A statement (Statement) is a financial report that displays details of transactions, profits and losses, account balance, and other relevant financial activities of a trader. This report helps traders analyze their performance and develop better trading strategies.

What is a Statement and Why is it Important?

A statement (Statement) or trading account report is a document that includes the details of a trader’s transactions, including deposits, withdrawals, profit and loss amounts, account balance, leverage ratio, free margin, trading history, and other relevant information. This report is crucial for evaluating trading performance and managing capital.

Why is a Statement Important?

- Performance Analysis: Traders can evaluate their performance over different time frames by reviewing the statement.

- Identifying Strengths and Weaknesses: A close look at past trades helps traders identify weaknesses in their trading strategies.

- Better Capital Management: The statement helps traders control their account balance and manage trading risks more effectively.

- Credibility in Managed Accounts: In PAMM or MAM accounts, investors use statements to assess the performance of the trader before investing.

What is a Forex Statement?

In the Forex market, the trading statement plays a key role in risk management and evaluating a trader’s performance. Professional traders and investment account managers (PAMM & MAM) use statements to prove their profitability to investors.

Why is a Statement Important in Forex?

- To Assess Personal Performance: Analyzing the statement helps traders optimize their trading strategies.

- To Gain Investor Trust: Investors looking for account managers use statements to review trading history before making a decision.

- To Evaluate Broker Efficiency: Sometimes, execution delays or price slippage can be detected through the statement.

Tips to Improve Your Forex Statement:

- Follow proper capital management and avoid using high leverage without a well-tested strategy.

- Keep the Drawdown (capital decline) as low as possible.

- Execute trades based on a tested and structured trading strategy.

- Eliminate emotions from your trading decisions and focus on risk management.

Trading Statement in TradingView – Performance Review

TradingView is one of the most popular and powerful analytical platforms in the financial markets, offering advanced tools for technical analysis, strategy backtesting, and portfolio management. Although TradingView is not a direct trading software like MetaTrader, users can view and review their trading performance reports through the available features.

How to Access the Trading Statement in TradingView

In TradingView, the trading statement can be viewed in two main ways:

- Using the “Pine Script Strategy Tester”

If you program a trading strategy using Pine Script, you can run it through the “Strategy Tester” to receive a complete performance report of your strategy. This report includes information such as: ✔ Total Profit and Loss (Net Profit & Loss) ✔ Risk/Reward Ratio ✔ Total number of trades ✔ Average percentage return on trades

This tool allows you to test and optimize your strategy before real execution to ensure its performance in different market conditions.

- Connecting the Broker Account to TradingView

Some brokers offer the ability to directly connect your trading account to TradingView. By doing this, users can: ✔ View the complete history of their trades ✔ Analyze account performance based on profit and loss ✔ Execute trades directly from TradingView

This feature allows users to perform technical analysis and execute trades in a single environment without the need to switch between different platforms.

How to Read a Statement

Reading and analyzing a statement is one of the most important skills every trader should master. To better understand a statement, it is essential to familiarize yourself with its key components:

Key Sections of a Trading Statement:

- Balance: The initial amount of money in your account before opening trades.

- Equity: The current account balance after applying floating profits or losses.

- Profit/Loss: The total profit or loss accumulated from executed trades.

- Margin: The amount of capital locked for opening positions.

- Free Margin: The available capital left for new trades.

- Drawdown: The percentage of capital decline from the highest balance previously recorded.

- Win Rate: The percentage of trades closed in profit.

To properly analyze a statement, traders must carefully evaluate these metrics and optimize their trading strategies based on the results obtained.

Key Terms in a Trading Statement

To properly analyze a trading statement (Statement), you need to be familiar with its key terms. Below, we review the most important concepts found in a trading report:

1. Balance (Initial Balance)

This represents the account balance before considering open trades, meaning the total of deposits, withdrawals, and profit/loss from closed trades.

2. Equity (Real-Time Balance)

The actual capital available in the account at any moment, including floating profit or loss from open trades.

🔹 Formula:

Equity = Balance + Floating Profit/Loss

3. Margin (Required Margin or Collateral)

The amount of capital locked by the broker to keep trades open. This depends on the trade volume and account leverage.

🔹 Formula:

Margin = (Lot Size × Contract Size) / Leverage

4. Free Margin (Available Margin)

The amount of capital still available for opening new trades.

🔹 Formula:

Free Margin = Equity – Margin

5. Margin Level

The ratio of Equity to Used Margin, expressed as a percentage. If this reaches 100% or lower, the account may trigger a Margin Call.

