Pump and Dump Explained (Simple Definition)

A pump and dump is a deceptive tactic where the price of an asset is pushed up artificially to attract buyers. Once demand rises, the organizers execute large scale sales, causing a steep drop in price. The main winners are the people running the scheme; late entrants typically bear the losses.

Historical Roots of Pump and Dump

This tactic has a long history dating back centuries. In traditional markets, merchants would spread rumors about shortages or rising value to push people into buying. By the early 20th century, the scheme became more organized in the stock market. Groups known as “pools” would buy shares cheaply, release fabricated positive news to drive prices up, and then unload their holdings onto others at inflated levels.

How the Tactic Evolved in the Digital Era

With the rise of the internet and social media, pump and dump operations gained new dimensions. They’re no longer confined to traditional markets or even equities; you now see them in cryptocurrencies, virtual goods, and even product promotions. Online groups on platforms like Telegram or Discord coordinate to artificially boost the price of an asset or the popularity of a brand. The speed of information flow and the hype dynamics of social networks make this type of fraud faster and more impactful.

Modern Pump and Dump Methods

Today, influencer amplification and targeted advertising are common tools. High profile figures directly or indirectly spark waves of buying. In more sophisticated variants, trading bots and algorithms create artificial volume and momentum, pushing prices unrealistically higher.

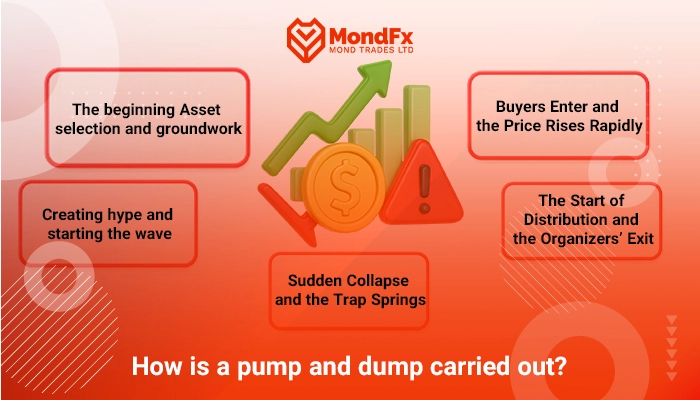

How is a pump and dump carried out?

Pump and dump begins with the secret accumulation of a low-liquidity asset and the creation of artificial hype through rumors and promotions. Then, by attracting new buyers and driving the price up, the organizers sell their holdings at the peak, causing a sudden market crash.

Stage One: The beginning Asset selection and groundwork

Every pump and dump starts with a choice. The organizing group usually goes after tokens with low float and low trading volume, because price control is easier under such conditions. After the selection, they secretly begin the initial buying to accumulate a significant position.

At this stage, no one yet realizes what is happening, because the purchases are made in small intervals so as not to create a noticeable change on the chart. At the same time, the promotional plan is prepared: from publishing content on social networks to planning the use of influencers or even creating positive rumors about the project. This phase is calm and calculated, because the success of the later stages depends on laying the groundwork for initial trust among buyers.

Stage Two: Creating hype and starting the wave

When the initial buying is complete, it is time to light the spark. This stage begins with the release of positive news, exaggerated promises, and phrases like a once in a lifetime opportunity. Social networks are the main tool here, because the speed of information dissemination and their psychological impact are very high.

At the same time, a few small trades are sometimes executed at higher prices so that the chart starts to rise. This initial rise provides the fuel needed to create FOMO. Users see that the price is climbing, while a small but highly excited community is talking about the bright future of this token. This combination encourages more people to buy and a larger wave of demand takes shape.

Stage Three: Buyers Enter and the Price Rises Rapidly

At this point, market excitement approaches its initial peak. Retail investors, influenced by the fear of missing out (FOMO), enter trades. The short term rise in the chart leads even semi professional traders to trust the trend.

Some trading algorithms that operate purely on momentum issue buy signals, which helps reinforce the upward wave. The important point is that, at this stage, each new entry pushes the price higher and that price increase itself serves as a reason for others to enter.

As a result, a feedback loop forms that heats the market even more. Meanwhile, true market depth remains limited; yet for many, the apparent trading volume is taken as a sign of collective confidence, while behind the scenes this volume may have been created by coordinated buying and selling.

Stage Four: The Start of Distribution and the Organizers’ Exit

When the price reaches the organizers’ desired levels, a quiet selling phase begins. This is done gradually so the market doesn’t notice. They usually sell into minor upward waves to keep the broader uptrend intact and avoid raising suspicion. To an ordinary trader, the chart still looks positive; a few short pullbacks followed by quick rebounds may even reinforce the impression that the trend is strong.

