Bonds, as one of the most popular financial instruments in global markets, play a crucial role in financing governments, companies, and various projects. These bonds are essentially a type of debt contract, whereby the investor lends a sum to the government or company, and in return, they receive a specified interest over predetermined periods, in addition to the principal amount being repaid at maturity.

Participation bonds are also used as a tool for financing projects and share many similarities with traditional bonds. However, there are key differences between these two types of securities, which have been discussed in detail in previous articles.

For investors interested in investing in bonds and participation bonds, understanding the differences between these financial instruments is of great importance. By thoroughly studying the characteristics and conditions of each type of bond, investors can make more informed investment decisions. It is recommended to read specialized articles related to this topic for further information.

Participation bonds are a type of security issued to finance construction, production, and service projects by various entities such as governments, municipalities, and both public and private companies. By purchasing these bonds, investors are considered partners in the respective projects and share in the profits generated from them.

The issuers of participation bonds can include banks, investment companies, financial institutions, and other authorized entities. These bonds are typically offered and traded through stock exchanges or selected bank branches.

Types of Participation Bonds

Participation bonds are a financial tool used by governments, municipalities, and both public and private companies to finance construction and infrastructure projects. Essentially, by purchasing participation bonds, investors become partners in the respective projects and receive a specified profit in return.

There are various types of participation bonds, each suited to different investor risk profiles and financial goals. Below, we explore some of the most important types:

Simple Participation Bonds

This type of bond is the most common and is more suitable for conservative investors due to its guaranteed repayment of principal and interest. In this category, investors receive quarterly interest payments after purchasing the bonds, and at the end of the term, they recover their principal amount.

Convertible Participation Bonds

This type of participation bond can be converted into shares of the issuing company. If the issuing company experiences positive financial performance in the future, the value of its shares will increase, allowing investors to earn higher profits by converting their bonds into shares. However, it’s important to note that this type of bond carries a higher risk compared to simple participation bonds.

Exchangeable Participation Bonds

This type of bond can be exchanged for shares of other companies. In this case, the issuer is obligated to hold the shares of the designated companies for exchange until the end of the bond term. This provides investors with the opportunity to diversify their investments by swapping their bonds for shares in different companies.

Listed and Unlisted Participation Bonds

From a trading perspective, participation bonds are categorized into two groups: listed and unlisted bonds. Listed participation bonds are traded on stock exchanges, with their prices determined by supply and demand. In contrast, unlisted participation bonds are traded over the counter, with their prices set by the issuer.

It’s worth noting that simple and registered bonds are the most common types, while other types, such as convertible and exchangeable bonds, are less frequently used.

Ultimately, deciding to invest in participation bonds requires careful consideration of market conditions, individual risk tolerance, and the investor’s financial goals. It is advisable to consult a financial advisor before making any investment decisions.

Advantages of Investing in Participation Bonds

Participation bonds have gained significant popularity as an investment tool in recent years. These bonds represent a form of debt for companies or governments that attract capital by paying a specified interest to bondholders. Investing in participation bonds offers several advantages, which we will explore below.

Guaranteed Returns

One of the most important benefits of participation bonds is their guaranteed returns. Unlike many investments whose returns depend on market conditions, the interest on participation bonds is predetermined and usually guaranteed by governmental entities. This feature is particularly attractive to individuals seeking low-risk investment opportunities.

Additionally, participation bonds provide a steady income stream, making them a reliable option for conservative investors looking for stable returns.

Tax Exemption

Another notable advantage of participation bonds is the tax exemption on their interest. In many countries, the interest earned from participation bonds is exempt from taxation, which enhances the overall return on investment. This benefit can be especially appealing for high-income investors.

High Liquidity

Participation bonds are typically traded on stock exchanges and possess high liquidity. This means investors can easily convert their participation bonds into cash when needed. This feature is crucial for investors who require quick access to their capital.

Low Risk

Investing in participation bonds generally carries lower risk compared to other investment instruments, such as stocks. This is due to the guaranteed return of principal and interest associated with participation bonds. However, it’s important to note that there is no such thing as zero risk, as various factors can influence the value of participation bonds.

Portfolio Diversification

Participation bonds can serve as a diversification tool in an investment portfolio. By combining participation bonds with other investment instruments like stocks and gold, investors can reduce the overall risk of their portfolio. This strategic approach helps in achieving a balanced and resilient investment strategy.

Disadvantages of Investing in Participation Bonds

Participation bonds are a financial instrument issued by governments or public entities to finance construction and infrastructure projects. These bonds essentially represent a loan to the government or relevant entity, in exchange for which the investor receives a specified interest. However, like any investment, participation bonds have disadvantages that should be considered before making an investment decision.

