What is a Demo Account in Trading? [Importance of a Demo Account in Trading]

A demo account is a simulated trading account that allows traders to perform trades in a risk-free environment without using real money.

In this type of account, brokers allocate a specific amount of virtual money to users, enabling them to simulate trades in real market conditions and become familiar with the market environment.

These accounts typically offer all the features of real trading accounts, including access to analytical tools, various order types, and live market prices, but with no risk of losing actual funds.

Using a demo account is especially important for beginners as it gives them the opportunity to familiarize themselves with strategies, trading platforms, and market psychology before starting to trade with real money.

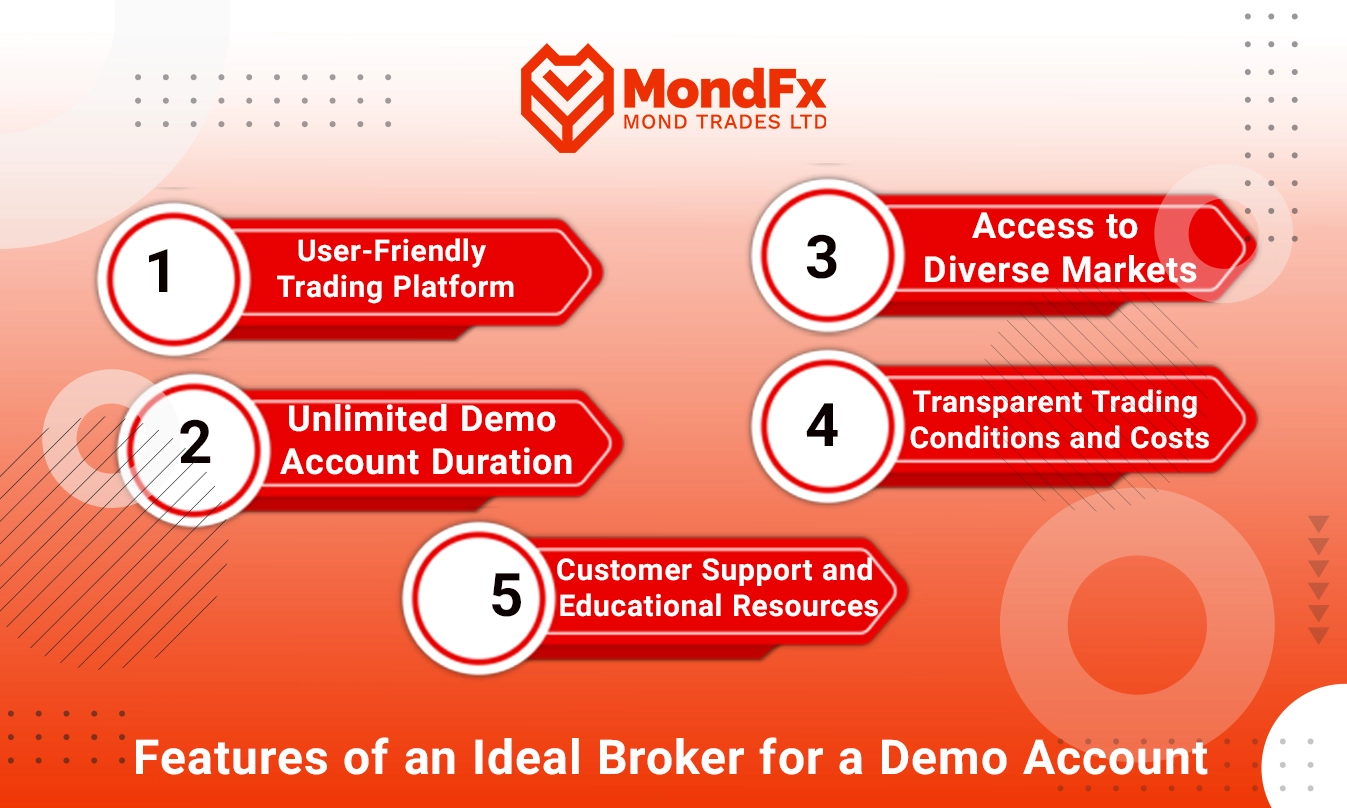

Features of an Ideal Broker for a Demo Account

To choose the best broker for using a demo account, it is crucial to consider the following key features:

User-Friendly Trading Platform

The broker you select should provide a platform that is easy to use and intuitive. Popular platforms like MetaTrader 4 (MT4)and MetaTrader 5 (MT5)are excellent choices for both beginners and professionals due to their comprehensive features, analytical tools, and simple interface.

