The world of financial markets is filled with terms that can be confusing. If you’re new to the Forex market, you may have come across terms like ‘pip’ and ‘pipette’. But what do these terms mean? In this article, we will explore the nature of pips and pipettes, how they are calculated, and how they function in the Forex market.

What is a Pip?

Let’s start by defining ‘pip’. ‘Pip’ is an acronym for ‘Price Interest Point’. In global financial markets, a pip is a unit of measurement used to quantify changes in the value between two currencies.

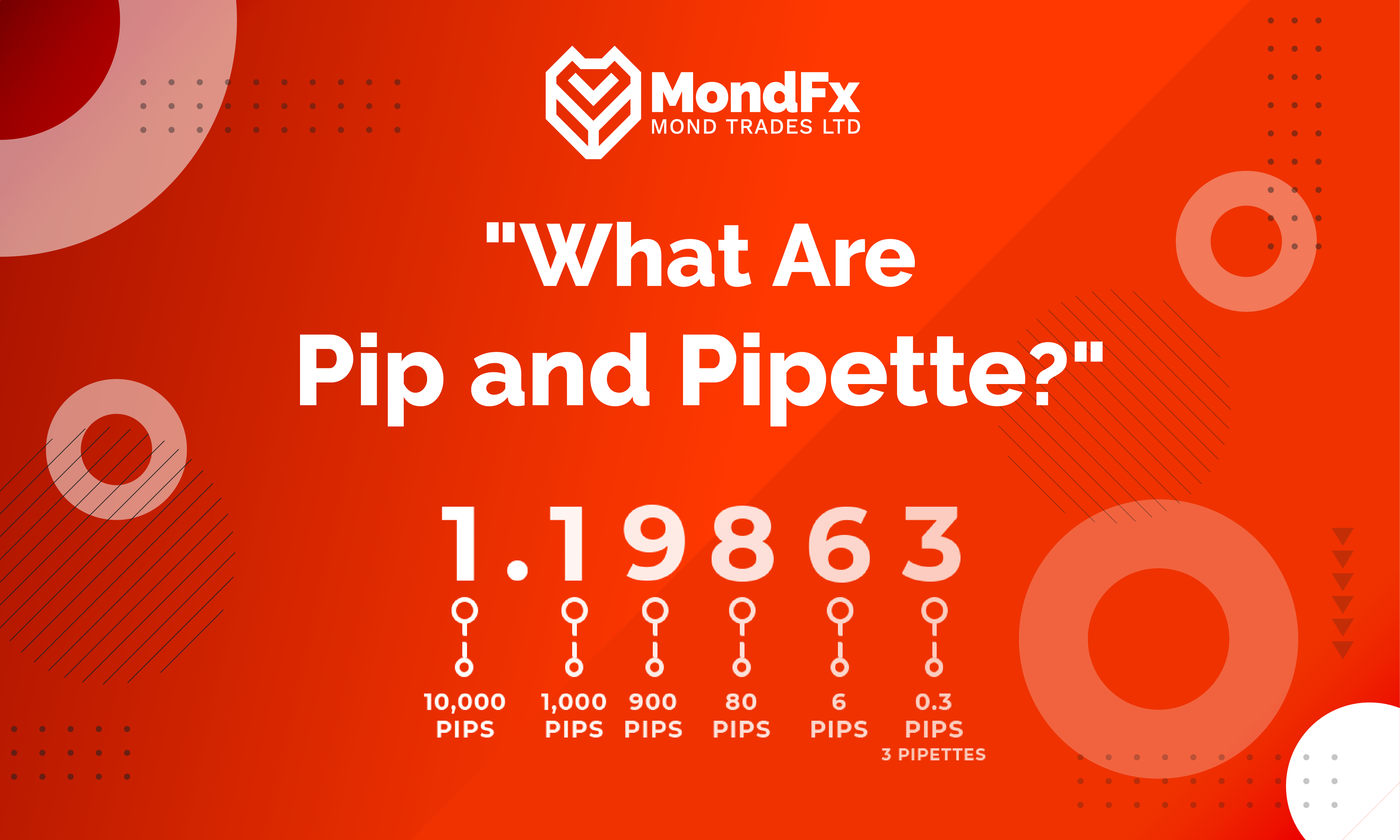

A pip is typically the last decimal place in a currency pair’s price quotation. However, this is not a fixed standard and can vary across different currency pairs.

For Forex pairs displayed with four decimal places, one pip equates to 0.0001. However, for Forex pairs involving the Japanese Yen, one pip is equivalent to 0.01. Does this concept seem complex? Let’s clarify it further with a few examples.

