Digital currency or cryptocurrency: which is correct?

One of the common challenges in content related to the digital economy is the conceptual conflation between the two terms digital currency and cryptocurrency. This conflation causes many analyses, news items and even financial agreements to be understood incorrectly. To choose the correct term, there is no need to go back to the basic definitions; rather, we should see in what context and with what purpose each of them is used.

What does digital currency mean?

The term digital currency is used more frequently in economic literature when the subject of discussion is formal financial systems, payment infrastructures, banks or the central bank. In this case, digital currency is a tool for transferring value in electronic form and does not necessarily have any connection to blockchain, decentralization or cryptography. When we talk about bank cards, payment wallets, interbank settlement or central bank digital currency, the correct term is digital currency.

What is meant by cryptocurrency?

The term cryptocurrency, however, is used when the focus is on technology, the network and decentralized architecture. This term is used more in analyses related to blockchain, crypto economics, consensus models, tokens and peer to peer networks. In this context, the word cryptocurrency indicates that the subject is not a traditional means of payment, but a digital asset based on a cryptographic structure and a distributed network.

This is why the choice between these two terms is not merely a linguistic issue; rather, it determines the angle from which you view the subject. If you are describing a general and broad concept, digital currency is the more precise and comprehensive term. However, if the discussion moves toward technology, innovation, blockchain and decentralized assets, the term cryptocurrency is the more accurate and specialized choice in this case.

History and emergence of digital currency

In the history of the modern economy, there is a moment that can be called the beginning of a great transformation; a time when a simple but revolutionary idea took shape: transferring money and value without the need for a bank or intermediary. This idea was, on the surface, simple, but in practice it could call into question the rules that had governed the financial system for centuries. Imagine a world in which you can transfer value directly to another person, without the involvement of any central institution and without needing to trust banks; this was the very vision that the founders of the first digital currency had in mind.

In 2009, while the world was still shaken by past economic crises and public trust in traditional financial systems was at its lowest, Bitcoin entered the stage. Bitcoin was not only a means of payment, but also an example of an emerging technology called cryptocurrency that made direct and transparent transactions possible. This digital currency opened up a new path for thinking about money and trust in the economy and showed that financial systems can operate without central institutions as well.

Following the success of Bitcoin, a new generation of digital currencies emerged: Ethereum, Litecoin and Ripple. Each, with its own specific innovations, pushed back existing boundaries; Ethereum with smart contracts that created programmable capabilities for transactions, Litecoin with faster transactions and Ripple with a focus on cooperation with banks and financial institutions. The changes brought about in the world by this revolutionary approach showed that digital currency is no longer merely a financial instrument, but part of a broad economic and technological transformation that is leading the world towards a different way of managing and transferring value.

Types of digital currency

As the history of digital currency shows, this technology started from a small idea and gradually expanded. However, digital currency is not just a single type of financial unit; in fact, it can be divided into two general categories, each of which has its own specific features and applications. Understanding these categories helps us gain a better understanding of the evolution path of digital currency and the differences between cryptocurrencies and other forms of digital money.

Centralized digital currency

This type of digital currency is controlled by a central entity such as a bank or a government. A simple example of it is the digital money held in bank accounts and credit cards. Such currencies are under direct supervision, and their security and transactions depend to a large extent on trust in that same central entity. Furthermore, the speed and capabilities of transactions are usually limited to the existing infrastructure, and the user’s freedom of action in these systems is less than in decentralized currencies.

Decentralized digital currency or cryptocurrencies

Cryptocurrencies are a type of digital currency that are built on blockchain technology and are not controlled by any central entity. Bitcoin, Ethereum, Litecoin and Ripple are among the most well known examples. These types of currencies use cryptography to ensure the security and transparency of transactions and enable the direct transfer of value between individuals. The decentralized nature of these currencies allows users to carry out financial transactions without trusting a third party and to securely maintain their digital ownership.

The role of digital currency and cryptocurrencies

In the world of digital assets, knowing the difference and overlap between digital currency and cryptocurrencies is the key to understanding their use and value. The simplest way to understand this is to look at well known examples and how they function:

Digital currency only: Assets that are digital but are controlled by an official entity and do not have cryptocurrency features such as decentralization or complex cryptography. Example: banks’ digital money or central bank digital currency.

Cryptocurrency only: Decentralized assets based on blockchain technology that process transactions without the need for intermediaries. Example: Litecoin, Ripple (decentralization and high security are among their key features).

Hybrid (both): Assets that are both digital and decentralized and encrypted, and usually include the world’s most popular cryptocurrencies. Example: Bitcoin and Ethereum, which are considered both digital currencies and cryptocurrencies and set the standards for the market.

