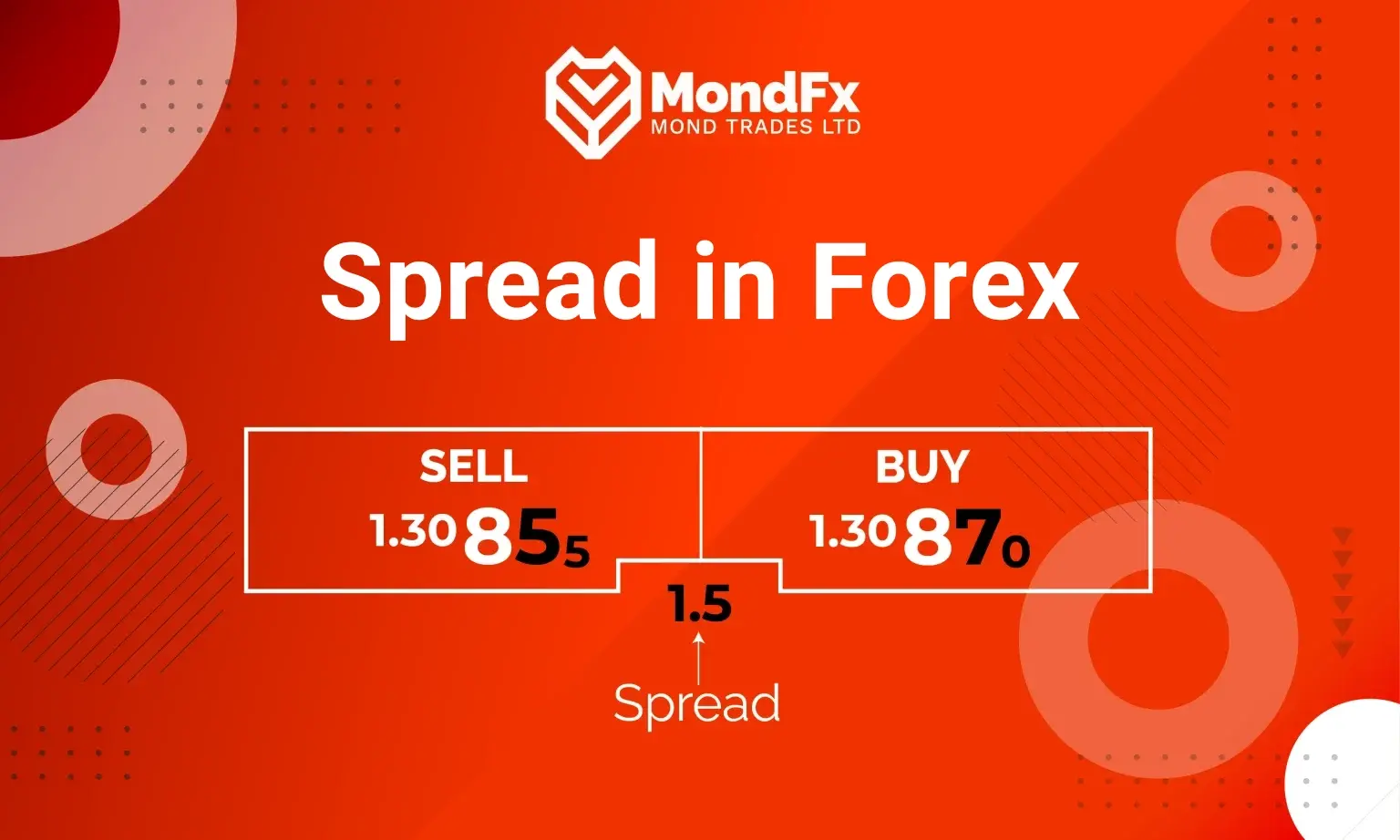

The Forex spread is a type of cost or fee that arises from the difference between the bid price (the highest price a buyer is willing to pay) and the ask price (the lowest price a seller is willing to accept) of a currency.

In simple terms, the spread represents the price gap between the highest bid and the lowest ask in a financial market.

While this concept is consistent across all financial markets, the amount of the spread can vary depending on market conditions.

To better understand, imagine you’re selling a house for $100,000. After advertising it, potential buyers make offers, which are typically lower than your asking price. The difference between your asking price and the buyer’s offer is what we call the spread.

Why is the Spread Important in Forex?

The spread in Forex offers several benefits and plays a crucial role in trading. Here are some of the key reasons why it matters:

1. Reducing Risk and Protecting Capital

One major advantage of understanding the spread is that it helps reduce trading risks. Lower risks mean better protection of your capital, which in turn enhances your trading performance.

2. Accurate Market Analysis

The spread allows traders to analyze the market more precisely. Narrower spreads provide clearer insights into market conditions, enabling better decision-making and ultimately leading to higher profitability.

3. Faster Trade Execution

When spreads are tighter, you can enter the next trade more quickly. This agility helps you stay more active in the market and seize opportunities as they arise.

How is Spread Measured?

In the Forex market, the spread is typically calculated based on the difference between the bid and ask prices of a currency pair. For example, if the ask price of USD/CAD is 1.33541 and the bid price is 1.33529, the spread is calculated as follows:

Pip in Forex

A Pip in the Forex market is the smallest unit used to measure price changes in a currency pair and is the fundamental concept for understanding profit and loss in Forex trading. The term “Pip” stands for Percentage in Point and is usually equal to 0.0001 (the fourth decimal place) for most currency pairs. For example, if the price of EUR/USD changes from 1.1050 to 1.1051, this change equals 1 pip.

