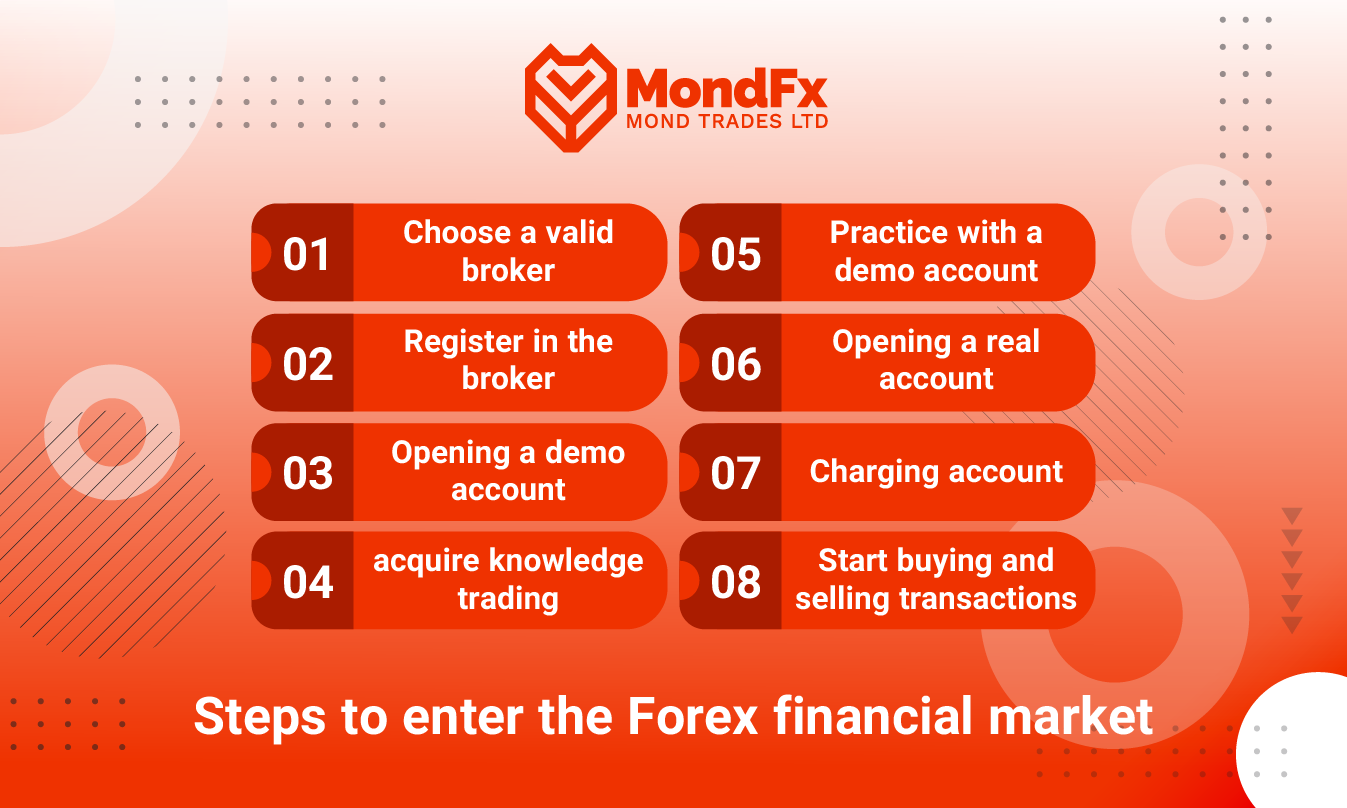

Steps to Enter the Forex Financial Market

Entering the Forex financial market requires careful planning, continuous education, and selecting the right tools. Below, we outline the key steps for successfully entering the Forex market:1. First Step to Entering Forex: Choosing the Right Broker

One of the most critical steps in entering the Forex market is choosing a reliable broker. Brokers act as intermediaries that allow traders to execute trades in the market. Selecting a trusted and reputable broker can directly impact your success and the security of your investment.Key Factors in Choosing a Broker

