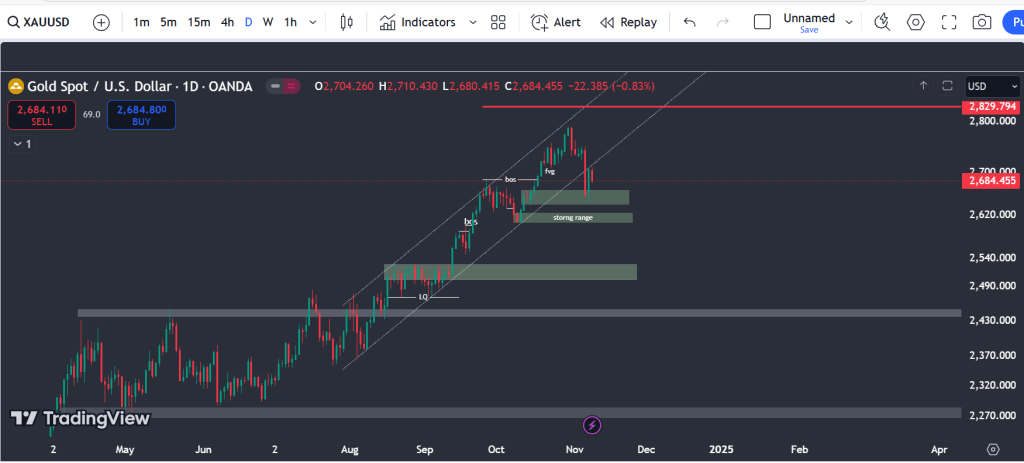

Global Gold Analysis (Daily Time Frame)

After Donald Trump’s victory and with the strengthening of the US dollar and the rise in US bond yields, gold experienced its largest single-day loss of the year, dropping by 3%. Meanwhile, the Federal Reserve, as expected, lowered interest rates by 25 basis points and maintained a balanced outlook on inflation and employment risks.

As mentioned in last week’s analysis, the 2792.90 level is crucial for gold to make a further rise, as a breakout of this level could lead to an increase toward the 2880.00–3000.00 range.

Main Scenario: Consider sell positions from corrections below the 2792.90 level, with a target range of 2560.52–2418.82.

Alternative Scenario: A breakout and stabilization above the 2792.90 level would allow the asset to continue rising toward the 2880.00–3000.00 range.

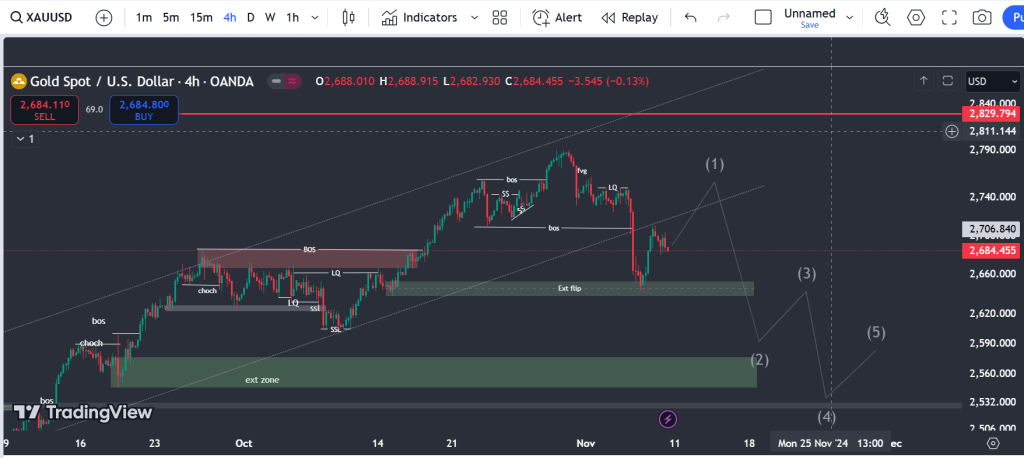

Gold Analysis (4-Hour Time Frame)

Gold has broken its ascending channel with a full-body candle and, additionally, the breakdown of the swing low around 2708 has formed a new downward range.

Main Scenario: Hunt and mitigate price around the 2750 level, followed by a further decline to the 2604 range.

Alternative Scenario: A deeper decline to the 2267.0 range, followed by an increase toward the 2791 level for a hunt and mitigation around that level.

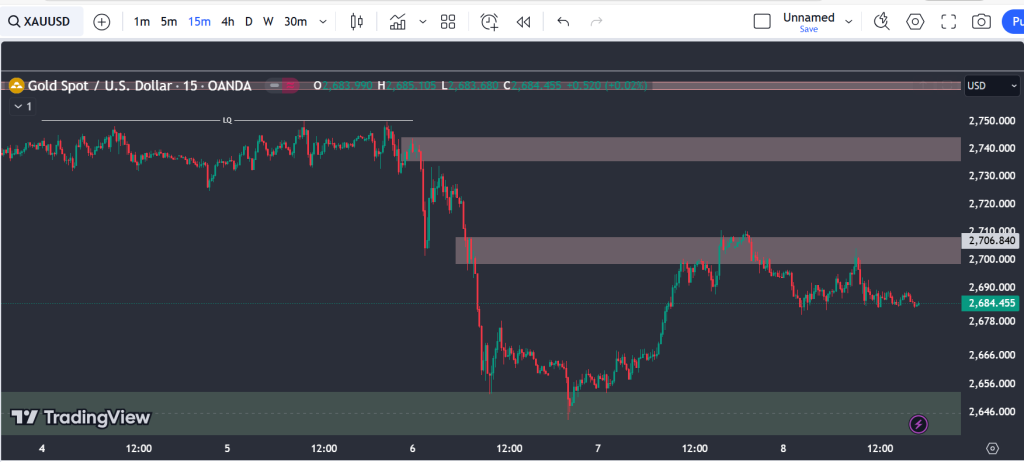

Gold Analysis (15-Minute Time Frame)

Gold reacted to the supply zone, and we expect the price to decline toward the 2653 level. If the support at 2643 holds, we anticipate a price increase back to the 2740 range.

This analysis provides the key price levels and potential scenarios for gold, helping you identify opportunities based on the market’s direction in the coming week.