In this approach, the trader seeks to move beyond superficial patterns or short term signals and to understand the true structure of the market, liquidity pools, institutional decision making points, and the reasons behind trend shifts. Rather than relying on luck, this style is built on a deep understanding of price behavior, which is what makes it one of the modern and effective methods in technical analysis.

The importance of learning to trade in the Smart Money style arises from the fact that many major market moves result from the decisions of large investors, and understanding these behaviors can increase the likelihood of making correct decisions. The purpose of this article from MondFx is to provide a clear, educational, and comprehensible perspective on the principles and logic of Smart Money, enabling traders to follow the market with a more precise and professional framework and take advantage of the opportunities this style provides.

What Is Smart Money?

Smart Money refers to the capital or funds that enter the market through large and professional market participants, those who typically have access to deeper information, more precise analysis, and extensive financial resources. This group includes major banks, financial institutions, investment funds, market makers, and even market whales; individuals who not only can better predict price movements but are also capable of influencing the market’s direction through their high trading volumes.

What distinguishes Smart Money from the typical behavior of retail traders is its perspective on the market. Instead of following superficial patterns or reacting to short term emotions, this flow of capital focuses on liquidity, price structure, and the points where decision making is critical for market makers. In fact, Smart Money seeks to capture the best prices, accumulate orders, and create conditions in which its entry and exit occur with the least risk and the highest return.

Understanding the concept of Smart Money means realizing why price behaves unexpectedly at certain levels, why support breaks, or why the market enters a deceptive range before a major move. This understanding forms the foundation of a trading style that brings the trader one step closer to the true logic of the market and professional decision making.

Characteristics of Trading in the Smart Money Style

Trading in the Smart Money style has features that distinguish it from other trading strategies. One of these features is the precise analysis of trading volume. In this method, traders pay close attention to volume and seek to identify the activities of large financial institutions in the markets. In fact, traders in this strategy look for the entry and exit points of the biggest market players in order to take advantage of this information.

Precise Analysis of Trading Volume

One of the prominent characteristics of Smart Money trading is the precise analysis used to determine trading volume in Forex. In this method, traders closely observe trading volume and seek to identify the activities of major financial institutions in the markets. In essence, traders in this strategy aim to discover the entry and exit points of the largest market participants to capitalize on this information.

Tracking the Behavior of Financial Markets

Another key feature of this style is tracking the behavior of financial markets. Smart Money traders carefully monitor market behavior and pay special attention to sudden changes. These changes can potentially indicate the entry or exit of large market players, and in such situations, making the right decision can bring significant profitability.

Using Reliable Information and News

Smart Money also emphasizes the use of reliable information and news. Unlike other traders who may be influenced by rumors and superficial analyses, Smart Money traders use reputable Forex news sources to support their precise analyses for executing trades.

Professional Risk Management

Risk management holds great importance in Smart Money trading. Smart Money traders accurately and carefully measure the risk of each trade and use various risk management tools such as Stop Loss and Take Profit to minimize losses in case of potential mistakes. This helps traders enter the market with greater confidence and avoid unnecessary risks.

How to Implement Smart Money Trading in the Forex Market?

To implement the Smart Money strategy in the Forex market, traders must follow several fundamental principles. These principles include market analysis, tracking major trends, using volume data, and applying precise risk management.

1.Identifying Major Trends

First, long term and short term trends in the market must be identified. For this purpose, analytical indicators such as Moving Averages and Trend Lines are used. Smart Money traders typically enter the market during major trends to benefit from large and sustained movements.

2.Using Trading Volume

Trading volume is one of the most important tools in the Smart Money strategy. When trading volume increases significantly, it may indicate the activity of large financial institutions. Traders must closely track volume and trade based on these signals.

3.Paying Attention to Support and Resistance Levels

Another fundamental principle in the Smart Money strategy is paying attention to support and resistance levels on charts. These levels are generally used for proper market entries and exits. Smart Money traders often use these points to identify entry opportunities.

4.Using Precise Risk Management Strategies

Risk management is extremely important in the Smart Money strategy. Traders must set accurate Stop Loss and Take Profit levels for each trade. Additionally, using the Risk to Reward Ratio helps traders operate more professionally.

