Step One: Choosing a Broker and Account Type

To start working with MetaTrader, the first step is selecting a reliable broker. A broker acts as an intermediary between you and the financial markets and provides you with access to the MetaTrader platform. Choosing the right broker is of great importance, as this decision will significantly affect your costs, trade execution speed, and the features of the services you receive.

Choosing a Reliable Broker

A reliable broker should have the following characteristics:

Regulatory licenses

The broker must be licensed by reputable regulatory bodies such as the FCA (United Kingdom), ASIC (Australia), or CySEC (Cyprus). These licenses indicate the broker’s transparency and credibility.

Customer support

Quick access to customer support through online chat, email, or phone is one of the important features of a broker. Brokers with strong support are able to resolve their clients’ issues quickly.

Competitive spreads and low trading costs

Low spreads and the absence of hidden fees allow you to execute your trades at lower costs.

Suitable trading platform

The broker should support well known and widely used trading platforms such as MetaTrader 4 or 5.

Choosing the Type of Trading Account

After selecting a suitable broker, the next step is choosing the type of trading account. Brokers usually offer several different types of accounts, each with its own specific features. Choosing among these account types depends on your level of experience, initial capital, and trading strategy. Here are some common types of accounts and their characteristics:

1. Standard Account

A standard account is generally suitable for traders with intermediate experience. These accounts have fixed or variable spread s and are appropriate for individuals with higher capital. Trades in these accounts are typically executed without commission, but the spread cost may be higher than ECN accounts.

2. Micro Account

A micro account is usually suitable for individuals who are new to the forex market or have limited capital. These types of accounts offer smaller trading volumes (one micro lot equivalent to 1,000 units), allowing you to start with less risk. The spread in these accounts is generally higher than in standard accounts.

3. ECN Account (Electronic Communication Network)

ECN accounts are designed for professional traders and those who need high speed trading and access to greater liquidity. In these accounts, spreads are typically very low because you are directly connected to the interbank market. However, ECN accounts usually charge a commission for each trade.

4. Zero Commission Accounts

Some brokers offer accounts in which no commission is charged; however, these types of accounts usually come with higher spreads. These accounts are suitable for individuals who prefer to reduce hidden costs and, instead of paying commissions, execute their trades directly with higher spreads.

Choosing an Account Type Based on Your Trading Strategy

The type of account you choose should also be based on your trading strategy. For example, if you are a scalper who intends to enter and exit trades in short time frames (such as 1 minute or 5 minute charts), an ECN account can be the best option, as access to high liquidity and low spreads is essential.

If your strategy involves medium term trading (Swing Trading), a standard account may be a better choice, since you do not require high execution speed and can benefit from reasonable spreads.

Reviewing Minimum Deposit Requirements and Other Conditions

Before choosing an account, you should also check the minimum deposit required to start trading with that account type. Some brokers have low minimum deposit requirements for micro accounts, whereas ECN or standard accounts may require higher initial capital.

Additionally, reviewing withdrawal and deposit conditions, supported currencies, and available bonuses is also among the important points to consider before opening an account.

Step Two: Registering on the Broker’s Website

To open an account in MetaTrader, after selecting the appropriate broker, you must visit its website and begin the registration process. Registration with a broker usually involves completing an online form that allows you to enter your basic information and submit your account opening request.

Completing the Registration Form

The registration form includes the basic information the broker needs to identify you. The information typically requested in this form includes:

Full name:

For verifying your identity and preventing any errors in data recording.

Phone number:

To contact you in case additional information is needed or to resolve any issues.

Email address:

For sending confirmations, updates, and account related information.

Country of residence:

This section is important because the conditions and regulations related to accounts may differ depending on the country.

Basic financial information:

Some brokers request information such as your monthly income or financial resources to ensure your financial capability for trading.

Identity Verification Documents

One of the important and essential steps in registering with a broker is the identity verification process. This step is necessary to prevent fraud and to comply with Anti Money Laundering (AML) and Know Your Customer (KYC)regulations. To complete the verification process, brokers usually require you to provide the following documents:

A photo of your national ID card or passport:

For verifying your identity.

