The Importance of News in the Forex Market: News serves as a primary driver of currency price fluctuations.

Two General Categories of News:

- Economic News

- Economic reports: unemployment rate, inflation, GDP, etc.

- Interest rate decisions: made by central banks.

- Geopolitical events: elections, wars, etc.

- Political News

- Political stability and instability.

- Relations between countries.

- Trade policies.

News Analysis:

- The Importance of the News Source: Credibility and track record of the source.

- The Impact of the News: Intensity and scope of the news.

- Content Analysis: Proper understanding of the news message.

Trading Strategies:

- Trading with News: Using news to enter and exit trades.

- Trading Against the News: Taking advantage of volatility caused by news.

- Using Technical Indicators: Along with news analysis.

- The Impact of News on the Forex Market

The Forex market, as the foreign exchange market and the largest financial market in the world, conducts an immense volume of transactions daily, with trading volumes exceeding 6 trillion dollars. In this market, in addition to the levels of buying and selling and the percentages of supply and demand, exchange rates fluctuate based on various factors, including geographical, political, and economic elements.

One of the most significant factors that constantly transforms this market is news; therefore, keeping track of and following news is essential and important for all Forex traders.

The Importance of News in the Forex Market

Every day, various events and incidents occur both nationally and internationally, and the news published about them has a direct impact on the Forex market. News is important for many reasons, some of the most significant include:

Impact on Supply and Demand

News, whether economic or political, can significantly affect the levels of supply and demand and lead to changes in prices.

Impact on Confidence and Credibility

News has a considerable impact on the confidence and credibility of a country. Positive news can have beneficial effects, while negative news can adversely affect the country’s economy.

Impact on Traders’ Decision-Making

Another effect of news is the potential change in traders’ opinions. The release of news can lead to spontaneous and sudden decisions among traders.

Impact on Technical Analysis

News directly affects traders’ analyses and can cause fluctuations in the final prices of currencies.

Impact on Interest Rates

Finally, news also influences currency interest rates and can intensify price movements, leading to sudden increases or decreases in prices.

News as the Primary Driver of Currency Price Fluctuations

This factor is recognized as one of the most important drivers of currency price fluctuations in the Forex market. News related to the economy, global conditions, politics, and other factors can have a significant impact on currency rates. Important news can strengthen or weaken one currency against another. The two main categories of news that directly affect currency price fluctuations are:

- Economic News

- Political News

Types of Economic News

- Economic information and news, including unemployment rates, economic growth, industrial production, and even retail sales, are among the news that impact currency prices. It is important to note that the nature of the information is also crucial.

- For example, if positive economic information and news are available, it will likely lead to an increase in currency prices. Conversely, if negative information regarding the mentioned factors is available, it will result in a decline in currency rates.

Types of economic news include:

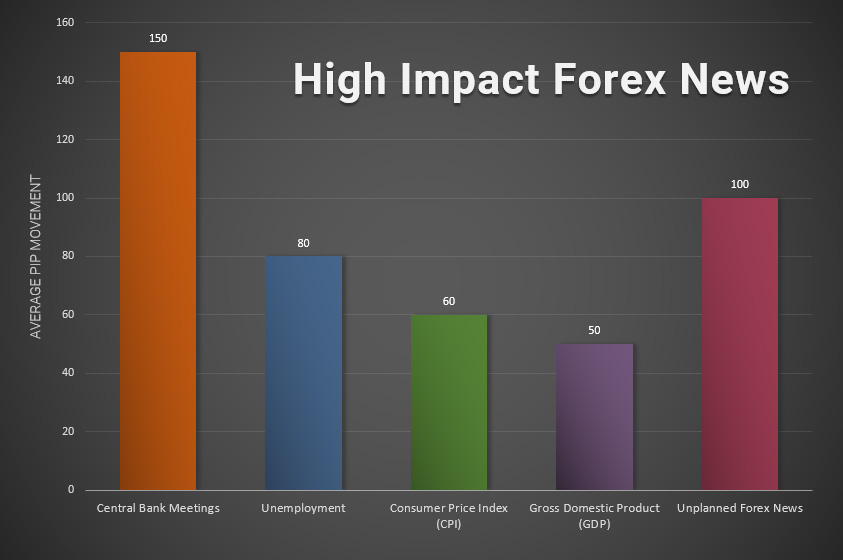

Economic Reports: Announcements of economic indicators such as unemployment rates, economic growth, industrial production, imports, and exports directly influence currency prices.