Let’s assume that EUR/USD is trading at 1.0799, signifying that 1 Euro can be exchanged for 1.0799 US Dollars. If this rate shifts to 1.0795, the difference of 1.0799 – 1.0795 = 0.0004, which equates to 4 pips. Conversely, if USD/JPY is quoted at 107.38, meaning 1 US Dollar can purchase 107.38 Japanese Yen, and subsequently this rate changes to 107.40, representing a price fluctuation of 107.40 – 107.38 = 0.02, which is equivalent to 2 pips.

What is a Pipette?

Due to advancements in technology, the growing popularity of online trading platforms, and the increasing trading volume in the Forex market, Forex brokers have begun displaying exchange rates with 5 decimal places for standard pairs and 3 decimal places for Japanese Yen pairs. This has led to the introduction of a new term called ‘pipette’.

A pipette is equal to 1/10th of a pip. This is typically the last decimal place (the fifth for major pairs and the third for Japanese Yen pairs) in the exchange rate. 10 pipettes equal 1 pip.

When should we use the terms ‘pip’ and ‘pipette’?

Pip remains the most commonly used term in the daily jargon of Forex trading. Typically, pip and pipette are used to express the following concepts:

. Expressing Spread: For example, ‘the spread is 3 pips’ means the difference between the buying and selling price is 3 pips.

. Expressing Price Change: The price has decreased by 120 pips.

. Expressing Profit or Loss: I made a 40-pip profit on that trade.

. Expressing the distance between the opening price and the stop-loss or take-profit price: ‘Stop-loss is 30 pips and take-profit is 60 pips'” means that the stop-loss price is 30 pips away from the opening price, and the take-profit price is 60 pips away.

How do I calculate the value of a pip?

You need to calculate the pip value when you want to understand the profit/loss of a trade and implement risk management strategies.

Pip value is always calculated for a specific size or volume, typically for a standard lot (100,000 units), mini lot (10,000 units), or micro lot (1,000 units). The first step in calculating pip value is to multiply the volume by 0.0001 (0.01 for JPY pairs).This figure provides you with the value denominated in the quoted currency.

Example 1: In a 20,000-unit trade of EUR/USD, you multiply 20,000 by 0.0001, which gives you the pip value in US dollars. In other words, a 1-pip change in the exchange rate equates to a $2 profit or loss.

Example 2: For a 30,000-unit trade of USD/JPY, the pip value would be 30,000 x 0.01, which equals 300 Japanese Yen.

The pip value expressed in the quote currency isn’t always the most useful. Typically, you’ll want to know the value in your account currency. When you have the pip value in another currency, simply convert it to your own. So, in the second example above, the pip value of 300 Japanese Yen can be converted to US dollars using the current USD/JPY rate (let’s assume USD/JPY is 107.40). To do this, divide 300 by 107.40, resulting in a pip value of $2.79.

A real-world example of pips

Numerous factors can influence the value of a currency, and consequently, currency pairs. Sometimes, when a country faces challenges such as severe inflation or a devaluation of its currency, trading its currency can become a chaotic and uncontrollable situation.

In such cases, the concept of a pip becomes meaningless. If we go back to Germany during the Weimar Republic (between 1918 and 1933), we can see a real-world example of pips becoming insignificant.

The German Mark (D-Mark) was the currency of Germany at that time, and before World War I, it was valued at a rate of 4.2 Marks to 1 US Dollar. However, after World War I, the exchange rate plummeted.

By November 1923, one US dollar was worth 4.2 trillion German Marks. The drastic devaluation of the German Mark meant that pips became completely worthless.

A more recent example of pips becoming insignificant can be found in Turkey in 2001. During the Turkish economic crisis, the Lira was trading at a rate of 1.6 million to one US Dollar.

Automated trading systems were unable to manage it, so the Turkish government removed six zeros from the exchange rate and renamed their currency to the New Turkish Lira in 2005.

In Conclusion

To trade successfully in the forex market, understanding the concepts of pip and pipette is essential. You must be familiar with the meanings of these terms, common jargon, and methods for calculating pip value. Without this knowledge, failure in the forex market is almost certain.

Success in trading is a continuous journey of learning and improvement.A strong understanding of financial markets is essential. If you aspire to enhance your skills as a professional trader, Mohammad Ahangari Asl’s comprehensive ‘Zero to Hero Forex Training’ course may be an ideal choice.

Encompassing a comprehensive curriculum from beginner to advanced levels, this course equips you to tackle the challenges of the financial market. To learn more and enroll in this training program, take action now and embark on a significant step towards becoming a professional forex trader.