The historical value of the Pound, the economic role of the United Kingdom, and the unrivaled strength of the US Dollar in global trade have given GBP/USD a special position among traders. It is a volatile, analytically rich, and popular currency pair that many traders consider one of the most attractive entry points into the Forex market and strategies based on price action or fundamental analysis.

Stay with us in the rest of this article from MondFx as we explore this currency pair together.

Key Features of the GBP/USD Currency Pair

The GBP/USD currency pair is considered one of the most popular assets in the Forex market. With characteristics such as exceptionally high liquidity, notable volatility, and strong sensitivity to economic and political data, this pair provides extensive trading opportunities for traders.

Very High Liquidity

As one of the major currency pairs in the Forex market, GBP/USD benefits from extremely high liquidity. The large trading volume of this pair allows for very fast trade execution and highly competitive spreads. This feature is especially important during the release of key economic data, enabling traders to enter and exit the market quickly without experiencing slippage or sudden price movements.

Wide Volatility Range

Compared to many other currency pairs, GBP/USD has a higher volatility range. This high volatility creates more trading opportunities for short term traders such as scalpers and day traders. On average, this pair moves between 80 and 120 pips per day, making it ideal for strategies based on market fluctuations.

High Sensitivity to Economic and Political News

The GBP/USD currency pair is highly sensitive to macroeconomic data from the United Kingdom and the United States. Reports such as inflation rates, Gross Domestic Product (GDP), unemployment rates, and monetary policy decisions by the Bank of England and the Federal Reserve have a direct and significant impact on the movement of this pair. Political developments including governmental changes, political crises, and international relations can also lead to rapid and sharp fluctuations in GBP/USD prices.

What Factors Affect the Price of GBP/USD?

The price of the GBP/USD currency pair is influenced by a combination of economic, political, and monetary factors. A clear understanding of these elements helps traders better anticipate market fluctuations.

Monetary Policies of the Bank of England and the Federal Reserve

The monetary policies of the Bank of England (BoE) and the United States Federal Reserve are among the primary drivers of GBP/USD movements. An interest rate hike in the United Kingdom typically strengthens the Pound against the Dollar and increases the pair’s exchange rate. Conversely, when the Federal Reserve raises interest rates, the US Dollar gains strength, causing the GBP/USD price to decline.

Key Economic Data

Economic statistics released by the United Kingdom and the United States have a direct impact on the value of the Pound–Dollar pair. Indicators such as Gross Domestic Product (GDP), the Consumer Price Index (CPI), unemployment rates, retail sales, and the trade balance are among the most important data points traders must closely monitor. The market’s reaction to these figures can be immediate and highly volatile.

Geopolitical and Political Conditions

Political and geopolitical developments in the UK and the US can lead to rapid and unexpected changes in the GBP/USD price. Factors such as changes in government, political crises, Brexit related negotiations, or international tensions directly affect market sentiment and can trigger significant volatility.

Interest Rate Differential Between the UK and the US

The difference in interest rates between the Bank of England and the Federal Reserve plays a significant role in determining the direction of GBP/USD. During periods when interest rates in the UK are higher than in the US, the Pound becomes more attractive and appreciates in value. Conversely, if US interest rates are higher, demand for the Dollar increases, causing GBP/USD to decline. This interest rate differential is one of the key drivers of long term trends in this currency pair.

The Best Time to Trade GBP/USD

The best time to trade this currency pair is when the London and New York markets are open simultaneously. This period typically falls between approximately 16:30 and 20:30 Tehran time. During this window, liquidity is higher and volatility increases, creating favorable opportunities for trading.