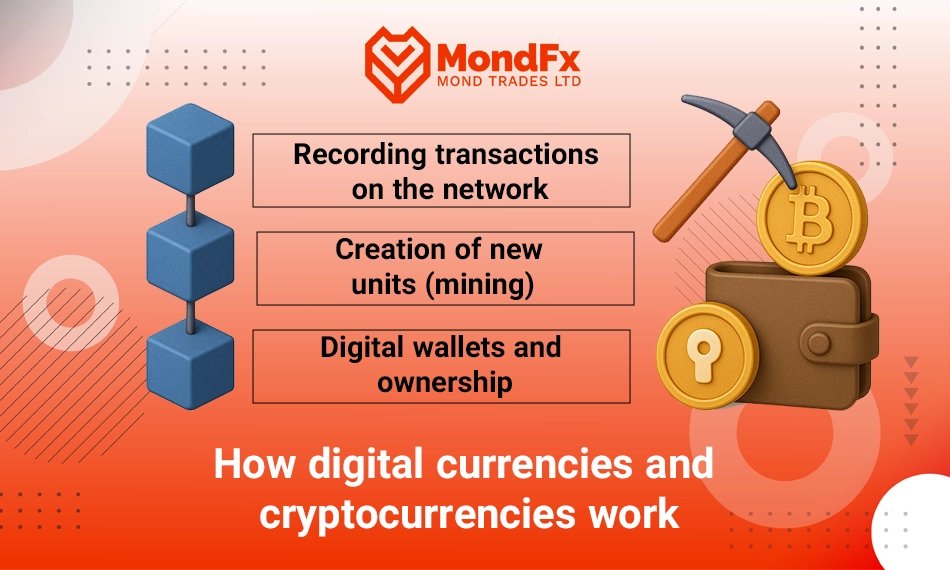

How digital currencies and cryptocurrencies work

Digital currencies and cryptocurrencies, unlike physical money, have no physical existence and are entirely digital. When you make a transaction with a cryptocurrency, what actually takes place is the recording and transfer of value in digital form, without the need for a bank or intermediary to confirm the transaction; this process takes place in the following three stages:

Recording transactions on the network

All cryptocurrency transactions are recorded on a shared and secure network called the blockchain. This network functions like a public ledger where all users can view transactions and verify their validity. Each transaction is added to a digital block, and the blocks are connected to one another in a chain. This structure ensures that the information remains transparent, secure and immutable.

Creation of new units (mining)

Some cryptocurrencies are created through a process called mining. In this process, computers solve complex mathematical problems and, in return, new units of cryptocurrency are generated. This method is used both to create money and to maintain the security of the network and the validity of transactions.

Digital wallets and ownership

To store, send and receive cryptocurrencies, users make use of digital wallets. Each wallet has a private key that defines ownership of the assets, and without it, access to the assets is impossible. This key acts like your digital signature and guarantees the complete security of your digital assets.

Applications and advantages of digital currencies and cryptocurrencies

Digital currencies and cryptocurrencies are no longer just an emerging technology; they are changing the way value is transferred, invested and even how assets are managed. Understanding their applications helps us better grasp the advantages, limitations and real opportunities of these assets.

Fast, intermediary free transfers

One of the most important applications is the ability to send and receive money without the need for a bank or intermediary. This feature reduces transaction costs, offers high speed and enables the transfer of value across the globe. For example, sending Bitcoin or Ethereum to a friend in another country can be done within a few minutes, without border restrictions or the heavy fees charged by banks.

Investment and preservation of asset value

Cryptocurrencies suddenly became popular as a digital investment tool after the astronomical price surge of Bitcoin. Many people use Bitcoin and Ethereum to preserve the value of their assets or to make a profit. Unlike traditional money, some cryptocurrencies, with their limited quantity and controlled supply, have the ability to resist inflation and loss of value.

Creation of smart contracts and decentralized applications

Platforms such as Ethereum make it possible to execute smart contracts and decentralized applications. These contracts are executed automatically and securely without the need for intermediaries and have wide ranging applications in finance, gaming, insurance and asset management.

Access to assets anytime and anywhere

In many countries, access to banks is limited or the financial infrastructure is inadequate. Digital currency can be a gateway for individuals to the global financial system and allow them to send, receive and store value without the need for bank accounts.

The relationship between digital currency and the forex market

The forex market has traditionally been formed on the basis of trading the official currencies of countries, but with the expansion of digital currencies, this market has also gradually come under the influence of these emerging assets. Today, many international brokers have made it possible to trade digital currencies alongside forex currency pairs.

