“Break Even in Forex,” also known as the “breakeven point in trading,” is the level at which a trade’s revenue exactly equals its costs. This concept is a fundamental part of risk management in Forex and helps traders protect their capital and optimize their no-loss exit points.

It plays a crucial role in capital management and risk reduction, assisting traders in calculating the price level required to cover their costs. A proper understanding of this concept can significantly improve capital management and financial risk reduction.

The Concept of Break Even in Forex

In the Forex market, Break Even or the “no-loss exit point” is the price level where a trade, after accounting for transaction costs like spreads and commissions, reaches a state where the trader is at the breakeven point. This price level is one of the key principles in capital management in Forex trading and has a direct impact on dynamic stop-loss strategies and capital protection.

In other words, this price level is the exact point where the trader has covered all entry costs, ensuring that exiting the trade results in neither a profit nor a loss.

For example, suppose a trader buys the EUR/USD currency pair at 1.2000, and the transaction costs, including spreads and commissions, amount to 5 pips (0.0005). In this case, the breakeven point for this trader would be 1.2005. This means that unless the price reaches this level, the trader is still at a loss.

The Importance of Break Even in Risk Management

Break Even is one of the most important risk management tools in financial markets. It helps traders plan better and protect their capital. Some key benefits include:

- Reducing potential losses: By knowing the breakeven point, traders can decide at which price level they should exit a trade to prevent losses.

- Capital protection: This concept helps traders prevent significant losses by setting stop-loss orders at the breakeven point.

- Improving trading strategies: Understanding the breakeven point allows traders to have better capital management and avoid entering high-risk trades.

How to Calculate Break Even in Forex

To calculate the break-even point in Forex trading, transaction costs must be taken into account. The general formula is as follows:

For long trades (buy orders):

Break Even = Entry Price + Transaction Costs

For short trades (sell orders):

Break Even = Entry Price – Transaction Costs

Example Calculation

Suppose a trader buys the GBP/USD currency pair at 1.3200, and the transaction costs (spread and commission) amount to 0.0003. In this case:

Break Even = 1.3200 + 0.0003 = 1.3203

This means that if the price reaches 1.3203, the trader is at the breakeven point, resulting in neither a profit nor a loss.

Break Even-Based Trading Strategies

Professional traders use various methods to optimize their trades by adjusting the breakeven point. Some common strategies include:

- Setting Stop Loss at the Break Even Point

One of the most popular strategies is adjusting the stop-loss order to the breakeven point after reaching a certain level of profit. This way, if the price retraces, the trader incurs no loss. - Using Trailing Stop

This method allows traders to automatically adjust their stop-loss levels as the price moves in their favor. As a result, if the price continues to rise, the stop loss also increases, securing a better exit point. - Increasing Trade Volume After Reaching Break Even

Some traders, after reaching the break-even level, lock in part of their profits and open a new position to take advantage of additional opportunities in the market.

Advantages and Disadvantages of Using Break Even in Trading

Break Even is an effective tool for risk and capital management that, when used correctly, can help prevent unnecessary losses. However, if applied without a proper strategy and thorough analysis, it may cause traders to miss out on significant profits.

| ✅ Advantages | ❌ Disadvantages |

| 🔹 Risk Reduction and Capital Protection

Prevents major losses by shifting the stop-loss to the entry point. |

🔸 Possibility of Premature Exit from a Trade

The market may fluctuate before making its main move, causing the trade to close too early. |

| 🔹 Increased Flexibility in Trading

Allows traders to exit a trade without losses and adjust their strategies accordingly. |

🔸 Requires Continuous Monitoring of Trades

Traders must constantly analyze the market to determine the right time to set the break-even level. |

| 🔹 Improved Capital Management and Logical Decision-Making

Reduces emotional influence and enhances market analysis accuracy. |

🔸 Improper Execution May Reduce Profitability

If the break-even point is set at the wrong time, traders might miss out on larger gains. |

| 🔹 Stress-Free Trading

Eliminates concerns about losing the initial investment. |

🔸 Risk of Overly Conservative Trading

Some traders may become excessively cautious and miss profitable opportunities. |

| 🔹 Reduced Emotional Impact on Trading

Helps control fear and greed, which often lead to poor decision-making. |

🔸 Potential Challenges in Highly Volatile Markets

In markets with high fluctuations, the price may hit the break-even point multiple times, closing the trade prematurely. |

Break Even Strategies in Forex

Break Even Strategy is one of the capital management techniques in Forex that helps traders minimize risk and exit the market at a suitable point. This strategy is used when the price reaches a level where the entry costs of a trade have been covered, resulting in neither profit nor loss. Below are some key methods for implementing the break-even strategy:

- Moving Stop-Loss to the Break Even Point

One of the most common methods is to shift the stop-loss (SL) to the entry price after the market moves favorably. This ensures that if the market reverses, the trade will close without a loss. This method is particularly effective in long-term or mid-term trades where volatility is higher. - Partial Position Scaling and Profit Taking

In this approach, traders secure a portion of their profits at specific price levels while managing the remaining position by moving the stop-loss to the break-even level. This way, even if the market reverses, the trader retains part of the earned profit. - Risk Management Based on Risk/Reward Ratio

An effective strategy is to calculate the break-even level based on the risk/reward ratio before entering a trade. For example, if the risk/reward ratio is 1:2, the trader can move the stop-loss to break-even after reaching the first take-profit level. - Using Indicators to Identify Break Even Levels

Certain indicators, such as Moving Averages (MA) and Pivot Points, can help traders determine break-even levels. Professional traders use these tools to identify key market levels and shift their stop-loss to the break-even point accordingly. - Proper Timing for Applying the Break Even Strategy

Timing plays a crucial role in executing the break-even strategy. If the stop-loss is adjusted too early, the trader may exit the trade before the main market move occurs. On the other hand, if the adjustment is too late, the price may reverse, leading to a loss.

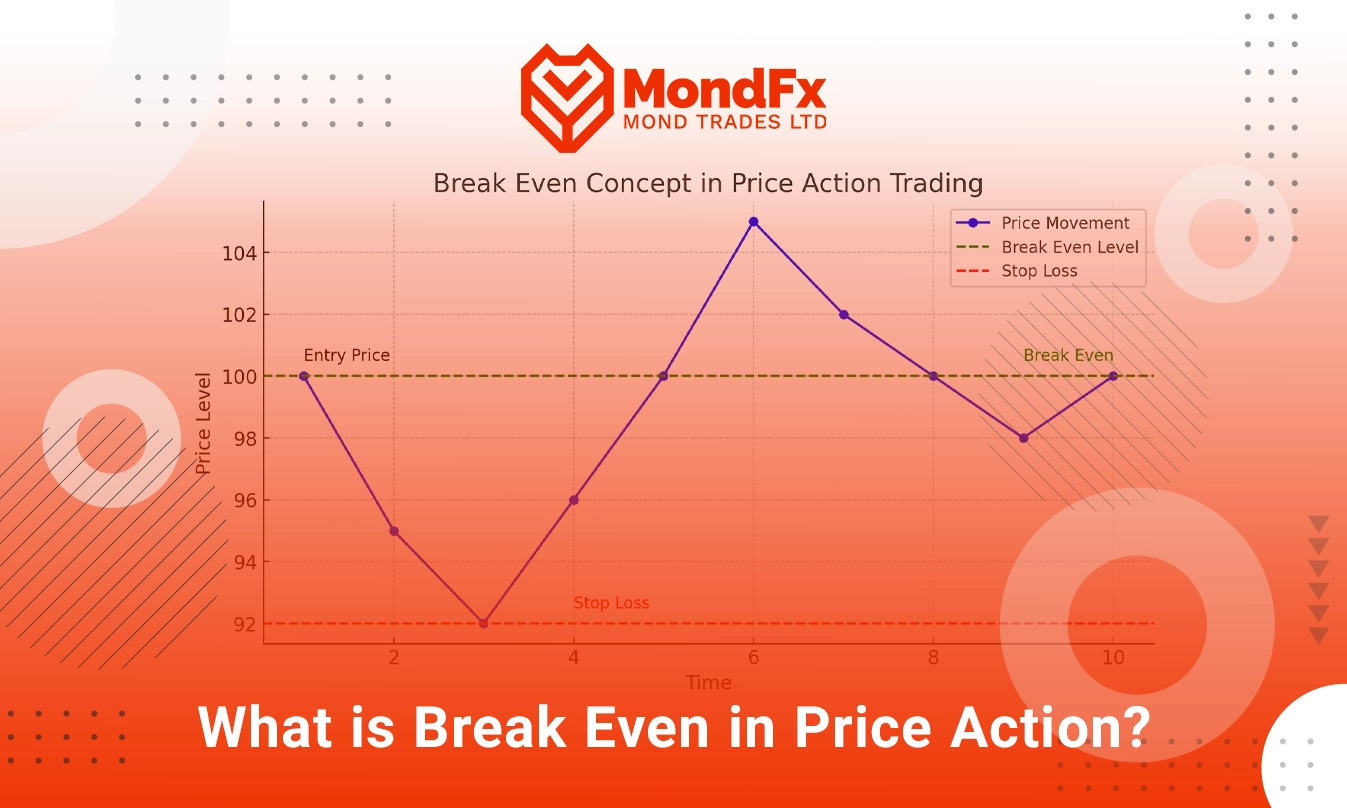

Break Even in Price Action: A Complete Guide for Traders

Break Even in Price Action is one of the key concepts in risk management, used by professional traders to protect capital and prevent unnecessary losses. This point occurs when the price reaches a level where the entry costs of a trade are covered, resulting in neither a net profit nor a net loss.