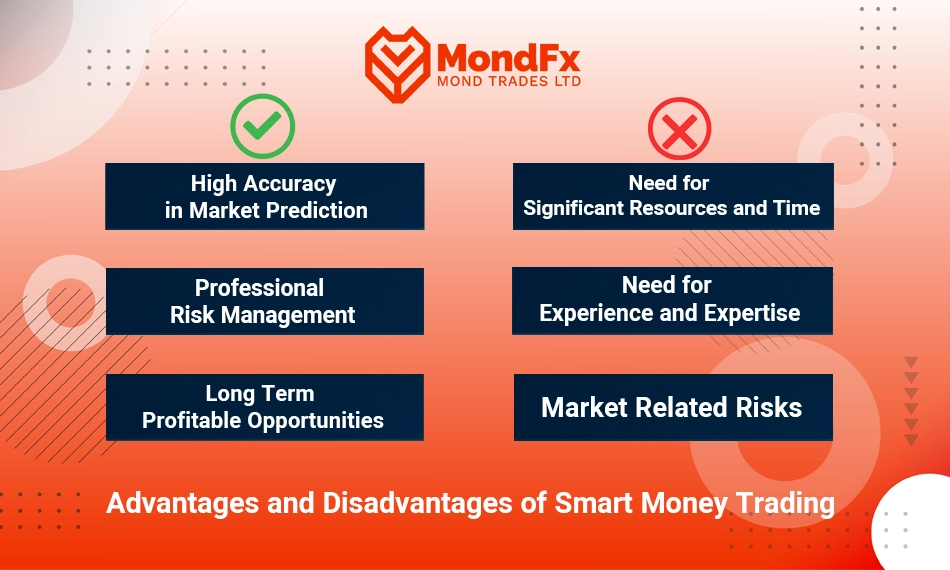

Advantages and Disadvantages of Smart Money Trading

Smart Money trading has its own specific advantages and disadvantages that every trader must examine carefully.

Advantages

High Accuracy in Market Prediction

Smart Money trading, due to the use of precise information and advanced analyses, can offer higher accuracy in market prediction. Traders who use this method typically pay close attention to technical analysis, fundamental analysis, and trading volume, and this high level of precision enables them to anticipate major market movements.

Professional Risk Management

One of the important advantages of Smart Money trading is risk management. This strategy helps traders minimize the probability of losses by using various tools such as Stop Loss and Take Profit. As a result, traders can effectively avoid risks and prevent large losses in various market conditions.

Long Term Profitable Opportunities

Following the Smart Money strategy can lead to sustainable long term profitability, as this strategy is based on major and primary market movements. Smart Money traders typically enter the market during main and long term trends, which often move steadily without severe fluctuations. This can result in consistent and long term gains.

Disadvantages

Need for Significant Resources and Time

One of the disadvantages of Smart Money trading is that implementing this strategy requires substantial financial and time resources. Traders must continuously analyze the market and identify reliable and accurate information from various sources. This can be challenging for individuals who do not have enough time or resources for extensive analysis.

Need for Experience and Expertise

Smart Money trading is generally suitable for individuals with a high level of experience and expertise in market analysis. Due to the complexities involved in different analyses and identifying market movements, this strategy may be difficult for beginners or those without sufficient knowledge. Therefore, to use this strategy effectively, traders must possess strong expertise and experience.

Market Related Risks

Although risk management is highly important in this strategy, market risks can never be completely eliminated. Financial markets especially in the short term can be highly volatile, even when analyses are accurate and information is reliable. Therefore, traders may still face risks that challenge the expected outcomes, despite using the Smart Money strategy.

Smart Money Indicator

Indicators in Forex are among the important tools in technical analysis, designed to identify and track market movements by large financial institutions, hedge funds, and professional investors. This indicator helps traders follow specific signals to enter trading positions similar to those of these major market participants and take advantage of potential opportunities.

Concept of the Smart Money Indicator

The Smart Money Indicator is designed based on the analysis of trading volume, price movements, and other market data to simulate the behavior of large market institutions. The primary goal of this indicator is to identify market movements driven by major financial entities. Simply put, this indicator shows traders when the market is influenced by a major movement or significant changes usually originating from powerful institutions.

