Author: Sajjad Sheikhi What is the Market Expecting from the FOMC Meeting?

The market expects the interest rate to be cut by 0.25% in this session; this expectation has been reinforced considering the weakness in the labor market, and especially after the September inflation data, which was lower than anticipated. Now, even economists deem a one step interest rate cut in the upcoming meeting to be reasonable. However, a few points concerning this very meeting, and especially the next FOMC meeting in December, are open to debate.

Regarding the upcoming meeting, the interest rate cut has become almost certain and is already priced in by the market; however, the interest rate is not the only factor that causes market volatility. The tone of the statement, the number of Board members' votes on the level of the interest rate, and Mr. Powell's speech are issues that cause intense fluctuations during the session.

With the deepening of the expansionary cycle, the possibility of a widening divide within the Federal Reserve Board exists. Monetary policy has entered a sensitive phase where there is a dual risk of persistent inflation and weak employment. Naturally, the split among members usually arises during these times.

The Dot Plot chart, which was published in September, indicates that 9 out of 19 members disagreed with two further rate cuts, and 7 of them did not envision any more cuts after September. These officials argue that due to the decline in the labor force participation rate, there is no need to create a high number of jobs to keep the unemployment rate stable. In fact, concurrently with the drop in the participation rate, the number of jobs required to keep the unemployment rate stable has also decreased, and the equilibrium rate is now nearly equal to the current levels of 29,000 in the NFP (Non Farm Payrolls). Therefore, thanks to the decrease in the participation rate, which was due to the deportation of immigrants, there is no risk of a sharp rise in the unemployment rate. Of course, this issue will lead to lower long term economic growth if productivity does not increase.

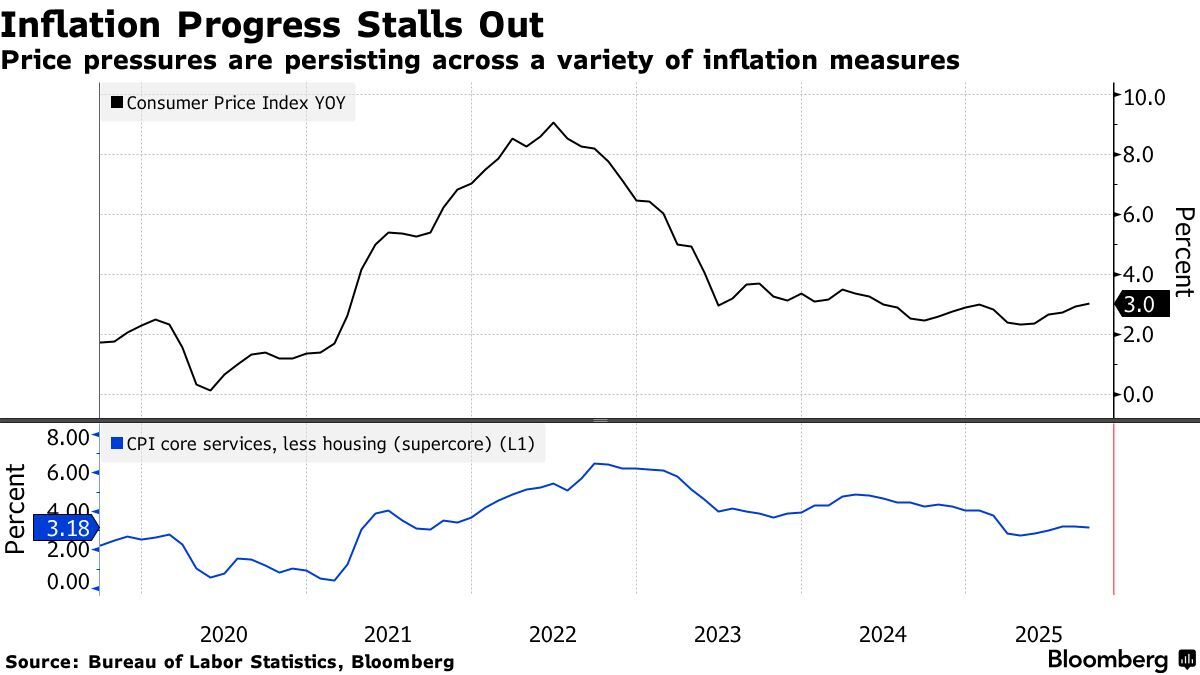

Inflation Ghost is Still Alive!

