Author: Sabah Novinfar

Bank of Japan Decision and the Yen’s Negative Reaction

As expected, the Bank of Japan (BoJ) raised the overnight interest rate to 0.75%, a level that is considered the highest interest rate in the country in the past three decades. However, contrary to the expectations of some market participants, the Japanese yen weakened sharply against major global currencies following this decision.

This negative reaction can be interpreted within the framework of the “buy the rumor, sell the news” strategy. In addition, the Bank of Japan’s reluctance to adopt a tightening (hawkish) stance played an important role in the yen’s weakening. Kazuo Ueda, the Governor of the Bank of Japan, stated that the necessary room still exists to continue the normalization of monetary policy, but emphasized that subsequent decisions will be entirely dependent on economic data.

Simultaneous Movement of the U.S. Dollar Index and the S&P 500

At present, the U.S. Dollar Index (DXY) and the S&P 500 Index are simultaneously on an upward path; a phenomenon that indicates a shift in the nature of the market’s risk appetite. The Federal Reserve futures market is pricing in only about a 20% probability of an interest rate cut in January and a 54% probability of a cut in March.

These pricing levels suggest that the Federal Reserve will most likely wait until spring to begin easing monetary policy. As a result, the interest rate differential between the United States and Japan remains at elevated levels, an element that could be a powerful catalyst for an intensification of carry trade positioning and the continuation of the USDJPY pair’s advance.

The U.S. Dollar: A Risk Asset with High Interest Rates

The same logic applies to other low yielding currencies as well. Due to its high interest rate level, the U.S. dollar has effectively become a high yield risk asset, and this feature alongside the traditional Christmas rally in the U.S. stock market could lead to further dollar strength.

In this regard, the presidents of the Federal Reserve Banks of New York (John Williams) and Cleveland (Beth Hammack) supported maintaining the current monetary policy at least until spring. According to Beth Hammack, interest rates are still slightly below the neutral level; therefore, the risk of overstimulating the economy and a return of inflationary pressures remains in place.

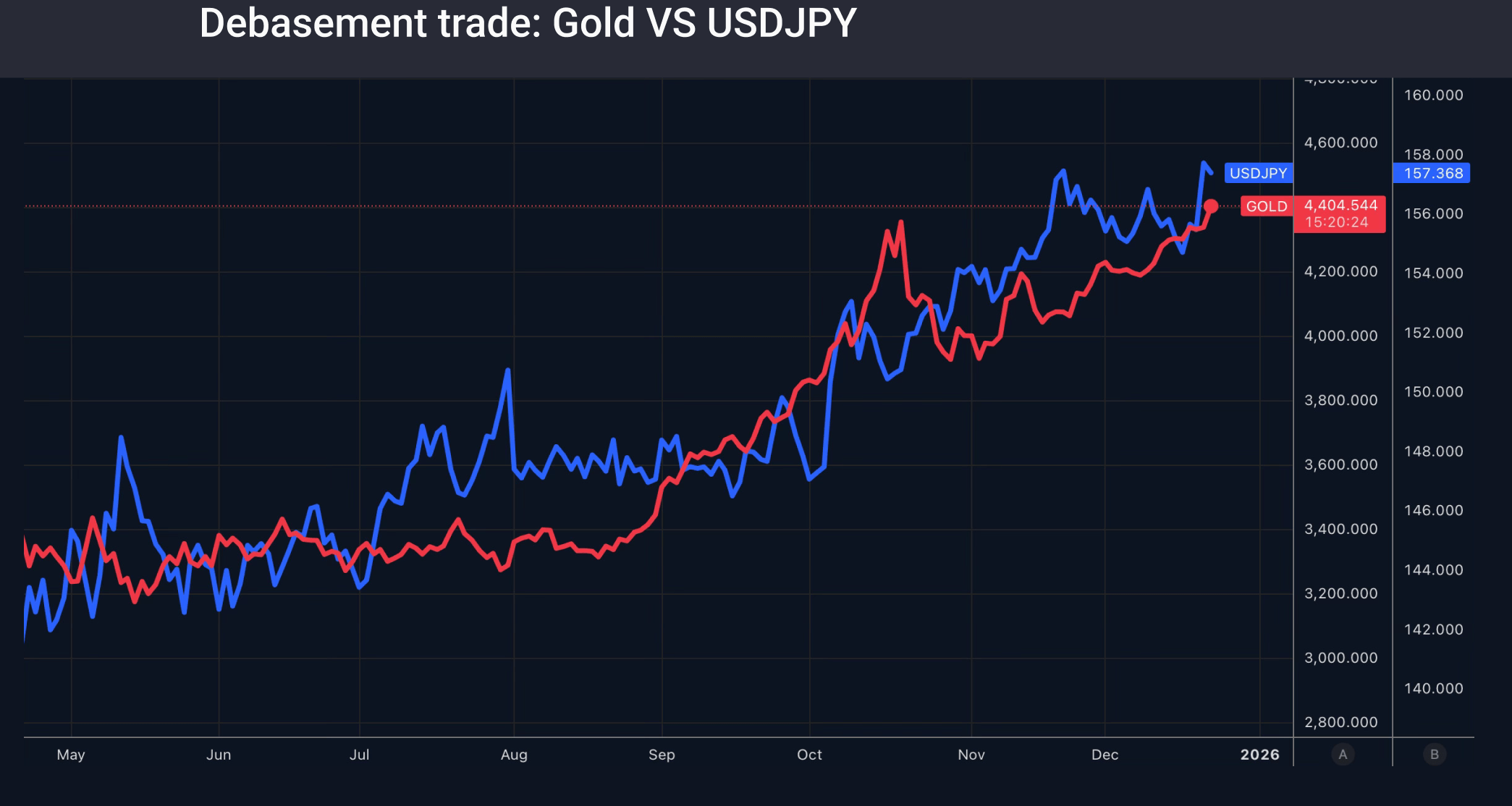

Gold Price Growth Driven by Currency Debasement

The weakening of major global currencies, alongside rising bond yields especially driven by the Japanese market and falling bond prices, has brought investors’ attention back to debasement based trading. This environment created conditions in which gold, for the first time in history, moved above $4,400 per ounce and set a new all time record.

This price rally was also influenced by an escalation in geopolitical risks, including the United States’ blockade of Venezuela’s oil exports and Ukraine’s first strike on one of the Russian shadow fleet’s oil tankers in the Mediterranean Sea. Together, these factors played an important role in increasing demand for gold as a safe haven asset.

Gold Outlook from the Perspective of Major Investors

Capital inflows into gold backed exchange traded funds (ETFs) have continued for the fifth consecutive week. Precious metals focused investment funds have increased their holdings in every month of 2025 except May which indicates sustained demand from institutional investors.

According to a Goldman Sachs report, private investors are directly competing with central banks for access to a limited volume of gold bullion. This supply constraint, alongside structural demand, could push gold prices in 2026 to levels around $4,900 per ounce.