However, although the nature of Bitcoin and Ethereum is different from that of the dollar, euro or yen, there are significant similarities between these two markets in terms of price behavior, volatility and technical analysis. This has led many traders to regard forex and digital currencies not as two separate paths, but as two complementary segments of a single global market that both move under the influence of capital flows, risk appetite and macroeconomic conditions.

Differences between digital currency trading and forex trading

Despite the apparent similarities between these two markets, there are important structural differences between digital currency trading and forex trading that every trader needs to understand. The forex market is a very large, deep market with extremely high liquidity that operates under the supervision of financial authorities, whereas the digital currency market has a decentralized structure and is not directly dependent on official institutions.

In terms of trading hours as well, the forex market is active on business days, while the cryptocurrency market operates 24 hours a day without any breaks.

The level of volatility in the crypto market is usually significantly higher than in forex, and this can both create greater profit opportunities and increase the risk of losses. These differences between the two markets mean that, although trading strategies in them may be similar in terms of analytical tools, they differ in terms of risk management and trading psychology.

What are exotic currency pairs in the forex market?

Alongside well known pairs such as EUR/USD or USD/JPY, the forex market also includes a group of pairs known as exotic currency pairs. These pairs are usually formed by combining a major global currency such as the US dollar with the currency of countries with smaller or developing economies. For example, the USD/TRY pair, which represents the rate of the US dollar against the Turkish lira, USD/MXN for the dollar against the Mexican peso, USD/ZAR for the dollar against the South African rand, and USD/THB for the dollar against the Thai baht are among the common examples in this group. Due to their lower liquidity compared with the major pairs, these pairs are usually associated with wider spreads and more intense volatility, and this makes trading them considerably more risky.

The price behavior of these pairs, rather than being influenced solely by broad global economic data, is heavily dependent on the economic and political conditions and even sudden decisions of the governments of those same countries. For instance, changes in interest rates in Turkey can cause sharp volatility in USD/TRY, or political crises in Latin America may lead to sudden price spikes in USD/MXN. This strong dependence on domestic factors makes exotic pairs, in comparison with major pairs, display more unpredictable behavior and require greater experience, precise risk management and a higher level of analytical proficiency.

The role of digital currency volatility in trading strategies

High volatility is one of the main characteristics of the digital currency market that distinguishes it from many traditional financial markets. Rapid and sometimes unpredictable price movements have attracted many forex traders to this market as well, because profit opportunities are available over shorter time frames. These same fluctuations have led to the emergence of specific trading styles in the crypto market, such as scalping, short term trading and strategies based on the breakout of resistance levels. At the same time, this very feature can place greater psychological pressure on the trader and increase emotional decision making. For this reason, the use of capital management tools, stop loss orders and emotional control takes on even greater importance in the digital currency market.

The role of exchange rates in the volatility of the forex and digital currency markets

In trading and markets, the exchange rate, as one of the key indicators of the economy, plays a direct role in the volatility of the forex market, and its effects are sometimes transmitted to the digital currency market as well. Changes in the value of currencies occur under the influence of factors such as interest rates, inflation, economic growth and the monetary policies of central banks, and these changes can lead to sharp movements in forex currency pairs and even in Bitcoin and other cryptocurrencies.

For example, a strengthening US dollar usually puts selling pressure on certain exotic currency pairs and reduces the prices of some digital currencies, while economic weakness in a country or global financial crises can increase investors’ inclination toward digital assets and lead to volatile movements in the crypto market. For this reason, professional traders monitor the forex and digital currency markets simultaneously and, by analyzing fundamental and technical data, try to identify volatility trends and trading opportunities in a realistic manner.

Examining the position of digital currency alongside gold, stocks and forex

In recent years, digital currency has gradually established its position alongside markets such as gold, stocks and forex. In the past, gold was known as a safe haven for capital and forex as a dynamic market for daily trading, but today Bitcoin and other cryptocurrencies have also been placed alongside these markets as an independent asset class.

Some investors use digital currency as a tool for diversifying their asset portfolios, while others view it as an opportunity for capital growth over shorter time frames. The position of digital currency in this context is neither entirely similar to gold nor exactly like stocks or forex; rather, it combines features of all three: it is volatile, has the ability to store value and also provides the possibility of active trading.

The impact of global economic news on cryptocurrency prices

Contrary to what many people initially assume, the digital currency market does not move completely independently of the global economy and is heavily influenced by news and economic events. Central bank decisions, changes in interest rates, inflation data, financial crises and even political tensions can have a direct impact on investor behavior in the crypto market. For example, an increase in interest rates usually reduces investors’ appetite for high risk assets such as Bitcoin, and capital tends to flow toward safer markets.

On the other hand, economic crises and distrust in traditional financial systems can lead to increased demand for digital currencies. For this reason, professional crypto market traders, like forex traders, closely follow economic news and global macroeconomic data.

