The Importance of Choosing Advanced Strategies in Forex

Choosing advanced strategies in Forex is one of the most critical factors in preserving and growing capital, because employing precise analytical and risk management techniques can ensure sustainable profitability amid the market’s turbulent conditions, which we will explore in more detail below:

Optimal Risk Management

In advanced strategies, various tools and techniques are employed to manage risk, ranging from proper position sizing to the use of trailing stops and even more sophisticated methods like hedging.

Such an approach reduces potential losses and allows traders to make their trading decisions logically and systematically, without fearing sudden market fluctuations. Furthermore, having a comprehensive risk control plan enables a trader to quickly execute an exit strategy if the market moves contrary to expectations, thereby preventing severe losses.

Utilizing Advanced Analytical Tools

Professional traders use methods beyond classic indicators to access more accurate data and gain deeper insight into price behavior. For instance, advanced-level price action and the precise interpretation of candlestick patterns can provide valuable information about market psychology. In addition, experienced analysts often use trading algorithms and robots that operate based on artificial intelligence or predefined rules.

These tools enhance the speed and precision of trades and enable traders to respond promptly to profitable opportunities.

Rapid Adaptation to Market Changes

One of the key characteristics of the Forex market is its high volatility and constant fluctuations. Having an advanced strategy helps traders quickly update their trading approach when trends shift, unforeseen news emerges, or unexpected volatility occurs.

For example, if major economic announcements or changes in central bank policies are released, a trader using an advanced strategy can promptly enter an appropriate position upon observing the initial signs of a trend change or exit an uncertain position.

