Global Gold Analysis (Daily Time Frame)

Gold continued its strong upward trend in the past week, driven by the expectation of a decrease in U.S. interest rates, reaching new historical highs. In the daily time frame, gold is in a powerful ascending channel, approaching the upper boundary of that channel.

With a breakout above the 2600 level and a bullish full-body candle closing, there is potential for further price increases toward resistance levels at 2658, 2705, and 2759.

The price range of 2500-2528 is considered a valuable area for buying opportunities.

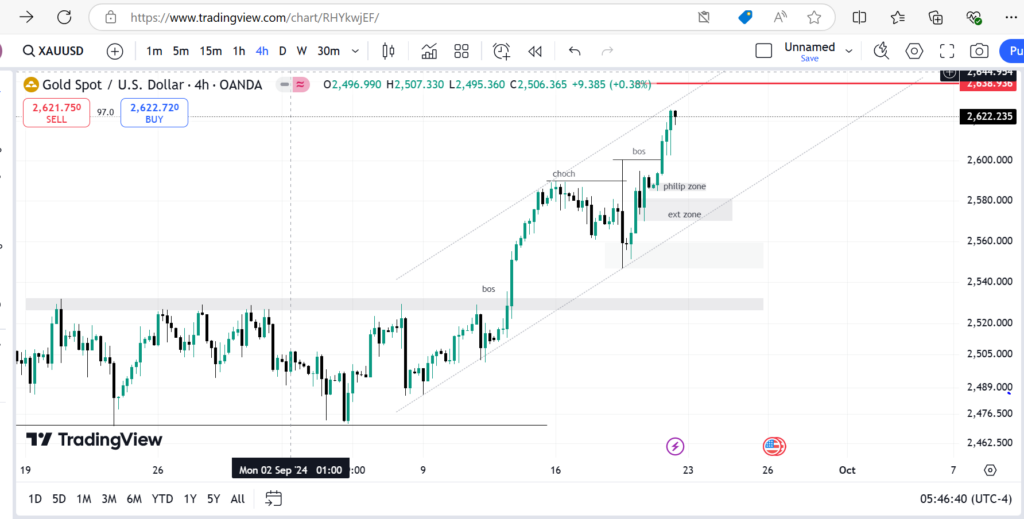

Gold Analysis (4-Hour Time Frame)

Gold is currently in an ascending channel and has continued its expansion movement after breaking above the 2600 level. Following this breakout, gold has not yet revisited its discount zone.

In the event of a retracement, validated areas at 2584-2589 represent valuable buying opportunities. If the price breaks into the Philip Zone, the extreme range of 2570-2581 is also a key area for potential buys.

For sell trades, resistance levels to watch are 2633, 2638, and 2686. These levels may present opportunities for short positions as gold approaches them.