🔹 Formula:

Margin Level = (Equity / Margin) × 100

6. Floating Profit/Loss

The amount of profit or loss from open trades, which fluctuates until the trade is closed.

7. Drawdown (Capital Decline)

A crucial risk management metric indicating how much capital has decreased compared to the highest previous balance.

🔹 Types of Drawdown:

✅ Absolute Drawdown: The difference between the highest balance and the lowest recorded balance.

✅ Maximum Drawdown: The largest capital decline within a trading period.

✅ Relative Drawdown: The percentage of capital reduction relative to the initial balance.

🔹 Formula:

Drawdown = (Peak Balance – Lowest Balance) / Peak Balance × 100%

8. Gross Profit

The total profit earned from trades within a specific period.

9. Gross Loss

The total losses recorded from trades within a specific period.

10. Net Profit

The total profit after deducting losses.

🔹 Formula:

Net Profit = Gross Profit – Gross Loss

11. Win Rate (Trade Success Rate)

The percentage of successful trades relative to the total number of trades.

🔹 Formula:

Win Rate = (Winning Trades / Total Trades) × 100

12. Profit Factor

The ratio of gross profit to gross loss, indicating the efficiency of a trading strategy. A value greater than 1 indicates a profitable strategy.

🔹 Formula:

Profit Factor = Gross Profit / Gross Loss

13. Recovery Factor

The ratio of net profit to maximum drawdown, showing how long it takes for an account to recover from losses.

🔹 Formula:

Recovery Factor = Net Profit / Maximum Drawdown

14. Expectancy (Trade Expectancy)

This value shows the average profit or loss per trade.

🔹 Formula:

Expectancy = (Win Rate × Avg Win) – (Loss Rate × Avg Loss)

15. Lots (Trade Volume)

Indicates the size of a trade. In Forex, 1 standard lot equals 100,000 units of the base currency.

16. Commission

The fee charged by brokers for executing trades. Some brokers earn only from the spread, while others charge both spreads and commissions.

17. Swap (Overnight Interest or Rollover Fee)

If a trade is kept open overnight, the broker may charge or credit an interest fee known as swap (rollover interest).

18. Stop Out

When the Margin Level reaches a specific threshold (typically 20% or lower), the broker automatically closes trades to prevent a Margin Call.

19. Breakeven

When a trade results in neither profit nor loss, it is called Breakeven. Some traders use a Breakeven Stop-Loss strategy to adjust their stop loss to the entry price.

