This factor causes the long term trend of their stocks to behave differently across various economic cycles. Therefore, in this article from MondFx, in addition to becoming familiar with what fixed capital is and how it affects a company’s profitability and risk, traders are helped to gain a deeper understanding of business structures, economic cycles, and the potential direction of prices. This knowledge is a genuine analytical advantage for any trader aiming to make more accurate and professional decisions.

Fixed Capital and Its Role in Trading

Fixed capital refers to a company’s long term assets that cannot be quickly converted into liquidity, such as land, buildings, machinery, and equipment. Unlike working capital, these assets are essential for the company’s production and operational activities, and their value typically changes over time. From a trader’s perspective, understanding fixed capital is particularly important because it reflects the company’s stability and financial structure, and it can reveal both investment risks and opportunities. For example, a company with high fixed capital may have limited financial flexibility in the short term, but over the long term, its substantial and infrastructural assets allow it to maintain stable production. Therefore, being aware of the amount and type of fixed capital helps traders better predict long term stock trends and make more accurate trading decisions.

Why Is Understanding Fixed Capital Important for Fundamental Analysis?

In fundamental analysis, fixed capital is considered one of the key indicators for evaluating a company’s financial health and stability. Fixed assets such as machinery, equipment, and buildings show how much long term capacity a company has for producing goods or services, and to what extent it can withstand market fluctuations and economic recessions.

For traders, this information is crucial because high fixed capital is usually associated with greater operational risk and may put pressure on the company’s liquidity during unfavorable market conditions. On the other hand, companies with well managed and balanced fixed capital are capable of maintaining stable production and achieving long term profitability, which helps in predicting medium and long term stock trends. Consequently, analyzing fixed capital is not merely an accounting detail but a powerful analytical tool for making smart trading decisions.

The Impact of Fixed Capital on a Company’s Performance During Economic Recession

Fixed capital especially in companies whose major assets are invested in equipment, machinery, and infrastructure plays a decisive role during economic recessions. Companies with high fixed capital generally have fixed operating costs that must be paid even when sales or revenues decline.

This limits their financial flexibility and increases their vulnerability to market fluctuations. For traders, understanding this characteristic is important because it can signal the long term risk of a stock and influence the prediction of future price trends. For example, during a recession, the stocks of companies with heavy fixed capital may experience sharper declines, while companies with balanced and well managed fixed capital are more capable of maintaining cash flow and relative profitability. Therefore, analyzing fixed capital helps traders make smarter decisions about entering or exiting positions and better predict long term market trends.

Why Is Fixed Capital Important?

Fixed capital is essential for any business seeking sustainable growth and long term development. This type of capital helps businesses remain resilient against short term market fluctuations and achieve continuous progress. Here are several key reasons why fixed capital is crucial for businesses:

1. Increased Production Capacity

Fixed capital enables businesses to purchase new or larger equipment, especially in industries that require specialized machinery and tools. These assets help production processes run more efficiently and allow for higher output. For example, building a new factory or acquiring modern machinery can significantly boost a company’s production capacity.

2. Stability and Resistance to Fluctuations

Fixed assets generally react less to rapid market changes and economic volatility. They are consistently used in business operations and tend to maintain their value over time. Unlike working capital, which can quickly be converted into cash, fixed capital allows businesses to remain resilient during economic crises and sudden market shifts.

3. Long Term Planning Capability

Having fixed capital gives businesses the opportunity to invest in long term projects and continue growing and developing gradually. These assets allow companies to pursue their long term goals without worrying about momentary market changes. For example, investing in modern technologies or establishing new facilities can contribute to sustainable growth and greater competitiveness.

Ultimately, fixed capital forms the foundation for building the infrastructure and capacities needed to move toward long term success in any business.

The Difference Between Fixed Capital and Working Capital

Fixed capital and working capital are two distinct types of financial resources, each playing its own specific role within a business. Understanding these differences is crucial for traders and business managers, as each type of capital has a different impact on financial performance and business strategies.

1. Fixed Capital

Fixed capital refers to long term assets that are used continuously in a business and cannot be quickly converted into cash. This type of capital is typically used to establish infrastructure and purchase fixed assets such as machinery, buildings, equipment, and technologies required for producing goods or services. Fixed capital contributes to the long term growth and development of a business.