Relatively Low Returns

One of the main drawbacks of participation bonds is their relatively low returns compared to other investment vehicles. The guaranteed interest on participation bonds is typically lower than the returns from riskier investments like stocks. This may not appeal to investors seeking higher returns.

Lower Liquidity

The liquidity of participation bonds can be lower compared to some other financial instruments. In other words, selling participation bonds before their maturity may come with challenges, and investors might not be able to quickly access their funds. This can be problematic for investors who need fast liquidity.

Sensitivity to Interest Rate Fluctuations

The nominal value of participation bonds can be affected by fluctuations in interest rates. If interest rates rise, the value of participation bonds may decrease, and vice versa. This situation increases the investment risk associated with participation bonds, as changes in the interest rate environment can directly impact their market value.

Additionally, some participation bonds have long redemption periods. This means that investors may not have access to their capital for an extended time. This aspect may not be suitable for investors who need short-term access to their funds.

Finally, it’s important to recognize that investing in participation bonds is not without risk. Although the government or issuing entity typically guarantees the repayment of the principal, there may be economic conditions under which the ability to pay back the interest or principal could be compromised.

Consequently, investing in participation bonds should be approached with careful consideration and thorough evaluation. Investors must assess their financial situation, investment goals, risk tolerance, and expected returns to determine whether this type of investment is suitable for them. Consulting with a financial advisor before making any decisions is also recommended.

Bonds

Bonds are a type of financial instrument through which an investor lends a specified amount of money to the issuer (usually a government, corporation, or organization). In return, the issuer commits to paying the investor a certain amount of interest (coupon) at specified intervals and to repaying the principal amount in full at the end of the maturity period.

In other words, bonds are contracts that allow issuers to raise capital from the public to finance their projects. By purchasing bonds, investors not only participate in funding profitable projects but also benefit from a steady income generated by coupon payments.

Mechanism of Bond Operation

The mechanism of how bonds operate is as follows: when an investor buys a bond, they are essentially lending money to the issuer. The terms of this contract, including the coupon rate, interest payment schedule, and maturity date, are established at the time the bond is issued.

Examples of Bonds

Bonds play a significant role in the economy as one of the investment tools. This instrument is essentially a debt contract made between the issuer and the investor. The issuer, which can be a government, corporation, or another organization, borrows money from investors by issuing bonds and commits to repaying the principal along with a specified interest at a designated time.

Example 1: Government Bonds

One of the most common types of bonds is government bonds. Governments issue these bonds to finance infrastructure projects, pay off debts, or cover budget deficits. For instance, the government of Iran may issue government bonds to fund the construction of a new highway. By purchasing these bonds, investors effectively lend money to the government in exchange for interest payments.

Example 2: Corporate Bonds

Corporations can also issue bonds to finance their activities, such as developing new products, purchasing equipment, or repaying debts. For example, an automotive company might issue bonds to fund the development of a new car model. Investors who buy these bonds are lending money to the company and, in return, receive interest payments.

Example 3: Municipal Bonds

Municipalities, like governments, can issue bonds to finance urban projects such as building schools, hospitals, or other city infrastructure. For example, the municipality of Tehran might issue bonds to fund the construction of a new subway line. By purchasing these bonds, investors lend money to the municipality in exchange for interest payments.

It’s important to note that bonds come in various types, each with its own unique features. Some of these characteristics include interest rates, maturity periods, payment types, and the credit ratings of the issuers. Investors should consider these factors before purchasing bonds and make decisions based on their financial conditions and risk tolerance.

Classification of Bonds

Bonds are classified based on various features. One of the most significant classification criteria is the interest rate. Bonds can have either fixed or floating interest rates. In fixed-rate bonds, the interest paid throughout the investment period remains constant, whereas in floating-rate bonds, the interest rate is tied to benchmark rates, such as inflation or interbank rates, and may change over time.

Regarding the time until maturity, bonds are categorized into three groups: short-term, medium-term, and long-term. Short-term bonds typically have maturities of less than one year, medium-term bonds have maturities between one to ten years, and long-term bonds have maturities exceeding ten years.

Types of Bonds

There are various types of bonds that are classified based on factors such as the issuer, maturity period, interest rate, and other characteristics. Below are some of the most important types of bonds:

Government Bonds

Government bonds are issued by governments to cover budget deficits and finance infrastructure projects. This type of bond generally has a lower risk compared to other types because governments usually have a greater ability to repay their debts. Government bonds can be divided into two main categories:

- Treasury Bonds: These are issued by the central government and typically carry the lowest risk.

- Municipal Bonds: These are issued by municipalities and other local entities, and their risk is slightly higher compared to treasury bonds.

