Author: Sajad Sheikhi

Gold’s Successive Record Breakouts in 2025

Throughout 2025, financial markets were consistently under pressure from multiple risks and uncertainties. From trade wars and heavy tariffs to ongoing geopolitical tensions and even a U.S. government shutdown, markets almost never experienced calm.

In such an environment, spot gold which was trading around $2,600 at the start of the year managed to set new all time highs and reached the $4,400 area by year end. Early year prices now feel less like a price level and more like a distant memory similar to $20,000 bitcoin in past years.

The year 2025 was filled with events that pushed investors toward gold as a safe haven asset. Together, these factors played a decisive role in shaping gold’s powerful uptrend.

Trump’s Tariffs: The First Major Shock to Markets

On April 2, 2025, Donald Trump once again showed that he has no red lines when it comes to tariffs. The U.S. president unveiled very heavy tariffs against various countries both allies and non allies an action that quickly imposed an intense risk off environment on financial markets.

The full implementation of these tariffs would have effectively caused serious disruption to global trade, and for this reason, Trump used tariffs as leverage for negotiation and extracting concessions. Many countries entered negotiations to reach new trade agreements, and the United States, in return for investment and acceptance of certain trade conditions, reduced part of the tariffs.

Nevertheless, the shadow of tariffs and trade uncertainty remained over markets throughout the year. The result of these conditions was higher inflation in the United States and a delay in Federal Reserve interest rate cuts.

The Twelve Day Iran War: A Short Term Disruption in the News Cycle

On June 13, 2025, coinciding with the end of Trump’s 60 day deadline for reaching an agreement with Iran, a short term war between Iran and Israel began. This conflict started with a surprise Israeli strike on nuclear sites and some senior commanders of the Islamic Revolutionary Guard Corps (IRGC). In response, Trump stated: “I gave them sixty days; today is day sixty one.”

Despite the geopolitical sensitivity of this event, the market reaction was limited. Trump had no desire for the conflict to drag on and, through his verbal interventions, prevented an escalation of tensions and an emotional reaction in the markets.

The Unexpected Weakness of the NFP Report and Jerome Powell’s Shift in Tone

The U.S. July Employment Report (NFP) was one of the market’s turning points in 2025. The report came out unexpectedly weak, and revisions to the previous months’ data also showed a significant decline. Over the three months of June, July, and August, the average job growth was only 35,000 jobs the weakest labor market performance since the COVID era.

In addition, the revisions revealed that roughly 260,000 jobs were eliminated over the same period. The magnitude of these revisions was so great that the head of the U.S. Bureau of Labor Statistics (BLS) was dismissed. At the same time, Jerome Powell, at the Jackson Hole meeting, adopted a dovish stance for the first time since the imposition of tariffs and stated that “the balance of risks has shifted toward the labor market.”

Although tariffs were still exerting upward pressure on inflation, the Federal Reserve’s baseline scenario was that their impact on inflation would be temporary and one off. Contrary to the market’s initial expectations, the main damage from the tariffs showed up not in inflation, but in the labor market. Due to weak demand and limited pricing power, companies were forced to cut jobs to preserve profit margins.

These developments paved the way for interest rate cuts a scenario that few had expected at the beginning of the year.

The Coincidence of Rate Cuts and Shattered Hopes for Peace

After the Jackson Hole meeting, expectations for interest rate cuts increased and the dollar entered a downward path. This trend coincided with a Trump Putin meeting focused on Ukraine peace talks. However, as expected, achieving peace was not easily attainable.

The combination of the market’s disappointment over the prospect of peace and the rising expectations for rate cuts set the stage for one of the strongest gold rallies in recent years.

Silver: The Hidden Star of 2025

While the market’s public attention was focused on gold, silver delivered an even more impressive performance and posted a striking 140% return. The main driver of this rise was stronger industrial demand.

With central banks entering an easing cycle and broad interest rate cuts, 2026 is expected to be a year of global economic growth. In such conditions, commodities and especially silver will benefit the most from this environment.

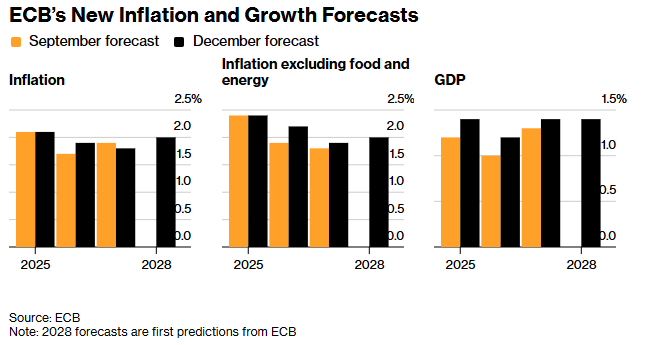

The central banks of Europe and the United States have also raised their forecasts for next year’s economic growth. In Europe, the economy’s resilience has exceeded expectations, and higher growth has been recorded compared to initial estimates. The European Central Bank views future growth as being driven by domestic demand and increased investment.

The Role of Artificial Intelligence in the Surge in Silver Demand

The Federal Reserve has also raised its 2026 economic growth forecast from 1.8% to 2.3% a meaningful revision that indicates a shift in the outlook for the U.S. economy. The main driver of this growth has been cited as the development of artificial intelligence and higher productivity.

Silver, as the best electrical conductor, has widespread applications in the production of AI related chips. For this reason, the boom in this technology has directly and indirectly benefited the silver market.

Silver Supply Shortage: A Structural Problem

Silver is classified as a by product metal, in the sense that more than 70% of its global production is a by product of extracting metals such as copper, zinc, lead, and gold. As a result, rising silver prices or demand does not necessarily lead to higher production. Silver supply depends on the conditions of base metals, not the needs of the silver market.

With demand growing rapidly especially from AI related industries the gap between supply and demand has widened, and this factor has driven the sharp rise in silver prices. This imbalance is expected to continue in 2026 as well, especially given the global economy’s readiness to enter a growth phase.

Gold Outlook in 2026

Goldman Sachs continues to view the outlook for gold in 2026 as bullish. According to the firm, structural central bank purchases will be the most important factor sustaining gold’s uptrend. Central bank demand especially in emerging economies has increased by about fivefold since 2022.

Diversifying foreign exchange reserves in response to geopolitical risks and declining trust in external currency assets especially after the seizure of Russia’s reserves are among the main reasons behind this shift in approach. Goldman Sachs considers this trend structural and long term, not temporary. Countries such as China also still have a low share of gold in their reserves, which creates further room for growth.

The second factor is the continuation of Federal Reserve rate cuts. With a weakening labor market and easing inflationary pressures, at least one and in an optimistic scenario, two additional rate cuts are expected.

Based on this, Goldman Sachs considers a target of $4,900 per ounce for gold plausible, and has also put forward targets of $11,400 for copper and $56 for Brent crude oil.

Summary

In 2025, gold and silver posted returns of 70% and 140%, respectively. Although the year was difficult for many assets, it turned into a highly profitable and historic period for gold and safe haven assets. Rising uncertainty, escalating geopolitical risks, interest rate cuts, and heavy central bank purchases were the main drivers of gold’s price increase.

On the other hand, silver delivered an exceptional performance due to a structural supply shortage and rising industrial demand especially from artificial intelligence. Given accommodative policies and the outlook for global economic growth, 2026 is also expected to be a positive year for commodities, and especially for silver.