Challenges and limitations

Despite their wide ranging advantages, digital currencies and cryptocurrencies are not without challenges. Being aware of the limitations and risks is an essential part for anyone who intends to use or invest in this field.

High volatility and price risk

One of the most important challenges is the severe price volatility. The value of many cryptocurrencies can undergo significant changes within a single day. This feature makes investing in cryptocurrencies attractive, but at the same time creates a high level of risk for those who enter the market without knowledge and analysis.

Limited public adoption

Although digital currencies and their use are expanding, they still do not enjoy broad global acceptance, especially by most governments, and many businesses and traditional financial institutions restrict the use of cryptocurrencies or regard them as illegal, which limits the applications of this technology.

Security issues and hacking

Despite blockchain technology, cryptocurrency wallets and exchanges can be targets for hackers. Mistakes in safeguarding the private key or using unreliable platforms can lead to the complete loss of assets.

Legal and regulatory challenges

Laws and regulations differ from one country to another, and many are still in the process of defining a legal framework for cryptocurrencies. This legal uncertainty creates legal risk and operational constraints.

Energy consumption and environmental impact

Some cryptocurrencies, particularly Bitcoin, require high energy consumption for mining. This has raised environmental concerns and has led some countries to restrict or prohibit mining.

The future and outlook of digital currency

Despite all the challenges and limitations, the future of digital currencies and cryptocurrencies is bright and full of opportunities. It is expected that their adoption in businesses and financial systems will increase, blockchain technology will evolve, and clearer laws and regulations will help build trust. These assets can redefine traditional methods of value transfer and investment and play an important role in the future global economy and technology.

Conclusion

Digital currencies and cryptocurrencies, despite their differences and overlaps, have brought about a fundamental transformation in value transfer, investing and financial technology. From Bitcoin to Ethereum and other digital assets, these technologies have shown that it is possible to carry out transactions, execute smart contracts and gain access to innovative financial instruments without intermediaries and central institutions.

At the same time, price volatility, legal constraints and security challenges serve as a reminder that awareness and knowledge are essential before using or investing in this field. With greater adoption, technological evolution and clearer regulations, digital currencies and cryptocurrencies will continue on their path toward playing a pivotal role in the future global economy and technology.

With the support of MondFx, you can move step by step along the path of building a personal strategy and engaging in informed trading.

Frequently Asked Questions (FAQ)

Is digital currency the same as cryptocurrency?

No. Although these two terms are used interchangeably in everyday speech, they are not conceptually identical. Digital currency is a broader concept that includes any type of money or financial value recorded electronically, whereas cryptocurrencies are a subset of digital currencies that are built on blockchain and a decentralized structure.

What is the main difference between centralized and decentralized digital currency?

Centralized digital currency is controlled by entities such as banks or governments, and all transactions are carried out under the supervision of a central authority, whereas decentralized digital currencies or cryptocurrencies operate without the involvement of a central institution and rely on distributed networks, with their security ensured through cryptography and network consensus.

Is the use of digital currency only for investment purposes?

No. Although many people use digital currencies for investment purposes, their use is not limited to this. Fast money transfers, the execution of smart contracts, use in decentralized applications and access to financial services without the need for a bank are among other important applications of digital currencies.

Why is digital currency more volatile than forex?

The digital currency market is less deep than forex and is influenced by news, market sentiment and the behavior of retail investors. The lack of centralized oversight and the lower volume of liquidity compared with forex cause prices to fluctuate more quickly and sharply.

Does digital currency come under the influence of global economic news?

Yes. Contrary to common belief, the digital currency market has a direct connection with macroeconomic conditions. Central bank decisions, interest rates, inflation data and global financial crises can lead to sharp increases or decreases in cryptocurrency prices.

How is the security of digital currency ensured?

The security of digital currency is ensured through blockchain technology, cryptography and private keys. However, if a user is not careful in safeguarding their private key or in choosing a secure exchange and wallet, there is a possibility of hacking or loss of assets.

Have all countries recognized digital currency?

No. The regulations relating to digital currency differ from one country to another. Some countries permit the use and trading of cryptocurrencies, some have severely restricted them, and others have not yet established a clear legal framework for them.

What impact does digital currency mining have on the environment?

The mining of certain cryptocurrencies such as Bitcoin has a significant environmental impact due to high energy consumption. This has led some countries to impose restrictions on mining activities and has pushed new projects toward more energy efficient methods.

Can digital currency replace traditional money?

At present, digital currency functions more as a complementary asset alongside traditional money. Despite the rapid growth of this field, the infrastructure, regulations and level of public adoption have not yet reached the point where it can be considered a complete replacement for traditional financial systems.