Regulation and Credibility:Choose a broker that is regulated by recognized international authorities such as FCA, CySEC, or ASIC. These regulatory bodies ensure the broker adheres to financial transparency and security standards.Trading Platform:The broker's platform should have a user-friendly interface and offer advanced tools for technical and fundamental analysis. Popular platforms like Meta Trader 4 (MT4) and Meta Trader 5 (MT5) are widely preferred.Fees & Commissions:Trading costs include spread, commission, and swap fees. Choose a broker with competitive costs that does not have hidden fees.Customer Support:24/7 customer service in your preferred language is essential for resolving issues quickly. A broker with strong support services can help with technical problems and trading inquiries.Deposit and Withdrawal Methods:Ensure the broker supports easy and secure deposit/withdrawal methods. For Iranian traders, brokers that offer local currency transactions are more convenient.Why Choosing the Right Broker Matters?A broker acts as a bridge between traders and the market. Choosing an unreliable broker can lead to loss of capital, poor user experience, or financial restrictions. Conducting thorough research on broker reputation and services reduces risks and ensures a secure trading experience.2. Second Step to Success: Registering with a Broker

After selecting a trusted broker, the next step in entering the Forex market is account registration. This process is your first official interaction with the broker and directly impacts your trading experience and data security. Below are the steps to register with a broker:Steps to Register with a Broker

Vis the Broker’s Official Website:Start by navigating to the broker’s official website. Ensure that the website is legitimate and accessed from official sources.Create a Trading Account:On the homepage, look for options like "Register" or "Create a New Account" and click on it. You will be asked to fill out a registration form with details such as: Full Name; Email Address; Phone Number; Password Select an Account Type:Most brokers offer multiple trading account types, such as Standard, ECN, or Islamic Accounts. Choose the account that best suits your trading goals and budget.Identity Verification (KYC):Most regulated brokers require you to verify your identity to comply with international financial regulations. This process involves submitting a government issued ID (Passport, National ID, or Driver’s License) and Proof of address (Utility bill or bank statement)Activate Your Account and Access the Trading Platform:Once your registration is complete and documents are verified, your account will be activated. You can then log in to the trading platform and begin trading.Key Tips for Registration

Provide Accurate Information:Entering incorrect details can lead to issues during identity verification or withdrawal processes.Read the Terms & Conditions:Before completing registration, review the broker's policies and regulations to ensure you understand the terms.Ensure Security:Use a strong password and never share your login credentials with anyone.

A proper and precise registration process ensures a safe and successful trading experience in Forex. This step allows you to access trading platforms, deposit/withdraw funds, and start executing trades.3. Opening a Demo Account

Opening a demo account is one of the most crucial steps in entering the Forex market. A demo account allows traders to familiarize themselves with the trading platform without using real money. Traders can practice under real market conditions, experience price fluctuations, and use technical analysis tools.Advantages of a Demo Account

Hands On Training:Learn how to use trading tools and navigate the platform.Strategy Evaluation:Test trading strategies before implementing them in a real account.Risk Free Practice:Gain practical experience without putting real money at risk.4. Acquiring Trading Knowledge

Education is one of the key pillars of success in the Forex market. To become a successful trader, you must learn technical analysis, fundamental analysis, risk management, and trading psychology. There are various educational resources available to help you on this journey.Useful Educational Resources

Webinars & Online Courses:Learn trading techniques from market experts.Books & Articles:Understand both basic and advanced concepts.Broker Educational Platforms:Many brokers offer free educational resources.Why is Education Important?

Better Decision Making:Education helps you make more informed trading decisions.Risk Management:Gain a deeper understanding of capital management principles.Market Psychology Awareness:Avoid emotional trading mistakes.5. Practicing with a Demo Account

Continuous practice with a demo account allows you to test trading strategies in real market conditions. This step is crucial for identifying strengths and weaknesses in your strategies and improving trading skills.How to Get the Most Out of a Demo Account?

Risk Management Practice:Set stop loss and take-profit levels to observe their impact on your trades.Testing Different Strategies:Experiment with short term and long-term trading approaches.Analyzing Results:Evaluate performance and identify weaknesses for improvement.6. Opening a Real Trading Account

Once you gain enough experience with a demo account, you can open a real trading account with a broker. This step includes identity verification and selecting the appropriate trading account type.Steps to Open a Real Trading Account

Register with a Broker:Log into your account and select "Open a Real Account".Submit Identity Documents:Usually includes a passport or national ID copy and proof of address.Choose an Account Type:Brokers offer different types such as Standard, Mini, Micro, or ECN accounts.Key Considerations for Opening a Real Account

Review Account Terms:Ensure the account type matches your trading strategy.Broker Security:Choose a broker that guarantees data security.7. Funding Your Trading Account

After opening a real account, you must deposit funds. There are multiple funding methods, and the choice depends on your needs and the broker's available options.Common Deposit Methods