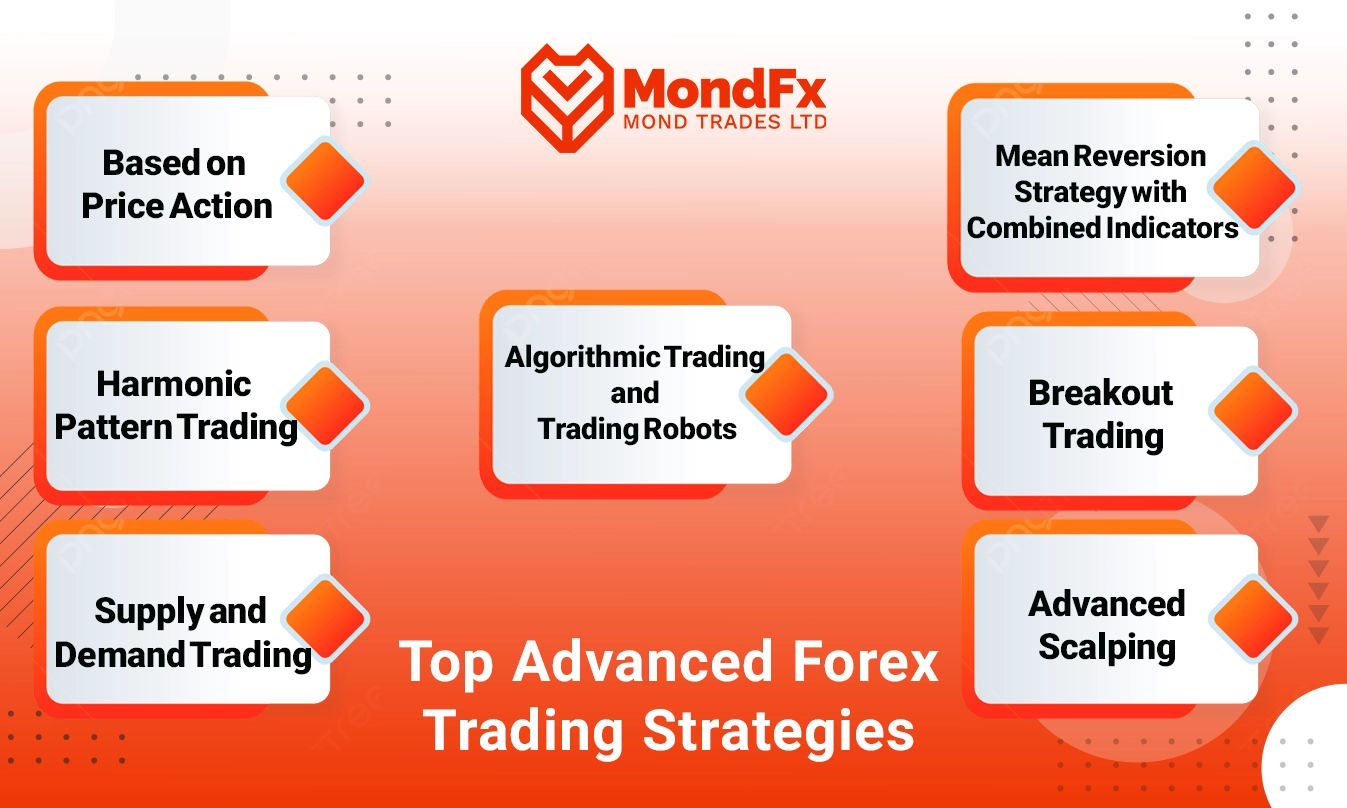

Top Advanced Forex Trading Strategies

Below, we take a more comprehensive look at a set of advanced Forex strategies. Each of these strategies provides a unique approach to maximizing profits and reducing risk in the world’s largest financial market. The explanations aim to offer a clear picture of how each method operates and what advantages it can bring, while avoiding repetitive details:

Strategy Based on Price Action

Price Action focuses on the direct analysis of price behavior; in other words, instead of relying on lagging indicators, it examines real-time fluctuations and candlestick structures.Identifying Key Levels:Price action traders first pinpoint significant supply and demand zones, important highs and lows, as well as psychological numbers. These areas have historically shown strong reactions from traders and can serve as the basis for entering or exiting a position.Advanced Candlestick Patterns:Patterns such as Pin Bar, Inside Bar, and Engulfing, when identified near critical levels, can provide vital clues about potential trend changes or continuations.Breakout and Reversal:In this method, traders closely monitor the break of trendlines or support and resistance levels. When a breakout is confirmed by candlestick behavior or trading volume, they enter a position. Conversely, upon observing reversal signals (for instance, a Pin Bar in the PRZ zone), they may take a counter-trend trade.

Harmonic Pattern Trading Strategy

This strategy interprets price movements using Fibonacci ratios within harmonic patterns. Patterns like Gartley, Bat, Crab, or Butterfly form based on a specific arrangement of price waves.Identifying the Correct Pattern:Each harmonic pattern’s XABCD structure follows precise rules. Correctly setting up Fibonacci tools and accurately spotting the waves is the cornerstone of success in this approach.

Determining the PRZ:The Potential Reversal Zone (PRZ) is a region where, according to Fibonacci ratios, the probability of a price reversal increases. Incorporating other technical analyses (like RSI or MACD indicators) with PRZ identification helps filter out false signals.

Risk Management:Top harmonic traders always place their stop loss outside the PRZ to stay protected from large losses should this key zone fail. Additionally, they often set take-profit targets at Fibonacci levels, where the likelihood of price reaching those levels is higher.

Supply and Demand Trading Strategy

In the supply and demand approach, the main focus is on identifying areas that previously experienced significant buying or selling pressure. These zones often mark the start of powerful upward or downward moves on the chart.Identifying Supply Zones:These zones typically appear at previous price peaks or locations where a severe drop occurred after price reached them. Traders generally look for short positions in these areas.

Identifying Demand Zones:These zones usually form major price floors, where buyers previously entered the market with strength and pushed the price upward.

Risk Management:When trading within a supply or demand zone, the stop loss is placed just above or below that zone so that losses remain contained if the level is breached. This keeps overall position risk at a manageable level.

Mean Reversion Strategy with Combined Indicators

Mean reversion strategies operate on the assumption that if the price deviates too far from its average or usual volatility channel, it will eventually return to its equilibrium range.Bollinger Bands:If candlesticks move beyond the upper band, the market might be in an overbought zone and may correct; conversely, touching or crossing the lower band can signal oversold conditions.

Momentum Indicators:Relative Strength Index (RSI) or Stochastic can confirm signals; for instance, an RSI above 70 signals overbought, and below 30 signals oversold.

Setting a Stop Loss:Though this strategy anticipates a return to the mean, sharp market movements can keep the price in overbought or oversold territory for extended periods. Consequently, having a definitive stop loss in place is crucial.

Breakout Trading Strategy

In this method, the trader identifies levels that, if broken, are expected to drive a strong price movement in the direction of the breakout.Confirming the Breakout with Volume:If trading volume surges alongside the price breaking a significant level, the breakout is more likely to be valid.

