PAMM stands for “Percentage Allocation Management Module.” In a PAMM account, a professional trader or account manager manages both their own funds and the funds of other investors. The way this account works is that investors allocate a portion of their capital to the manager, who then executes trades using their skills and experience. The profit or loss from the trades is distributed among the investors based on the proportion of their investment to the total capital in the PAMM account.

For example, if the account manager has $10,000 of their own capital, and other investors contribute a total of $40,000 to the PAMM account, the total capital of the account becomes $50,000. If a trade is profitable, the profits will be distributed according to each individual’s share of the total investment. This type of account is a good option for individuals who do not have the experience or time to trade and prefer to benefit from the knowledge and expertise of professional traders.

How Does a PAMM Account Work?

In the forex market, there are several types of social trading methods, and one of the most well-known is the PAMM (Percentage Allocation Management Module) account. This type of account allows traders to create a trading account with specific features, and investors can allocate a portion of their funds to invest in this account. In this system, all investors collectively share the profits and losses generated from the trades of the main trader. Additionally, the account manager receives a commission from the profits after they are generated by the investors.

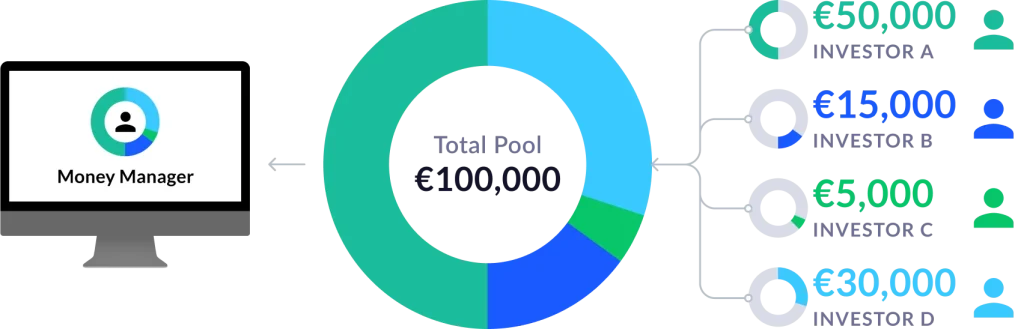

The PAMM account system consists of three main parties: the broker, the investor, and the account manager. As an investor, you do not need knowledge or experience in forex trading to get started. First, you must sign up with a broker that offers PAMM account services. Then, you can select one of the available PAMM accounts to invest in. Keep in mind that each PAMM account has its own terms and conditions, so before joining any account, it is essential to read its rules and regulations to avoid potential issues. For instance, in some PAMM accounts, you may not be able to withdraw your funds for a specific period, or you may need to pay a commission to the account manager.

For a novice investor, it’s important to know that the account manager is only allowed to trade with the funds in the account and cannot withdraw any of the funds. Furthermore, the account manager is not responsible for preventing losses or protecting your investment. Your share of the profit is determined by the percentage of your investment in the account. For example, if you own 30% of the total capital in the PAMM account, you will receive 30% of the profit generated from the trades, after deducting the trader’s commission. Likewise, if there are losses, you will also bear your proportionate share of the loss.

Finally, it’s important to note that this investment method is suitable for individuals who do not have the time or knowledge to trade in forex, but it requires careful selection of a suitable PAMM account and an understanding of its terms and conditions.

PAMM accounts generally consist of two main components:

- Investors: These are individuals who wish to invest in financial markets but do not have the experience or time to engage in trading.

- Account Manager: This is the person or company responsible for managing the account. The account manager makes trading decisions on behalf of the investors.

In this system, investors deposit their funds into a shared account that is managed by the account manager. Profits and losses are distributed among the investors based on a percentage allocation. This allocation is determined by each investor’s contribution to the overall capital in the account. In other words, each investor shares in the profits or losses according to the proportion of their initial investment.

Now, we will go into further detail about how PAMM accounts work.

Role of the Account Manager in PAMM Accounts

In PAMM accounts, the account manager is the person or entity responsible for making trading decisions. This manager is typically a professional trader with experience and expertise in analyzing financial markets. The manager uses both technical analysis and fundamental analysis to make decisions on buying and selling assets.