Bank Transfer:Ideal for large transactions.Credit & Debit Cards:Fast and easy for smaller deposits.E-Wallets:Options like Skrill, Neteller, or PayPal.Local Currency Deposits:A convenient option for Iranian traders.Key Considerations When Depositing Funds

Fees & Charges:Some methods may have transaction fees.Processing Time:Ensure your chosen method is fast and efficient.Transaction Security:Use secure and verified payment methods.8. Starting Live Trading: Entering the Real Forex Market

Once your account is funded, you can begin live trading. At this stage, you must follow risk management principles and execute your trading strategies effectively.Essential Tips for Starting Live Trading

Market Analysis:Use technical and fundamental analysis tools to forecast market movements.Risk Management:Never risk more than 2-3% of your capital in a single trade.Emotional Control:Avoid emotional decisions and stick to your strategy.Essential Trading Tools

Stop Loss & Take Profit:Tools for risk and profit management.Economic Calendar:Stay updated with market news and events.Trading Platforms:Use Meta Trader 4 (MT4) or Meta Trader 5 (MT5) for execution.Trading and Entering the Forex Market is Suitable for whom?

To Enter and Succeed in Trading, Individuals Should Have the Following Characteristics:1. Individuals Who Have Enough Time for Trading

Forex trading requires time and continuous attention to market fluctuations. Those who can dedicate sufficient time to analyzing the market, following economic news, and executing trades consistently can take better advantage of this market.2. Highly Motivated and Disciplined Individuals

Forex trading demands strict discipline and adherence to trading strategies. People who possess high motivation, the ability to follow trading plans, and control over their emotions can achieve success in this market.3. Those Who Can Tolerate High Risk

Due to its high volatility, the Forex market carries significant risks. Individuals who can manage and tolerate risk and are prepared to protect their capital in case of potential losses can perform well in this market.4. Having Financial and Economic Knowledge

People with a strong foundation in finance, economics, and market analysis can make the most of opportunities in the Forex market. This knowledge helps them make precise trading decisions and effectively manage trading risks.5. Individuals Who Are Interested in Continuous Learning

The Forex market is constantly evolving. Those who have a strong desire for continuous learning, updating their trading knowledge, and adapting to new market conditions can achieve greater success in this field.

6. People Interested in Technical and Fundamental Analysis

Technical and fundamental analysis are essential tools in Forex trading. Individuals who enjoy analyzing charts, using technical indicators, and evaluating economic factors can utilize these tools to make more accurate trading decisions.Advantages and Disadvantages of Entering the Forex Market

Before entering the Forex market, it is essential to consider both its advantages and disadvantages:Advantages

1. Low Trading Costs

Compared to other financial markets, trading costs in Forex are generally lower. Tighter spreads and lower commissions allow traders to execute more trades and increase profitability.2. 24/7 Access to Forex

Forex is a global market that operates 24 hours a day. This flexibility enables traders to execute trades at any time that suits their schedule and take advantage of different market opportunities.3. Access to Advanced Analytical Tools

The Forex market provides traders with advanced analytical tools, including technical charts and various indicators. These resources help traders make more accurate trading decisions and analyze market trends effectively.4. High Volatility and Profitable Opportunities

Due to its high price volatility, the Forex market offers numerous profit making opportunities. Traders who conduct precise market analysis can benefit from currency rate fluctuations and generate substantial returns.5. Flexibility in Trade Volume

The Forex market allows traders to enter with various trade sizes. This flexibility enables both beginners and professionals to trade according to their financial capacity and manage associated risks effectively.Disadvantages

1. High Competition

Forex is an extremely competitive market, where experienced professional traders use advanced strategies. This intense competition can be challenging for beginners, requiring continuous effort to improve skills and knowledge.2. Psychological Factors Affect Trading Decisions

Psychological factors such as fear and greed can significantly impact trading decisions, leading to financial mistakes. Emotional control and trading discipline are crucial to avoid impulsive decisions.3. High Risk of Financial Losses

Due to severe price fluctuations, the Forex market carries significant risks. Poor risk management can result in substantial financial losses, potentially endangering initial capital.4. Legal and Security Risks

Choosing an unregulated or unreliable broker can lead to legal and security issues. Some brokers may lack proper licensing, putting traders' capital at risk. Selecting a regulated and trustworthy broker is crucial to ensure fund security.5. Requires Extensive Knowledge and Experience

Success in Forex demands in-depth knowledge of market analysis, risk management, and trading psychology. Without proper expertise and experience, the likelihood of sustained profitability decreases, increasing the risk of financial losses.