Pullback:After a breakout, price often briefly retraces (pullback) to the vicinity of the broken level. Seasoned traders use this pullback to re-enter the market and adjust their stop loss.

Entry Timing:Entering too early, before confirming a breakout, can result in false breakouts (fake outs). Conversely, entering too late may mean missing out on much of the profitable move. Hence, selecting an optimal entry point is paramount.

Advanced Scalping Strategy

Scalping is an extremely fast-paced trading style in which the trader aims to profit from small price moves in lower time frames (1-minute, 5-minute, or 15-minute charts).Choosing the Right Time Frame and Tools:Scalpers typically rely on very short-term charts and use indicators such as short-term moving averages to spot ultra-short-term trends.

Strict Risk Management:Due to the high frequency of trades, any miscalculation in risk or stop loss setting can trigger consecutive losses. Setting small stop losses and maintaining a rational risk-to-reward ratio are key aspects of scalping.

Attention to Trader Psychology:Scalping requires composure, rapid decision-making, and emotional control. High stress levels and hastiness in exiting and re-entering trades can wipe out all profits.

Algorithmic Trading and Trading Robots

With advancements in technology and the emergence of AI-based tools, algorithmic approaches have gained more prominence in Forex trading.Design and Programming:To develop a trading robot, one must be proficient in programming languages associated with trading platforms (such as MQL4, MQL5, Python, or R). Creating the algorithm, selecting key variables, and setting entry/exit parameters all take place in this phase.

Backtesting and Forward Testing:Before deploying a robot on a live account, traders assess its performance using historical market data (backtesting). Subsequently, they evaluate it under current market conditions on a demo account or with minimal capital in a live account (forward testing).

Risk Control and Money Management:Even the best trading robots can quickly deplete capital if risk management rules are ignored. Setting stop losses, daily loss limits, and restricting trade sizes are crucial elements of algorithmic trading.

In conclusion, these advanced approaches give Forex traders a broader perspective on price action, recurring patterns, and various factors that influence market movements. Combining sound technical analysis, fundamental knowledge, strict money management principles, and a solid grasp of trading psychology can pave the way for sustained success in a market as vast and dynamic as Forex.

Risk and Capital Management: The Key to Success in Advanced Strategies

Regardless of the type of strategy, no trader can achieve long-term success without proper risk and capital management.Some key points in this regard are:

Appropriate R/R: The risk-to-reward (R/R) ratio must be acceptable; in other words, before entering a trade, you should know how much profit you stand to gain if successful and how much loss you would bear if unsuccessful.

1–2% Rule: Many professional traders recommend not risking more than 1–2% of your total capital on any single trade.

Portfolio Diversification: Diversifying across different currencies and currency pairs can prevent concentrating risk in a single pair or a single position.

The Best Advanced Forex Trading Strategy in 2024

In 2024, numerous analysts and reputable financial institutions reported that the “Hybrid Price Action and AI-based Order Flow Analysis Strategy” was recognized as one of the most successful and high-yield approaches in the Forex market. This strategy consists of two primary components:

Advanced Price Action

In this section, the trader analyzes pure price movement based on candlestick behavior and key support and resistance levels. Identifying specific patterns such as Engulfing, Pin Bar, or valid Breakouts of trendlines and range levels is crucial for pinpointing entry and exit points.

The main advantage of this method is the high accuracy of signals and the ability to react quickly to real-time market changes.

By focusing on the price movement itself, the trader relies less on lagging indicators and can enter profitable positions more rapidly.

AI-based Order Flow Analysis

Order flow analysis involves examining actual buying and selling volumes, the orders placed in the Order Book, and the behavior of major market players. In 2024, with enhanced computational power and the development of AI algorithms, combining this data with price action has proven highly effective.

AI, by assessing vast amounts of real-time and historical data, more accurately identifies liquidity levels and potential price reversal points.

Another advantage of using AI is targeted risk management; that is, as soon as the robot or algorithm detects signs of a shift in order flow or extreme volatility, it can move the stop loss or close the position.

Why Did This Strategy Succeed?

The Combination of Human Decision-Making and Algorithmic Precision:The trader leverages price action knowledge and candlestick patterns to identify key levels, while AI analyzes vast amounts of order data and price fluctuations in real time.

