In today’s financial markets, traders must decide which type of broker to use: centralized or decentralized. This choice can have a significant impact on your trading performance, costs, and security. In this article, we will explore the differences between these two types of brokers.

Centralized Broker: These brokers act as intermediaries between traders and financial markets and are usually regulated by government authorities.

Decentralized Broker: These brokers operate on blockchain networks or decentralized systems, where transactions occur without intermediaries and are automated.

What is a Centralized Broker?

A centralized broker acts as an intermediary that sends your trades to financial markets and is usually regulated by governmental bodies. These brokers play a key role in controlling and managing market conditions.

Features of a Centralized Broker

- Legal Supervision: These brokers are licensed by governmental authorities, which enhances the security of your investment.

- Variety of Services: From different types of accounts to advanced tools for various strategies.

- Strong Customer Support: Access to 24/7 customer support and services in multiple languages.

Advantages

Here are some of the advantages of using a centralized broker:

- Increased Security for Traders: Centralized brokers are typically regulated by financial authorities, ensuring the safety of your investments.

- Diverse and Specialized Services: Centralized brokers usually offer a wide range of services such as various account types, advanced trading platforms, and analytical tools.

- Simplified User Experience: Centralized brokers generally have more user-friendly interfaces, making them suitable for beginners.

What is a Decentralized Broker?

A decentralized broker, unlike centralized brokers, operates on a blockchain network with no central authority directly overseeing it. These systems are automated, and all transactions are recorded on the blockchain.

Features of a Decentralized Broker

- No Intermediaries: You trade directly with other market participants.

- High Transparency: All transactions are recorded and traceable on the blockchain.

- Blockchain Security: The security of these systems depends on the blockchain networks.

Advantages

Decentralized brokers have features that make them appealing to some traders:

- High Security on the Blockchain: Transactions are conducted on the blockchain, providing greater security against hacking and external manipulation.

- Elimination of Intermediaries and Extra Costs: Since there are no intermediaries, fees and commissions are reduced.

- More Transparency in Transactions: All transactions are recorded on the blockchain, making the entire process transparent and traceable.

Which One Is More Suitable for You? Key Differences Between Centralized and Decentralized Brokers

Choosing the right broker is one of the most important decisions on your journey to becoming a professional trader. Given the variety of brokers and their different features, it’s essential to consider specific factors and criteria when selecting the best broker for your needs.

| Decentralized Broker | Centralized Broker | Feature |

| Simpler accounts based on blockchain | Various types such as ECN, STP, Fixed Spread accounts | Types of Trading Accounts |

| Lower spreads, transaction costs like Gas fees | Floating or fixed spreads, additional commissions may apply | Spreads and Commissions |

| Uses DEX platforms or blockchain-based platforms | Uses well-known platforms like MetaTrader 4 & 5 | Trading Platforms and Analytical Tools |

| Limited support, security depends on blockchain and smart contracts | 24/7 support, regulatory oversight, fund security | Customer Support and Security |

| No formal regulatory oversight, mostly blockchain-based technology | Supervised by regulators like FCA, ASIC, CySEC | Regulations and Laws |

| Deposits and withdrawals via cryptocurrency, Gas fees apply | Various deposit and withdrawal options, additional fees may apply | Deposit and Withdrawal Fees |

Types of Trading Accounts

- Centralized Brokers: These brokers usually offer various types of trading accounts, including ECN, STP, and fixed spread accounts, allowing you to choose based on your trading strategy. These accounts are typically regulated by financial authorities.

- Decentralized Brokers: Decentralized brokers usually provide simpler accounts, as they operate using blockchain and connect directly to decentralized networks. This may limit your choice of accounts or trading tools.

Spreads and Commissions

- Centralized Brokers: Centralized brokers generally offer floating or fixed spreads for various account types. These spreads may change depending on market conditions, and due to regulatory oversight, they may also charge additional commissions or hidden fees.

- Decentralized Brokers: These brokers typically have lower spreads, as there are fewer intermediaries. However, some decentralized brokers may charge additional fees like Gas fees for blockchain transactions due to a lack of oversight.

Trading Platforms and Analytical Tools

- Centralized Brokers: Centralized brokers typically use well-established platforms like MetaTrader 4, MetaTrader 5, or cTrader, which offer advanced features for technical analysis and fast execution of trades.

- Decentralized Brokers: Decentralized brokers mostly use DEX platforms or blockchain-based platforms. These platforms generally have fewer analytical tools compared to traditional platforms but offer new tools for decentralized and faster trading.