Proof of address:

To confirm your place of residence, you may be asked to upload a document such as a recent water, electricity, or phone bill, or a recent bank statement. This document must contain your name and address.

In some cases, the broker may request additional documents such as proof of income or other financial documents, especially if you intend to trade large volumes or use high leverage.

Identity Verification and Completion of the Process

After uploading the documents, the broker will begin reviewing your information. This process typically takes a few hours to a few days. Some brokers use modern technologies to complete these steps automatically and quickly. However, if the documents are not uploaded correctly or require a more detailed review, the verification process may take longer.

Once your identity is verified, your account will be activated, and you can log in to the MetaTrader platform and start trading.

Step Three: Downloading and Installing MetaTrader

After successfully registering on the broker’s website and completing your identity verification, the next step is to download and install the MetaTrader software. MetaTrader is one of the most widely used trading platforms in financial markets, helping you analyze the market, execute trades, and manage your account.

Downloading MetaTrader

To download the MetaTrader software, you need to visit your broker’s website, such as the MondFx broker. Brokers usually provide different versions of MetaTrader for various operating systems (Windows, Mac, Android, and iOS). Some brokers also provide a direct download link through your user account.

For Windows:

The Windows version of MetaTrader can be easily downloaded from the broker’s website or the official MetaTrader website. Run the downloaded file and follow the installation instructions.

For Mac:

For macOS users, a specific version of MetaTrader may be required. In this case, you should download and install the version designed specifically for Mac.

For mobile:

MetaTrader is also available for smartphones. To download it, go to the App Store (for iOS) or Google Play (for Android) and search for “MetaTrader.”

Installing MetaTrader

After downloading the installation file, the installation steps for MetaTrader may vary depending on your operating system. Here, we explain the installation process for Windows:

Run the downloaded file. A window will appear asking for installation confirmation.

Click on “Next” to begin the installation process.

In the next step, choose the installation directory (the default path is usually appropriate).

After selecting the installation path, click “Next” again.

Once the installation is complete, click “Finish.”

For Mac and mobile users, the installation process is similar; you simply need to download the application from the App Store or Google Play and follow the installation steps.

Step Four: Logging In to Your MetaTrader Account

After successfully installing the MetaTrader software, the first step to start trading is logging in to your trading account. Once you run the software, a window will appear prompting you to enter your account information. You must enter the details provided by your broker in order to connect to your account.

Choosing a Demo or Real Account

At the beginning, you need to decide whether you want to log in to a demo account or a real account.

If you are a beginner or want to learn the MetaTrader platform without any risk, you can choose a demo account. A demo account allows you to use virtual funds to execute trades and familiarize yourself with the tools, indicators, and features of MetaTrader.

If you are ready to enter the market with real money and execute actual trades, you must choose a real account. To use a real account, you need to enter the real account information you received from your broker.

Entering Account Information

After selecting the account type (demo or real), you must enter the following details:

Login (Username):This is the account number you received when registering with the broker. It is assigned specifically to you and is used to log in to your trading account.

Password:As the name suggests, this is your password for accessing the account. Make sure to enter your password correctly and keep it stored in a secure place.

Server Address:Enter the broker’s server address. This address is usually provided by your broker, or MetaTrader may automatically detect it based on your account information.

Connecting to the Account

After entering your account information, click on the “Login” option. You are now connected to your trading account in MetaTrader. If the login is successful, you can easily enter the market and begin your trades.

Important Notes After Logging In to MetaTrader

After logging into MetaTrader and successfully connecting to your account, there are several essential actions that can help you make the best use of the platform’s features and enhance your overall trading experience.

The first step after logging in is adjusting the time zone. MetaTrader’s default time zone may not match the time zone of your financial markets. To ensure that price data and dates are accurate and aligned with real market time, you should synchronize MetaTrader’s time zone with the correct one. This helps you analyze data and execute your trades more easily, without facing any confusion regarding timing.

