In Forex trading, a “lot” is a standard unit used to describe the volume or size of a trade. A lot represents the amount of currency being bought or sold in a transaction. Forex traders typically utilize different lot sizes to execute their trades. In this article, we will delve into this important concept in detail.

Importance of Understanding Lot Size

Understanding lot size in Forex is crucial for risk management. The lot size that a trader selects can directly impact the level of risk they undertake in a trade. The larger the lot size, the greater the potential profit or loss from the trade, which consequently increases the risk.

Additionally, Forex brokers usually require a minimum deposit to open an account, and the available lot sizes may vary depending on the type of account. Understanding lot sizes can help traders determine which account type is more suitable for their trading style and account size.

Trading strategies are also influenced by lot size. Different strategies may require varying lot sizes. For instance, day trading strategies, which involve opening and closing trades within the same day, may consider smaller lot sizes, while long-term strategies may involve larger lot sizes.

Concept of Standard Lot in Forex

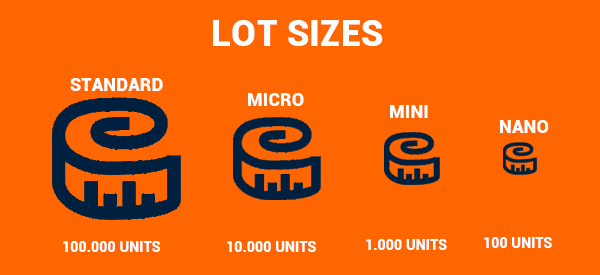

In Forex trading, a standard lot is the largest lot size, equivalent to 100,000 units of the base currency in a currency pair. For example, in the EUR/USD currency pair, one standard lot equals 100,000 euros.

The value of a pip in a standard lot can vary depending on the currency pair being traded. Generally, one pip in a standard lot is equivalent to $10. However, for some currency pairs, the pip value may differ.

Standard lots are typically used by experienced and professional traders who have larger trading accounts and choose to take on higher risks.

Advantages of Standard Lot

-Higher Returns: Trading with standard lots can lead to higher returns because of the larger lot size. However, price fluctuations against the trader’s position can also result in larger losses.

-Long-Term Trading: Standard lots are generally suitable for long-term trades, as they allow traders to capture larger price movements over an extended period.

Disadvantages of Standard Lot

– Higher Margin Requirements: Standard lots require higher margins, which may be a barrier to entry for some traders.

– Not Ideal for Short-Term Trading: Trading with standard lots may not be suitable for short-term trades, as the lot size might be too large to effectively capture smaller price fluctuations.

Concept of Mini Lot in Forex

A mini lot is one-tenth the size of a standard lot, equivalent to 10,000 units of the base currency in a currency pair. For example, in the EUR/USD currency pair, one mini lot equals 10,000 euros.

Mini lots are typically used by retail traders who have smaller trading accounts and wish to hold smaller positions in the market.

Advantages of Mini Lot

-Lower Risk: Trading with mini lots carries a lower risk compared to standard lots, making it more manageable for traders, especially beginners.

-Lower Margin Requirements: Mini lots require less margin, making them a suitable choice for traders with smaller accounts.

-Flexibility in Position Size: Trading with mini lots allows traders to adjust the size of their positions according to their account balance and risk tolerance.

-Suitability for Short-Term Trading: Mini lots can be ideal for short-term trades as their smaller size enables traders to capture smaller price fluctuations more effectively.

Disadvantages of Mini Lot

-Lower Returns: Trading with mini lots typically results in lower returns compared to trading with standard lots.

-Limited Participation in Certain Strategies: Using mini lots may restrict participation in some strategies that require larger position sizes.

-Higher Percentage Spread: Trading with mini lots may incur a higher percentage spread compared to standard lots, as some brokers charge a higher spread for smaller lot sizes.

If you intend to use mini lots for your trades, the broker Mound FX could be an excellent option. This is because, at this broker, the spreads for trading with mini lots do not differ from those of standard lots.

Concept of Micro Lot in Forex

A micro lot is one-tenth the size of a mini lot, equivalent to 1,000 units of the base currency in a currency pair. For example, in the EUR/USD currency pair, one micro lot equals 1,000 euros.

Traders with limited capital may use micro lots, allowing them to participate in the Forex market with a smaller account balance while still being able to trade.

Micro lots can also be used for risk management purposes. Traders looking to limit their market exposure may choose to trade with micro lots to keep their position sizes small and reduce the impact of losses.

Some traders might also use micro lots to test various trading strategies. By utilizing a small position size, they can test their strategies in real market conditions without risking a significant amount of capital.

Advantages of Micro Lot

-Reduced Risk: Trading with micro lots allows traders to take smaller positions, which reduces overall risk exposure.

-Lower Capital Requirement: Micro lots require less capital compared to trading with standard or mini lots, making them accessible to traders with smaller accounts.

-Higher Trading Frequency: Traders can engage in more frequent trades without risking significant amounts of capital, allowing for more opportunities to capitalize on market movements.

Disadvantages of Micro Lot

-Limited Returns: Trading with micro lots may yield lower returns due to the smaller size of positions.