Corporate Bonds

Corporate bonds are issued by companies to raise the necessary capital for business expansion, equipment purchases, or refinancing existing debts. The risk associated with these bonds depends on the creditworthiness and financial condition of the issuing company. Corporate bonds can be divided into two main categories:

- High-Grade Bonds: These are issued by companies with strong financial health and a history of regular interest payments, thus carrying lower risk.

- Low-Grade Bonds: These are issued by companies with weaker financial standing and carry higher risk.

Convertible Bonds

This type of bond gives holders the right to convert their bonds into the company’s common stock. The conversion rate is predetermined and is typically beneficial to bondholders when the company’s stock price increases.

Zero-Coupon Bonds

These bonds do not pay periodic interest at the time of issuance. Instead, the bond’s face value is paid to the holder at maturity. The return on this type of bond comes from the difference between the purchase price and its face value.

Floating Rate Bonds

The interest rate on these bonds varies based on a specific benchmark, such as interbank interest rates. This structure reduces the risk of interest rate fluctuations for investors.

Advantages of Investing in Bonds

Bonds are recognized as one of the popular investment tools, and many individuals turn to them to preserve and increase the value of their assets. This financial instrument comes with several advantages, which we will discuss below.

One of the most important benefits of bonds is their fixed and regular income. By purchasing bonds, investors earn the right to receive a specific interest payment at designated intervals. This steady income can serve as a reliable source of revenue for retirees or individuals seeking consistent earnings.

On the other hand, bonds are considered a relatively low-risk investment. Compared to other investment instruments like stocks, the risk of loss in bonds is lower. However, this does not mean that there is no risk at all; investors should pay attention to various factors, such as the credit risk of the bond issuer.

Additionally, bonds can play a significant role in diversifying an investment portfolio. Combining bonds with other investment instruments like stocks and real estate can help reduce the overall risk of the portfolio.

Furthermore, some bonds come with tax exemptions. This benefit can be attractive to investors as it increases the after-tax return on their investment.

Finally, bonds can serve as a tool for preserving capital. In high inflation scenarios, investing in bonds can help protect against the erosion of money’s value.

Disadvantages of Investing in Bonds

Bonds are recognized as one of the popular investment tools, and many individuals turn to them to preserve the value of their assets. However, like any investment, bonds also have disadvantages that investors should consider before making decisions.

One of the most significant drawbacks of bonds is their relatively low yield compared to other investment instruments such as stocks. While bonds are known as low-risk investments, their returns tend to be lower as well. In high inflation environments, the real value of bond returns may decrease, impacting the purchasing power of the investor.

Additionally, credit risk is another concern that bond investors face. There is a possibility that the bond issuer (whether a government or a corporation) may fail to meet its obligations to pay interest and principal. This could result in losses for investors. Therefore, assessing the creditworthiness of the bond issuer before investing is crucial

Additionally, the market value of bonds is influenced by changes in interest rates. An increase in interest rates leads to a decrease in bond prices, while a decrease in interest rates results in an increase in their prices. Therefore, investors need to pay attention to interest rate fluctuations and consider the risks associated with price volatility.

Moreover, the liquidity of bonds may also be limited, especially for those with longer maturities. In such cases, an investor may find it challenging to convert their bonds into cash easily and might have to sell them at a loss.

Finally, investing in bonds means locking in capital for a specified period. During this time, the investor has limited access to their funds and cannot take advantage of other investment opportunities.

