Risk of Selling by the Largest Bitcoin Holder!

The company that, with around $56 billion, is considered the largest holder of Bitcoin has announced that it may be forced to sell part of its Bitcoins. This has created fear in the market and led to increased risk off sentiment.

Michael Saylor, the company’s CEO, stated that if the ratio of the company’s total value to its Bitcoin holdings falls to 1 or below (negative), they may have to sell Bitcoins in order to pay dividends. This ratio, called mNAV, essentially compares the company’s market cap to a portion of its assets in this case, its Bitcoin holdings. If this ratio turns negative, it means the company’s shares are trading below their intrinsic value.

Now, after this situation was outlined by the CEO, this ratio has already dropped from 1.3 to 1.19.

The Never Ending Story of Tether’s Reserves

Last week, the credit rating agency S&P Global downgraded Tether’s stability score to its lowest level, stating that the share of higher risk assets in Tether’s reserves has increased. These higher risk assets include Bitcoin, gold, collateralized loans, and bonds. Tether’s level of transparency has also been rated as low, and in the event of a sharp market downturn, investors may fear that Tether’s reserves are insufficient, which can spread anxiety across the market.

That said, the question of Tether’s reserves has always been a topic of debate, and the company has consistently pledged to maintain full backing relative to Tether’s market cap. On the other hand, the gold and Bitcoin holdings purchased by the company have grown significantly compared to three years ago. Therefore, it does not currently appear that Tether is facing a serious challenge in maintaining its backing.

Potential Rate Hike in Japan Shakes the Market!

In the early hours of Monday, Mr. Ueda, the Governor of the Bank of Japan, struck a hawkish tone in his speech and signaled a green light for a possible interest rate hike in December. Ueda stated that the pros and cons of a December hike will be examined, and that if economic indicators develop in line with their expectations, they will raise rates.

Over the past month, following Ms. Takaichi’s election victory and the adoption of an expansionary fiscal stance, the Japanese yen has weakened sharply and fallen to worrying levels. If the yen weakens beyond a certain point, there is a risk of rising inflation in imported goods and growing public dissatisfaction. Therefore, the government and the central bank must strike a balance between economic growth and the value of the yen.

Ueda emphasized that if the rate hike is delayed, there is a risk of a sharp increase in inflation, which could force the BOJ to adjust interest rates rapidly. In this way, excessive delay in raising rates also poses a significant risk for Japan.

The Yen: Enemy of Global Markets!

The yen, due to capital flows from carry traders, generally moves in the opposite direction of global markets. Because of Japan’s low borrowing costs, investors borrow in yen and invest in global markets. This trade becomes less attractive when Japan plans to raise interest rates or when the yen strengthens.

The best example is August 2024, when an unexpected rate hike by the BOJ caused a sharp sell off across nearly all markets. Bitcoin, as a risky asset, was also significantly affected by this development.

Conclusion

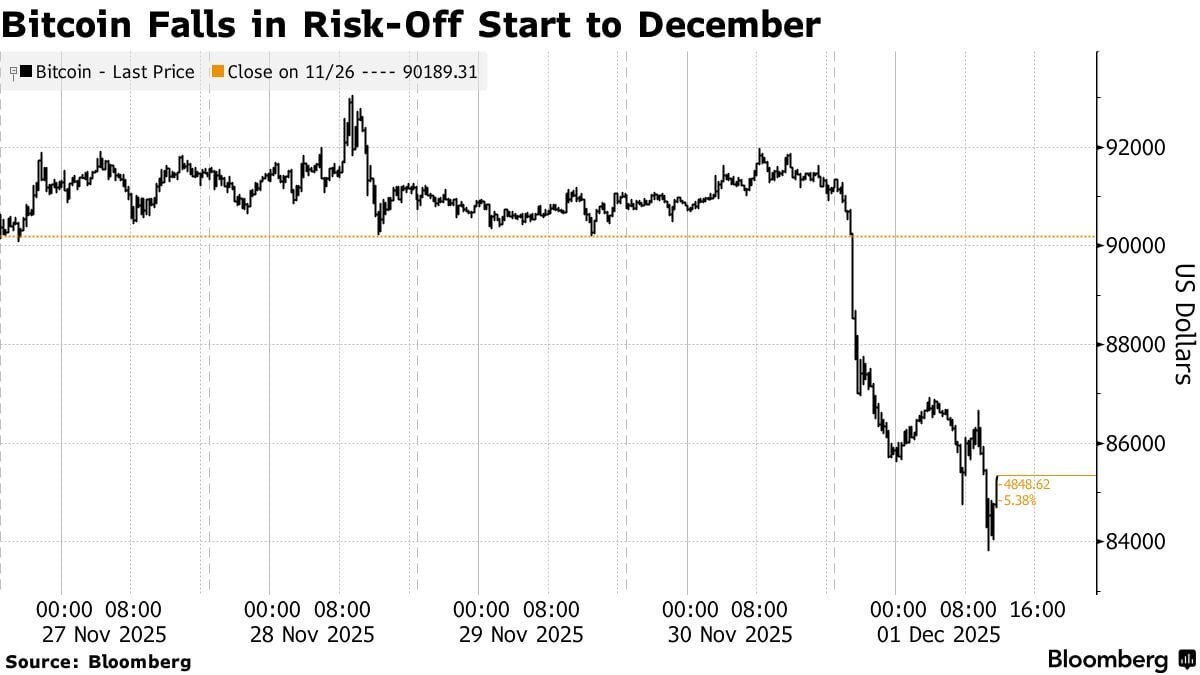

Due to concerns over Tether’s reserves, the risk of Bitcoin sales by the largest corporate holder, and the possibility of an interest rate hike in Japan, Bitcoin has given back all of its gains from last week, and more than $1 billion was liquidated in the latest drop.

Bitcoin will likely remain under pressure in the short term. That said, as expectations of rate cuts increase, there is still room for upside until mid December. However, after the December meeting, markets may once again turn lower, as there is a possibility of a “hawkish cut” at the FOMC meeting.