Dow Jones Analysis (Daily Time Frame)

In the past week, despite the overall bullish trend, the Dow Jones index has been in a range-bound zone. Based on the price movement of the last two trading days, it is expected that this index will experience a correction, potentially moving towards the 44,365 level.

Scenario 1: If this correction occurs, there is a possibility of lower figures being seen.

Scenario 2: After the expected correction ends, the index needs to break the 45,098 resistance in order to establish a new historical high.

Dow Jones Analysis (4-Hour Time Frame)

In the 4-hour time frame, considering the lower high that has been formed, if the price stabilizes below the broken trendline, it could correct towards the 43,736 level.

If the above scenario does not occur, the price needs to break the 44,910 resistance first. If that happens, it could be set to reach a new historical high.

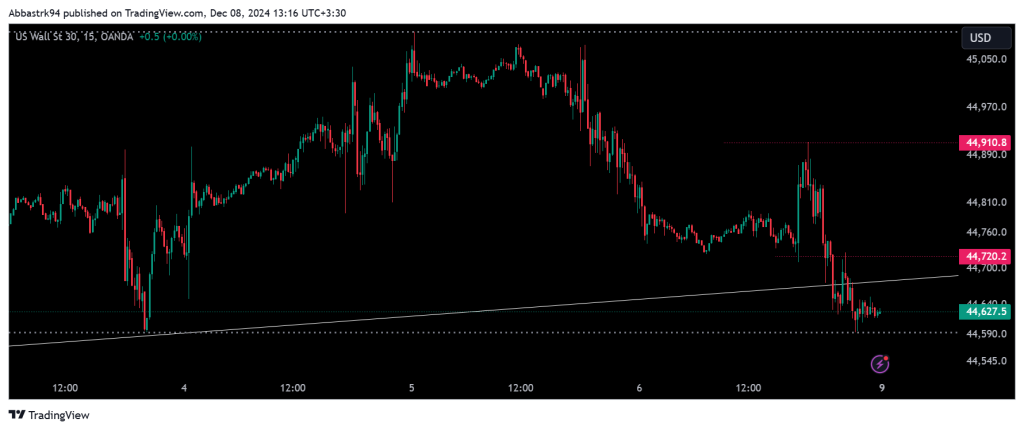

Dow Jones Analysis (15-Minute Time Frame)

In the 15-minute time frame, the Dow Jones index has lost both its static and dynamic support levels, strengthening the bearish scenario. It could move at least to the 44,365 zone.

The only way this bearish scenario would be invalidated is if the price reclaims the 44,720 level.