In this article, we will discuss how to identify break-even levels in price action, practical strategies, and essential tips to optimize this technique.

What is Break Even in Price Action?

In Price Action trading, traders make decisions based on price movements without relying on common indicators. The break-even point in this method is the level where a trade neither generates profit nor incurs a loss, meaning that the price has exactly covered the entry costs.

In general, Price Action traders identify break-even levels based on:

✔ Support and resistance levels

✔ Candlestick patterns

✔ Liquidity zones

If the price reaches the break-even level and the trader moves the stop-loss accordingly, potential losses can be avoided.

How to Identify Break Even in Price Action?

1. Support and Resistance Zones

Support and resistance levels are key areas for identifying break-even points. If the price reaches a major support or resistance level and lacks the momentum to break through, there is a high probability of reversal. In such cases, Price Action traders move their stop-loss to the break-even point.

2. Breakouts and Pullbacks

- If the price breaks through a key level and then retraces (pullback) back to that level, it can be considered a break-even zone.

- Many traders move their stop-loss to break-even after the price confirms a breakout to prevent sudden reversals.

3. Confirmation Candles

Price Action trading heavily relies on candlestick behavior. If a strong candle closes in the trade’s favor after entry, it signals that the stop-loss can be moved to break-even. Conversely, if weak candles appear afterward, traders may need to manage their position cautiously.

4. Trading Volume and Liquidity Zones

Break-even levels often coincide with high-volume areas (liquidity zones). If the price reacts to a liquidity zone, it serves as a signal to adjust the stop-loss to break-even.

Break Even Strategies in Price Action

1. Moving Stop-Loss to Break Even After a Key Level Breakout

One common method is to move the stop-loss to the entry point after a significant breakout (e.g., a strong resistance level). This ensures that if the price reverses, the trade closes without a loss.

2. Managing Positions with Partial Profit-Taking

Some traders close half of their position when the price reaches the break-even level, while adjusting the stop-loss of the remaining portion to break-even. This strategy reduces risk and secures part of the profits.

3. Using Candlestick Behavior Near Break Even

When the price approaches the break-even level, analyzing candlestick formations can help traders decide whether to hold or exit the trade.

✔ Strong candles in the trade’s direction indicate continuation.

❌ Reversal candles signal a possible exit opportunity.

4. Identifying Trends with Higher Time Frames

Higher time frames, such as the 4-hour and daily charts, can provide stronger confirmations for break-even levels. If a break-even level aligns with a key zone on a higher time frame, the probability of price reacting to it increases.

Why is Break Even Important in Price Action?

✅ Reducing Trade Risk: By shifting the stop-loss to the break-even point, traders can prevent unnecessary losses.

✅ Optimizing Capital Management: Preserving initial capital is one of the key principles of success in Forex and Price Action trading.

✅ Boosting Confidence in Trades: When a trader knows that a trade will close at the break-even point without loss, they will experience less stress.

✅ Increasing Profit Potential: Break-even allows traders to aim for higher targets without worrying about potential losses.

What is Back to Break Even (Back to BE)?

“Back to Break Even” occurs when the price, after moving in a profitable direction, returns to the break-even level, causing the trade to close at the no-loss exit point.

This is one of the major challenges in capital management in Forex trading, and professional traders use dynamic stop-loss and trailing stops to avoid this situation.

This phenomenon can significantly impact trader decision-making, and understanding it properly can help improve trading performance.

Why Does Back to Break Even Happen?

🔹 Price Retracements: In many cases, after a bullish or bearish move, the price undergoes a retracement and returns to the trade entry level.

🔹 Liquidity Zones: Market makers often drive the price toward high-liquidity areas (such as the break-even level) to trigger pending orders.

🔹 Lack of Trend Strength: If the price fails to reach the level that traders expect, the likelihood of returning to break-even increases.

🔹 Emotional Trader Actions: Some traders, after reaching profit, move their stop-loss to the break-even level. In this case, if the market retraces, the trade closes without a profit.

How to Prevent Back to Break Even?

✅ Placing the Stop-Loss at a Logical Distance from Break Even: Avoid setting the stop-loss exactly at the entry point; instead, place it at a reasonable level to prevent normal market fluctuations from closing the trade.

✅ Using Higher Time Frames: Reviewing higher time frames can help traders choose better entry points and avoid premature entries.

✅ Partial Profit-Taking: Closing part of the trade at key levels ensures that if the price reverses, at least a portion of the profit is secured.

✅ Paying Attention to Volume Analysis: Examining volume in key areas can indicate whether the price is likely to return to break-even or continue in the trend direction.