In recent analyses of the cryptocurrency market, you may have come across the term “Wrapped Tokens.” Although the introduction of these tokens, particularly Wrapped Bitcoin, has been prevalent in the blockchain industry for some time, understanding the fundamental differences between them and the original cryptocurrencies remains unclear for many enthusiasts in this field.

A Wrapped Token refers to a digital asset whose value is directly tied to another digital asset, such as Bitcoin. For example, each unit of Wrapped Bitcoin holds the same value as one unit of Bitcoin.

The main purpose of creating wrapped tokens is to enable the use of various digital assets across different blockchains. For instance, Bitcoin, which has its own dedicated blockchain, cannot be directly used on the Ethereum blockchain. In such cases, wrapped tokens act as representatives of the original asset on other blockchains.

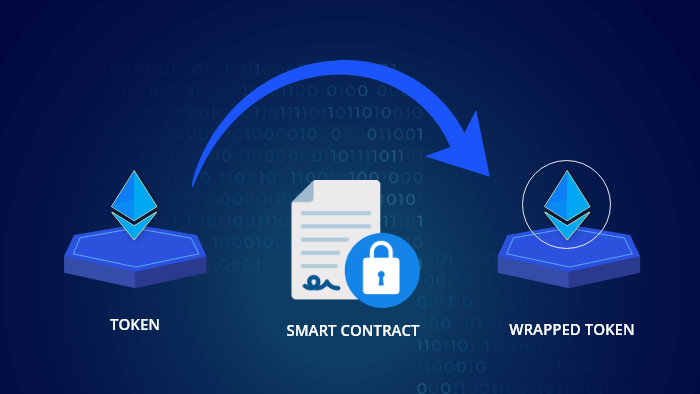

The mechanism behind wrapped tokens works as follows: for every wrapped token, an equivalent amount of the original asset is securely stored in an address. This process is typically executed using smart contracts, which ensure that the value of the wrapped token always aligns with the value of the original asset.

By using wrapped tokens, interaction between different blockchains becomes possible, allowing users to benefit from a wide range of decentralized services and applications (dApps) built on various blockchains. In other words, these tokens act as a bridge between different blockchains, contributing to the expansion of the cryptocurrency ecosystem.

In fact, due to the structural differences between various blockchains and the lack of a simple mechanism for direct asset transfers between them, wrapped tokens serve as a bridge. These tokens enable interaction between different blockchains, facilitating broader collaboration and partnerships within the cryptocurrency ecosystem.

If you’re familiar with the concept of stablecoins, you can easily grasp the idea of wrapped tokens. Both types of tokens are designed to create stability and interoperability in the cryptocurrency market. The key difference is that stablecoins are pegged to a stable asset like the dollar, while wrapped tokens are linked to another digital asset, such as Bitcoin. In other words, wrapped tokens can be considered a type of stablecoin that is backed by another cryptocurrency instead of a fiat currency.

It’s important to note that the process of creating and managing wrapped tokens is fully handled by smart contracts, so users do not need to understand the technical complexities involved. Users can simply buy and sell these tokens on reputable exchanges.

Wrapped tokens can be broadly divided into two categories: those based on the Ethereum blockchain and those on Binance Smart Chain (BSC).

Wrapped tokens on Ethereum are created according to the ERC-20 standard and act as representatives of a digital asset on another blockchain. This allows for the utilization of assets that are not inherently compatible with the Ethereum blockchain.

Similarly, wrapped tokens on BSC are created following the BEP-20 standard, enabling the use of other assets on this blockchain. It’s worth noting that the process of wrapping and unwrapping tokens incurs network fees. Due to different consensus mechanisms, BSC’s network fees are typically lower than those on Ethereum.

How do wrapped tokens work?

To better understand the mechanism of wrapped tokens, consider the example of Wrapped Bitcoin (WBTC). In this process, a digital asset known as the “custodian” is responsible for holding a specified amount of the original asset (in this case, Bitcoin). This custodian can be a centralized exchange, a multi-signature wallet, a decentralized autonomous organization (DAO), or even a smart contract.

For every unit of Wrapped Bitcoin, the custodian is required to hold one Bitcoin offline or in a secure address. All this information is transparently recorded on the blockchain.

Wrapping and Unwrapping Process

To wrap an asset, the user sends it to the custodian’s address. Once the custodian receives the asset, an equivalent amount is issued as a wrapped token on the target blockchain (such as Ethereum). This process is completely automated and governed by smart contracts.

Conversely, to unwrap, the user returns their wrapped tokens to the custodian and, in return, receives an equivalent amount of the original asset. The custodian then reduces their balance by burning the wrapped tokens.

Role of Decentralized Autonomous Organizations (DAOs)

In many cases, DAOs act as custodians of wrapped tokens. DAOs are decentralized organizations governed by rules defined in smart contracts. Utilizing DAOs as custodians enhances transparency and security in the process, as decisions are made based on predefined rules, minimizing human intervention.

Advantages of Wrapped Tokens

Wrapped tokens offer several benefits to the cryptocurrency ecosystem. One of the most significant advantages is the increased interoperability between different blockchains. Each blockchain has its own token standards, such as ERC-20 on Ethereum and BEP-20 on Binance. Wrapped tokens create an intermediary layer, enabling the use of tokens with different standards within a single blockchain.