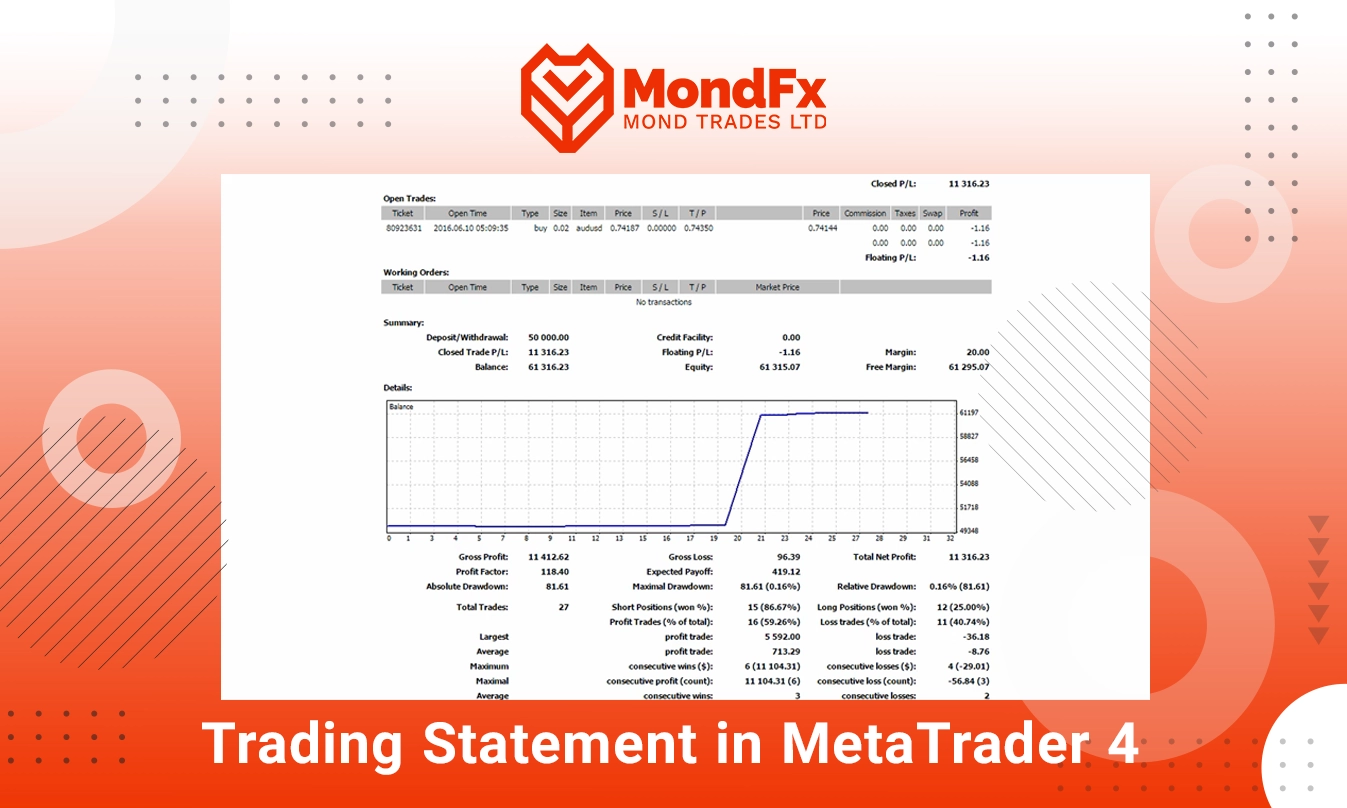

Trading Statement in MetaTrader 4 (MT4)

One of the most well-known trading platforms in the Forex and other financial markets is MetaTrader 4 (MT4). In this software, the account statement can be manually saved and reviewed.

How to Obtain a Statement in MetaTrader 4:

- Open the “Terminal” window (shortcut key: Ctrl + T).

- Go to the “Account History” section.

- Right-click on the empty space and select “Save as Report” or “Save as Detailed Report.”

- The statement file is saved in HTML format and can be viewed in a browser.

Information Displayed in the MT4 Statement:

- All completed trades with details (time, volume, entry and exit prices, profit/loss)

- Account balance and current balance

- Drawdown

- Trade success rate

The MT4 statement allows traders to have a better understanding of their performance and optimize their trading strategies based on real data.

How Statements Help Improve Trading Performance

Professional traders regularly review their statements and use them to optimize their trading strategies. In this section, we will explore how statements contribute to improving trading performance.

1. Identifying Strengths and Weaknesses in a Trading Strategy

Why is it Important?

A statement shows which strategies have been successful and which ones have resulted in losses. This information helps traders identify strengths and weaknesses in their trading methods.

How to Use It?

- Analyze Win Rate: If the percentage of profitable trades is lower than expected, reconsider your strategy.

- Evaluate Risk/Reward Ratio: If your profits are lower compared to your losses, optimize your entry and exit points.

- Review Trade Holding Time: Are short-term trades more successful than long-term ones? Your statement will provide insights.

2. Improving Risk Management and Controlling Drawdown

Why is it Important?

Drawdown is one of the biggest reasons traders fail. If your drawdown is too high, your account may face the risk of a Margin Call.

How to Use It?

- Compare Drawdown to Net Profit: If your drawdown is high and profit is low, reduce your risk exposure.

- Reduce Trade Volume (Lot Size): If large trades result in heavy losses, consider trading smaller positions.

- Use Stop Loss Properly: If your losses are too high, consider smaller stop losses with more precise adjustments.

3. Evaluating Performance Across Different Time Frames

Why is it Important?

Traders should know during which market sessions they perform best. Some traders are more successful during New York sessions, while others perform better in Asian markets.

How to Use It?

- Identify the Best Trading Days: Do you perform better on specific days? Your statement reveals this.

- Analyze Entry and Exit Times: Are certain times of the day more profitable? Should you avoid trading during news releases?

- Adjust Strategy Based on Time Frames: You may realize that longer time frames suit you better, requiring a change in your trading style.

4. Increasing Profitability Through Profit/Loss Analysis

Why is it Important?

A successful strategy must have a good Profit/Loss Ratio. Many traders fail because of small profits but large losses.

How to Use It?

- Analyze Average Profit and Loss Per Trade: Are your losses greater than your profits? If yes, adjust your Take Profit targets.

- Review Profit Factor: If the Profit Factor is below 1, your strategy is unprofitable and needs improvement.

