Pound Analysis (Daily Time Frame)

In the daily time frame, after breaking the 1.10023 area and experiencing a price drop, the Euro entered a daily rejection block with a potential reaction and price increase to the range of 1.10459–1.10847. If the price is rejected from this area, a drop to 1.8518 is expected. The green highlighted areas are valuable for Euro buy trades.

Pound Analysis (4-Hour Time Frame)

In the 4-hour chart, the price has dropped below the 200-period simple moving average at 1.1020. From a technical perspective, the support level of 1.0900 has so far prevented further declines. If this level is broken, the pair could drop to 1.0880. The upper limit of 1.1000 acts as a key resistance level.

Resistance levels: 1.0955, 1.1000, 1.1050

Support levels: 1.0880–1.0900, 1.0780, 1.0710

The main scenario indicates a break below the support range of 1.0880–1.0900 (the lowest points from August 8 and October 10), which could lead to a decline towards 1.0780 (the lowest level from August 1).

An alternative scenario is a breakout above the resistance level of 1.0955 with potential increases up to 1.1000. The green areas are valuable for Euro buy trades.

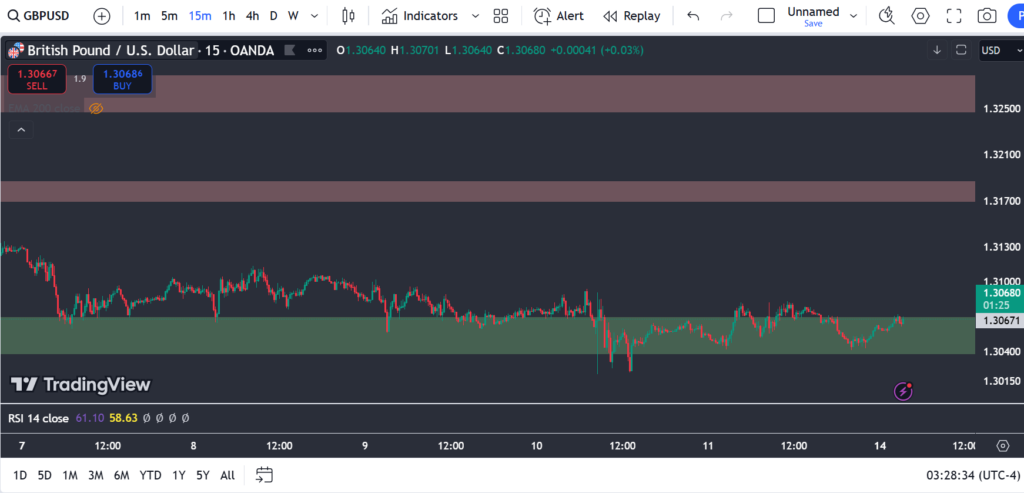

Pound Analysis (15-Minute Time Frame)

In the 15-minute time frame, the trend is bearish, with an expected price drop to 1.08900. If the support level of 1.08815 is broken, a drop to 1.08388 is likely, where a confirmation can be used to enter buy positions.