Examples:

Purchasing a new factory

Investing in production machinery

Buying information technology systems for data processing

Building new commercial infrastructure

2. Working Capital

Working capital refers to the short term financial resources used to meet a business’s daily operational needs. This type of capital is essential for purchasing raw materials, paying employee salaries, covering daily expenses such as rent and advertising, and handling other ongoing operational costs. Working capital can be easily converted into cash and helps manage the business’s day to day activities.

Examples:

Inventory (stock on hand)

Cash available for paying expenses

Accounts receivable (amounts to be collected from customers)

Accounts payable (amounts owed to suppliers)

The Key Differences Between Fixed Capital and Working Capital

| Feature | Fixed Capital | Working Capital |

|---|---|---|

| Duration of Use | Long term (for years) | Short term (for daily operations) |

| Type of Asset | Physical assets not quickly convertible into cash | Cash inventory and accounts receivable |

| Purpose of Use | Long term growth and development, purchase of infrastructure and equipment | Meeting daily business needs, paying expenses |

| Convertibility to Cash | Very limited | Easily convertible to cash |

| Example | Purchasing a factory, production machinery | Inventory, cash, accounts receivable |

So, both fixed capital and working capital are essential for the success and growth of a business, but they are used for different purposes. Fixed capital is mostly allocated to long term projects, the construction of infrastructure, and facilities, while working capital is necessary for carrying out daily activities and meeting the immediate cash needs of the business. A precise understanding of these differences helps traders and business managers adopt more effective financial strategies for the growth and stability of their business.

Methods of Financing Fixed Capital

Financing fixed capital is one of the major challenges for businesses, as this type of capital is usually used for long term projects and the purchase of assets such as land, buildings, machinery, and equipment. Due to the high costs and long payback periods, choosing the right method for financing fixed capital can have a significant impact on a business’s success. In this article, we examine various methods of financing fixed capital.

1. Using Internal Resources (Personal Investment)

One of the common methods for financing fixed capital is the use of internal business resources. These resources include retained earnings, savings, or operational income that are directly allocated to investments in fixed assets. This method does not require borrowing or incurring debt, allowing the business to avoid external financial pressures.

2. Bank Loans

Bank loans are one of the most common methods for financing fixed capital. In this approach, a business borrows from banks or financial institutions, and these funds are used to purchase fixed assets. Loans are usually provided with a specified interest rate and a defined repayment period.

3. Issuing Shares

Another method of financing fixed capital is issuing shares. In this method, businesses sell their shares to investors and thereby attract the financial resources needed to purchase fixed assets. This approach is typically used by larger companies or those seeking expansion on a larger scale.

4. Leasing (Finance Leasing)

Leasing is another financing method in which the business rents an asset instead of purchasing it directly. Through this method, a business can lease assets such as machinery, equipment, or vehicles for a specified period and may also have the option to purchase them at the end of the term.

5. Foreign Investment (Investors and Business Partners)

In some cases, businesses may turn to foreign investors or business partners to finance fixed capital. This type of financing can be carried out through attracting private investors or forming business collaborations between two companies. In such cases, the business partner or investor covers part of the cost of purchasing fixed assets and, in return, receives a share of the business’s profits.