- Identify High-Gain and High-Loss Trades: Is a specific strategy causing excessive losses? Consider removing or modifying it.

5. Improving Execution Accuracy

Why is it Important?

Sometimes, broker issues, slippage, or high spreads can reduce profitability. These issues are visible in your statement.

How to Use It?

- Check for Delays in Trade Execution: If trades have entry/exit delays, your broker might not be suitable.

- Analyze Commission and Swap Fees: If fees significantly affect your profit, consider finding a broker with better conditions.

- Compare Spreads: Are your trades executed during high spread conditions? You may need to adjust your trading hours.

6. Enhancing Transparency for Investors and Account Managers

Why is it Important?

If you manage PAMM or MAM accounts or want to attract investors, providing a clear and positive statement boosts credibility.

How to Use It?

- Present a Professional Statement to Investors: Investors prefer traders with consistent and low-risk profitability.

- Reduce Drawdown for Higher Trust: Accounts with low drawdowns attract more investors.

- Show Long-Term Growth: Providing monthly and yearly reports improves investor confidence.

7. Adjusting Trading Strategies Based on Statement Data

Why is it Important?

If your performance has been weak, your statement helps analyze real data and create a new strategy.

How to Use It?

- Monitor Market Changes: Have market trends affected your profits? If yes, update your strategy accordingly.

- Backtest and Optimize Strategies: Use your statement data to test and refine new approaches.

- Use AI and Algorithmic Trading: Some traders utilize statement data to develop automated trading algorithms.

What is a Trading Journal?

A Trading Journal is a personal and customized report of trades, recorded by the trader themselves. This journal can be manually written on paper, stored in an Excel file, or managed through trading journal software.

Information Recorded in a Trading Journal:

✔ Reasons for trade entries and exits

✔ Trader’s emotions and psychology during each trade

✔ Market conditions at the time of entry (e.g., uptrend or downtrend)

✔ Economic news that influenced decision-making

✔ Changes in trading strategy

✔ Mistakes and lessons learned from each trade

✅ Key Feature: It is fully customizable, allowing traders to record additional details about their thoughts and emotions during trades.

Comparison of a Trading Statement vs. a Trading Journal

| Feature | Trading Statement | Trading Journal |

| Data Entry Method | Automated by platform | Manual by trader |

| Data Accuracy | Highly accurate with numeric details | Depends on trader’s precision |

| Psychological Analysis | ❌ No | ✅ Yes |

| Includes Strategy Explanation? | ❌ No | ✅ Yes |

| Includes Trader’s Emotions? | ❌ No | ✅ Yes |

| Displays Overall Profit/Loss? | ✅ Yes | Depends on trader’s records |

| Pattern Recognition for Trades | Limited | Extensive |

| Market Conditions & News Impact | ❌ No | ✅ Yes |

| Optimization of Trading Strategies | Yes, but limited | Yes, fully customizable |

A Trading Statement provides precise numerical data on past trades, while a Trading Journal offers insights into the trader’s decision-making process and psychology. Using both tools together maximizes trading efficiency and strategy development.

Why is it Important to Use Both Tools Together?

1. A Trading Statement is Essential for Numerical Data Analysis

📊 A Trading Statement automatically calculates profit/loss, win rate, and drawdown. If traders rely only on a trading journal, they must enter this data manually, which can be time-consuming and prone to errors.

2. A Trading Journal Provides Personal Insights

📖 Recording emotions, reasons for entry/exit, and market conditions in a trading journal helps traders recognize their mistakes and learn from them. A statement only shows whether a trade was profitable or not, but it does not explain why it was successful or unsuccessful.

3. Combining Both Creates a Stronger Strategy

Traders who use both a statement for numerical analysis and a journal for decision-making insights tend to perform better. The combination of these two tools ensures both quantitative (numbers and statistics) and qualitative (decision-making reasons) data are analyzed.

How to Use a Trading Statement and Trading Journal Together?

✅ Step 1: Review Your Trading Statement

- Analyze total profit and loss.

- Check your win rate and drawdown levels.

- Determine if your trading strategy is profitable or needs adjustments.

✅ Step 2: Complete Your Trading Journal

- Record reasons for trade entries and exits.

- Write down your emotions and mindset during trades.

- Document mistakes and lessons learned from each trade.

✅ Step 3: Compare Data from Both Tools

- Did losing trades occur under specific emotional conditions?

- Were you more successful during specific market sessions?

- Is your drawdown too high, requiring adjustments in risk management?

