Most Important Forex News

Understanding and correctly analyzing forex market news can play a decisive role in a trader’s success or failure. In this section, we will review the most important and influential forex news that every professional trader should be aware of. This information helps you make better trading decisions and take advantage of market opportunities.

1. Central Bank Decisions

Central banks such as the Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of Japan (BOJ) play a crucial role in determining currency trends. Their decisions regarding interest rates, monetary policies, and financial easing programs can create significant volatility in the forex market.

| Indicator | Explanation | Example |

|---|---|---|

| Interest Rate | Changes in interest rates by central banks directly affect the value of the national currency. Typically, an interest rate hike strengthens the currency as investors seek higher returns. | An announcement of an interest rate hike by the European Central Bank (ECB) can strengthen the Euro against the US Dollar. |

| Monetary Policies | Expansionary or contractionary monetary policies by central banks influence liquidity in the market and affect exchange rates. | An announcement of contractionary policies by the European Central Bank (ECB) can strengthen the Euro. |

2. Macroeconomic Reports

Economic reports such as unemployment rates, Gross Domestic Product (GDP), inflation (CPI), and the industrial production index are key data that indicate the economic health of a country. These reports can significantly influence market direction.

| Indicator | Explanation | Example |

|---|---|---|

| Unemployment Rate | A rising unemployment rate is usually a sign of economic weakness and can devalue the national currency. | – |

| Inflation (CPI) | High inflation may lead to an interest rate hike, which can ultimately strengthen the currency. | A report of an unexpected increase in US GDP can strengthen the Dollar in the forex market. |

3. Geopolitical News and Global Events

Geopolitical news plays a significant role in economic and investment decisions, as the political conditions of any country can directly impact currency prices, commodities, oil, and global financial markets.

For instance, political crises, wars, or sanctions can lead to changes in exchange rates, increases or decreases in oil prices, and shifts in investment flows.

| Indicator | Explanation | Example |

|---|---|---|

| International Crises | Political and military crises can trigger capital flight to safer currencies like the US Dollar or Euro. | A trade crisis between the United States and China can strengthen the US Dollar against the Chinese Yuan. |

| Elections | Election results can alter a country’s economic and financial policies, thereby affecting exchange rates. | – |

4. Financial Market Indices

Stock indices, oil prices, and other essential commodities directly or indirectly influence currency exchange rates. Fluctuations in oil prices, in particular, affect the currencies of oil exporting countries such as the Canadian dollar (CAD) and the Russian ruble (RUB).

| Indicator | Explanation | Example |

|---|---|---|

| Stock Market Indices | Growth in stock market indices can lead to increased investments and strengthen the national currency. | A rise in BP’s stock price can strengthen the Canadian Dollar. |

| Oil Prices | Rising oil prices typically boost the value of currencies from oil-exporting countries. | – |

5. Trade Balance and Balance of Trade

A country’s trade balance, which shows the difference between its exports and imports, also affects exchange rates. A positive trade balance typically strengthens the national currency and vice versa.

| Indicator | Explanation | Example |

|---|---|---|

| Trade Balance | A positive trade balance indicates economic strength and higher demand for the national currency. | A report of increased exports from Japan can strengthen the Japanese Yen against the US Dollar. |

| Exports and Imports | Higher exports relative to imports can increase demand for the national currency, strengthening its value. | – |

6. Fiscal and Budgetary Policies

Decisions related to fiscal and budgetary policies, such as tax changes, government spending, and economic incentive programs, can influence the demand and supply of currencies.

| Indicator | Explanation | Example |

|---|---|---|

| Economic Stimulus Programs | These programs can support economic growth and boost investor confidence. | An announcement of an economic stimulus program by the UK government can strengthen the British Pound. |

| Taxes and Government Spending | Lower taxes can increase domestic investments and strengthen the value of the national currency. | – |

7. Confidence Indicators and Market Expectations

Consumer and business confidence indicators reflect the market’s expectations regarding the economic future. These indicators can have psychological effects on the market and cause short term fluctuations in exchange rates.

| Indicator | Explanation | Example |

|---|---|---|

| Business Confidence Index | High business confidence can lead to increased investments and strengthen the national currency. | An increase in Canada’s Consumer Confidence Index can strengthen the Canadian Dollar. |

| Consumer Confidence Index | A rise in this index indicates greater confidence in the economy and potential growth, which can strengthen the national currency. | – |

Forex News Analysis

News analysis in the Forex market is considered one of the vital tools for professional traders. This analysis helps traders identify the fundamental factors affecting the market and make more informed trading decisions.

News analysis in the Forex market is considered one of the vital tools for professional traders. This analysis helps traders identify the fundamental factors affecting the market and make more informed trading decisions.

The importance of news analysis on the Forex market includes:

-

Predicting Market Volatility

By accurately analyzing news, traders can predict potential market fluctuations and take advantage of profitable opportunities. These predictions enable traders to identify the appropriate times to enter and exit trades and optimize their trading strategies.