In addition to enhancing interoperability, wrapped tokens significantly improve liquidity and efficiency in financial markets. By converting idle assets on one blockchain into wrapped tokens and transferring them to other blockchains, market liquidity is increased, creating new investment opportunities.

Another notable advantage of wrapped tokens is the reduction in costs and the increase in transaction speed. For instance, by converting Bitcoin into a wrapped token on a blockchain with lower fees and higher speeds, users can benefit from the advantages of both networks simultaneously.

Overall, wrapped tokens serve as a powerful tool for enhancing the efficiency and flexibility of digital financial markets, playing a crucial role in the development of the cryptocurrency ecosystem.

Disadvantages of Wrapped Tokens

Despite their numerous advantages, wrapped tokens come with challenges. One of the most significant criticisms is their reliance on a centralized entity as the custodian. In the current system, this entity is responsible for securely storing the original asset for each wrapped token. If this responsibility is not fulfilled properly, the value of the wrapped tokens is jeopardized, and user trust can be compromised.

To address this challenge, various decentralized protocols are being developed with the aim of eliminating the role of centralized entities and creating a transparent, reliable system for managing wrapped tokens. Once these protocols are implemented, users can utilize wrapped tokens with greater confidence.

In addition to the trust issue, the costs associated with creating and managing wrapped tokens pose another challenge in this area. High transaction fees, especially on networks like Ethereum, can hinder the widespread adoption of wrapped tokens.

Limitations of Wrapped Tokens

Despite their numerous advantages, wrapped tokens have limitations that should be considered before use.

Associated Costs: The process of wrapping a cryptocurrency and creating the wrapped token typically involves fees. These costs include blockchain network fees as well as fees from the platforms providing wrapping services.

Price Volatility: Although the value of a wrapped token ideally matches that of the original asset, discrepancies can occur in volatile markets. These differences may arise from severe market fluctuations, supply and demand variations, and operational risks associated with the wrapping service platforms.

Financial Contagion Risk: Increased use of wrapped tokens can lead to greater interdependence among cryptocurrencies. Consequently, a financial crisis in one cryptocurrency could spill over to other cryptocurrencies, including wrapped tokens.

Security Risks: Platforms that provide token wrapping services may be vulnerable to hacking attacks. If such attacks occur, the assets of users stored as wrapped tokens on these platforms could be at risk.

Legal and Regulatory Limitations: Legal and regulatory frameworks related to cryptocurrencies and wrapped tokens are constantly evolving. These changes can affect how wrapped tokens are used and the associated risks.

Security of Wrapped Bitcoin Tokens

From a technical perspective, Wrapped Bitcoin tokens are stored on secure blockchain platforms like Ethereum and Binance Smart Chain. By converting to standard tokens such as ERC-20 or BEP-20, they benefit from the security of their underlying networks. This means that as long as the main blockchain network (like Ethereum) remains secure, wrapped tokens will also maintain a high level of security.

However, a primary concern regarding the security of these tokens is their reliance on custodians who are responsible for holding the original Bitcoins. If these custodians illegally transfer or lose the original Bitcoins for any reason, holders of wrapped tokens will incur losses. In other words, trust in these custodians is a key factor in assessing the security of wrapped tokens.

To mitigate this risk, some wrapped token projects implement additional security mechanisms such as multi-signature setups and oversight systems. However, overall, investors should carefully consider the reputation and track record of the custodians involved in these projects before investing in wrapped tokens.

How to Protect Wrapped Tokens

To safeguard wrapped tokens, as with any valuable digital asset, the use of hardware wallets is strongly recommended. Hardware wallets like Ledger Nano and Trezor provide the highest level of security by securely storing private keys and recovery phrases offline. This means that even if unauthorized access to your device occurs, attackers will not be able to access your assets.

Despite this high level of security, hardware wallets still allow interaction with various DeFi platforms through software like Ledger Live. Ledger Live serves as an interface between the hardware wallet and online platforms, enabling you to use your assets across a wide range of decentralized applications without compromising their security.

Thus, using hardware wallets alongside their companion software is an ideal solution for securing wrapped tokens while benefiting from the diverse capabilities of the DeFi ecosystem.

Conclusion

Wrapped tokens have created a valuable bridge between the world of cryptocurrencies and the decentralized finance (DeFi) sector. This innovative technology allows for the use of a wide range of digital assets across different blockchains. In other words, through the wrapping process, assets that are inherently defined within a specific blockchain can be utilized as equivalent tokens on other blockchains. This has led to increased liquidity, efficiency, and interoperability in digital financial markets.

Although the technology behind wrapped tokens is still in its early stages and may face some challenges and limitations, it holds great potential for transforming the blockchain industry. With advancements in technology and infrastructure, we can expect to see the development of more advanced and reliable versions of these tokens.

This article aimed to comprehensively introduce the concept of wrapped tokens and explain how they work, while also examining their benefits and challenges. Given the increasing importance of wrapped tokens in the world of cryptocurrencies, a deep understanding of this technology is essential for investors, developers, and participants in the field.