Compound Interest: The Magic of Wealth Growth

Compound interest occurs when the earnings from your savings or investments are reinvested, generating additional earnings. This phenomenon accelerates the growth of your savings and investments over time. Conversely, compound interest can also increase your debts over time. In this article, we will discuss in detail the concept that Albert Einstein referred to as the “eighth wonder of the world.”

Definition of Compound Interest in Simple Terms

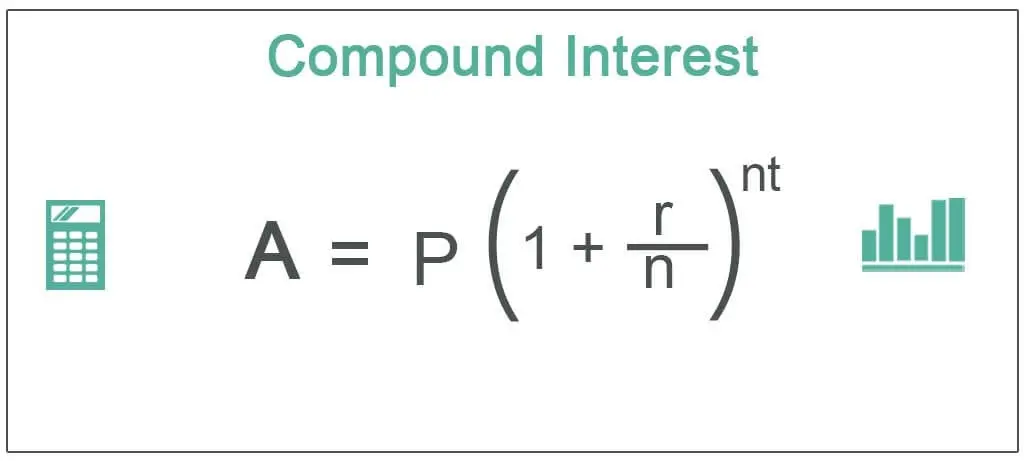

With compound interest, you earn not only on your initial principal but also on the interest that you accumulate. Compound interest occurs when the interest earned is added back to the principal, allowing you to earn even more interest and compounding your returns.

For example, suppose you have 100 million tomans in a savings account that earns 10% interest annually. In the first year, you earn 10 million tomans in interest, bringing your new balance to 110 million tomans. In the second year, you earn 10% interest on the new balance of 110 million tomans, which amounts to 11 million tomans. At the end of the second year, your new balance will be 121 million tomans.

Thanks to the magic of compound interest, the growth of your savings account balance accelerates over time as you earn interest on larger and larger amounts. If you keep 100 million tomans in this hypothetical savings account for 30 years without adding any additional funds, your balance will eventually reach 1 billion and 700 million tomans.

Difference Between Compound Interest and Simple Interest

Simple and compound interest operate quite differently. With simple interest, the interest earned is applied only to the initial principal amount. In contrast, with compound interest, the interest earned in each period is added to the principal, and this new total is used to calculate future interest.

Simple interest is commonly used for calculating interest on auto loans and other types of short-term consumer loans. On the other hand, the interest applied to credit card debt is compounded, which is why credit card debt can grow very quickly.

The Impact of Compound Interest Investment at a Young Age

Many young people often overlook the importance of saving for the future. They may prioritize other expenses and feel that they have plenty of time to save later. However, the reality is that the earlier you start saving, the more powerful compound interest can be, even with relatively small amounts. Saving small amounts can be far more beneficial than saving larger amounts at an older age. Here’s an example of its impact:

If a young person starts saving just a small amount, say 100,000 tomans per month, at a 10% annual interest rate, they will benefit significantly from compound interest over the years. By starting to save at a young age, even modest contributions can lead to substantial wealth accumulation by the time they reach retirement, demonstrating the importance of early investment and the magic of compound interest.