Unlimited Demo Account Duration

Many brokers offer demo accounts with time restrictions, but it is better to choose one that provides a demo account without any time limits.

This feature allows you to gain a full understanding of the market and test your trading strategies in a realistic environment without feeling pressured by time.

Access to Diverse Markets

A reliable broker should enable access to a variety of trading markets, such as forex, stocks, cryptocurrencies, and commodities.

This allows you to familiarize yourself with different asset classes and expand your trading experience across multiple financial instruments.

Transparent Trading Conditions and Costs

It is essential to choose a broker that clearly informs you of all costs, including spreads, commissions, and other fees.

This transparency helps you avoid hidden charges and provides a better understanding of your trading expenses.

Customer Support and Educational Resources

A key feature of reputable brokers is offering professional customer support and diverse educational materials for both beginners and experienced traders.

Given the complexity of financial markets, having access to 24/7 customer support and professional training resources can make a significant difference in your learning and trading progress.

Advantages and Disadvantages of Demo Accounts in Forex

Demo accounts offer exceptional features that can be highly beneficial for both beginner and professional traders. Here, we’ll explore their advantages and disadvantages.

Advantages

No Financial Risk:

A demo account allows you to trade without using real money, making it ideal for beginners to familiarize themselves with the market without worrying about financial loss.

Testing Strategies:

You can test various trading strategies and evaluate their effectiveness under different market conditions.

Platform Familiarization:

Demo accounts introduce you to the functionalities and tools of trading platforms, such as charts, indicators, and order placement.

Experience Real Market Conditions:

Many demo accounts simulate real market conditions, including price fluctuations, spreads, and order execution times.

Skill Development:

Using a demo account helps you hone your trading skills without the pressure of losing real money, preparing you for live trading.

Risk Management Training:

You can practice managing risks and controlling trades in a demo account to avoid costly mistakes in live trading.

Unlimited Learning Opportunities:

Most demo accounts have no time limit, allowing you to improve your skills and strategies at your own pace.

Disadvantages

Lack of Real Emotional Experience:

In a demo account, you trade with virtual money, so you don’t experience real emotions like fear and greed, which are critical factors in live trading.

Psychological Differences in Trading:

Transitioning from a demo to a live account can be challenging due to the psychological pressure of trading with real money.

Encourages Risky Behavior:

Since there’s no financial risk, some users may develop habits of taking high risks, which can lead to significant losses in real trading.

Order Execution Differences:

Order execution in a demo account might differ from a live account, such as slippage or slower execution speeds in real market conditions.

Incomplete Cost Simulation:

Demo accounts usually do not replicate costs like commissions, variable spreads, or maintenance fees, which can affect your understanding of actual trading expenses.

Limited Market Depth Simulation:

Some demo accounts may not accurately simulate real market depth and liquidity, which are critical in actual trading.

Dependence on Ideal Conditions:

Trades in a demo account might perform better due to the absence of real emotional and market complexities, leading to false confidence.

Introduction to 7 Best Brokers for Demo Accounts

A demo account is an excellent tool for learning and practicing in financial markets. Below, we introduce some of the best brokers for opening demo accounts and their features. These brokers provide conditions that allow traders to enhance their skills and test their trading strategies without any financial risk.

| Broker Name | General Description | Advantages |

|---|---|---|

| MondFX | A professional broker offering excellent services for beginners and professionals. Provides free demo accounts | Free demo account, strong support, low spreads, diverse assets, free education. |

| LiteFinance | A reputable broker with a simulated real market environment and unlimited demo accounts. | Unlimited demo accounts, access to MT4 and MT5, accurate market simulation. |

| Alpari | A leading forex broker offering demo accounts suitable for beginners and professionals. | Wide variety of trading tools, competitive spreads, helpful educational resources. |

| AMarkets | A broker offering a comprehensive demo account similar to a real account, ideal for scalping and long-term trading. | 24/7 multilingual support, advanced strategy testing, suitable for scalping and long-term trading. |

| Pepperstone | An international broker with low spreads and real market conditions. | Competitive spreads, fast execution, access to global markets. |

| IC Markets | One of the most popular brokers offering low spreads and unlimited demo accounts. | Realistic demo account simulation, low spreads, support for MT4, MT5, and cTrader. |

| FXTM | A well-known broker with extensive resources for both beginners and professionals. | Comprehensive educational materials, transparency in costs, access to MT4 and MT5. |

1. MondFX

General Description:

MondFX is a professional broker in the forex market offering excellent services for beginners and professionals. It provides free demo accounts that simulate real market conditions, creating an ideal environment for learning and practice.