Applications of the Smart Money Indicator

The Smart Money Indicator is particularly useful for identifying major trends and the strengths behind market movements. It helps traders pinpoint the best entry and exit times, as powerful movements often occur when large institutions enter the market, which can lead to profitable opportunities. For example, when trading volume increases significantly and prices shift sharply, this may signal the activity of key market players.

How the Smart Money Indicator Works

The Smart Money Indicator typically uses information related to trading volume, price fluctuations, and signals found on price charts to identify entry and exit points. By analyzing these data, the indicator attempts to simulate the behavior of major market institutions and alert traders to when and where they should enter or exit positions. Additionally, this indicator helps identify key support and resistance levels.

Advantages of Using the Smart Money Indicator

Using the Smart Money Indicator allows traders to follow the major players in the market and profit from strong and sustained movements. Because it identifies market movements in real time, this indicator can be especially useful for traders seeking to recognize major trends. It also helps traders detect unusual trading volume and price changes that may be caused by the actions of large institutions.

Disadvantages of the Smart Money Indicator

Despite all its advantages, the Smart Money Indicator also has disadvantages. One issue is that it may not be sufficient on its own for making trading decisions. This indicator should be used alongside other analytical tools and trading strategies to achieve the best results. Additionally, it may sometimes generate false signals, which can be problematic particularly in volatile and unpredictable markets.

Smart Money with Artificial Intelligence

Smart Money with artificial intelligence is an innovative and advanced approach in financial market analysis that combines professional trading strategies with the power of machine learning and computational intelligence. This combination enables traders to predict market movements more accurately by using AI algorithms and models.

The Concept of Smart Money with Artificial Intelligence

In the world of trading, Smart Money refers to following the movements and strategies of major financial institutions. However, the use of artificial intelligence in Smart Money means that advanced algorithms and machine learning models automatically analyze market trends and provide optimized trading signals. This technology helps traders take advantage of major market movements more accurately and more quickly.

Applications of Smart Money with Artificial Intelligence in Financial Markets

One of the main applications of Smart Money with artificial intelligence is the use of advanced algorithms to identify complex patterns in the market. These algorithms can detect hidden trends that are not visible to humans and inform traders of potential trading opportunities. Additionally, artificial intelligence can continuously update its models using new data.

In financial markets such as Forex, stocks, and cryptocurrencies, artificial intelligence can help traders take advantage of strong market fluctuations and more accurately identify entry and exit points. This reduces risks and increases the likelihood of success in trades.

How to Work with Smart Money Using Artificial Intelligence

Using Smart Money with artificial intelligence for trading in financial markets requires familiarity with data analysis methods and advanced algorithms. In this section, the steps for working with AI in Smart Money trading are explained in full.

1.Choosing the Right Artificial Intelligence Algorithm

The first step in working with Smart Money using artificial intelligence is selecting suitable algorithms for market analysis. These algorithms may include machine learning models such as classification algorithms, regression models, or neural networks. Each of these models is specifically designed to simulate market behavior and predict price movements. Choosing the correct algorithm depends on the type of market and your trading objectives.

2.Collecting and Processing Market Data

To train artificial intelligence models, reliable and accurate financial data are required. These data may include prices, trading volume, price changes over different time periods, and other technical and fundamental information. After collecting the data, they must be processed for use in the algorithms. This processing includes removing incomplete or incorrect data, normalizing the data, and converting them into formats suitable for AI models.

3.Training the Artificial Intelligence Model

After processing the data, the AI model must be trained using historical data. This process is generally carried out using supervised or unsupervised learning algorithms. During this stage, the model is continuously fed with data and learns to identify hidden patterns in the market. Although this training process can be time consuming, it enables the model to make more accurate predictions about future market movements.

4.Using the Model for Prediction and Analysis

After training the model, it can be used to predict prices, identify entry and exit points, and analyze market trends. The artificial intelligence model can automatically and in real time process new data and generate trading signals. These signals may include buy or sell suggestions, which are usually issued at specific times based on data analysis.