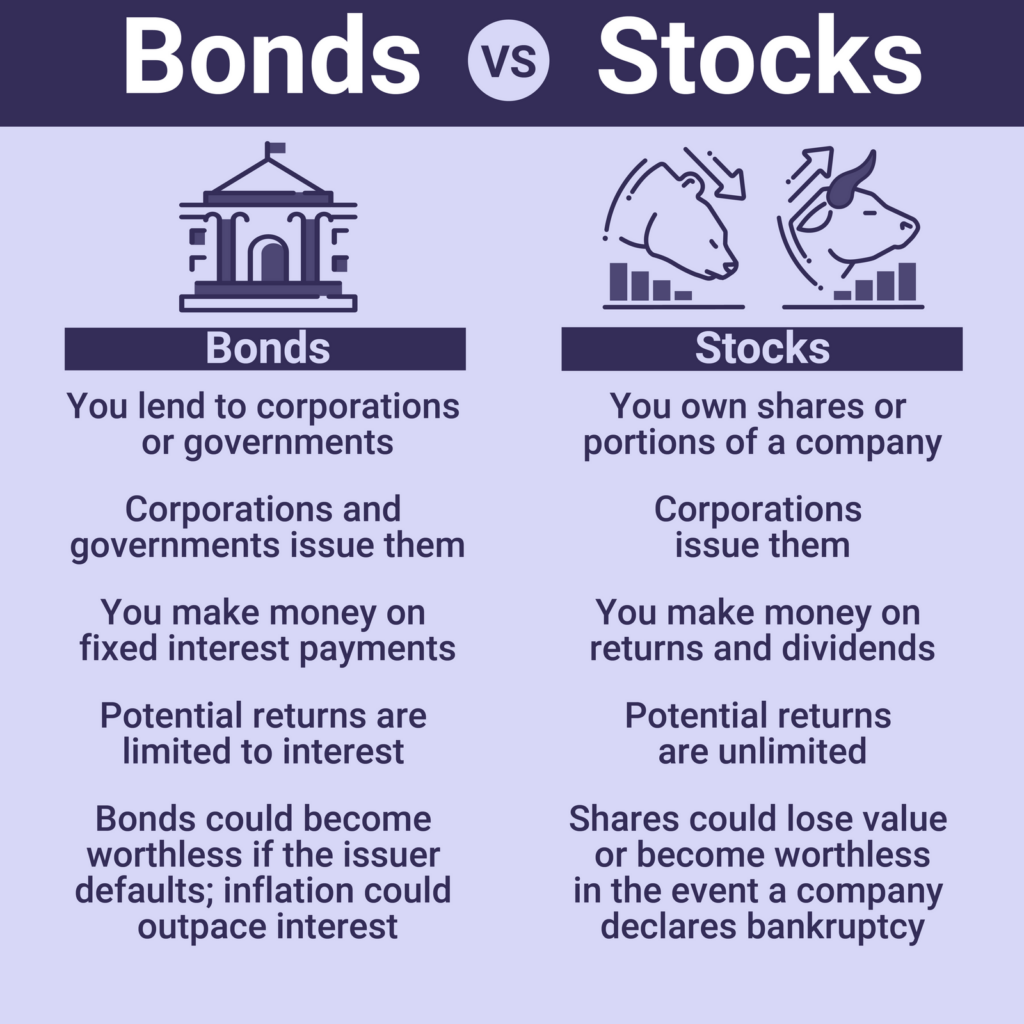

Differences Between Bonds and Participation Certificates

Bonds and participation certificates are both financial instruments used for financing projects and generating profit for investors. However, there are fundamental differences between these two types of instruments that distinguish them from one another.

One of the most significant differences lies in their profit-generating nature. Bonds, due to their fixed and predetermined interest payments, are considered usurious (riba) from an Islamic banking perspective. As a result, they do not hold a position in the Iranian economic system. In contrast, participation certificates are recognized as permissible from a Shariah standpoint because they utilize Islamic mechanisms such as sharing in profits and losses.

The profit paid on participation certificates is calculated in two parts: guaranteed profit and participatory profit. The guaranteed profit serves as a reward for the initial investment, while the participatory profit is based on the project’s performance and the investor’s share in it. In contrast, bonds provide fixed and predetermined interest payments.

The primary purpose of issuing participation certificates is usually to finance specific construction, production, or service projects. In other words, the proceeds from the sale of participation certificates are exclusively invested in the defined project. In contrast, bonds may be issued to finance general or multiple purposes.

Other differences between these two types of instruments include:

Legal Nature: Holders of participation certificates are considered partners in the project and share in its profits and losses. In contrast, bondholders are merely creditors.

Investment Risk: The investment risk associated with participation certificates is generally higher due to its dependency on the project’s performance compared to bonds.

Secondary Market: The secondary market for participation certificates may not be as well-developed as that of bonds.

Conclusion

Bonds and participation certificates are two widely used financial instruments in capital markets, each with its own unique features and applications. Both tools are utilized to finance companies, governments, and various projects, enabling investors to earn returns while contributing to economic growth.

Despite their apparent similarities, these two financial instruments have fundamental differences. One of the most significant distinctions is their Shariah compliance. Bonds, due to their usurious nature, do not align with Islamic banking principles and are not permissible in many countries governed by Islamic laws, including Iran. In contrast, participation certificates are designed in accordance with Shariah principles and serve as an alternative to bonds in these countries.

Another key difference between these two instruments lies in the way returns are paid to investors. In participation certificates, investors receive both periodic returns and a guaranteed principal return at the end of the investment term. In contrast, with bonds, interest is only paid periodically, and the principal return at maturity is not guaranteed.

As a result, the choice between bonds and participation certificates depends on various factors, including investment goals, risk tolerance, market conditions, and the regulations governing each country. Investors should gather sufficient information about each of these instruments and consult with financial advisors before making any decisions.