relationship with the broker. Inability to meet the required margin may result in penalties or even account closure. This event can also tarnish the trader’s credibility in the market.

To prevent the adverse effects of a margin call, effective risk management is crucial. Using tools like stop losses, setting appropriate position sizes, and avoiding excessive leverage can help reduce the likelihood of this issue. Furthermore, having a well-defined trading plan and adhering to it can be effective in managing risk.

Ultimately, education and experience in the Forex market play a vital role in preventing margin calls. Familiarity with market concepts, technical and fundamental analysis, and understanding market psychology can help traders make more informed decisions and manage their risks effectively.

The Impact of Trade Volume on Preventing Margin Call

A margin call is one of the major challenges faced by Forex traders. This unfortunate event occurs when the value of a trading account falls below a certain level, forcing the broker to close some or all of your positions. Proper management of trade volume is a key factor in preventing this occurrence.

Trade volume refers to the amount of money allocated for each trade. Choosing the appropriate volume plays a crucial role in maintaining the stability of your trading account. As trade volume increases, the risk of a margin call also rises. This is because with each price fluctuation, you will incur greater losses or gains. Therefore, precise management of trade volume enables you to control risk and reduce the likelihood of a margin call.

By carefully assessing your trade volume and aligning it with your overall risk management strategy, you can enhance your ability to navigate market volatility and protect your trading capital.

Determining Appropriate Trade Volume

To determine the suitable trade volume, several factors must be considered. First, you should identify your risk tolerance level. This means determining the amount of money you are willing to risk on each trade. Then, by using risk management tools such as stop losses, you can calculate your trade volume. For instance, if you decide to risk a maximum of 2% of your capital on each trade, you should adjust your trade volume accordingly.

Additionally, diversifying your trades can help reduce the risk of a margin call. Instead of focusing on a single currency pair, you can diversify your portfolio with multiple pairs. This approach lessens the impact of fluctuations in one currency pair on your overall account.

Finally, it is important to remember that risk management is an ongoing process. Market conditions are constantly changing, and you should regularly assess your trade volume. By adhering to these guidelines, you can minimize the likelihood of a margin call and manage your trading risks effectively.

Top of Form

Bottom of Form

Summary

A margin call is a serious risk for Forex traders. By following the tips outlined in this article, you can minimize the risk of a margin call and protect your capital. Remember that trading in financial markets carries inherent risks, and there are no guarantees of profit. To prevent a margin call, it is essential to adhere to several key points:

- Risk Management: Accurately setting stop losses for each trade, diversifying your capital, and avoiding excessive risk are crucial risk management practices.

- Choosing Appropriate Leverage: High leverage significantly increases risk. Selecting a leverage level that aligns with your risk tolerance is critical.

- Portfolio Diversification: Investing in multiple currency pairs can reduce the impact of fluctuations in any single pair on your overall account.

- Continuous Education: Financial markets are constantly changing, making ongoing education and knowledge updates essential for success.

- Emotional Control: Fear and greed can heavily influence your decision-making. Managing these emotions helps you make more rational choices.

- Continuous Monitoring: Regularly monitor the market and take necessary actions when needed.

- Thorough Understanding of Trading Tools: Familiarity with tools like stop losses, take profits, and pending orders aids in better risk management.

In summary, preventing a margin call requires a comprehensive approach. By adhering to risk management principles, selecting appropriate leverage, diversifying your portfolio, engaging in continuous education, and controlling your emotions, you can minimize the likelihood of a margin call and become a successful trader.

5 Frequently Asked Questions About Preventing Margin Call in Forex

1.What is a margin call and why does it happen?

A margin call occurs when the value of your trading account falls below a certain level, prompting the broker to close some or all of your positions to prevent further losses. This typically happens due to severe market fluctuations or improper risk management.

2.How can margin calls be prevented?

To prevent a margin call, it is crucial to adhere to sound risk management principles. These include setting stop losses for each trade, diversifying your capital, selecting appropriate leverage, and maintaining a well-diversified investment portfolio.

3.What is the importance of stop loss in preventing margin calls?

A stop loss is a vital risk management tool that allows you to limit your losses to a specified level. By setting a stop loss, even if the market moves against your prediction, your losses will be minimized, thus preventing the forced closure of all your positions by the broker.

4.How does leverage affect margin calls?

High leverage allows you to open larger positions with less capital, but it also increases risk. Excessive leverage significantly heightens the likelihood of a margin call.

5.Can margin calls be completely avoided?

While it is not possible to eliminate the risk of a margin call entirely, adhering to risk management principles and having a solid trading strategy can greatly reduce this risk.