Let’s consider the scenario you described:

If you start saving 6 million tomans every month from the age of 20, with an average annual interest rate of 4% compounded monthly, and continue this for 40 years, by the time you turn 65, you will accumulate about 9 billion tomans. Your total initial investment would be only 3 billion and 240 million tomans.

On the other hand, your twin brother begins investing at the age of 50. He starts with an initial investment of 300 million tomans and contributes 30 million tomans each month for 15 years, also at a 4% monthly compounded return. By the time he turns 65, despite having a total initial investment of 5 billion and 700 million tomans, he will have only accumulated around 8 billion tomans.

This example clearly illustrates the powerful effect of starting to save early and the impact of compound interest over time. Even with a smaller initial investment, beginning at a younger age can lead to significantly greater wealth accumulation compared to starting later, even with larger contributions.

Let’s consider the scenario you described:

If you start saving 6 million tomans every month from the age of 20, with an average annual interest rate of 4% compounded monthly, and continue this for 40 years, by the time you turn 65, you will accumulate about 9 billion tomans. Your total initial investment would be only 3 billion and 240 million tomans.

On the other hand, your twin brother begins investing at the age of 50. He starts with an initial investment of 300 million tomans and contributes 30 million tomans each month for 15 years, also at a 4% monthly compounded return. By the time he turns 65, despite having a total initial investment of 5 billion and 700 million tomans, he will have only accumulated around 8 billion tomans.

This example clearly illustrates the powerful effect of starting to save early and the impact of compound interest over time. Even with a smaller initial investment, beginning at a younger age can lead to significantly greater wealth accumulation compared to starting later, even with larger contributions.

When you reach the 45-year mark in your savings, your brother will have only saved for 15 years. Despite the fact that he has invested nearly twice as much as you, he will have a smaller amount.

Factors Affecting Compound Interest

Rate of Return

The rate of return can significantly impact the amount of profit and the growth of your capital. The higher the rate of return, the faster compound interest grows. In other words, an increase in the rate of return causes your investment or savings balance to rise more rapidly.

For example, an annual return rate of 8% leads to faster capital growth compared to a 4% rate. It is worth noting that the longer the investment duration, the more pronounced the impact of the rate of return will be. Compound interest grows exponentially over time. Therefore, a high rate of return can lead to a substantial increase in your capital in the long run.

For example:

If you invest 60 million tomans at annual rates of 5% and 10% for 10 years, using the compound interest formula, the amounts are as follows:

- At a 5% rate: Final balance ≈ 97 million tomans

- At a 10% rate: Final balance ≈ 155 million tomans

As you can see, a higher rate of return leads to a significant increase in capital growth.

Investment Duration

The duration of the investment plays a very important role in the effect of compound interest. The longer the investment period, the greater the impact of compound interest, which increases exponentially.

Compound interest grows exponentially, meaning that over time, the amount of profit increases based on a larger and larger balance. As a result, the longer the investment duration, the more significant the effect of compound interest will be, leading to faster capital growth.

For example:

Suppose you invest 60 million tomans at an annual rate of 5%:

- Duration of 10 years: Final balance = 97 million tomans

- Duration of 20 years: Final balance = 154 million tomans

As you can see, increasing the investment duration significantly raises the final balance. This is due to the effect of compound interest on previous profits and the continuous growth of the balance.

Frequency of Interest Compounding

The frequency of compounding refers to the number of times interest is calculated and added to the principal within a specified period. The more frequently compound interest is calculated and added to the principal, the greater the final amount will be. In other words, interest that is added to the principal more frequently results in a faster increase in the investment balance.

Types of compounding frequencies include annual, semi-annual, quarterly, monthly, and daily compounding. Among these frequencies, annual compounding yields the lowest return, while daily compounding provides the highest return.

For example:

Suppose you invest 60 million tomans at an annual rate of 5% with different compounding frequencies:

- Annual compounding: Final balance = 97 million tomans

- Monthly compounding: Final balance = 99 million tomans

- Daily compounding: Final balance = 99.48 million tomans

- As shown, more frequent compounding leads to a higher final balance.

