Author: Sajad Sheikhi

The importance of the bond market in the government’s budget

In her new budget plan, Reeves has to convince investors of the sustainability of the government’s debt and its other expenditures and revenues so that the bond market does not come under heavy selling pressure; otherwise, rising bond yields will trigger a new crisis for the government.

The market assesses the credibility of the budget by examining the following:

The budget deficit must be controllable: Reeves has to offset the £30 billion deficit; markets monitor whether the government’s assumptions for making up the £30 billion are genuinely implementable or are merely the product of creative accounting.

Revenue and expenditure sources must be realistic: the market checks that the stated revenue sources are realistic; recent reports of Reeves stepping back from income tax measures indicate that the budget’s funding sources have become more constrained.

The government’s debt must be sustainable in the long term: that is, Reeves must convince the market that the debt is under control and assure it that she can service it without placing additional strain on the budget and the economy.

If Reeves fails to present a budget that is credible and trustworthy in the eyes of the market, the UK government bond market will come under heavy selling pressure, pushing up borrowing costs and bond yields across the economy; higher bond yields mean higher financing costs for the government, which makes the situation worse. In fact, the greater the fiscal risk as perceived by the market, the higher the yield investors will naturally demand to buy government bonds.

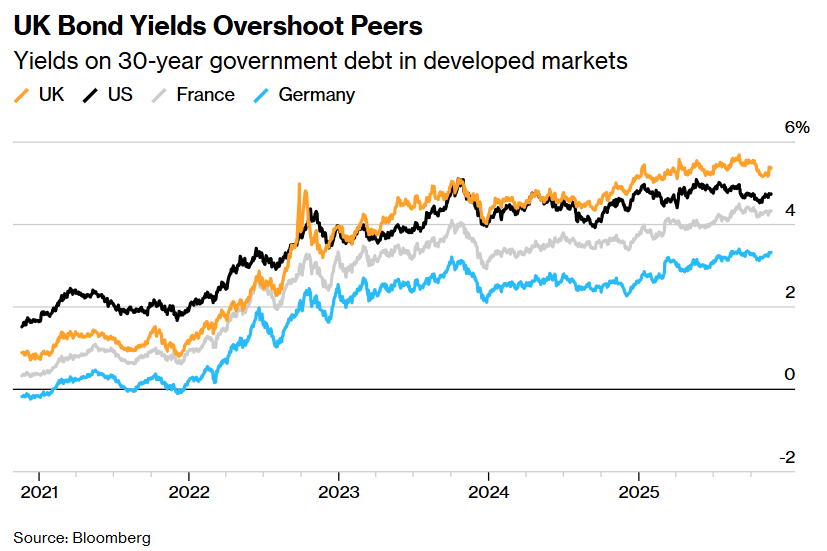

In the last fiscal year, the government’s financing cost was £106 billion, far above the £40 billion recorded before the Covid period; this sharp increase has been driven by high inflation in the UK and higher interest rates. The chart below shows that the yield on 30 year UK government bonds is significantly higher than in other developed markets; this stems from the UK’s higher inflation relative to its peers. Due to the fallout from Brexit, weak productivity and certain structural features in energy pricing, post Covid inflation in the UK has been more severe than in other competing.

Government bonds (gilts) are particularly prone to sell offs!

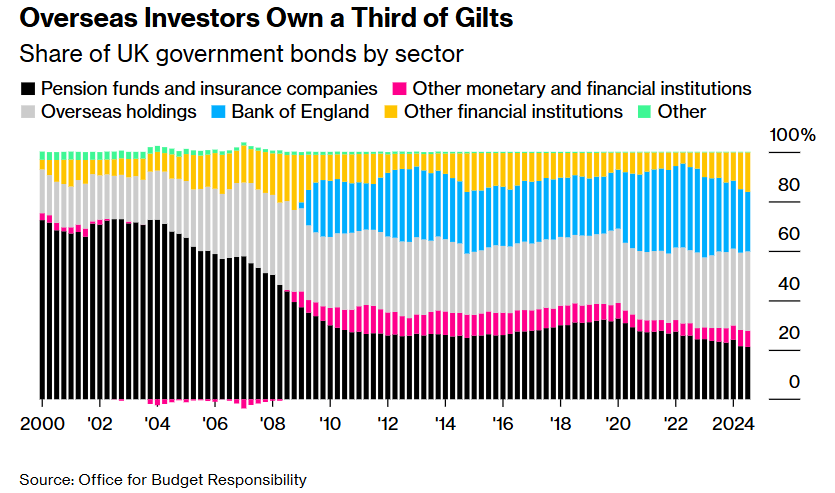

The UK government bond market is smaller than that of its peers; this means that smaller traders can have a pronounced impact on yield volatility. Some also blame changes in the investor base in the gilts market. Pension funds, which are typically long term, stable buyers, have recently shifted towards equities and higher risk markets; at the same time, the Bank of England is selling bonds and reducing the size of its balance sheet. In such circumstances, with demand from fundamental buyers having weakened, the market is more exposed to volatility driven by foreign investors and retail traders; this group of market participants is ready to sell bonds at the slightest signal in the budget.

The inset chart shows the share of each investor group in the gilts market.

The UK government does not have a good track record in managing finances!

While its peers (Germany, the United States and Japan) have never had to be bailed out by the IMF, the British government in 1976, after a sudden surge in debt servicing costs and a sharp collapse in the pound, was forced to obtain a £3.9 billion loan from the IMF.

Earlier this year, a former member of the Bank of England compared the current situation with the crisis of the 1970s, because long term borrowing costs have risen to their highest level since 1998. These conditions are likely to ease with the presentation of a credible budget and the prospect of interest rate cuts by the Bank of England (BoE).

UK interest rate cut expectations

The latest data show that inflation has come in below the central bank’s expectations and that the labour market is also losing momentum. The UK inflation rate fell in October for the first time in seven months, reaching 3.6%. This report has revived hopes of an interest rate cut in December, and the market now assigns roughly an 80% probability to at least one further cut before the end of the year.

Conclusion

The UK government is drawing up its budget at a time when it must keep the bond market under control and, at the same time, avoid reneging on the government’s election promises. The trajectory of BoE monetary policy is also closely tied to the budget, because certain tax increases may fuel inflation and recession, thereby complicating monetary policy and the process of cutting interest rates. If Reeves can win the market’s confidence in the revenue side of the budget, government bond yields will fall and a UK financial crisis will be averted.