-

Risk Management

Through precise news analysis, traders can manage the risks associated with their trades more effectively. By understanding the impact of news on the market, traders can make the best use of risk management tools such as Stop Loss and Take Profit orders and prevent potential losses.

-

Quick and Accurate Decision Making

In conditions where the Forex market is rapidly changing, news analysis can help traders react quickly. This ability to swiftly respond to market changes can make the difference between profit and loss for traders and allow them to make appropriate trading decisions in the moment.

Types of Economic News

In this article, we provide a comprehensive overview of the various types of economic news that every professional trader should be aware of to make optimal trading decisions:

| Indicator | Explanation | Impact on Forex | Example |

|---|---|---|---|

| 1. GDP Reports | GDP reflects the total production of goods and services in a country. An increase in GDP indicates strong economic growth, which can strengthen the national currency. | Higher GDP signifies economic growth, potentially leading to higher interest rates and a stronger currency. | An unexpected rise in US GDP can strengthen the US Dollar against other currencies. |

| 2. Unemployment Rate | The unemployment rate is the percentage of people actively seeking jobs but unable to find one. It is a key measure of economic health. | A rising unemployment rate indicates economic weakness, potentially devaluing the currency. Falling unemployment suggests economic improvement. | A rise in unemployment in the European Union can weaken the Euro against the US Dollar. |

| 3. Inflation (CPI) | The Consumer Price Index (CPI) measures changes in the price of a basket of consumer goods. High inflation may lead to higher interest rates. | High inflation may prompt central banks to raise interest rates, strengthening the currency. However, excessive inflation can cause economic concerns and devalue the currency. | Increased inflation in the UK can strengthen the British Pound as the central bank may raise rates. |

| 4. Industrial Production Index | Measures the output of industrial sectors and factories, reflecting economic health. | A rising industrial production index indicates economic growth and increased demand for the national currency, strengthening it. | A rise in Japan’s industrial production index can strengthen the Japanese Yen against the US Dollar. |

| 5. Trade Balance | The trade balance shows the difference between a country’s exports and imports. A positive balance indicates higher exports. | A positive trade balance typically strengthens the currency, as demand for the national currency increases for purchasing exported goods. | An increase in German exports can strengthen the Euro. |

| 6. Retail Sales Figures | This indicator measures retail sales and reflects consumer demand. | Higher retail sales indicate economic improvement and can strengthen the national currency. | Increased retail sales in the US can strengthen the US Dollar. |

| 7. Consumer and Business Confidence Indices | These indices measure consumer and business optimism about the economy. | Higher confidence levels usually indicate economic improvement and currency strengthening, while lower confidence can weaken the currency. | A rise in Canada’s consumer confidence index can strengthen the Canadian Dollar. |

| 8. Central Bank Decisions | Central bank decisions on interest rates and monetary policies significantly impact currencies. | Higher interest rates generally strengthen the national currency, while lower rates may weaken it. | A Fed announcement to raise interest rates can strengthen the US Dollar. |

| 9. Corporate Earnings Reports | Corporate earnings reports, especially from major companies, can significantly influence currencies. | Positive earnings reports may increase investments and strengthen the currency, while negative reports can reduce confidence and devalue the currency. | Positive earnings reports from major US tech companies can strengthen the US Dollar. |

When Are Important Forex News Releases Published?

This section reviews the timing of important Forex news releases and how to make optimal use of this information:

1. Main Working Hours of Economic Markets

Economic news is typically released during the working hours of each country. Understanding these specific times allows traders to be present during critical market moments and benefit from potential volatility.

United States

Many important economic reports, such as GDP data, unemployment rates, and the Consumer Price Index (CPI), are typically released early in the morning, between 8:30 AM and 10:00 AM local time in the US.

Europe

Economic news from Europe, including decisions from the European Central Bank (ECB) and reports from Germany and France, are generally announced between 10:00 AM and 12:00 PM local time in Europe.

Japan

Japan’s economic reports, such as the industrial production index and unemployment rates, are typically released early in the morning, between 8:00 AM and 9:00 AM local time in Japan.

2. Days of Economic News Releases

Most economic news is released on weekdays (Monday to Friday). Public holidays in any country may lead to the cancellation or rescheduling of news releases.

Monthly Reports

Many economic reports are published monthly. For example, unemployment reports, GDP data, and inflation reports are usually released during the first or second week of each month.

Quarterly and Annual Reports

Some of the more important news, such as quarterly earnings reports of companies or annual economic analyses, are published at specific times of the year.

3. Using the Forex Economic Calendar

Features of the Economic Calendar

It includes the date and time of news releases, the expected impact level of the news (high, medium, low), and analysts’ forecasts.

Trading Platforms

Many trading platforms, such as Meta Trader and Trading View, feature an integrated economic calendar that is easy to use and accessible.