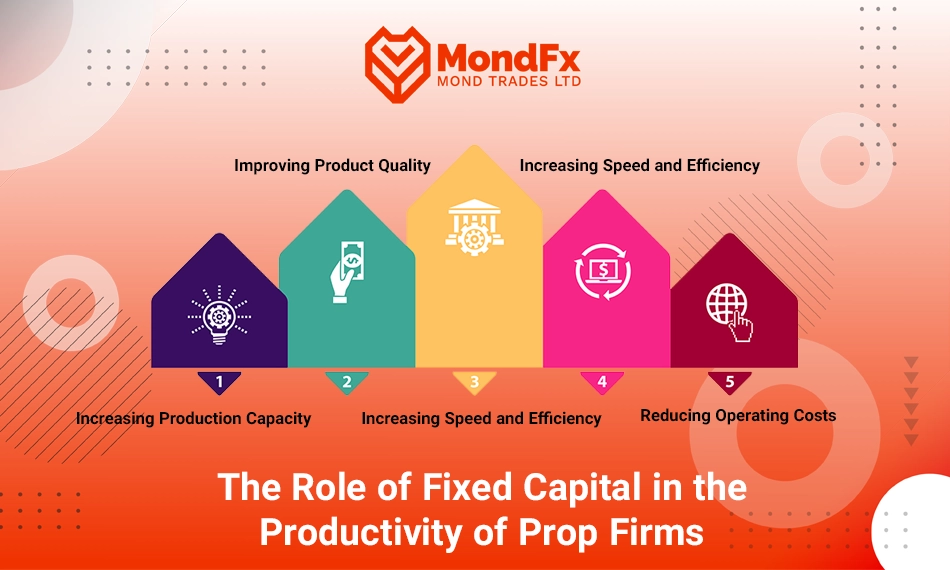

The Role of Fixed Capital in the Productivity of Prop Firms

Fixed capital refers to assets that are used for a long time in a company’s production and commercial processes, such as machinery, buildings, equipment, and various technologies. These types of assets play a very important role in increasing a company’s productivity because they directly affect production capacity, product quality, and the speed of business processes. Here, we examine the role of fixed capital in enhancing productivity:

1. Increasing Production Capacity

Fixed capital can significantly boost productivity by improving and expanding a company’s production capacity. For example, purchasing new machinery or expanding production lines can increase output, enabling the company to produce more products using the same resources.

2. Improving Product Quality

Using advanced equipment and new technologies can lead to significant improvements in product quality. This is especially important in manufacturing industries, as modern and more precise equipment can result in high quality goods and reduce production errors.

3. Increasing Speed and Efficiency

Fixed capital can improve the speed and efficiency of production and business processes. For example, automation systems and advanced machinery can reduce production time, allowing companies to respond more quickly to market demand.

4. Reducing Operating Costs

Investing in fixed assets can lead to reduced operating costs in the long term. For instance, using new technologies to optimize processes or employing more efficient machinery can lower energy and maintenance costs, ultimately increasing a company’s productivity and profitability.

5. Supporting Strategic Decision Making

Fixed capital enables companies to invest in long term and strategic projects. These assets, due to their long lifespan, help companies plan and implement sustainable growth strategies, which in turn increases the overall productivity of the company.

Final Words

Understanding the concept of fixed capital goes beyond a simple accounting definition and helps traders and investors grasp the real structure of companies, as well as their level of risk and financial stability. Long term assets such as machinery, equipment, and infrastructure not only increase a company’s production capacity and productivity but can also indicate the level of financial flexibility and the company’s ability to maintain cash flow and profitability during economic recessions.

Therefore, examining fixed capital and its distinction from working capital, its financing methods, and its impact on company performance is a key analytical tool for predicting long term stock trends. Traders who carefully analyze these factors can make smarter and more professional trading decisions and identify more secure and lower risk investment opportunities. Ultimately, fixed capital is not only the foundation of long term growth and development for companies but also an important indicator for risk management and choosing successful trading strategies in financial markets.

If you are looking to begin a reliable journey in the world of financial markets, partnering with the MondFx team can be a great starting point for building your personal strategy.

Frequently Asked Questions About Fixed Capital

What is fixed capital and how is it different from working capital?

Fixed capital refers to a company’s long term assets that are essential for production and operations and cannot be quickly converted into cash, such as machinery, equipment, and buildings. In contrast, working capital consists of short term resources used to meet the daily needs of a business, such as inventory, cash, and accounts receivable.

Why is fixed capital important for traders?

By examining fixed capital, traders can assess a company’s financial stability and operational risks. Companies with high fixed capital may be more vulnerable during recessions, but their long term production capacity remains stable. This information helps in predicting long term stock trends.

How does fixed capital affect a company’s profitability and cash flow?

Fixed capital can increase long term profitability by expanding production capacity, improving product quality, and reducing operating costs. At the same time, high fixed capital may create short term liquidity pressure, especially during economic downturns.

How do companies with high fixed capital behave during a recession?

Companies with heavy fixed assets typically have high operating costs and less financial flexibility. For this reason, their stocks may decline more during a recession, but in the long run, they maintain stable production capabilities and preserve value.

What are the methods of financing fixed capital?

Businesses can finance fixed capital through internal resources, bank loans, issuing shares, leasing (finance leasing), or attracting foreign investors. The appropriate method depends on the size and needs of the company, as well as its impact on liquidity and financial risk.

How does fixed capital help in predicting long term stock trends?

Fixed capital reflects a company’s financial structure and operational capacity. By analyzing the amount and type of fixed capital, traders can better predict long term stock trends and identify suitable entry and exit points for their trades.