Simultaneously with this issue, concerns about inflation have not completely vanished. The September inflation data, which was released with a one week delay, appeared to be lower than expected and favored an interest rate cut. However, some details of the data indicate that inflation concerns could still be justified. Core Services Inflation (Services minus Energy and Shelter) has re-accelerated over the past four months and is reported to be above 3% annually.

Furthermore, inflation in sectors that directly originate from tariffs, such as household appliances and recreational goods, grew at a high rate. Inflation in healthcare services, which have a high impact on the PCE Price Index, was upward.

A crucial point in the data details was the sharp drop in Owners' Equivalent Rent (OER), or the OER index. This index accounts for about one third of core inflation and has a high influencing weight. OER is a simulation of the rent that homeowners could have received from their homes; that is, homeowners are asked what price they would be willing to pay for their house if they were to pay rent for it. This index effectively accounts for changes in the rental market and should align with the rental inflation rate, but in September, we are seeing a divergence between rental inflation and OER. This means that if the OER index aligns itself with rent (rises) in the coming months, it will likely cause trouble for the Federal Reserve.

On the other hand, the Federal Reserve expects inflation to remain above target until 2028, and this long period poses the risk of an increase or stabilization of inflation expectations, which in turn creates the risk of persistent inflation.

Thus, even Mr. Waller, who was one of the first "Dovish" Fed members and voted for a rate cut earlier than other members, is now advising the Fed to move cautiously, as the divergence between economic growth and the labor market is an unusual equilibrium and will certainly align in some way (either the labor market catches up to economic growth, or economic growth weakens). Until it is clear which scenario will occur, Waller recommends that the Federal Reserve exercise caution.

To What Extent Can the Federal Reserve Cut Interest Rates?