The next step is activating alerts. MetaTrader allows you to set alerts so that when prices reach certain levels or significant market changes occur, you will be notified immediately. By setting price alerts, you can avoid missing trading opportunities and respond quickly.

Finally, if you are a beginner or intend to improve your MetaTrader skills, using a demo account is recommended. A demo account allows you to familiarize yourself with the various tools in MetaTrader and test your strategies without the risk of losing real capital. Using a demo account not only helps you avoid potential risks in live trading but also enables you to gain more experience and a better understanding of how the platform works.

Step Five: Logging In to Your Account in MetaTrader

After successfully installing and launching MetaTrader, the first step to begin trading is logging in to your trading account. When you open the software, a screen will appear asking you to enter your account information. These details are provided to you by your broker and are essential for connecting to your trading account.

At this stage, you must enter your Login (username), Password, and select your trading server. The login and password are the same details you received during your registration with the broker.

If the relevant server is not available in the list, you can add it manually. If you cannot find the desired server, you may contact the broker’s support to obtain the correct server information. After entering the correct details and selecting the server, click on the “Login” option. At this point, your account will be connected to MetaTrader, and you will be ready to start trading.

Important Notes After Opening an Account in MetaTrader

After successfully logging into MetaTrader and connecting to your account, there are several important steps you should take to make the best use of the platform and increase your efficiency.

The first thing you should pay attention to is adjusting the time and time zone settings. These settings help MetaTrader operate in accordance with your geographical location. Since financial markets operate during different hours, proper time adjustment ensures that you can enter the market at the right moment and take advantage of trading opportunities.

The next step is activating the alert system. Alerts allow you to be informed of price changes or specific market conditions. This feature can be particularly useful when you are busy with other tasks or when the market is highly active. By enabling alerts, you will stay aware of all significant market movements.

If you are new to financial markets and not fully familiar with MetaTrader, using a demo account is highly recommended. A demo account allows you to practice within the MetaTrader trading environment without the risk of losing real money. In these accounts, you can use actual market data, but your funds are virtual, enabling you to gain experience with ease.

Proper capital management is one of the principles that you must follow from the very beginning of your trading journey. One of the most important tools that helps reduce risk is the use of a Stop Loss for each trade. A Stop Loss allows you to prevent large losses if the price moves unfavorably. Adhering to this principle, along with other risk management rules, can prevent sudden drops in your account balance and contribute to long term trading success.

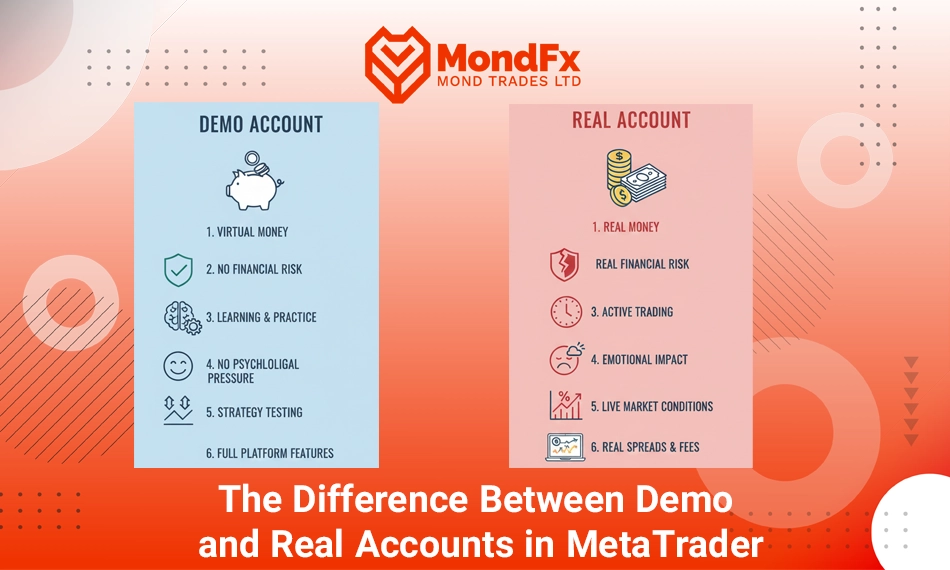

The Difference Between Demo and Real Accounts in MetaTrader

Both demo and real accounts are used in MetaTrader, but they have fundamental differences that help traders choose the one that best suits their needs. In this section, we will compare these two types of accounts.