- Technical Analysis: This analysis involves studying historical market data (charts and indicators) to predict future trends. For instance, using indicators like moving averages or RSI to determine entry and exit points in the market.

- Fundamental Analysis: This type of analysis focuses on economic, political, and financial factors that impact prices. For example, economic news, decisions by central banks, or a company’s financial health can have a significant effect on the prices of currencies, stocks, or commodities.

In summary, the account manager utilizes these methods to make informed decisions on behalf of the investors, aiming to generate profits from the market.

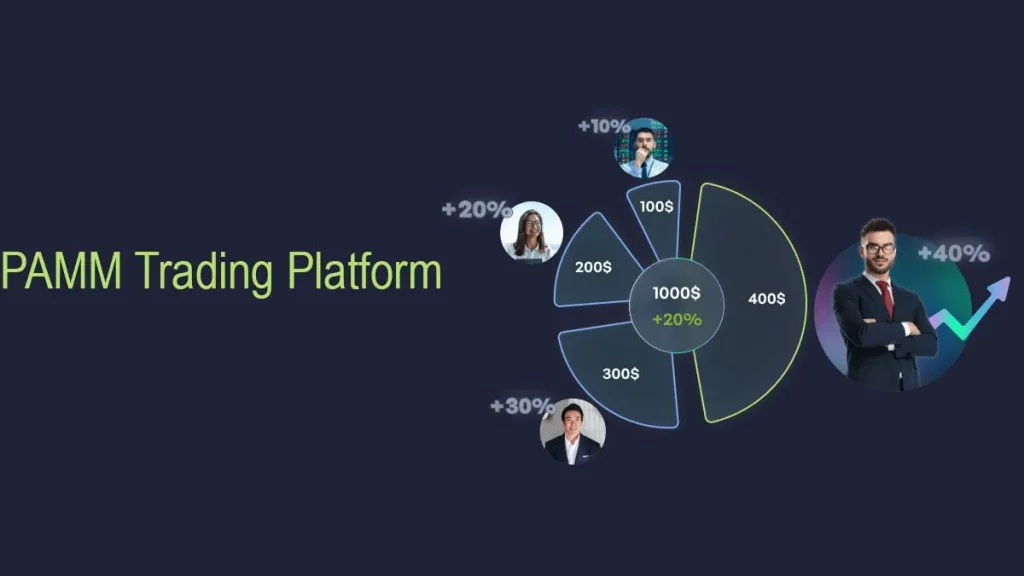

Profit and Loss Distribution Based on Investment

One of the main features of PAMM accounts is that profit and loss are distributed according to the amount of capital each investor has in the account. This means that if the account manager earns a profit, the profit will be allocated to each individual based on their share of the total capital in the account. Similarly, if there is a loss, it will be distributed according to the investors’ capital.

For example:

Imagine the PAMM account manager has made a 10% profit on a trade. If Investor A has $1,000 in the PAMM account and Investor B has $5,000, the profit will be divided according to the amount each person has invested.

- Investor A, with $1,000, holds 1/6 (or about 16.67%) of the total capital, so their share of the 10% profit will be 1.67%.

- Investor B, with $5,000, will receive a larger share of the profit.

Difference from Other Investment Models

This system differs from other investment models such as mutual funds or ETFs (Exchange Traded Funds). In these types of accounts, investors typically own a partial share of the investment portfolio. However, in PAMM accounts, investors do not have ownership of the assets or securities in the account. They only share in the profits or losses proportionally.

In PAMM accounts, investors also do not have complete control over trading decisions; all decisions are made by the account manager.

Conclusion

In this article, we aimed to introduce you to PAMM accounts. In fact, PAMM accounts can be considered one of the indirect methods of investing in the forex market, making them suitable for a wide range of individuals, from beginners to professionals.

Overall, PAMM accounts offer a convenient way for non-professional investors to participate in financial markets without requiring the expertise needed for trading. In this model, professional managers make trading decisions on behalf of investors, and profits and losses are allocated according to each individual’s share in the account. However, it is important to note that the success of this model depends on the manager’s skills and strategies, and there are always risks involved in investing.