Customer Support and Security

- Centralized Brokers: Centralized brokers usually provide strong 24/7 customer support, and you can contact them via email, live chat, or phone. Additionally, these brokers are regulated by authorities that ensure the security of your funds.

- Decentralized Brokers: Customer support in decentralized brokers is usually less accessible, as many of them operate on automated networks and blockchain. The security of your funds largely depends on the blockchain technology and smart contracts in use, and if the network you are using experiences issues, you may encounter difficulties accessing your funds.

Regulations and Laws

- Centralized Brokers: Centralized brokers are regulated by reputable financial authorities like FCA, ASIC, and CySEC. These regulatory bodies protect the rights of clients and require brokers to follow strict guidelines.

- Decentralized Brokers: Decentralized brokers generally lack formal regulatory oversight because they operate on blockchain and smart contracts. While this provides more freedom for traders, it also poses greater risks, such as the potential for hacking or lack of customer support.

Deposit and Withdrawal Fees

- Centralized Brokers: Centralized brokers typically offer a variety of deposit and withdrawal methods, including credit cards, bank transfers, digital wallets, etc. Deposits and withdrawals are usually fast, but some brokers may apply additional withdrawal or deposit fees.

- Decentralized Brokers: In decentralized brokers, deposits and withdrawals are usually made through cryptocurrencies. Transaction fees may include blockchain network fees or Gas fees, which depend on the network conditions.

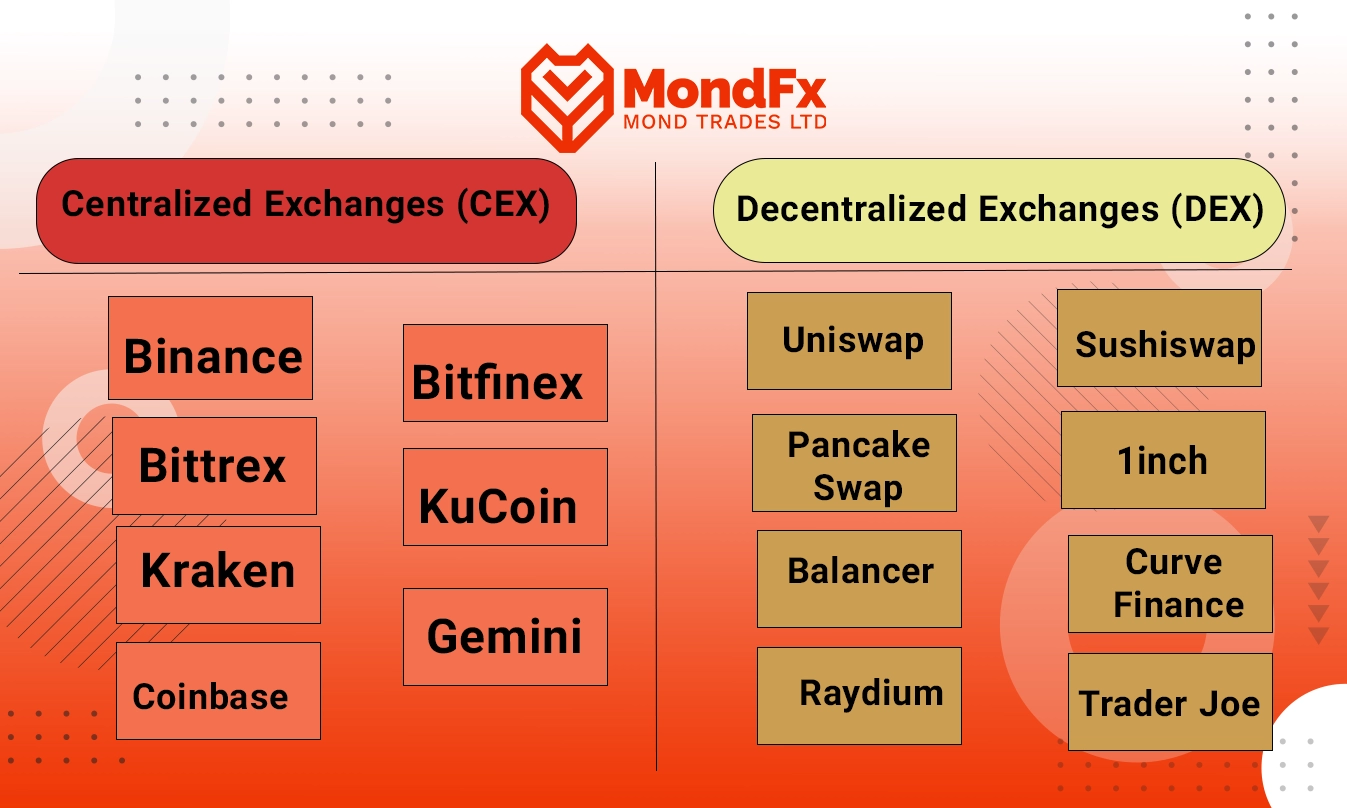

Introduction to Centralized and Decentralized Exchanges

In the world of cryptocurrency, exchanges are divided into two categories: centralized (CEX) and decentralized (DEX). Centralized exchanges are managed by a specific entity and execute trades through intermediaries, while decentralized exchanges perform transactions directly between users without the need for intermediaries.