Session Timing

| Market Session | Time (Tehran) | Feature |

|---|---|---|

| London | 11:30 to 20:30 | Highest GBP liquidity |

| New York | 16:30 to 1:30 AM | Highest USD liquidity |

| London–New York Overlap | 16:30 to 20:30 | Highest volume and volatility |

Volatility Behavior of the GBP/USD Currency Pair

The GBP/USD pair, due to its inherently volatile nature, has consistently attracted the attention of Forex traders. Alongside EUR/USD, it is considered one of the major currency pairs in the market, and because of its sensitivity to economic news, central bank decisions, and interest rate changes, it experiences high volatility. This volatile behavior creates numerous opportunities for both short term traders (day traders) and long term traders (swing traders), making its analysis whether technical or fundamental particularly important.

A precise examination of the short term and long term trends of GBP/USD and its reactions to economic indicators is the key to success in trading this popular and well known pair in the Forex market.

How to Analyze the GBP/USD Currency Pair?

To succeed in trading GBP/USD, a combination of fundamental analysis and technical analysis is essential. Each method highlights different aspects of the market, and using them together can significantly enhance the accuracy of trading decisions.

Fundamental Analysis of GBP/USD

In fundamental analysis, traders examine the economic, financial, and political factors that influence the relative value of the British Pound and the US Dollar. Indicators such as inflation (CPI), Gross Domestic Product (GDP) growth, unemployment rates, monetary policies of the Bank of England (BoE) and the Federal Reserve (Fed), as well as speeches or statements by senior economic officials, are among the key elements in this analysis. Geopolitical events such as Brexit negotiations or domestic political changes can also create significant trends in the GBP/USD pair.

Technical Analysis of GBP/USD

In technical analysis, traders evaluate the price behavior of GBP/USD using graphical and computational tools. Instruments such as price patterns (e.g., head and shoulders, triangles), support and resistance lines, trendlines, moving averages, the Relative Strength Index (RSI), and the MACD indicator are used to identify suitable entry and exit points.

Analyzing lower timeframes such as the 1 hour and 4 hour charts is useful for short term traders (day traders and scalpers), while examining daily and weekly timeframes is more applicable for long term traders.

Key Tips for Trading GBP/USD

To succeed in trading the GBP/USD currency pair, following certain key principles can help improve trading decisions and enhance risk management. A clear understanding of influencing factors and the use of proper capital management strategies are essential components when trading this pair.

Simultaneous Review of UK and US Economic Data

In GBP/USD trading, analyzing the economic data of only one country is not sufficient. Traders must evaluate the economic indicators of both countries simultaneously to obtain a clearer picture of the relative strength of the Pound and the Dollar. Data such as inflation rates, economic growth, unemployment levels, and monetary policy decisions play a crucial role in determining the market’s direction.

Special Attention to Political Developments in the UK

Political developments in the United Kingdom especially changes in government, the prime minister, or policies related to the European Union can have immediate and significant effects on the value of the Pound and, consequently, on the price of GBP/USD. Continuously monitoring political news from reliable sources can be highly useful in anticipating sudden market movements.

The Importance of Risk Management in Sensitive Conditions

Given the high volatility of GBP/USD especially during the release of major economic or political news risk management strategies become particularly crucial. Using stop loss orders, determining appropriate position sizes, and avoiding emotional trading can prevent significant losses.

Reviewing the Interest Rate Differential Between the Two Countries

The interest rate differential between the Bank of England and the Federal Reserve is one of the long term factors influencing the overall trend of the GBP/USD currency pair. Traders should monitor this differential closely, as changes in monetary policies can determine the direction of this pair over longer timeframes.

What Is Pound to Dollar Conversion and How Is It Done?

Pound to dollar conversion refers to the exchange of the United Kingdom’s national currency (GBP) for the national currency of the United States (USD). This conversion is carried out based on the market’s current exchange rate and indicates how many US Dollars are required to purchase one unit of the British Pound.

The GBP to USD exchange rate is determined in real time in the Forex market as well as in official exchange offices and banks. For example, if the GBP/USD rate is 1.2500, it means that each Pound is worth 1.25 US Dollars.