1. Difference in the Type of Capital

Demo Account:

In a demo account, you use virtual money to execute trades. This money is not real and is only intended for practice and familiarizing yourself with the trading environment. Therefore, there is no risk involved, and all the profits and losses you see are not real.

Real Account:

In a real account, you enter the market with real money. All your profits and losses are real and based on actual funds. These types of accounts allow you to participate in the market with real capital and execute trades accordingly.

2. Financial Risk

Demo Account:

In this type of account, there is no risk of losing money. You can execute as many trades as you want without worrying about losses. This account is designed solely for learning and practice.

Real Account:

In a real account, there is actual financial risk. Any trading mistake or incorrect decision can lead to losing your real money. Therefore, in a real account, risk management and the use of appropriate strategies are extremely important.

3. How They Are Used

Demo Account:

A demo account is mostly useful for beginners or those who want to become familiar with the MetaTrader platform environment. This account allows you to explore the tools, indicators, and features of the platform without the risk of losing capital.

Real Account:

A real account is intended for individuals who are ready to enter the market with real money and actively participate in it. These accounts are designed for generating real profits and are suitable for those who have already tested their trading strategies and reached a solid conclusion.

4. Psychological Experience and Emotions

Demo Account:

In a demo account, due to the use of virtual money, there is no psychological pressure on the trader. There is no concern about financial losses. This may cause the trader to make unrealistic decisions because their emotions are not affected.

Real Account:

In a real account, due to the use of real money, the trader’s emotions are affected. Traders may face psychological pressure and experience emotions such as fear, greed, or anxiety, which can lead to trading mistakes.

5. Application for Training and Strategy Testing

Demo Account:

A demo account is the best tool for training and testing strategies. You can try different strategies without any risk and see whether they are effective for you or not. This allows you to gain practical experience before entering the real market.

Real Account:

A real account is suitable for those who are ready to use their strategies under real market conditions. In these accounts, you test your strategies in practice and experience real market effects, including liquidity, spreads, and commissions.

6. Accessibility to Additional Features

Demo Account:

A demo account provides you with all the features and tools of the MetaTrader platform. You can use all technical analysis tools, indicators, and order types. There is no difference between the demo and real accounts in terms of software capabilities.

Real Account:

In a real account, in addition to having access to all tools, you will face real market conditions. This includes real spreads, order execution delays, and costs related to commissions and fees.

MetaTrader Software Training

MetaTrader software is one of the most popular trading platforms used in financial markets, especially in Forex. This platform provides traders with various tools for market analysis, executing trades, and account management. In this training, we will explain the different stages of using MetaTrader, from installation to executing trades, in full detail.

MetaTrader User Interface

After opening the MetaTrader software, the first thing you will see is its user interface. The MetaTrader interface is divided into several sections. The most important sections include the chart window (where price charts are displayed), the Market Watch window (which shows the prices of various symbols), the Navigator window (which contains trading accounts, indicators, and expert advisors), and the Terminal window (which displays the status of positions and the trade history).

Adding a Symbol to the Chart

To add a symbol to the chart, first go to the Market Watch section, then find the desired symbol and right click on it. After that, select the “Chart Window” option so that the price chart of that symbol is displayed in the chart window.

Market Analysis Using MetaTrader Tools

MetaTrader has various tools for technical and fundamental analysis. Some of these tools include charts, indicators, and trendlines. You can use different types of charts such as line, candlestick, or bar charts to gain better insight into price movements. Additionally, MetaTrader provides numerous tools such as Moving Average,Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and other indicators.