Interest Rate Decisions

Changes in interest rates, alterations in monetary policies, and decisions regarding inflation made and reported by central banks can directly transform currency prices.

Geopolitical Events

News related to trade, agreements, sanctions, and relevant events can significantly alter currency prices. Additionally, certain laws and news related to taxes, trade, and investments also affect currency prices.

Moreover, news related to currency price forecasts, war, and Gross Domestic Product (GDP) will effectively influence the final currency price. News about elections and their outcomes has a substantial impact on currency prices. In simple terms, political changes and election results can create significant fluctuations in the Forex market.

Impact of Political News

Political news significantly affects currency prices. Some of the impacts of political news on currency prices include the following:

Political Stability and Instability

News related to political tensions between countries can lead to sudden fluctuations in currency prices. Additionally, such news creates concerns in the market, resulting in rapid changes in currency values.

International Relations

Certain relationships between countries and important decisions, such as sanctions, political agreements, and changes in financial and economic policies, directly influence prices, especially currency prices in the financial market.

Trade Policies

Trade policies also have a substantial impact on currency prices, which can include interest rates, inflation, international trade, monetary policies, and political events. By closely monitoring these policies, traders can make the best trading decisions and maximize their opportunities in the market.

News Analysis

It is important to note that analyzing news is also among the factors affecting currency prices in the market. For this analysis, you can focus on the following aspects.

Reliable News Sources

First, it’s important to ensure that the news published comes from reputable and trustworthy sources. Generally, sources such as reputable media outlets, reliable economic websites, and reports from central banks can help you accurately analyze the news.

Assessing the Impact of News

Next, you should analyze the impact of each piece of news on currency prices. To do this, examine how the published news can directly and indirectly affect the Forex market. By assessing the intensity and scope of the news, you can understand its potential influence on currency prices.

Content Analysis of News

Some news articles carry much greater content significance and value. Naturally, such news will have a more pronounced impact on currency prices and the dynamics of financial markets. Therefore, it is advisable to conduct a thorough analysis of the content and, by understanding the message correctly, steer your trading strategy toward greater profitability.

Trading Strategies

To succeed in trading in the vast Forex market, employing effective financial strategies is also crucial. Some of the most important well-known trading strategies that are optimal for conducting trades include the following.

Trading with News

- Trading with news is a type of trading strategy employed by traders in financial markets. In this strategy, traders use economic events and information to execute trades. The foundation of this strategy is based on news and economic information, and it typically involves traders entering the market during, before, or after the release of news.

- This news can include announcements of economic indicators, central bank decisions, sanctions, and events related to the global economy.

Advantages of Trading with News:

- Creates profitable opportunities

- High impact on prices

Counter-Trend Trading

In this trading strategy, traders act in the opposite direction of market movements after the release of news. Instead of trading based on the news, they anticipate market reversals. If positive news is released and the market moves upward, traders can sell and take advantage of the market’s change in direction.

Advantages of this Strategy:

- Utilizes sudden changes

- Can lead to profitable trades

Using Technical Indicators

Utilizing technical indicators alongside news analysis is an effective method for trading in financial markets. In this approach, traders use technical analysis to identify price patterns and determine entry and exit points for trades. To effectively use technical indicators, traders should follow these steps:

Technical Analysis: In this phase, traders start by using technical indicators such as moving averages, MACD, RSI, and chart patterns like triangles, three-candle patterns, and double tops/bottoms to identify price patterns. This method also allows for determining entry and exit points for trades.

News Analysis: In the second phase, traders analyze news and economic events, examining what news and events are expected to be released in the future and how these published news items may impact the financial market and currency prices.

Combining Analyses: By integrating technical analysis and news analysis, traders can make the best decisions and look for positive points to enter trades.

Risk Management: Attention to risk management is crucial in all activities and actions within financial markets. For better management, traders can use stop-loss orders or set expectations for profits and losses in their trades.

Final Thoughts

Important news and political and economic events can have a significant impact on the forex market and currency prices. This information can lead to sudden changes in prices and cause traders to be more sensitive to their decisions and activities in the market.

As a trader, it is advisable to closely follow daily news and consistently conduct thorough analysis and evaluation of this information, ultimately paving your way toward greater profitability.