5.Using the Signals and Making Trading Decisions

The signals generated by the AI model can help traders make better trading decisions. These signals are issued accurately and based on available data and can be updated according to market changes. Traders can use these signals as guidance for decision making, thereby reducing the risks associated with emotional decisions.

6.Continuous Monitoring and Improvement of the Model

One of the important features of artificial intelligence is continuous learning. Models can update and improve themselves after each trade using new data. Therefore, traders must constantly monitor the model’s performance and, if necessary, retrain it with new data to achieve better results. Additionally, human supervision of the model’s decisions is essential to ensure accuracy.

7.Risk Management and the Use of Conservative Strategies

Alongside using AI models for market analysis, traders must also consider risk management strategies. While artificial intelligence can automatically determine entry and exit signals, tools such as stop loss and take profit must always be used for managing risk. These tools help traders avoid heavy losses in volatile and unpredictable market conditions.

Advanced Smart Money

Advanced Smart Money is a trading strategy that, through the use of more complex analyses, more accurate predictive models, and modern tools such as artificial intelligence and machine learning, aims to help traders operate more optimally in financial markets. This approach elevates trading beyond traditional analysis and places greater emphasis on simulating the behavior of major financial institutions and global markets.

The Concept of Advanced Smart Money

Advanced Smart Money specifically refers to the use of complex algorithms and modern technologies to analyze and predict financial markets. This strategy typically involves the use of advanced machine learning models, big data analysis, and both fundamental and technical analysis. Traders who use this method seek to simulate the decisions and behavior of large institutions such as hedge funds and central banks, which often rely on extensive datasets to analyze and predict market conditions.

Key Components of Advanced Smart Money

Advanced Machine Learning Algorithms

Machine learning algorithms help traders process market data and identify hidden patterns that may not be detectable by humans. These algorithms can automatically generate trading signals and predict market trends.

Big Data Analysis

Big Data analysis is critically important for identifying market trends and behaviors. In this method, traders use massive amounts of data such as economic news, technical information, social media data, and even macroeconomic analyses to make trading decisions. Big Data analysis can help more accurately simulate the behavior of major financial institutions.

Use of Advanced Simulation Models

Advanced Smart Money allows traders to create precise simulation models of the market that can predict market behavior more effectively than traditional models. These models typically use historical data and advanced forecasting techniques to simulate various scenarios, helping traders make better decisions in different market conditions.

How to Use Advanced Smart Money

How to Apply Advanced Smart Money?

Data Collection and Analysis

The first step in using advanced Smart Money is collecting market data from various sources. These data may include prices, trading volume, economic news, and fundamental information. After collecting the data, they must be processed for precise analysis. This processing typically includes removing incomplete data, normalizing the data, and converting them into formats suitable for machine learning models.

Training Machine Learning Models

After processing the data, traders must train machine learning models. These models may use various supervised and unsupervised algorithms such as neural networks, decision trees, and regression algorithms to predict market trends. The trained models can then be used to forecast prices, identify entry and exit points, and even simulate the behavior of major financial institutions.

Using Predictions and Trading Signals

Once the models are trained, traders can use their predictions to make decisions about trading positions. These predictions often include entry and exit signals. Traders can use these signals to manage their positions and optimize their trading strategies.

Monitoring and Improving the Models

One of the prominent features of advanced Smart Money is the continuous learning of the models. Traders must constantly monitor the performance of their models and, if necessary, retrain them using new data. These continuous updates can improve prediction accuracy and enable traders to take advantage of market opportunities more effectively.

What Is a Trend?

A trend in financial markets refers to the general and long term movement of prices in a specific direction. In other words, a trend indicates the overall direction of price movement for an asset (such as stocks, currencies, or commodities) over time. A trend can be upward, downward, or neutral, and it is commonly used by analysts and traders as a basis for making buy and sell decisions in the market.

Types of Trend

An overview of the different types of trends:

Uptrend

An uptrend occurs when prices are continuously rising. In this trend, higher price levels are recorded, and the market moves upward. An uptrend is typically identified by the formation of Higher Highs and Higher Lows. This type of trend indicates increased confidence in the market and usually occurs when demand for the asset is rising.