But the reality is that the asset is being transferred from informed participants to late arriving investors. This stage often lasts longer than most people expect, which makes it harder to detect. On the surface, everything seems normal, but the foundation of the trend is weakening.

Stage Five: Sudden Collapse and the Trap Springs

Once the organizers finish distributing their holdings, the market no longer has enough fuel to sustain the trend. A relatively large burst of selling is enough to knock the price down several steps and spark investor panic. At this point, many traders try to exit quickly, but the market lacks sufficient depth.

This shortage of liquidity causes even stop loss orders to execute with severe slippage. Those who entered late suffer the greatest losses. The drop can happen within minutes or hours and is usually accompanied by silence from the organizers when they have achieved their goal and left the market. At this stage, the chart is nothing but a tall peak followed by a steep decline, a pattern that leaves victims with a harsh lesson.

Why do even professionals get caught?

It may be assumed that only beginners fall victim to pump and dump schemes, but the reality is that even professional traders may become entangled in this tactic. The main reasons are competitive pressure, limited tools, and the power of market narratives. In many newly launched tokens, short selling or hedging instruments are limited; therefore, even if professionals know the trend is unsustainable, exiting the market or taking a contrarian position is not easy. On the other hand, momentum indicators produce positive short term signals, and some trading algorithms confirm these signals. Moreover, the pressure not to miss lucrative opportunities prompts even professional teams to deploy part of their capital. The result is that sometimes even experience and knowledge cannot withstand the combination of market psychology and technical constraints.

Methods for Detecting Pump and Dump Schemes

Identifying a pump and dump before getting trapped in losses is a vital skill for every investor. Given the modern tactics and high speed of these schemes in digital markets, spotting early warning signs can make the difference between profit and loss. Below are the most important detection methods for this type of fraud.

Watch for Abnormal, Rapid Price Increases

One of the first signs of a pump is a sudden, sharp rise in an asset’s price especially when trading volume is low. This surge is often not justified by any fundamental news or meaningful project developments. Newer investors may jump in without research after seeing the quick run up. Such rallies are usually short lived, and once a peak is reached, the dump begins.

Analyze Trading Volume and Market Liquidity

Reviewing trading volume can reveal unusual activity. In pump and dump scenarios, volume often appears elevated but is actually generated by coordinated buy/sell actions from the organizers. Comparing current volume with historical averages and paying attention to low liquidity can serve as a caution signal to enter more conservatively.

Reviewing Published News and Rumors

Pump scammers create a buying wave by spreading fake or exaggerated news. Therefore, following official and credible sources and comparing headlines with the project’s actual data can make it easier to identify deceptive attempts. Repeated hype filled posts on social media, especially from influencers, usually indicate the start of a pump.

Price Behavior on the Chart and Reversal Patterns

Short term charts can provide useful information about pump and dump activity. A rapid, continuous rise with a few small pullbacks and quick rebounds often reflects the classic pump pattern. A sudden, steep drop after this phase is the hallmark of the dump. Identifying such patterns before organizers begin large scale selling can reduce risk.

Paying Attention to Market Psychology Indicators

The excitement driven by FOMO (fear of missing out) is one of the main drivers of a pump. Investors should pay attention to collective behavior and the speed of their own and others’ decision making. A sudden influx of many new buyers due to psychological pressure, without rigorous analysis, sets the stage for a price collapse.

Assessing the Characteristics of the Selected Asset

Pump and dump schemes are more often executed on assets with low float and low trading volume. Evaluating the market structure, circulating supply, and the number of large holders can help identify the likelihood of a pump. Assets whose prices are easy to control are more vulnerable to this type of fraud..

Conclusion

Pump and dump is one of the most dangerous schemes in financial markets. While it may appear to be a lucrative opportunity on the surface, in reality, it is a clever trap designed to transfer capital from inexperienced investors into the hands of professional manipulators. The process begins with artificial hype, unrealistic price growth, and emotional crowd manipulation and ends with mass selling and a sudden market crash.

It’s crucial to understand that no price increase is sustainable without strong fundamental support. Therefore, conducting thorough project analysis, monitoring trading volume, tracking news from reliable sources, and recognizing behavioral signals in the market can help protect your capital from falling victim to such schemes.

Ultimately, your best defense against pump and dump is knowledge, patience, and trading discipline. If you learn to base your decisions on analysis and logic rather than emotions and market hype, you will not only avoid these traps but also be able to use abnormal market behavior as a signal for more strategic decision making.