Author:Sajjad Sheikhi

Silver’s Growth Surpasses Gold

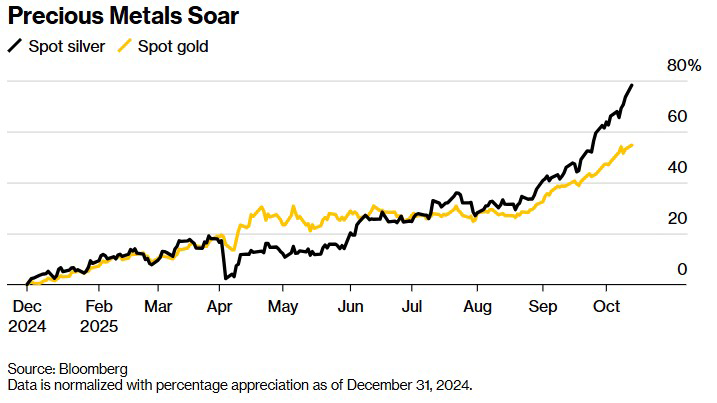

Price charts reveal that silver has outperformed gold this year. A global supply shortage, rising investor demand for safe haven assets, and persistent inflation concerns have all contributed to the sharp rally in this precious metal.

In the London market, silver prices have surged by around 70%, while gold has gained only about 55%. This gap highlights that silver has garnered more attention than gold in 2025, with its performance standing out from both an investment perspective and an industrial demand standpoint.

Silver: A Precious and Industrial Metal

Unlike gold, which is primarily known as a safe haven asset, silver possesses a wide range of practical applications that make it essential for industrial production. Its high electrical conductivity makes it a critical component in electrical circuits, switches, electric vehicles, batteries, and solar panels. Silver is also used in medical equipment, jewelry, and coinage.

Because the price per ounce of silver is significantly lower than that of gold, it is more attractive to retail investors. Moreover, its price tends to experience greater volatility than gold during precious metals bull markets. This dynamic makes investing in silver both riskier and more potentially rewarding.

Reduced Supply in the London Market

In the London metals market, silver inventories are larger than gold’s, but their value is considerably lower. There are about 790 million ounces of silver versus 284 million ounces of gold; however, silver’s value is estimated at nearly $40 billion, while gold’s is around $1.1 trillion.

Recently, silver inventories in London have fallen by about one third, and global demand has outpaced mine supply. Exchange traded funds (ETFs) have attracted new inflows, adding further pressure on physical inventories. In addition, U.S. tariffs on certain imported metals have spurred speculative buying and reduced inventories.

Global Silver Production Challenges

Global silver production faces constraints. The three main producers Mexico, Peru, and China are dealing with declining ore grades, limited development of new projects, and environmental restrictions. These constraints have tightened silver supply and increased pressure on global markets.

Shifting inventories from New York to London may ease the immediate crunch, but it will not resolve the persistent supply deficit, and silver will continue to face shortages.

Rising Demand in India and China

China and India are the world’s largest buyers of silver. Their vast industrial bases, large populations, and the historical significance of silver jewelry are the main drivers of high demand.

In India, during the traditional buying season and the Diwali festival, silver imports have nearly doubled compared to last year. Indian jewelers are even willing to pay 10% or more above the global market price, intensifying physical silver shortages in other markets. This demand pressure also affects industries reliant on silver, such as solar panel manufacturing.

High Volatility: Attractive but Risky

Due to its lower liquidity and greater sensitivity to price fluctuations, silver carries higher risk compared to gold. During market upswings, silver tends to rise faster than gold, but in price corrections, its declines are also sharper and more rapid. Investors entering the silver market should adopt a medium term outlook and pay close attention to volatility risk management.

Conclusion and Outlook

In 2025, silver, with an approximately 70% rise in the London market, has attracted more attention than gold. The main reasons for this trend include:

Global supply shortages

Rising investor demand for safe haven assets

Extensive industrial applications in electric vehicles, solar panels, and medical equipment

Growing demand from India and China

Global production constraints and environmental regulations

The silver market remains more volatile and riskier than gold; however, its correlation with gold means that any change in gold prices has a direct impact on silver as well. With ongoing economic uncertainties including the U.S. government shutdown and tariff negotiations between China and the United States an upward trend in precious metals, especially silver, is to be expected.