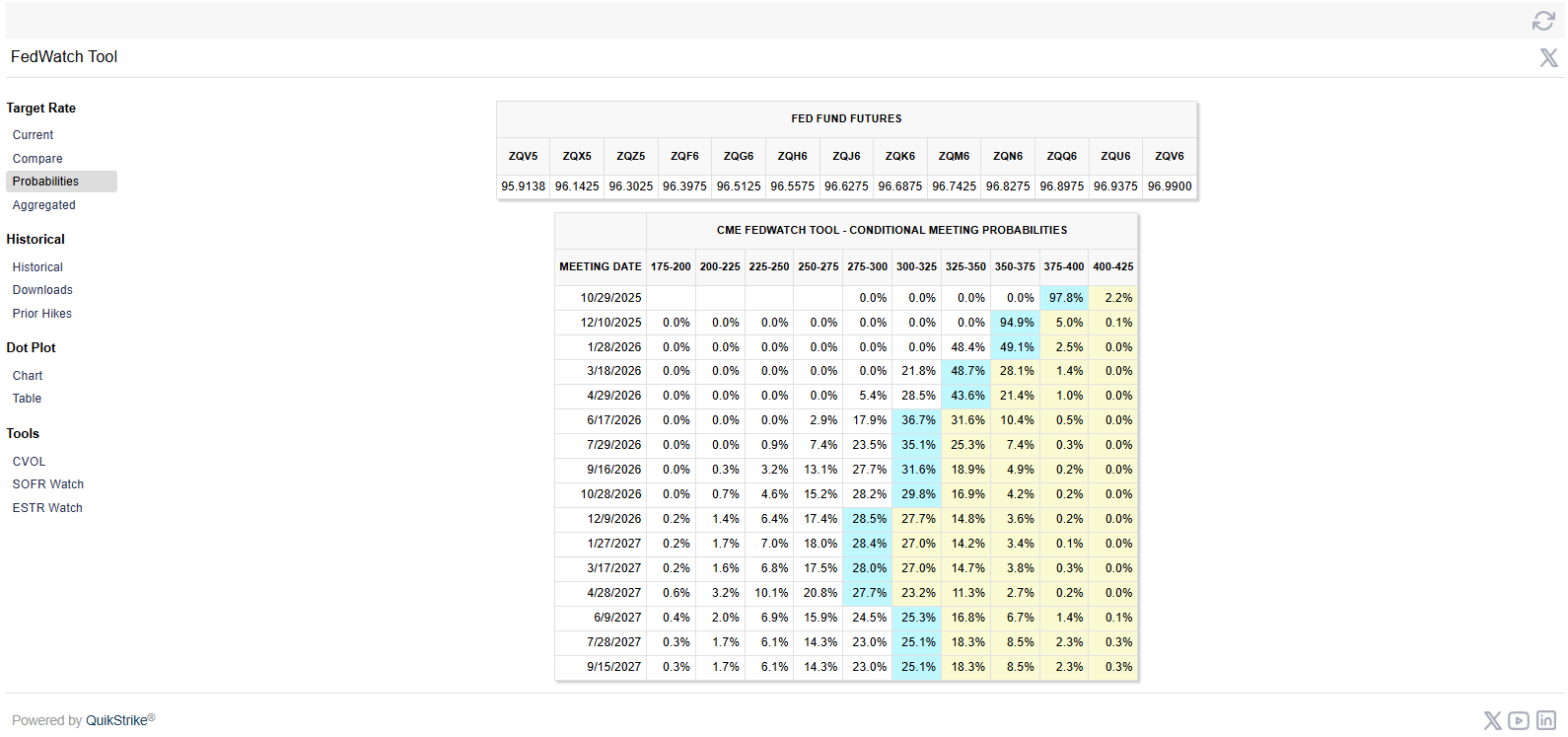

To what extent the Federal Reserve can cut interest rates is another controversial topic that market participants are debating. In its latest economic forecast, published in September

The market is pricing in rate cuts very optimistically this year and next year, as shown in the image above. The market expects two cuts in 2025 and three more in 2026, but are these expectations realistic? We will examine this issue further.

The neutral interest rate (a level of the interest rate that neither stimulates nor restricts economic growth) is estimated to be around 3 percent; however, this level may be too low according to some economists!

In fact, economists, looking at the high momentum of economic growth and the persistence of inflationary pressures, warn that the Federal Reserve may be more accommodative than it thinks. With the GDPNow model, the Atlanta Federal Reserve predicts that economic growth will be 3.8 percent in the third quarter, higher than all competitors! The Fed argues that a weak labor market counteracts inflation caused by tariffs; therefore, regardless of inflation, we can cut rates. Nevertheless, the Fed's own GDP forecasts for 2025, 2026, and 2027 were raised; this level of economic growth indicates that the current level of the interest rate is not very restrictive and the neutral interest rate is higher than the levels the Fed estimates.

While interest rate cuts have been limited, the US is still registering strong growth. The reason is that monetary policy is not the only factor affecting economic growth; fiscal policy and government spending also have an impact. Fiscal policies, unlike monetary policies, have been largely eased: taxes have been sharply cut, stocks have risen, and the value of the dollar has significantly declined since Trump entered the White House.

A Goldman Sachs index shows that financial conditions are now in their easiest state since April 2022. Additionally, an index from the Federal Reserve indicates that these financial conditions have added 1 percent to GDP since August.

Inflationary expectations are another point the Federal Reserve must consider. The central bank argues that price increases due to tariffs are temporary and won't be sustained; this holds true only if inflationary expectations are suppressed. The annual inflation's downward trend has now been halted for a long time, and the Federal Reserve also expects inflation to remain above target until 2028. These factors contribute to the anchoring of inflationary expectations, which will, in itself, be a factor in increasing inflation.

Summary

The latest inflation data was lower than expected, making a rate cut in the upcoming meeting almost certain. However, the details of the data still point to inflationary pressure from tariffs and the persistence of services inflation, which is a warning for those who consider the Fed too "dovish." For now, a rate cut in December is not certain, and the Federal Reserve must proceed in a data dependent manner. Also, given the evidence and strong economic growth, the neutral interest rate is likely higher than the levels the Federal Reserve estimates; this means that, overall, the Federal Reserve does not have much room for rate cuts.

Considering these factors, the Fed should be slightly more hawkish than market expectations and not confirm the December rate cut. This would give the Federal Reserve more flexibility in controlling monetary policy and would also hedge against inflationary risks.