Reduced Delays in Entering and Exiting Trades:Order flow data and real-time AI analysis minimize errors in identifying breakouts or false reversals, offering more accurate entry and exit points.

Rapid Response to News and Events:In 2024, with more frequent economic releases and traders being highly sensitive to sudden news, having an intelligent system that reacts immediately after news is published provides a competitive advantage.

Despite all these benefits, it should be noted that without proper risk management and sufficient mastery of technical analysis and AI tools, this strategy may not yield the desired outcome. Ultimately, merging human expertise with the computational power of smart algorithms was the main key to the success of this advanced approach in 2024.

Advantages and Disadvantages of Advanced Forex Trading Strategies

Employing advanced strategies in Forex trading involves both advantages and disadvantages. Being aware of these can help traders make the right choices and maximize efficiency. Below are some of the most important pros and cons:

Advantages ✔

Higher Accuracy in Trades Using more complex tools and patterns (such as harmonic patterns, supply and demand zones, and trading robots) allows for more precise selection of entry and exit points.

Better identification of trading opportunities and avoiding false signals increase the likelihood of success.Effective Risk Control Advanced strategies typically include various risk management techniques such as hedging, precise stop-loss placement, and trailing stops.

Relying on more detailed analyses can prevent sudden losses and facilitate steady profitability.Rapid Response to Market Changes The Forex market is highly dynamic and volatile, and advanced strategies enable traders to respond more swiftly to sudden changes through predefined mechanisms.

Accurate recognition of price patterns and advanced candlestick patterns makes it possible to forecast short-term and long-term trends.Use of Automated and Algorithmic Tools Many advanced strategies utilize trading robots and AI-based algorithms that enhance speed and precision in trades.

Traders can leverage continuous, 24-hour robot-driven analysis, freeing up time to focus on improving and refining their overall investment approach.

Disadvantages ❌

Complexity and Need for Specialized Knowledge Implementing advanced strategies successfully requires mastery of technical, fundamental, and specialized concepts. This complexity can be a deterrent for novice traders.

Failing to fully grasp the rules and foundations of a strategy may lead to unexpected losses or poor performance.Higher Costs Many advanced tools (such as specialized trading robots and professional analytical software) require monthly subscription fees or a substantial initial investment.

Additionally, using expert consultants or professional programmers to develop algorithmic systems can result in extra financial burdens.Possibility of Increased Trading Volume and Commission Fees Advanced strategies often lead to a higher number of trades, causing traders to pay more in broker commissions or spreads.

If the strategy fails or results in unprofitable trades, these costs can significantly reduce overall profit margins.Risk of Relying on Automated Systems In algorithmic trading or the use of trading robots, if the robot or trading system is not properly designed, tested, or maintained, it can lead to severe losses.

Excessive dependence on automated analysis can also weaken the trader’s manual decision-making skills, preventing timely interventions in critical situations.

In summary, advanced Forex strategies can increase profitability and reduce risk when applied correctly; however, one must factor in potential costs, the specialized knowledge required, and the inherent risks of each method. Ultimately, the key is for each trader to choose a trading style aligned with their goals and level of risk tolerance, while being fully aware of all the associated considerations.Best Forex Strategies for 2025

The Forex market in 2025 continues to offer dynamic opportunities for profitability. To succeed, using up-to-date and effective strategies is essential. Below are some of the top strategies:Trend Trading Strategy

Description:Identifying and following upward or downward trends using tools like moving averages.

Advantages:Simple and suitable for beginners.

Tip:Confirm the trend with indicators like MACD.

Breakout Trading Strategy

Description:Trading when the price breaks through support or resistance levels.

Advantages:Identifies major market movements.

Tip:Confirm breakouts with trading volume to avoid false breakouts.

Swing Trading Strategy

Description:Capitalizing on mid-term price swings using technical analysis.

Advantages:Ideal for traders with limited time.

Tip:Use Bollinger Bands to identify market volatility.

Scalping Strategy

Description:Quick entry and exit to capture small profits in the short term.

Advantages:Fast profit potential.

Tip:Best suited for currency pairs with high liquidity and low spreads.

News Trading Strategy

Description:Leveraging economic news to predict market movements.

Advantages:High profit potential in a short time.

Tip:Mitigate risk by setting stop-loss orders.