4. Geopolitical News and Unpredictable Events

Some economic and financial news, due to the unpredictable nature of geopolitical events, may be released at any time. These events include elections, trade agreements, and international crises.

Market’s Quick Response

Such news often leads to rapid market reactions, and traders must be fully prepared to manage the risks associated with sharp volatility.

Using News Tools

Accessing credible news agencies and utilizing fast news platforms can help traders respond quickly to breaking news.

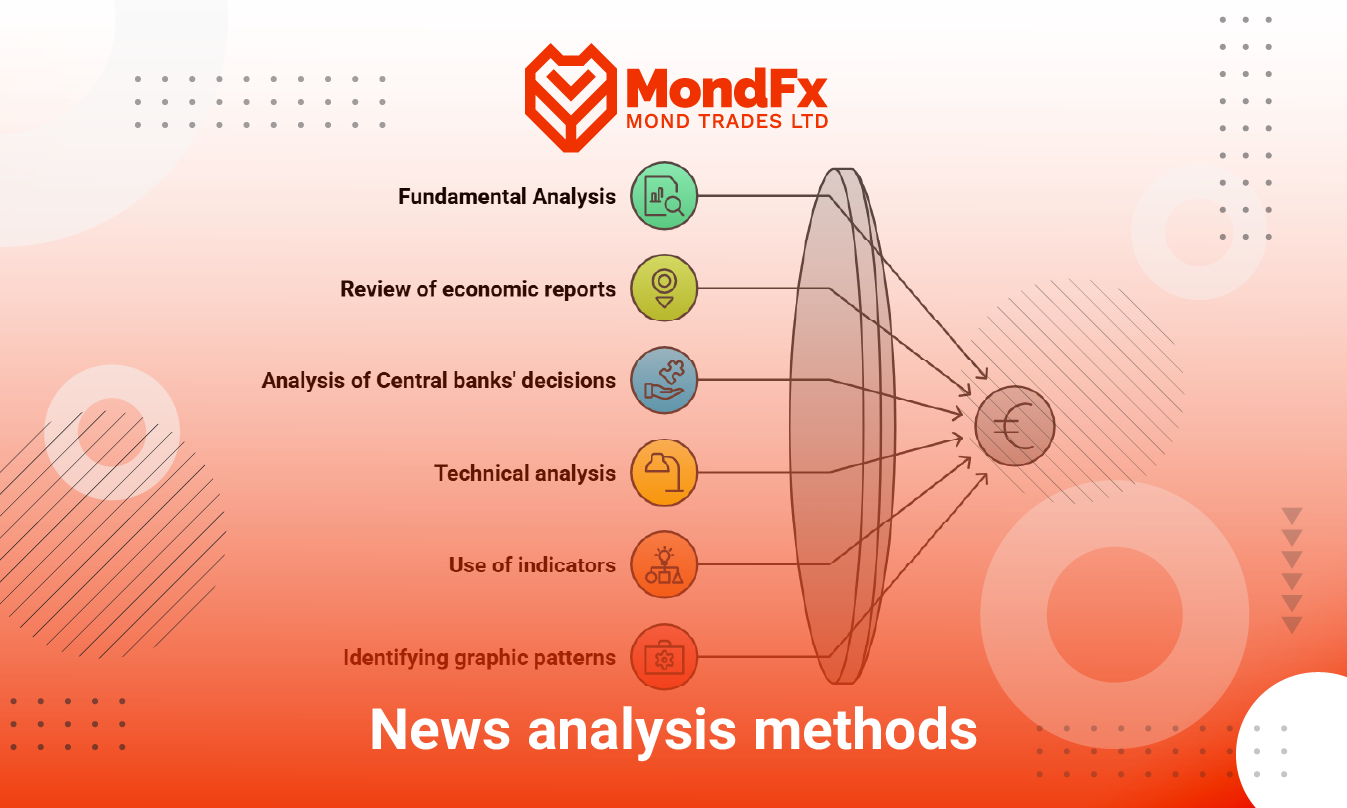

Methods of Forex News Analysis

Forex news analysis is based on the following methods:

Forex news analysis is based on the following methods:

| Topic | Explanation |

|---|---|

| Fundamental Analysis | Fundamental analysis examines economic, financial, and political factors that can influence currency exchange rates. |

| Review of Economic Reports | Careful study of economic reports such as GDP, inflation, and unemployment helps traders identify economic trends and predict their impact on the forex market. |

| Analysis of Central Bank Decisions | Evaluating central bank decisions on monetary policies and interest rates can significantly impact currency values. These decisions often lead to substantial market volatility. |

| Technical Analysis | Technical analysis involves studying price charts and using technical tools like indicators and chart patterns to identify optimal entry and exit points and refine trading strategies. |

| Using Indicators | Indicators such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands help traders analyze market trends and predict potential changes. |

| Identifying Chart Patterns | Chart patterns like head and shoulders, triangles, and flags indicate potential market trend changes and assist traders in making trading decisions. |