Downtrend

A downtrend occurs when prices are consistently falling. In this trend, lower price levels are recorded, and the market moves downward. A downtrend is identified by the formation of Lower Highs and Lower Lows. This trend reflects decreasing confidence in the market and usually happens when supply exceeds demand.

Sideways Trend

A sideways or horizontal trend occurs when prices move within a specific range and no clear upward or downward trend exists. In this trend, the market moves between certain support and resistance levels, and prices continuously oscillate between these zones. This trend typically appears when the market is indecisive and investors are waiting for greater clarity.

How to Identify a Trend

Identifying trends in financial markets is highly important for traders because they typically base their trades on the direction of the trend. There are various tools and techniques used to identify trends, including:

Trendlines Analysis:

One of the simplest methods for identifying a trend is using trendlines. Trendlines are usually drawn by connecting highs and lows to determine the direction of market movement.

Technical Indicators:

Many indicators, such as Moving Averages, RSI, MACD, and others, help traders identify market trends. For example, when the price moves above the moving average, it indicates an uptrend.

Chart Patterns:

Certain chart patterns, such as triangles, flags, and head and shoulders patterns, can signal either a trend reversal or continuation.

The Importance of Trends in Trading

A trend is one of the fundamental principles in technical analysis and helps traders in making financial decisions:

In an uptrend, traders typically look for buying opportunities.

In a downtrend, traders seek selling opportunities or short positions.

In a sideways trend, various strategies such as scalping can be useful.

Overall, following the trend is a popular strategy among traders. Many traders believe that buying in an uptrend and selling in a downtrend can lead to greater profitability, as these trends often continue steadily.

Final Thoughts

Trading in the Smart Money style means trying to see the market from the perspective of its main players, a perspective that relies on liquidity, price structure, institutional decisions, and the reasons behind potential market movements. In this approach, the trader, instead of following superficial patterns or emotional reactions, seeks to understand the logic behind price movement and identify the behavior of large capital. Smart Money is neither a single indicator nor a shortcut trick; rather, it is a collection of analytical principles, behavioral approaches, precise risk management, and a deep understanding of real market flows.

Whether through volume analysis, identifying key liquidity zones, using technical tools, or leveraging artificial intelligence models, the main goal remains the same: understanding how the market is shaped by powerful players and how one can trade in alignment with these flows. This style offers advantages such as more accurate predictions, professional risk management, and long term profitable opportunities, but it also requires experience, time, precise analysis, and acceptance of the natural risks of the market.

Ultimately, Smart Money trading is a professional path for traders who want to make decisions based on data, logic, market structure, and the behavior of large capital rather than emotional reactions. If you embrace liquidity flow analysis and price behavior as the core of your trading, this approach can become one of your most powerful tools in the financial markets.

Frequently Asked Questions (FAQ)

What does Smart Money mean?

Smart Money refers to the capital injected into the market by large and professional players such as banks, financial institutions, funds, and whales, which typically determine the main direction of price movement.

Is Smart Money trading only for professionals?

No. Although this style is rooted in the behavior of major market participants, its principles are also usable for retail traders provided they take market structure analysis and risk management seriously.

Do I need a specific indicator to learn the Smart Money style?

No. This style focuses more on price structure, liquidity, and market behavior. Indicators can be complementary, but your main tool is the chart and price action analysis.

What is the difference between Smart Money and Price Action?

Price action examines price behavior, but Smart Money goes one layer deeper and focuses on liquidity, price manipulation, order blocks, and order accumulation zones.

Does the Smart Money style have errors?

Yes. No trading style is perfect. If the market structure changes or the trader enters without proper risk management, losses are possible. Smart Money only increases the probability of success; it does not guarantee profit.

How long does it take to learn the Smart Money style?

Depending on your trading experience, it usually takes anywhere from a few months to a year to understand the principles and then apply them in real trading.

Is Smart Money suitable for all timeframes?

Yes. However, it is more accurate in higher timeframes, and in lower timeframes it requires more experience and skill to identify fake outs and price manipulation.

What is the most important factor in Smart Money trading?

Understanding liquidity, having patience while waiting for the right entry point, and managing risk. A Smart Money trader seeks the best price not the fastest trade.