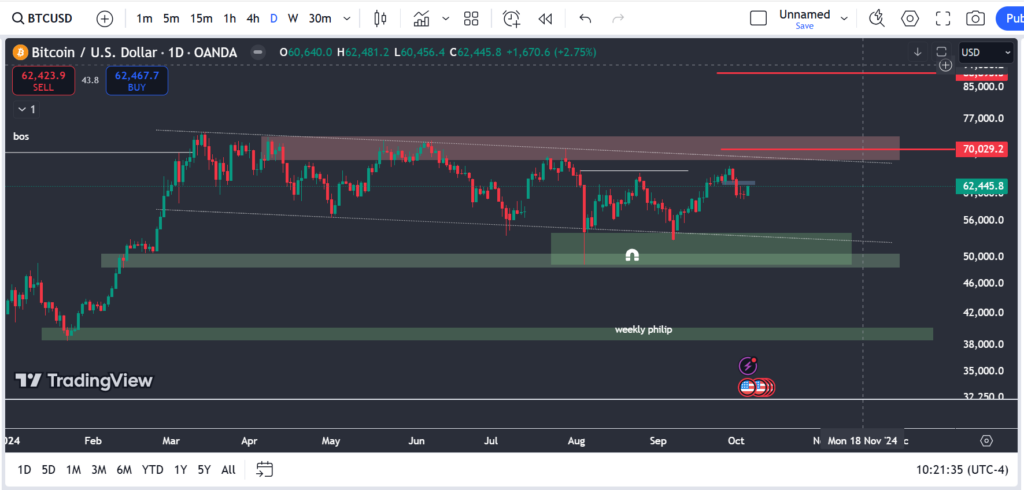

Bitcoin Analysis (Daily Time Frame)

While Bitcoin is still trading in a range and has not exited the downward trend, reclaiming the $62,000 level on Friday after dropping to $60,000 earlier in the week may just be a “recovery rally” before a deeper correction. On the daily timeframe, Bitcoin is reaching the top of the downward corrective channel, with a potential rise to the red supply zone and liquidity sweep at the highs. If it breaks and stabilizes above 73,990, the next target for Bitcoin would be 88,893. If the price cannot break 73,990, the decline could continue to the 48,530, 44,203, and 40,225 areas.

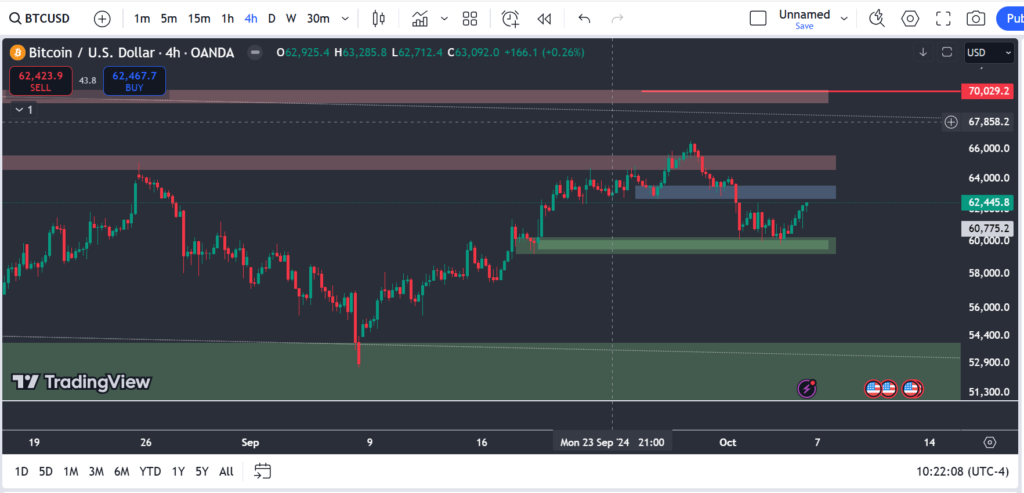

Bitcoin Analysis (4-Hour Time Frame)

After a correction to 59,825 and hitting the 4-hour upward order block, Bitcoin may rise to 63,655. If it breaks the blue breaker block, a rise to the red zones is highly probable. The only way Bitcoin targets $70,000 is by reclaiming $64,500. Until then, any upward movement is merely a recovery rally that adds more liquidity to the sell side at $59,000 and $57,000.

Bitcoin Analysis (15-Minute Time Frame)

After hitting the green demand area and breaking the last swing highs, Bitcoin will rise to the 63,948 and 65,704 areas if it stabilizes above 62,803. The red zones are suitable for entering sell positions.