Inflation and Taxes

Inflation and taxes can have significant impacts on compound interest. These two factors can affect the purchasing power and net returns of investments.

If the inflation rate exceeds the rate of return on your investment, the purchasing power of your earnings and capital decreases. In other words, even if you achieve high compound interest, you may lose value in your money due to inflation.

To calculate the real return on an investment, you need to subtract the inflation rate from the nominal rate of return. This figure reflects the true power of compound interest. For example, if the annual return rate is 8% and the inflation rate is 3%, the real return would be approximately 5%.

On the other hand, the earnings from investments are subject to taxes, which can significantly impact your net returns. Tax on compound interest means that the amount of profit you ultimately receive is reduced.

Therefore, to optimize the benefits of compound interest, it’s essential to consider the effects of inflation and taxes. Investments should be managed in a way that maximizes the real rate of return after accounting for taxes and inflation.

Compound Interest in Different Markets

Stock Market

In the stock market, compound interest refers to benefiting from the growth of investments based on profits generated from the investments themselves, in addition to previous gains.

This means that the earnings from these investments are reinvested, leading to an overall increase in returns. Over time, new profits are added to the initial capital, and these new amounts also generate additional profits. This results in the total earnings you achieve in the future being greater than what you would earn solely from the initial investment.

Real Estate Market

In the real estate market, compound interest refers to using the returns from initial investments to generate greater returns in the future. This process is similar to compound interest in the stock market, but with some differences. In real estate, compound interest typically comes from rental income and the appreciation of property values.

When you purchase a property and rent it out, the rental income can be added to your initial capital. This income can be used to buy additional properties or to improve the current property.

Additionally, over time, property values tend to increase. This appreciation can support future investments. If you sell the property at a higher price and reinvest the proceeds, the effects of compound interest become evident.

Cryptocurrency Market

In the cryptocurrency market, compound interest refers to increasing capital by reinvesting the profits gained from trades. This approach can exponentially boost your capital, as the profits you earn become part of the principal, generating even more profits in subsequent periods.

A crucial point about the cryptocurrency market is its high volatility. Using compound interest strategies can be as risky as it is potentially profitable. This means that reinvesting profits from trades into your capital can lead to heavier losses if subsequent trades fail.

In addition to the examples mentioned for compound interest, this concept applies to various types of businesses, investments, and savings, functioning in the same way as the examples provided. It’s important to remember that while compound interest has many positive aspects, making poor investment choices can ultimately lead to losses.

Challenges of Using Compound Interest

Using compound interest can lead to rapid capital growth and increased profitability, but applying this strategy comes with its own set of challenges. Here are some of these challenges:

- Investment Risks

Financial markets, especially the cryptocurrency market, are highly volatile. These fluctuations can affect compound returns and may even result in the loss of the principal investment. - Fees and Transaction Costs

Continuous capital growth, especially in the cryptocurrency market where transaction fees can be high, can impose significant costs. Additionally, hidden expenses such as account maintenance fees or undisclosed charges can reduce the compound returns achieved. - Financial Discipline

Effectively utilizing compound interest requires careful planning and smart financial management. Financial mistakes can harm not only the principal investment but also the profits generated. - Complex Tax Regulations

Tax regulations related to compound interest can be complicated and may require legal and financial advice. Lack of awareness of these laws can lead to legal and tax-related issues. Sudden changes in tax laws can also impact your investments. - Psychological Issues

During market fluctuations or crises, emotional decision-making can lead to incorrect and loss-inducing choices. Additionally, after achieving small profits, you may be tempted to withdraw funds. Thus, controlling emotions plays a crucial role in investing with compound interest. Conclusion

Compound interest can play a significant role in enhancing your investment returns. By leveraging compound interest, you not only achieve higher profits in a shorter time frame but also experience a substantial increase in your earnings over the long term. However, if you are dealing with compound debt, you may find yourself trapped in a growing obligation, resulting in an increasing debt burden over time.