How to Read a Trading Statement

A trading statement is one of the most important tools that traders use to evaluate their performance. A proper understanding of this financial report helps traders identify the strengths and weaknesses of their strategies and make better trading decisions.

Key Sections of a Trading Statement

To analyze a trading statement accurately, you should be familiar with its terms and different sections:

🔹 Balance: The amount of capital in your account before any trades are made. This amount is calculated without considering open trades.

🔹 Equity: The account balance after applying the unrealized profit and loss (P/L) from open trades. If a trade is in profit or loss, the equity will change accordingly.

🔹 Profit/Loss: The total profit or loss made from closed trades. This amount reflects the performance of trades over a specific time period.

🔹 Margin: The amount of capital required to open a trade. Brokers block a certain portion of the balance as margin based on leverage for executing trades.

🔹 Free Margin: The amount of capital available for opening new trades after considering open trades. If free margin is low, the risk of a margin call increases.

🔹 Drawdown: The decrease in capital compared to the previous peak balance. Drawdown shows how much your capital has decreased during a trading period. Managing drawdown is one of the most important risk management principles.

🔹 Win Rate: The percentage of trades that were closed with a profit. This indicator is a key measure of the quality of a trading strategy. For example, if the win rate is 60%, it means that out of every 10 trades, 6 were profitable.

How to Analyze a Trading Statement

✔ Compare Balance and Equity: Check if unrealized profits have contributed to increasing equity. If equity has decreased significantly compared to balance, your strategy might need revisiting.

✔ Evaluate Drawdown: If the drawdown is high, your risk management might be weak. In this case, you should reduce the trade size and adjust your stop-loss settings.

✔ Analyze Win Rate: If the win rate is low but the overall profit is positive, it suggests that your strategy is well-adjusted based on the risk/reward ratio. However, if both the win rate and total profit are low, you should reassess your strategy.

✔ Check Margin and Free Margin: If your free margin is too low, there is a risk of a margin call. In this case, it’s better to reduce trade size or use lower leverage.

Digital Statements

A digital statement is an electronic report of a trader’s transactions and financial performance, automatically generated by trading platforms, brokers, and financial software. Instead of paper-based versions, these statements are available in digital file formats (PDF, HTML, CSV, or Excel), allowing traders to easily download and analyze them.

Where Can You Obtain a Digital Statement?

✅ Trading Platforms: Such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView

✅ Brokerage Accounts: Many brokers allow users to download their account statements.

✅ Investment Management Software: Platforms like Myfxbook and FX Blue offer advanced digital statements.

Advantages of Digital Statements

- High Accuracy & Automatic Data Recording

A digital statement automatically records all trade details, preventing human errors in data entry. This precision helps traders analyze their performance accurately and without mistakes. - Time-Saving & Easy Access

Traders do not need to manually record their transactions. A statement can be downloaded within seconds and accessed anytime, anywhere, using a mobile phone, tablet, or computer. - Easy Comparison & Data Analysis

Most digital statements come in Excel or CSV formats, allowing traders to sort and analyze their data more effectively using advanced analytical tools. - Integration with Analytical Software

Platforms like Myfxbook, FX Blue, and MetaTrader Analytics allow traders to upload their statements and generate detailed reports for performance tracking. - High Security & Reduced Risk of Data Loss

Unlike paper statements, which can be lost or damaged, digital versions can be stored in cloud storage, hard drives, or broker servers for safe access anytime. - More Transparency for Investors & Account Managers

Digital statements are highly valuable for investors, investment firms, and account managers (PAMM & MAM). These statements can be easily shared, allowing investors to review account performance before making decisions.

Disadvantages of Digital Statements

- Lack of Emotional & Decision-Making Insights

A digital statement only presents numerical data and does not provide insights into the trader’s psychology, emotions, or decision-making process. This is why a Trading Journal remains essential. - Requires Data Analysis Skills

Digital statements provide raw data, which can be challenging for beginners to interpret. Traders who lack data analysis skills might misuse or misinterpret the information. - Possible Technical Issues & System Errors

Sometimes, digital statements may display incorrect data, especially if the trading platform or broker experiences technical issues, execution delays, or software bugs. - Limited Customization

Some digital statements lack flexibility, preventing traders from adding specific notes or explanations. Reasons for trade entries and exits cannot be directly recorded in a digital statement, making a Trading Journal necessary. - Requires Additional Analytical Tools for Advanced Insights

For in-depth analysis, traders often need to use external software like Excel, Myfxbook, or FX Blue, which can be costly or complex for some users.