What is a Lot?

A Lot is a standard unit of measure for determining the volume of a trade. It specifies the amount of a currency pair you are buying or selling in a transaction.

The four main types of lot sizes are:

Standard Lot: Equal to 100,000 units of the base currency. Ideal for professional traders or large accounts.

Mini Lot: Equal to 10,000 units of the base currency. Suitable for intermediate traders.

Micro Lot: Equal to 1,000 units of the base currency. Perfect for beginners or those aiming to manage lower risks.

Nano Lot: Equal to 100 units of the base currency. Designed for smaller accounts or strategy testing.

For example, if you trade 1 Standard Lot of EUR/USD, a 10 pip price movement will result in a $100 profit or loss. However, if you trade a Mini Lot, the same 10-pip movement will affect your account by only $10.

Spread Calculation Formula

The spread in Forex is calculated as the difference between the Ask Price (Selling Price) and the Bid Price (Buying Price):

Spread=Ask Price−Bid Price

Example:

Ask Price: 1.2051

Bid Price: 1.2050

Spread=1.2051−1.2050=0.0001

To calculate the cost of the spread for a trade, multiply the spread by the trade volume (lot size). For example:

If the spread is 2 pips and the trade volume is 1 Standard Lot (100,000 units):

0.0002×100,000=20USD

How to Manage Spread Costs in Trading?

Managing and optimizing the Spread in financial markets, including the Forex market, is crucial for traders aiming to reduce costs and maximize profits. By applying effective strategies, investors can significantly cut trading expenses and enhance their returns.

Here are some of the most effective ways to manage spread costs:

1. Choose Currency Pairs with Low Spreads

The first and most important strategy is selecting currency pairs with low spreads. By focusing on pairs with tighter spreads, traders can reduce costs significantly and boost their trading profitability.

2. Trade During Optimal Times

Spread levels fluctuate depending on market activity. Trading during periods when spreads are at their lowest helps traders avoid unnecessary expenses and increases overall profitability.

3. Use Leverage Carefully

Leverage is a powerful tool for increasing trade volume, but it should be used cautiously. Proper leverage management allows traders to maximize their capital efficiency while minimizing potential risks, leading to higher net returns.

4. Implement Suitable Trading Strategies

Applying well-thought-out trading strategies can directly reduce spread costs. These strategies help avoid unnecessary trades, minimize expenses, and increase profit margins.

5. Compare and Choose the Right Broker

One of the best ways to manage spread costs is by comparing brokers’ spread offerings and services. Opting for a broker with competitive spreads ensures reduced trading expenses and a better overall experience.

Types of Spreads in Forex

Spreads in Forex can be classified into two main types:

1. Fixed Spread

A Fixed Spread remains constant regardless of market conditions. Even during periods of high volatility or sudden price changes, the spread does not fluctuate and stays consistent, providing traders with predictable costs.

2. Variable Spread

A Variable Spread does not have a fixed value and changes depending on market supply and demand. Any market volatility or sudden movements can cause the spread to widen or narrow, making it directly tied to real-time market conditions.

Difference Between Spread and Commission

| Comparison Factor | Spread | Commission |

|---|---|---|

| definition | The difference between the bid and ask prices in a trade | A separate fee paid to the broker for executing the trade |

| Type of Cost | Applied directly within the trade prices | Charged separately, usually based on trade volume |

| Primary Usage | Commonly found in standard and regular accounts | Predominantly used in professional and ECN accounts |

| Cost Transparency | May appear less transparent initially | Fully transparent with a fixed amount or percentage |

Factors Influencing Spread in Forex

Some of the key factors affecting spread fluctuations in the Forex market include:

Market Conditions

The overall market situation, including price dispersion, trading volume, liquidity levels, and major news releases, has a significant impact on spreads. During unfavorable or volatile market conditions, spreads typically widen, increasing trading costs.

Time

Spreads tend to narrow when the market is more active, and trading volume is high. However, during quieter market hours, especially with low trading volume, spreads often widen.

Economic Conditions

Economic factors such as inflation rates, economic growth, interest rate changes, and monetary policies directly influence spreads. Additionally, major economic news and events can lead to increased spread volatility.

Market Behavior

The behavior of traders and the overall market volatility also affect spreads. In highly volatile conditions, spreads tend to widen due to greater uncertainty and risk.

Spread Indicator for Meta Trader 4 and 5

Meta Trader offers several indicators for calculating and displaying the spread, allowing you to view the actual spread in real-time without needing manual calculations. To use the spread indicator, follow these steps:

1. Open Meta Trader

Launch the Meta Trader software and select the View option from the top menu.

2. Access Indicators

Go to the Terminal option, which opens a panel at the bottom of the screen.

3. Find the Indicator

In the Terminal panel, click on Code Base to view a list of available indicators.

4. Download the Indicator

Locate the desired spread indicator and click on the Download button.

5. Configure and Apply

Once downloaded, adjust the indicator settings and click Ok to apply it to your chart.

6. View the Spread

You can now monitor the spread live and in real time directly on your chart.