Dow Jones Analysis (Daily Time Frame)

The Dow Jones index, after a 6.5% drop from its historical high in the past two weeks, temporarily halted its decline at the 42140 area and ended the trading week at 42966 with a relatively weak rebound.

- Main Scenario: Given the momentum and the steep decline, it is expected that after some correction, the index will continue its decline and experience lower lows. If it breaks below 42140, it can move towards the 41684 and then 39963 areas.

- Alternative Scenario: If the above scenario does not occur and the 43739 area is reclaimed, the index can revisit the 44605 and 45098 areas.

Dow Jones Analysis (4-Hour Time Frame)

Despite a relatively strong rebound in this time frame, it could not reach the 43739 high before the end of the week. Therefore:

- Main Scenario: If it does not reach and break the 43739 area, it is expected that after breaking 42140, the index will experience a lower low at 41684.

- Alternative Scenario: If the 43739 high is broken, the index can move to the 44605 area and possibly higher.

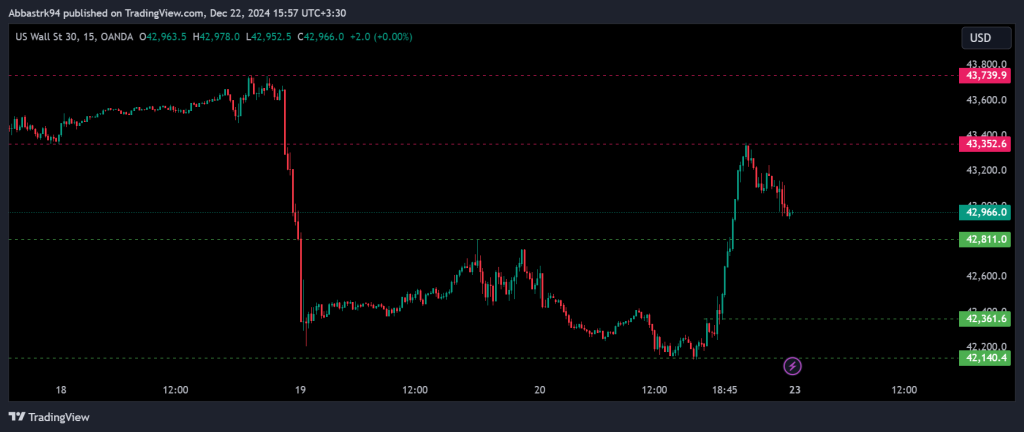

Dow Jones Analysis (15-Minute Time Frame)

After a strong move above the previous high area of 42811, it is expected that the index can initially reach 43352 and then 43739. However, if it fails to revisit the 43352 high and falls back below the 42811 area, the next targets for the Dow Jones index will be 42361 and then 41684.

However, it should be noted that given the arrival of the last week of the calendar year, a range-bound market can also be expected.