Executing Trades in MetaTrader

To execute a trade in MetaTrader, you must first open the “New Order” window. To do this, you can use the F9 shortcut key or click on the “New Order” option in the Terminal window. In the window that opens, you must enter your trade details, including the trading symbol, trade volume,Stop Loss and Take Profit level. After entering this information, you can execute your trade by clicking on the “Buy” or “Sell” buttons.

Managing Trades in MetaTrader

After opening a position, you can manage it through the Terminal window. Here, information related to the status of positions such as entry price, current price, current profit and loss, and Stop Loss and Take Profit levels is displayed. To close a position, simply right click on the desired position and select the “Close Order” option.

Using a Demo Account for Practice

If you are a beginner or want to test your trading strategies before using real money, it is recommended to use a demo account. A demo account allows you to test all the features of MetaTrader using virtual money and become familiar with market conditions without being exposed to risk.

MetaTrader Settings

After logging into your account, one of the first things you should do is set the software’s time zone. These settings help ensure that chart times and prices match the actual market time. Additionally, to stay informed about price changes, you can enable the alert system. By doing this, when the price reaches a specific level, you will be immediately notified.

Conclusion

Opening an account in MetaTrader is a process that, although it may seem simple on the surface, requires attention to several essential steps to be done correctly and without errors. The first step is choosing a reliable broker an important choice that affects your financial security, execution quality, support, and trading experience. After selecting a broker, determining the type of trading account becomes important, as standard, micro, or ECN accounts each have different cost structures and levels of risk, and must align with your strategy and capital.

Next, registration on the broker’s website and completing the verification process takes place a necessary step to comply with global standards and prevent financial misuse. You must then download and install the appropriate version of the MetaTrader software and enter your account details to access your trading environment. After logging in, setting the time zone, activating alerts, and using risk management tools will help you have a more efficient experience.

Alongside these steps, understanding the difference between a demo and a real account is highly important. A demo account is the best way to learn and practice without risk, while a real account brings real market experience, emotions, and capital management. Being aware of these differences helps beginner traders enter the market with greater readiness and reduces the likelihood of costly mistakes.

Overall, opening an account in MetaTrader is a combination of making the right choice, completing accurate registration, and using the platform’s features intelligently. Every beginner trader can take their first steps in financial markets with greater confidence by learning these steps and using a demo account.

If you are looking to start a secure path in the world of trading and financial markets, collaborating with the MondFx team can be a good starting point for building your personal strategy.

Frequently Asked Questions About Opening an Account in MetaTrader

What is MetaTrader and what is it used for?

MetaTrader is a popular trading platform for market analysis, viewing charts, and executing trades in Forex and other financial markets. This software provides traders with a variety of analytical tools.

Do I need to choose a broker to use MetaTrader?

Yes. MetaTrader is not directly connected to the market, and you can only create an account and enter the platform through a reputable broker.

Which type of account is more suitable for beginners?

Micro accounts and demo accounts are the best options for beginners, as they allow practice and learning with smaller volumes and lower risk.

What is the difference between a demo and a real account in MetaTrader?

In a demo account, virtual money is used and there is no financial risk, but in a real account, trades are executed with real money, leading to a completely different psychological experience.

Can I open an account without verification?

No. All reputable brokers require identity verification documents such as a national ID card, passport, and proof of address to comply with KYC regulations.

How long does it take for my account to be approved after submitting documents?

This time varies from a few hours to a few days and depends on the broker and the quality of the documents provided.

Should I download MetaTrader from the broker’s website or the official site?

Brokers usually provide their own customized version of MetaTrader, and it is recommended to download that version so that the servers are automatically registered in the software.

How do I log in to my trading account in MetaTrader?

After installing the software, you must enter your account number (Login), password, and the broker’s server address, then click on the Login option.

What should I do if the broker’s server is not found in MetaTrader?

You can manually search for the server name from the Add New Broker Server section. If unsuccessful, contact the broker’s support team for assistance.

What is the best type of account for scalping?

An ECN account is the most suitable choice for scalpers due to its low spreads and high execution speed.