Advantages:

Full-featured demo accounts with no time limits.

Strong support: A professional multilingual team assists traders at every step.

Advanced trading platforms: MondFX supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offering comprehensive tools for technical and fundamental analysis.

Competitive spreads: Designed for scalping and short-term trading.

Free educational resources: Provides valuable materials and specialized webinars for both beginners and professionals.

Diverse tradable assets: Access to various markets, including forex, indices, commodities, and cryptocurrencies.

2. LiteFinance

General Description:

LiteFinance is a reliable broker with ideal conditions for demo accounts, allowing users to practice in a simulated real market environment.

Advantages:

Unlimited demo accounts.

Access to MetaTrader 4 and MetaTrader 5 platforms.

Accurate real-market simulation.

3. Alpari

General Description:

Alpari is one of the leading brokers in the forex market, offering demo accounts for beginners and professionals alike.

Advantages:

Wide range of trading instruments, including forex, commodities, and cryptocurrencies.

Competitive spreads and commission-free demo accounts.

Offers helpful educational resources.

How to Open a Demo Account with Alpari

Visit the official Alpari website:www.alpari.com.

Click on the Sign Up button on the homepage.

Fill out the registration form with your personal information.

After completing the registration, go to the trading accounts section and select the demo account option.

Choose the platform type (MT4 or MT5) and the desired amount of virtual funds, then create your account.

4. AMarkets

General Description:

AMarkets provides a fully-featured demo account with conditions similar to real accounts, making it an excellent choice for both beginners and advanced traders.

Advantages:

24/7 multilingual customer support.

Allows testing advanced strategies.

Ideal for scalping and long-term trading.

5. Pepperstone

General Description:

Pepperstone is a highly reputable international broker known for its low spreads and fast execution.

Advantages:

Very competitive spreads.

Fast order execution.

Access to global markets, including forex, indices, and commodities.

6. IC Markets

General Description:

IC Markets is one of the most popular brokers, known for its low spreads and unlimited demo accounts, ideal for scalping.

Advantages:

Demo accounts with realistic market simulation.

Very low spreads.

Supports MT4, MT5, and cTrader platforms.

7. FXTM (ForexTime)

General Description:

FXTM is a renowned broker offering extensive resources and tools for both beginners and professionals.

Advantages:

Wide range of educational resources.

Transparency in trading costs.

Access to MetaTrader 4 and MetaTrader 5 platforms.

How to Create a Demo Account in TradingView

TradingView is one of the best platforms for technical analysis and social trading, designed for traders in financial markets.

This platform allows users to utilize advanced tools for market analysis and use demo accounts to test their strategies. Below is a step-by-step guide to creating a demo account in TradingView.How to Create a Demo Account in TradingView

TradingView is one of the best platforms for technical analysis and social trading, designed for traders in financial markets.

This platform allows users to utilize advanced tools for market analysis and use demo accounts to test their strategies. Below is a step-by-step guide to creating a demo account in TradingView.Step-by-Step Guide to Creating a Demo Account in TradingView

Visit the TradingView Website or Download the App:

Navigate to tradingview.com or download the TradingView app on your mobile device.

Sign Up or Log In:

If you’re a new user, click on Sign Up and create an account using your email, username, and password.

Alternatively, you can use your Google,Apple, or Facebook accounts to register.

Existing users can log in by clicking Log In and entering their credentials.

Access the Demo Account (Paper Trading):

After logging in, locate the Trading Panel at the bottom of the screen or on the right-hand side of the chart.

Click on the panel, find the Paper Trading option, and select it.

Press Connect to activate the demo account.

Set Your Virtual Balance:

Once connected to Paper Trading, you can customize the balance of your demo account.

Go to the Settings (gear icon)in the Paper Trading section.

Enter your desired virtual fund amount (e.g., $10,000) and save the changes.

Start Trading:

With your virtual balance set, you can now begin trading.

Use advanced TradingView tools, including charts, indicators, and analysis tools, to test your strategies.

Experiment with trades in various markets such as forex, stocks, cryptocurrencies, and commodities.

Why Use a Demo Account in TradingView?

Using a demo account in TradingView provides several advantages:

Trade without risking real money.

Test your trading strategies in a simulated environment.

Familiarize yourself with the advanced tools and features of TradingView.

Identify and improve your trading strengths and weaknesses.

A demo account in TradingView is an excellent tool for practice and strategy testing, offering users a risk-free way to trade using virtual funds. It helps traders explore the platform's analytical tools and simulate real market conditions while building their skills.