Centralized Exchanges (CEX)

- Binance

The largest exchange in the world with extensive features for cryptocurrency trading.

Features: Low spreads, futures trading, staking, and more.

Regulation: Regulated by several authorities. - Coinbase

One of the most popular cryptocurrency exchanges, suitable for beginners.

Features: Simple user interface, free educational resources.

Regulation: Legally regulated in the United States. - Kraken

A reputable exchange with advanced features for professional traders.

Features: Low spreads, supports futures and margin trading.

Regulation: Regulated by NFA and SEC. - Bitfinex

An exchange with advanced features and high trading volume.

Features: Margin trading, support for various cryptocurrencies.

Regulation: Partial regulation. - KuCoin

An exchange with over 200 trading pairs and diverse features.

Features: Suitable spreads, futures trading, and staking.

Regulation: Minimal regulatory oversight. - Gemini

An American exchange with a focus on security and regulation.

Features: Simple interface, supports staking and buy/sell services.

Regulation: Strictly regulated in the United States. - Bittrex

A well-known exchange for trading across various markets.

Features: High security, no hidden fees.

Regulation: Financially regulated in the United States.

Decentralized Exchanges (DEX)

- Uniswap

One of the largest decentralized exchanges using the Ethereum protocol.

Features: Uses smart contracts, no intermediaries.

Regulation: No regulatory oversight, but secure. - Sushiswap

A decentralized exchange similar to Uniswap with additional features for trading.

Features: Provides liquidity and staking.

Regulation: Decentralized with no formal oversight. - PancakeSwap

A decentralized exchange for trading on the Binance Smart Chain.

Features: Low transaction fees, compatible with many wallets.

Regulation: Decentralized, no regulatory oversight. - 1inch

A decentralized exchange aggregator that finds the best prices from various exchanges.

Features: Transaction optimization, supports multiple blockchains.

Regulation: No formal regulation. - Balancer

A decentralized exchange that allows creating various liquidity pools.

Features: High flexibility for liquidity, low fees.

Regulation: No formal regulation. - Curve Finance

A decentralized exchange for trading stablecoins and similar cryptocurrencies.

Features: Low fees and high efficiency in transactions.

Regulation: Decentralized, no regulatory oversight. - Raydium

A decentralized exchange for the Solana network.

Features: Low fees, high speed.

Regulation: No regulatory oversight. - Trader Joe

A decentralized exchange for the Avalanche blockchain.

Features: Access to DeFi, high liquidity.

Regulation: No formal oversight.

What is the Role of Centralized Brokers in the Modern World?

In the modern financial world, centralized brokers continue to hold a special position due to the security, transparency, and wide range of services they offer.

Although decentralized brokers (DeFi) are rapidly growing, centralized brokers still dominate many markets, including Forex, stock exchanges, and commodities.

Especially for traders seeking legal oversight, capital protection, and superior customer service, centralized brokers remain a trusted option.

The Future of Centralized Brokers

Centralized brokers are likely to remain a core part of trading systems in the future. However, they will need to adapt to new technological advancements such as blockchain and cryptocurrencies.

It is highly probable that these brokers will seek to integrate decentralized (DeFi) features into their models to meet the new needs of customers and maintain their position in global markets.

The Role of Decentralized Brokers in the Modern World

With the rapid growth of blockchain and cryptocurrency technologies, decentralized brokers are becoming one of the key components of modern financial markets.

These brokers play a prominent role, especially in the world of digital currencies and blockchain, and are an attractive option for those seeking financial freedom and more control over their trades.

While traditional markets and centralized brokers still have their place, decentralized brokers are emerging as serious competitors.

The Future of Decentralized Brokers

The future of decentralized brokers looks promising, especially with further advancements in blockchain technology and the increasing adoption of cryptocurrencies.

As technology continues to evolve and public awareness of the benefits of these systems grows, we are likely to see further expansion of decentralized brokers. Additionally, in the future, we might witness a synergy between centralized and decentralized brokers, combining the best features of both models.