-Higher Transaction Costs: Engaging in more trades with micro lots can lead to increased transaction costs, as more positions need to be opened and closed.

-Potential Strategy Limitations: Some trading strategies may not work effectively with micro lots, as the smaller position size could limit the effectiveness of certain techniques.

Which Lot Size is Right for You?

Choosing the appropriate lot size in Forex is a critical decision that can impact trading returns and risk management. Traders should consider the following factors, in addition to the size of their account, when selecting a lot size:

-Risk Tolerance: Your risk tolerance is a crucial factor in determining lot size. Traders with lower risk tolerance may prefer to trade with smaller lot sizes to limit their exposure to market risks, while others may feel more comfortable taking larger positions.

-Trading Strategy: Your trading strategy also plays an important role in selecting the appropriate lot size. For example, day trading strategies that involve opening and closing positions within a single day may require smaller lot sizes to effectively manage risk.

-Market Conditions: Market conditions, such as volatility and liquidity, can also influence lot size. In volatile markets, traders may need to use smaller lots to manage risk, while in more liquid markets, they may be able to take on larger positions.

-Broker: The broker you use may limit the available lot sizes. Some brokers may only allow trading in standard or mini lots, while others, like Mound FX, offer users the option to trade with nano accounts, providing even smaller lot sizes for greater flexibility.

The Relationship Between Lot Size, Leverage, and Pip Value

Understanding the concept of pips and their relationship with lot size is fundamental for determining profit, loss, and overall risk management. Below, we explore the concept of pips and how to calculate their value across different lot sizes.

What is a Pip?

“Pip” stands for “Percentage in Point” or “Price Interest Point.” It is the smallest price movement in the Forex market. In most currency pairs, a pip is usually the fourth decimal place, except for currency pairs that include the Japanese yen, where a pip is the second decimal place.

Calculating Pips

To calculate the value of a pip, you need to consider the exchange rate and the lot size. The formula is as follows:

[{Pip Value} = {Lot Size} \times \{Pip Change}]

For example, if your position size is 10,000 units or one mini lot in the EUR/USD currency pair and the price changes by one pip, the pip value is calculated as follows:

[{Pip Value} = 10,000 \times 0.0001 = 1]

This means that for every one pip change, the value of your position changes by 1 unit of the base currency.

Understanding the Impact of Lot Size on Pip Value

- Standard Lot (100,000 units):

– Pip Value: \(100,000 \times 0.0001 = 10\) USD per pip.

- Mini Lot (10,000 units):

– Pip Value: \(10,000 \times 0.0001 = 1\) USD per pip.

- Micro Lot (1,000 units):

– Pip Value: \(1,000 \times 0.0001 = 0.10\) USD per pip.

As you can see, the larger the lot size, the higher the pip value, which directly influences potential profits or losses from price movements in the market.

The Role of Leverage

Leverage allows traders to control larger positions with a smaller amount of capital. For instance, a leverage ratio of 100:1 enables a trader to control a position of $100,000 with just $1,000 in their account. While leverage can amplify profits, it can also significantly increase losses.

Understanding how lot size and leverage interact is crucial for managing risk effectively. Higher leverage allows traders to open larger positions, which can lead to larger gains or losses per pip, depending on the lot size chosen.

In summary, grasping the relationships between lot size, pip value, and leverage is vital for successful trading in the Forex market, as these factors directly impact profitability and risk management strategies.

Common Mistakes in Trading

Overleveraging

One of the common mistakes traders make is overleveraging, which involves trading with a lot size that is very large compared to the account size. While high leverage can amplify profits, it also increases losses. Understanding the appropriate lot size based on risk tolerance is crucial to avoid overleveraging.

Ignoring Risk Management

Failing to implement effective risk management strategies can lead to significant losses. Traders should always consider the potential risk of each trade, set appropriate stop-loss levels, and choose a lot size that aligns with their risk tolerance.

Neglecting Market Analysis

Successful trading requires a thorough understanding of market analysis. Ignoring fundamental and technical analysis can lead to poor decision-making. Traders should stay informed about economic indicators, news events, and technical signals to make informed decisions about entry and exit points.

Conclusion

In conclusion, mastering the concepts of pips and lots is essential for anyone looking to succeed in the Forex market. A thorough examination of lot sizes, profit targets, and risk management based on pips allows traders to make more informed decisions and steer the complexities of trading toward profitability.

Continuous learning, adaptability to market conditions, and avoidance of common mistakes are vital components of a successful trading journey. By utilizing these strategies and maintaining discipline in your approach, you can harness the power of pips and lots to optimize your trading experience.

If you’re looking to enhance your skills as a professional trader, the comprehensive course “From Zero to Hero in Forex” by Mohammad Ahangari Asl could be an excellent option. This course covers topics from beginner to advanced levels, preparing you for the challenges of the financial market. By learning professional trading strategies and risk management techniques, you can increase your chances of success in the highly competitive trading world. For more information and to enroll in this educational course, take action now and take a significant step toward becoming a professional in Forex.