Pound to dollar conversion takes place in various contexts:In the Forex market, by traders seeking profit from price fluctuations

In exchange offices and banks, for everyday needs such as travel, business, or international payments

In financial operations of multinational corporations and international currency transfers

The exchange rate is influenced by factors such as central bank monetary policies, interest rates, key economic data, and geopolitical developments. For this reason, individuals who intend to convert currency must always pay close attention to real time rates and market fluctuations in order to make the best financial decision.

Which News Events Affect GBP/USD?

The GBP/USD currency pair is highly sensitive to economic, financial, and political news from both the United Kingdom and the United States. Identifying the key news events that can impact the price of this pair is crucial for traders.

Monetary Policy Decisions by the Bank of England and the Federal Reserve

Changes in interest rates, tightening or loosening monetary policies, and statements issued by the Bank of England and the Federal Reserve create immediate market reactions and significantly influence the value of GBP/USD.

Inflation Reports

Inflation related data such as the Consumer Price Index (CPI)and the Producer Price Index (PPI) shape market expectations for future monetary policy decisions and can alter the direction of the GBP/USD pair.

Employment Data

Statistics such as the unemployment rate in the UK and the Non Farm Payrolls (NFP) report in the United States are among the most important economic indicators, often triggering sharp volatility in this currency pair.

Gross Domestic Product (GDP)

Economic growth statistics for both countries are fundamental factors that can shape the medium and long term trend of GBP/USD. Strong economic growth typically leads to the strengthening of the corresponding currency.

Political and Geopolitical Developments

Political events such as changes in government, domestic crises, or major international negotiations especially developments related to Brexit can have short term but significant impacts on the behavior of this currency pair.

Central Bank Officials’ Speeches

Statements made by the Governor of the Bank of England or the Chair of the Federal Reserve regarding economic outlooks and future monetary policy can trigger sharp and sudden volatility in the GBP/USD market.

The Importance of Analyzing Market Expectations

In addition to official economic data, traders must pay attention to market expectations and shifts in global risk sentiment, as these variables can influence market direction even without new data releases.

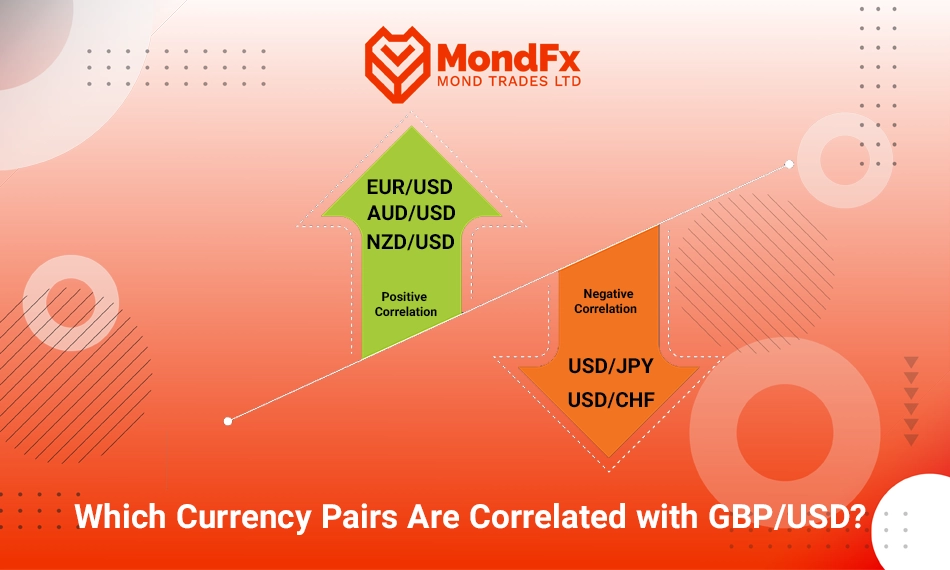

Which Currency Pairs Are Correlated with GBP/USD?

