Global Gold Analysis (Daily Time Frame)

Gold experienced significant growth last week, rising to the 2758 range. Despite geopolitical tensions and upcoming fundamentals suggesting a bullish outlook, we anticipate a correction and price decline this week. Given the strong upward trend in gold, if the support level of 2602 holds, we expect the upward trend to continue toward 2829.

Main Scenario:

Consider buying positions from corrections above the 2601.27 level, aiming for 2880.00 – 3000.00.

Alternative Scenario:

A break and stabilization below the 2601.27 level would allow the pair to continue declining to levels of 2468.90 – 2356.76.

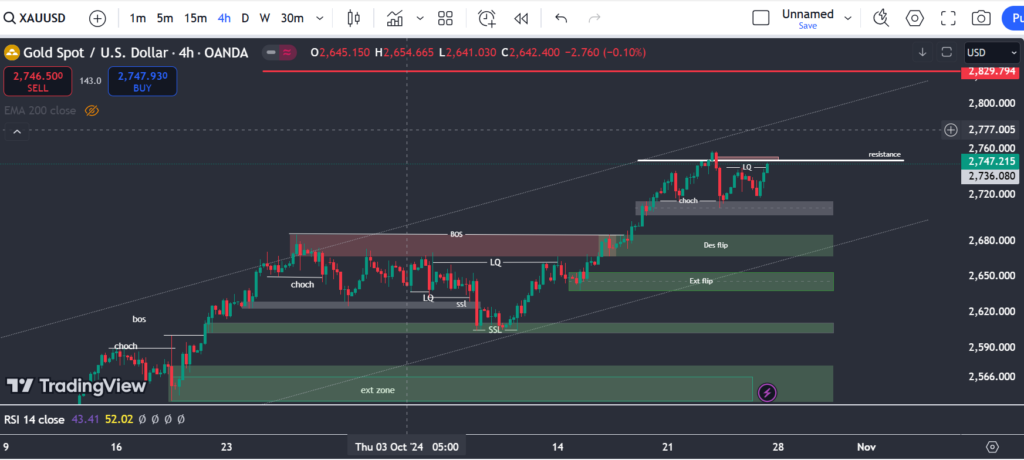

Gold Analysis (4-Hour Time Frame)

After breaking and stabilizing above 2685, it has increased to 2758.

Main Scenario:

Price correction down to 2685-2667, where buy positions can be tested. The next area for entering a buy position is the 2653-2638 range.

Alternative Scenario:

If the resistance level of 2747 breaks and stabilizes above this level, we expect price increases to 2780 and 2829, where sell positions can be tested.

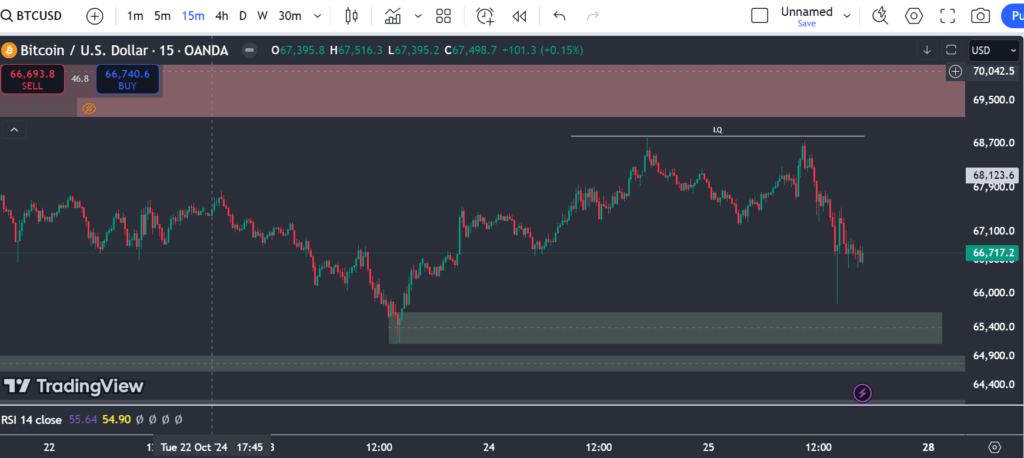

Gold Analysis (15-Minute Time Frame)

We expect a price increase to the 2750 range, followed by a decline and correction down to 2697.

The green zones marked on the chart are valuable for buy trades.

If the 2752 level breaks and stabilizes above this area, we foresee a price increase to 2780.