In the Forex market, correlation refers to the statistical relationship between the price movements of two currency pairs. GBP/USD also maintains specific positive or negative correlations with several other pairs. Understanding these correlations can help traders with risk management, strategy development, and overall market analysis.

Positive Correlation of GBP/USD with Major Currency Pairs

GBP/USD typically has a strong positive correlation with EUR/USD. This means that in many cases, when EUR/USD rises, GBP/USD also tends to move upward, and vice versa. The reason for this high correlation lies in the economic similarities between the Eurozone and the United Kingdom, as well as the similar way these currencies react to movements in the US Dollar.

Additionally, other currency pairs such as AUD/USD and NZD/USD also show positive correlation with GBP/USD during certain periods particularly when US Dollar volatility is the main driver of market movement.

Negative Correlation of GBP/USD with Dollar Dominated Pairs

GBP/USD generally has a negative correlation with pairs such as USD/JPY or USD/CHF. This means that an increase in the value of GBP/USD often coincides with a decrease in the value of USD/JPY or USD/CHF. This behavior is logical because in these pairs, the US Dollar is the base currency, and Dollar strength can have an inverse impact on GBP/USD.

The Importance of Understanding Correlations in GBP/USD Trading

Understanding currency correlations enables traders to avoid excessively similar trades or conflicting positions within their portfolio. For example, opening simultaneous long positions in GBP/USD and EUR/USD may increase risk, since these pairs usually exhibit similar price behavior. On the other hand, understanding negative correlations can help traders implement hedging strategies.

Conclusion

The GBP/USD currency pair also known as the Pound Dollar is one of the most recognized and heavily traded pairs in the Forex market. With its historical background, long standing presence, and well known nickname Cable, it has always attracted significant attention from professional traders. As one of the major currency pairs, it offers exceptionally high liquidity, notable volatility, and strong sensitivity to economic and political data.

The volatile nature of GBP/USD provides numerous opportunities for both short term (day traders) and long term (swing traders) participants, making its analysis through both technical analysis and fundamental analysis highly important. Key economic indicators from the UK and the US, decisions by the Bank of England (BoE) and the Federal Reserve (Fed), interest rate differentials, and political developments are the main factors influencing the price of this pair.

The best time to trade GBP/USD is during the overlap between the London and New York sessions, when liquidity and volatility are at their highest. Additionally, understanding its correlation with other currency pairs such as EUR/USD, USD/JPY, and USD/CHF can greatly assist in strategy development and risk management.

Ultimately, success in trading GBP/USD requires precise analysis of economic data from both countries, monitoring short and long term trends, staying updated on political and geopolitical news, and applying proper risk management tools. This combination enables traders to capitalize on market opportunities while minimizing potential losses.

If you are looking for a reliable starting point in the world of trading and financial markets, collaborating with the MondFx team can be an excellent first step toward building your own personalized strategy.

Frequently Asked Questions

What is the GBP/USD currency pair?GBP/USD, or Pound to US Dollar, is a major currency pair in the Forex market that shows the value of one British Pound in terms of the US Dollar. Due to its long history, high liquidity, and significant volatility, it is one of the most popular assets among traders.Why is GBP/USD called “Cable”?The name Cable originates from the time when the exchange rate between the Pound and the US Dollar was transmitted via an undersea cable between London and New York. Since then, this nickname has become widely used among Forex traders.What factors affect the price of GBP/USD?The main factors include monetary policies of the Bank of England (BoE) and the Federal Reserve (Fed), key economic data such as GDP, CPI, unemployment rate, and retail sales, political and geopolitical developments in the UK and the US, and the interest rate differential between the two countries.What is the best time to trade GBP/USD?The best time to trade this pair is when the London and New York markets are open simultaneously (approximately 16:30 to 20:30 Tehran time). During this period, liquidity and volatility are higher, providing more trading opportunities.Does GBP/USD have high volatility?Yes. Due to its sensitivity to economic news, central bank decisions, and political developments, this currency pair has high volatility and offers numerous opportunities for both short term and long term traders.